Summary:

- Tesla stock has had a weak start to the year, losing close to a third of its value while the broader market has been on a tear.

- The latest Q1 2024 delivery bust is further weakening confidence in the stock, highlighting the toll of demand headwinds across its core U.S. and China markets.

- Our previously-discussed expectation for a pivot in investors’ focus towards FSD, which is unlikely to materialize anytime soon, will take greater shape as Tesla faces an increasingly structural EV slowdown.

- This will accordingly add incremental pressure to the stock on top of impact from Tesla’s dour outlook in core auto sales.

jetcityimage/iStock Editorial via Getty Images

The Tesla (NASDAQ:TSLA) stock has been off to a weak start this year, losing close to a third of its value while the broader S&P 500 index rose close to 11% over the same period. Growing weakness in the EV demand environment despite aggressive price cuts at the expense of Tesla’s margins remains a key area of concern for investors.

Specifically, markets had earlier expected full year 2024 deliveries to range between 2 million to 2.1 million units, with demand expected to pick up in the back half of the year. Yet the combination of weak demand in China during the first two months of the year, alongside production disruptions in Berlin due to the Red Sea crisis are adding complexity to Tesla’s outlook. This is consistent with the 1Q24 delivery bust reported this morning.

Looking ahead, we see limited structural tailwinds to Tesla’s core auto business. As auto sales growth is expected to remain slow, alongside limited margin expansion in Tesla’s favour of volumes over pricing, we remain confident that investors’ focus will increasingly tilt towards FSD progress. This is consistent with CEO Elon Musk’s recent announcement of a one-month free FSD trial on all U.S. deliveries moving forward. In addition to boosting uptake for the high-margin software subscription, the latest perk is likely to be a positive on Q2 volumes.

However, intensifying regulatory hurdles mean limited progress to full recognition of relevant revenues into P&L over the near-term, offering limited respite to Tesla’s bottom-line. Taken together, we believe the stock will remain range-bound at current levels (~$170-range). A structural recovery would require material FSD monetization progress to unlock pent-up value attributable to the technology, which is central to the Tesla stock outlook.

Tesla 1Q24 Delivery Update

Tesla delivered 386,810 vehicles in 1Q24, representing y/y decline of -9% and sequential decline of -20%. Specifically, Model 3/Y volumes, which continue to dominate the sales mix, declined by -10% y/y during 1Q24. Meanwhile, Tesla has stopped separately disclosing Model S/X volumes, and have instead reported a lump-sum of 17,027 deliveries for “other models” that likely include the premium passenger line-up alongside Cybertruck and Semis. The results are largely consistent with the combination of consumer weakness – especially in China – and limited pricing incentives on the premium line-up during 1Q24.

Model 3/Y’s disappointing 1Q deliveries aligns with previously anticipated headwinds pertaining to revised rules for tax credit eligibility under the Inflation Reduction Act. Recall that the Treasury Department had tightened battery sourcing requirements on EVs eligible for the full $7,500 tax credit under the IRA. The change, which took effect January 1, eliminates Tesla’s best-selling rear-wheel drive and long-range Model 3 variants from the eligibility list. This had likely pulled forward some of Model 3 demand in 4Q23. Even Tesla’s decision to unveil the refreshed Model 3 line-up to the U.S. market in 1Q24 – a quarter later than in China and Europe – did little to arrest a sequential decline in related sales volumes.

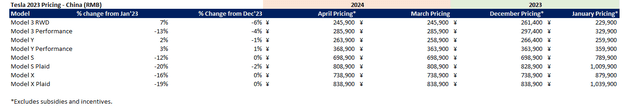

Intensifying competition in China also remains a heightened headwind for Tesla. Specifically, recent data from China’s Passenger Car Association (“CPCA”) shows Tesla had only shipped slightly over 60,000 vehicles from its Shanghai facility in February. This represents a -16% m/m decline in volumes, with about 132,000 vehicles shipped from Giga Shanghai in the entire first two months of the year combined. And only about half of this volume was absorbed by the local Chinese EV market, despite Tesla’s embrace for deep price cuts.

These are some of the lowest volumes from Tesla’s Shanghai facility since December 2022. Tesla’s latest results also diverge from rivalling Chinese upstarts – including Li Auto (LI), NIO (NIO), XPeng (XPEV), and key local rival BYD (OTCPK:BYDDF / OTCPK:BYDDY). Many finished 1Q24 with resilient deliveries despite the seasonal drop-off in February volumes due to the Lunar New Year holiday, in addition to macroeconomic and competitive headwinds. And although BYD’s delivery of 300,114 BEVs in the first quarter falls below Tesla’s volumes over the same period, the Chinese automaker likely continues to hold the crown in the local market. Specifically, Tesla had shipped 131,812 vehicles from Giga Shanghai in the two months through February 2024, with only 53% or 69,860 units sold in the Chinese market according to data from the CPCA. This compares to BYD sales of more than 160,000 BEVs during the same period, with the majority shipped to the Chinese market, highlighting Tesla’s struggles in expanding market share. This continues to highlight the toll of intensifying competition and consumer weakness facing Tesla in its core Chinese market.

The EV Slowdown is Here to Stay

Looking ahead, we expect Tesla’s core auto business to take a back seat as growth and demand are expected to face an extended slowdown. Specifically, Chinese EV sales growth is expected to slow to 25% y/y in 2024, down from 36% observed in 2023 and 96% in 2022. Meanwhile, in the U.S., EV sales are expected to grow by about 30% y/y in 2024, decelerating from 50% expansion observed in 2023. However, demand is likely to favour the increasing herd of non-Tesla options. Specifically, 1Q24 U.S. EV sales grew 15% y/y. Yet stripping Tesla sales from the metric, U.S. 1Q24 EV sales grew a whopping 33%, matching momentum observed in the prior year period.

As a result, we expect ongoing price adversities for Tesla, which would, inadvertently, drive renewed headwinds to its auto gross margins. This would likely further complicate Tesla’s path to restoring 20%+ auto gross margins. The extended price headwinds are likely to persist, as Tesla remains committed to driving volume growth critical for optimizing its aspired market share leadership in autonomous mobility. This is likely to overshadow declining battery costs and early optimism on the longer-term ramp-up of its next-generation vehicle platform, which promises up to 50% cost reductions.

Gauging the Value of FSD

FSD progress has become more important than ever for Tesla’s valuation outlook. Admittedly, much of the stock’s outsized premium has long depended on Tesla’s high-margin FSD and robotaxi prospects. Yet with normalizing volume growth, Tesla faces an increasing pivot in investors’ focus on how it plans to optimize monetization of its autonomous mobility technologies.

This pent-up value has grown in tandem with Tesla’s robust auto market share gains in recent years. The greater Tesla’s vehicle sales volumes, the greater its FSD adoption prospects, hence management’s priority for delivery growth over near-term auto sales margins. As discussed in a previous coverage on the stock, Tesla’s EV market leadership is critical to ensuring optimization of the anticipated lifetime value per customer, especially in high margin subscriptions critical to bolstering its balance sheet.

Additionally, a point often overlooked is the lifetime value of Tesla vehicle sales. In addition to full self-driving (“FSD”) subscription sales that have no definitive timeline on realization into revenue due to mounting regulatory hurdles for Level 4/5 autonomous mobility, Tesla vehicle sales are also source to adjacent revenue streams such as in-vehicle infotainment subscription sales and Supercharging network sales. As vehicle sales volumes continue to grow – albeit at lower profitability in the near-term – adjacent revenue streams would benefit from additional demand at incrementally lower marginal costs over the life of the vehicle.

Source: “Tesla Overcomes Demand Risks”

Admittedly, FSD-related revenues cannot be entirely recognized into Tesla’s P&L yet due to regulatory constraints. However, robust adoption is in itself enough to buoy investors’ optimism of ensuing valuation tailwinds for Tesla. This is consistent with Musk’s recent announcement to offer a one-month free trial on Tesla’s FSD subscription on all U.S. deliveries. This will be accompanied by a complementary walkthrough and demo prior to the completion of the vehicle’s handover to its new owner. We believe the initiative could be a positive to Q2 volumes by incentivizing prospective car buyers in the market to choose Tesla. Meanwhile, the perk could also drive greater uptake of the $199/month subscription (or $12,000 outright), and reinforce Tesla’s lifetime revenue prospects from its leading share of EVs in operation.

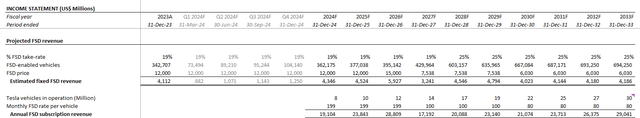

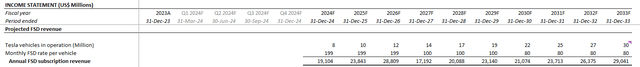

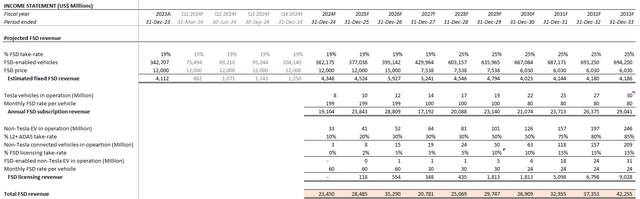

Specifically, we believe Tesla has three avenues to generating revenue from its FSD technology: 1) outright FSD purchase from Tesla owners, 2) monthly FSD subscriptions from Tesla owners, and 3) FSD licensing to third-party OEMs. This differs from our previous forecast, which estimates FSD-related revenues from anticipated uptake on longer-term Tesla vehicle sales.

1) Outright FSD purchase

Tesla currently sells a “perpetual license” for its FSD software to owners at $12,000. This is down from a previous rate that goes as high as $15,000 just a year ago. The latest industry data estimates close to 285,000 new FSD customers in Tesla’s North American market in 2022, which represents uptake of about 22% on sales of 1.3 million vehicles that year. Our estimate assumes 25% FSD perpetual license uptake on future annual Tesla vehicle sales. The assumption considers that the majority of prospective users would opt for the monthly subscription alternative instead due to personal reasons such as the average intended length of vehicle ownership. Note that the current $12,000 outright price tag implies breakeven at five-year vehicle ownership based on the $199/month subscription rate, and is not transferrable between Tesla vehicles. Our forecast for long-term revenue generated FSD perpetual license sales also assumes a reduction in the price, as the product gains regulatory approval and adoption ramps at scale.

2) FSD monthly subscription

Tesla also provides FSD subscription at a rate of $199 per vehicle per month. We believe this will be the most popular choice for prospective FSD users in the longer-term, given flexibility and economic reasons. As mentioned earlier, the FSD perpetual license option is non-transferrable and implies vehicle usage of more than five years to breakeven. This compares to the average American’s preference to own a car for five years or less. Similarly, we expect the monthly subscription rate to come down over time as well to foster mass market adoption and, inadvertently, better economies of scale for Tesla’s FSD margins.

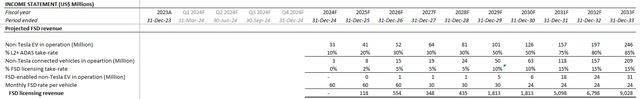

3) Third-party OEM FSD licensing

In addition to FSD adoption for Tesla vehicles, the company is also eyeing licensing opportunities for the technology. However, adoption is likely to remain slow, especially given intensifying regulatory scrutiny over Tesla’s FSD product, and broader industry skepticism about the trajectory of autonomous mobility developments.

I really think lots of car companies should be asking for FSD licenses. And we’ve had some tentative conversations, but I think they don’t believe it’s real quite yet. I think that will become obvious probably this year. And I do want to emphasize that if I were CEO of another car company, I would definitely be calling Tesla and asking to license Tesla full self-driving technology. It’s definitely the smart move.

Conservatively, we expect FSD licensing to third-party OEM to be already in the works, with potential for nominal uptake beginning next year, which is in line with management’s commentary. Our forecast for relevant sales is based on an estimated 10-year CAGR of 22% on non-Tesla EVs in operations over the longer-term, with the additional consideration of L2+ ADAS uptake and subsequent FSD uptake. We expect third-party FSD licensing uptake to be comparatively lower as a percentage compared to prospective Tesla vehicle owners.

This is in line Tesla’s competition against ongoing in-house developments across both legacy automakers and EV upstarts alike, alongside other proprietary offerings sold by firms like Mobileye (MBLY) and Luminar Technologies (LAZR). For instance, Volkswagen Group (OTCPK:VWAGY / OTCPK:VLKAF / OTCPK:VWAPY) has adopted Mobileye’s SuperVision product to empower the autonomous driving features across its brand portfolio, including Porsche. Meanwhile, others like Mercedes-Benz (OTCPK:MBGAF/ OTCPK:MBGYY) have partnered with chipmakers like Nvidia (NVDA) for the in-house development of its own proprietary self-driving systems. For instance, the German automaker’s “Drive Pilot” self-driving system has also recently became the first to receive Level 3 ADAS regulatory approval from California. Specifically, Level 3 ADAS certification validates Drive Pilot’s ability in monitoring external driving conditions, despite still requiring human intervention at all times. Meanwhile, Tesla’s FSD is only approved for Level 2 ADAS, meaning a human driver still needs to be actively monitoring external driving conditions at all times, while keeping hands on the steering wheel.

Taken together, we expect pent-up FSD revenue growth at a 10-year CAGR of 7%. Though nominal compared to current core auto sales, the low marginal costs of FSD-related revenue underpins substantial cash flows critical to the stock’s valuation outlook.

Price Considerations

With expectations for an increasing pivot in investors’ focus to FSD progress, as core auto sales slow, we expect difficulty for a structural recovery in the Tesla stock over the near-term. The Tesla stock is likely to stay range-bound in the $160-level in the near-term, with potential downside to $162 based on our analysis.

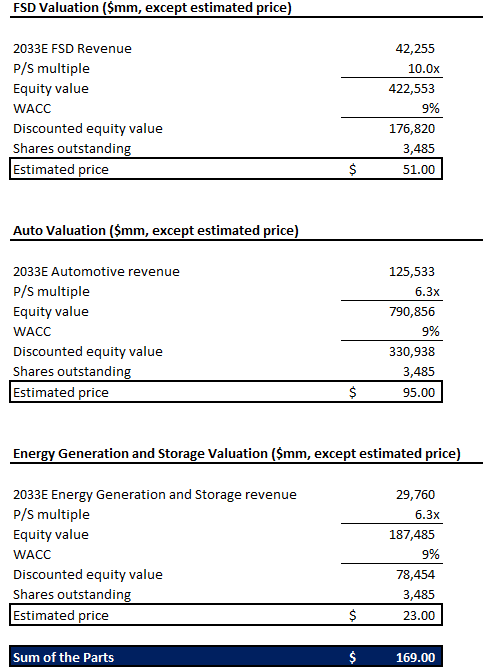

Our price target is derived from a sum-of-the-parts valuation that considers the fundamental outlook of Tesla’s core auto, energy generation and storage, and emerging FSD businesses. Admittedly, Tesla also touts substantial prospects attributable to its robotaxi ambitions, despite multi-year delays from its original go-to-market timeline. However, considering the uncertain regulatory trajectory over autonomous mobility technologies, relevant prospects cannot be reasonably quantified at the moment, in our opinion.

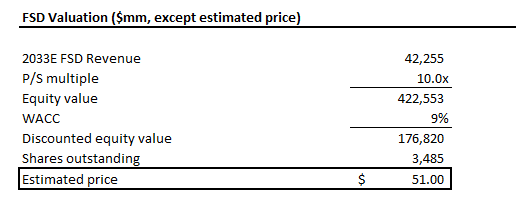

1) FSD valuation

We estimate an intrinsic value of $176.8 billion for Tesla’s FSD business. The estimate applies a 10x multiple to our earlier discussed long-term FSD revenue projections. The valuation multiple applied is in line with the average observed across high-growth (30%+) software sector peers with a similar profit margin trajectory. A 9% WACC in line with Tesla’s capital structure and risk profile is also applied to discount the estimated 2033 value back to 2024.

Author

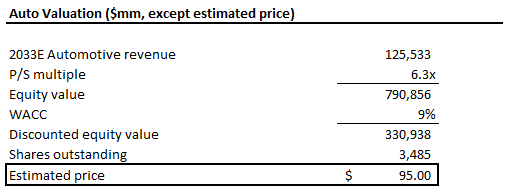

2) Auto valuation

We estimate an intrinsic value of $330.9 billion for Tesla’s core auto business. The estimate applies a 6.3x multiple on our long-term auto revenue forecast for Tesla, adjusted for the latest delivery results. The valuation multiple applied is in line with the average observed across Tesla’s megacap peers that exhibit a similar growth profile. We believe this is a better valuation benchmark compared to our previous use of trends observed across the mid-cycle U.S. OEM average, considering Tesla’s technology-driven, higher-margin business model which is deserving of an incremental premium. A 9% WACC is also applied to discount the estimated 2033 value back to 2024.

Author

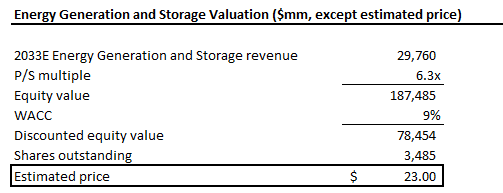

3) Energy generation and storage valuation

We estimate an intrinsic value of $78.5 billion for Tesla’s energy generation and storage business. The estimate also applies a 6.3x multiple on our long-term energy generation and storage revenue forecast for Tesla. The valuation multiple applied is in line with the average observed across Tesla’s megacap peers that exhibit a similar growth profile. We believe the use of its megacap peers instead of legacy energy generation and storage industry as comparable peers is a more adequate metric for Tesla’s business, given its proprietary technologies in the field and higher growth outlook. A 9% WACC is also applied to discount the estimated 2033 value back to 2024.

Author

Taken together, the business should have a sum-of-the-parts valuation of about $586.2 billion, or $169 apiece based on diluted shares outstanding of 3,485 million units reported in 4Q23. This is in line with the stock’s pre-market trading price on April 2 upon release of 1Q24 delivery results.

Author

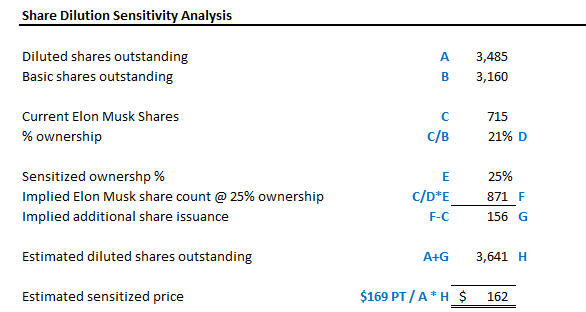

However, our downside price for Tesla of $162 apiece is derived based on anticipation of further dilution risks in the future. This is in line with Musk’s previous push for 25% ownership in Tesla in order to proceed with AI developments at the company, which is critical to its outlook.

Considering Musk’s recently reported ownership of about 21% with his 715 million shares in Tesla, it implies further dilution of about 156 million units of Tesla shares to bring his ownership up to 25%. This would result in an estimated diluted share count of about 3,641 million units. At an estimated intrinsic value of $586.2 billion for Tesla, our projection is equivalent to $162 apiece. Although it remains uncertain on whether the Board would approve such requests, the risk should not be overlooked given Musk’s influence over the brand. This sentiment could potentially serve as incremental downward pressure weighing on Tesla’s price performance.

Author

Conclusion

The latest delivery bust for Tesla is a warning for not only the company but the broader EV industry. Although investors’ confidence in Tesla’s market leadership and FSD prospects likely remains, the stock continues to face downside risks ahead given weakness to its forward fundamental story. This is also consistent with the stock’s persistent valuation premium at 59x forward earnings compared to its auto and megacap peers’ average. This accordingly highlights elevated execution risks ahead for Tesla and increasing urgency for the company to deliver on other aspects of its current valuation premium.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!