Summary:

- TSLA has failed to leverage its first mover advantage and EV know-hows to address the volatile market trends and sales cycle through an earlier launch of the $25K mass-market model.

- With its installed capacity under-utilized and consumer demand waning, it is uncertain how and when a reversal in market sentiments may occur, as observed in the FQ1’24 delivery report.

- For now, with most of the pessimism priced in, it appears that we may see the stock well supported at current levels, especially aided by the robo-taxi exuberance.

- It is uncertain how TSLA aims to launch the robo-taxi segment, be it through a licensed SaaS, in-house ride-share platform, or direct partnership with UBER.

- TSLA remains well capitalized to weather the intermediate term uncertainties as well, with 2024 likely to be a trough year.

RapidEye/E+ via Getty Images

We previously covered Tesla, Inc (NASDAQ:NASDAQ:TSLA) in January 2024, discussing why its EV King investment thesis had faded, with it no longer the largest global volume producer as of FQ3’23, with its profit margins likely to continue suffering as an adverse effect of the sustained price cuts.

While improved manufacturing scale might be possible in the long term, we believed that there might be more near-term uncertainty, arising from the increased operating expenses and potential unionization of its labor force, naturally resulting in our Hold rating then.

In this article, we shall be discussing three factors why we believe TSLA may face further downgrades, as the automaker fails to leverage its first mover advantage and EV know-hows to address the volatile market trends and sales cycle through the $25K mass-market model.

With its installed capacity under-utilized and consumer demand waning, it remains to be seen how and when a reversal in market sentiments may occur, resulting in our reiterated Hold rating.

The TSLA Investment Thesis Remains Expensive, In The Absence Of Clarity On Three Key Factors

By now, it is apparent that TSLA is a rather expensive stock, with the over exuberance embedded in its stock valuations implying immense expectations for its long-term EV and FSD execution.

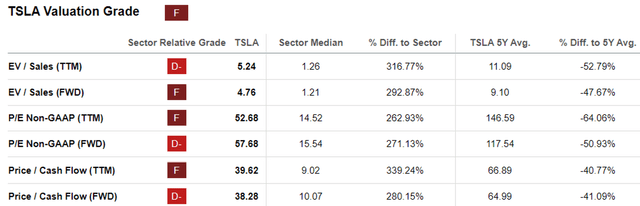

TSLA Valuations

For context, TSLA currently trades at FWD P/E valuations of 57.68x and FWD Price/ Cash Flow of 38.28x, expensive compared to its December 2022 bottom of 20.31x/ 21.49x and the sector median of 15.54x/ 10.07x, though moderated from the previous article of 68.73x/ 54.58x, respectively.

Its premium can be observed against the legacy automakers, such as Ford (F) trading at 7.19x/ 4.39x, General Motors (GM) at 4.95x/ 2.95x, and Stellantis (STLA) at 4.24x/ 2.79x, respectively.

Even when we compare TSLA against its profitable PHEV/ EV peers, such as BYD Company Limited (OTCPK:BYDDF) at 18.35x/ 3.07x and Li Auto (LI) at 15.47x/ 9.39x, it is apparent that the former is not cheap here

1. TSLA’s First Mover Advantage Is Quickly Evaporating Away

We believe that one of the reasons for TSLA’s premium forward valuations is attributed to its first mover advantage in the EV segment, since it allows the automaker to operate a supposedly profitable business as the others (legacy automakers included) burn cash to catch up to the former’s lead.

While this has worked out for TSLA, it does not last for long, since STLA has already reported profitability for the EV segment in the recent FQ4’23 earnings call (margin unspecified).

This does not include the BYDDF’s excellent manufacturing scale and vertically integrated supply chain in China, resulting in $66.83B of automobiles and related products, and other products revenues in FY2023 (+48.8% YoY) and growing overall gross margins of 20% (+3 points YoY), despite participating in the domestic price war.

The same cannot be said for TSLA, which reported declining FQ4’23 automotive gross margins of 18.8% (+0.2 points QoQ/ -7.1 YoY) and overall operating margins of 9.7% (+2.2 points QoQ/ -6.3 YoY), with FY2023 numbers of 19.4% (-9 points YoY) and 9.1% (-7.6 points YoY), respectively.

With the price war still ongoing and demand still impacted as borrowing costs for new vehicles remain elevated at 7.1% as of February 2024, compared to the normalized 5.4% in December 2019, we can understand why the automaker has not been able to fully ramp up to its installed capacity of 2.35M annually.

It also remains to be seen if TSLA may be able to achieve its 20M vehicle target by 2030, as the macroeconomic outlook appears uncertain in the intermediate term.

The same demand headwind has also been observed in the automaker’s widening gap between production at 433.37K (-12.4% QoQ/ -1.6% YoY) and delivery at 386.81K (-20.1% QoQ/ -8.5% YoY) in FQ1’24, implying a worsening ratio of 89.2% (-8.6 points QoQ/ -6.7 YoY).

As a result, we expect to see TSLA report increased inventory recorded on balance sheet and intensified inventory/ purchase commitments write-downs in FQ1’24, similar to that observed in FY2023 at $13.62B (+6.1% YoY) and $463M (+161.5% YoY), respectively.

Based on the consensus FQ1’24 revenue estimates of $22.81B (-9.3% QoQ/ -2% YoY) and adj EPS estimates of $0.54 (-23.9% QoQ/ -36.5% YoY), it is also apparent that the automaker’s price cuts may have been overly done, further derailing its first mover advantage.

2. The Uncertain Launch Of TSLA’s $25K EV

The second reason is likely attributed to the market leading know-how in EV manufacturing and mastery in global supply chain, allowing TSLA to eventually lower ASPs while preserving profit margins – exemplifying its inherent market advantage through the supposed launch of the $25K EV.

While Model 3 was originally priced at $35K in 2017, the same base model is now priced at $38.99K as of February 2024, with the $25K model yet to be officially launched despite numerous market rumors.

The last time it was properly acknowledged by TSLA was in the FQ4’21 earnings call, where the automaker was “not currently working on a $25,000 car,” due to “too much on our plate, frankly.”

By December 2023, the CEO’s tune has changed to:

We are working on a low-cost electric vehicle that will be made in really high volume. We are quite far advanced in that work. I review the production line plans for that every week. I think that the revolution in manufacturing that will be represented by that car will blow people’s minds. (Elektrek)

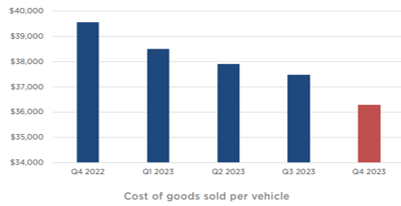

TSLA’s Lower COGS

TSLA

Assuming that TSLA is truly launching the $25K mass-model EV soon while accelerating the moderation of its COGS per vehicle from the ~$36K reported in FQ4’23 (-4% QoQ/ -8% YoY), it appears that one may expect a quick reversal in its financial performance than those reported in FY2023 (as discussed in part one).

Combined with the drastic decline in the lithium spot prices by -84.6% since the hyper-pandemic top, FY2024 may potentially be a trough year, with things improving from FY2025 onwards as the Fed also embarks on three rate cuts in 2024.

While we believe that the $25K mass model should have been launched prior to the EV down cycle by early 2023, naturally enhancing TSLA’s first-mover investment thesis as more legacy automakers guide mass-market models only by 2026/ 2027, it is better to be late than never we guess.

With the market anticipation for the $25K EV at fever pitch as other legacy automakers throw in the towel, readers may want to tune in to TSLA’s upcoming FQ1’24 earnings call on April 23, 2024 for more clarity on its mass market model.

3. FSD/ Robo-taxi

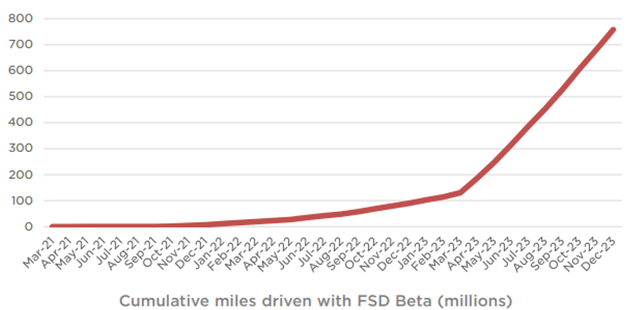

TSLA’s Cumulative Miles Driven With FSD Beta

The third reason is TSLA’s supposed autonomous/ FSD capability and the massive possibility of robo-taxi as its top/bottom line driver.

During the FQ4’23 earnings call, the management has highlighted growing cumulative miles driven with FSD Beta at 750M (+86.6% YoY) as of December 2023, perhaps demonstrating why they feel confident in announcing a Robo-taxi event on August 08, 2024.

Even then, with multiple automakers and big-tech companies yet to successfully launch a wide-scale commercial robo-taxi, with Google’s Waymo (GOOG) currently operating in four cities in the US and GM’s Cruise yet to resume operations after the recent debacle, it remains to be seen how TSLA aims to enter the yet to be profitable and likely to highly regulated robo-taxi market.

One speculation will be for TSLA to launch its own robo-taxi SaaS based on the FSD technology, licensing the driverless platform to interested automakers and taxi operators alike. This may be the easiest step for the management indeed, given that the platform is already available to existing drivers.

The second option will be for TSLA to launch their own robo-taxi ride-share platform while partnering with logistics service providers/ retailers to entirely bypass its competitors, such as Uber (UBER), Lyft (LYFT), and Grab (GRAB).

Assuming that the platform is rapidly deployed and adopted by both consumers and businesses, we can understand why the market has downgraded ride-share stocks indeed.

The last and less likely option will be for TSLA to directly partner with UBER and the others, depending on the regulatory approvals, allowing the former to directly leverage on the latter’s existing platform/ users in getting the robo-taxi service right out of the door.

For reference, readers may want to note that Google’s (GOOG) Waymo has been integrated into UBER’s platform in Phoenix, US, posing further questions as to how TSLA may choose to competitively launch their domestic robo-taxi service moving forward.

In China, DiDi Global (OTCPK:DIDIY) has chosen to exclusively partner with Guangzhou Automobile Group [GAC] to launch their robo-taxi service by 2025, as opposed to Baidu (BIDU) whom decides to develop/ manufacture their own autonomous software, EVs, and ride-share platform.

As a result, anyone expecting a rapid ramp up in TSLA’s eventual robo-taxi prospects may want to temper their intermediate term expectations, especially since it is uncertain how the FSD may be translated to commercial success.

This is attributed to a total of 285K cars with FSD in North America by the end of 2022, implying a take rate of approximately 19% based on 1.5M vehicles sold in the region, with no further updates offered thus far.

Otherwise, TSLA may be looking to utilize part of its excess inventories (as discussed in part one) as its commercial robo-taxi fleet, which may be a prudent choice after all.

Only time may tell.

So, Is TSLA Stock A Buy, Sell, or Hold?

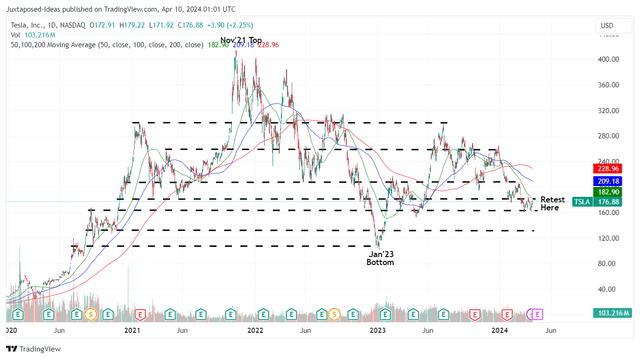

TSLA 3Y Stock Price

For now, TSLA has dramatically returned much of its 2023 gains, while currently trading below its 50/ 100/ 200 day moving averages and bouncing off the previous support levels of $160s.

With most of the pessimism from the FQ1’24 delivery news priced in, it appears that we may see the stock well supported at current levels of $170s, especially aided by the enthusiasm from the upcoming robo-taxi event in August 2024.

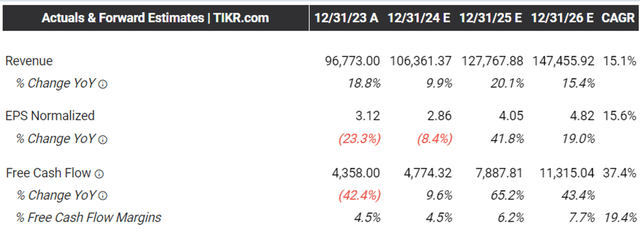

The Consensus Forward Estimates

This optimism has also been observed in TSLA’s consensus forward estimates, with the automaker expected to record a top/ bottom line expansion at a CAGR of +15.1% and +15.6% through FY2026, while consistently generating positive Free Cash Flows.

Combined with the growing cash/ short-term investments on balance sheet at $29.09B (+31.1% YoY) and reasonable long-term debts of $4.68B (+127.1% YoY), we believe that it remains well capitalized to weather the intermediate term uncertainties.

Despite so, we prefer to prudently maintain our previous Hold rating on the TSLA stock, since there may be more uncertainties over the next few months prior to the August 2024 event and the eventual launch of the robo-taxi service.

We expect the EV demand and margin headwinds to persist for a little longer as well, as the automaker cuts production in the China factory.

While interested readers may consider dollar cost averaging here, they may also want to size their portfolios according to their risk appetite and portfolio allocation, given the stock’s inherent premium valuation and the massive optimism embedded within.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.