Summary:

- I maintain a Buy rating on Tesla with a $355 price target, anticipating 10-15% earnings growth annually over the next five years.

- Tesla’s Q3 report exceeded expectations, showing revenue growth, margin improvement, and strong performance in the energy generation segment despite industry challenges.

- The company’s operational excellence, including significant milestones in production and Supercharger network expansion, supports a promising long-term outlook.

- Despite high valuation multiples, the future potential of FSD, Robotaxis, and the Supercharger network justifies a long-term investment in Tesla.

Sundry Photography

Prelude

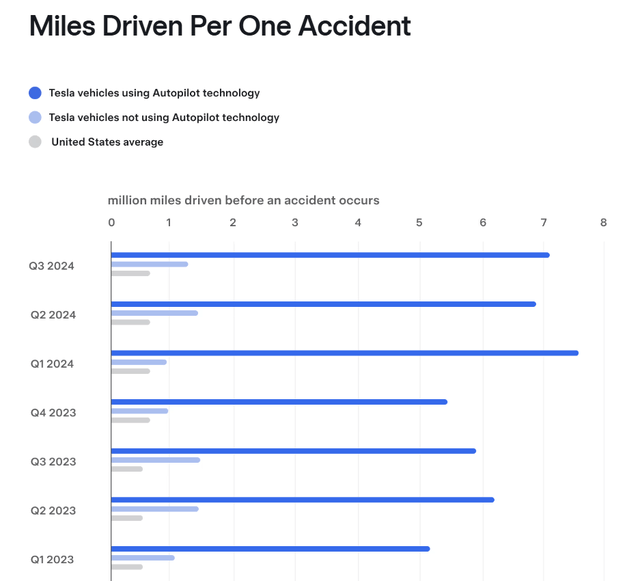

I’ve covered Tesla numerous times in the past, most recently after the Q1 report with a prudent Buy rating at the $177 price point. I remain very bullish on Tesla as the company continues to execute on its very busy roadmap and FSD continues to show extremely positive safety results compared to human drivers. My current price target for Tesla is $355, which assumes 10-15% earnings growth for each of the next five years. I believe it is still a good time to accumulate Tesla stock, therefore I am maintaining my Buy rating on the stock.

Solid Earnings Amidst Weak Expectations

Tesla (NASDAQ:TSLA) shares jumped in after-hours trading after the company reported a much stronger report than expected. The electric vehicle (EV) leader reported a 7.8% YoY increase in Q3 revenue, reaching $25.18 billion. Automotive revenue, which is comprised of auto sales, regulatory credits, and leasing revenue, came in just over $20 billion. This was an immaterial increase in percentage terms both YoY and QoQ. Despite the weak growth, any amount of growth in automotive revenues is a welcome sign to investors after the company weathered the EV winter of 2023. The auto industry broadly faced challenges as inflation and high interest rates greatly weakened consumer demand.

The energy generation segment continued its explosive YoY growth, reaching $2.3b, up 52% from this quarter last year. However, this was a sizable decline from last quarters $3b mark. Energy storage deployments decreased sequentially in Q3 from 9.4 GWh to 6.9 GWh but were up 75% YoY. The company noted “As energy storage products continue to ramp, and our vehicle fleet continues to grow, we are expecting continued profit growth from these businesses over time.” Energy segment gross margin reached a record high this quarter. Services revenue also reached an all-time high of $2.79b.

EPS came in at $0.72 vs. $0.60 consensus and $0.66 last year. EPS increased $0.20 in Q3 from $0.52 in Q2. GAAP net income for the quarter was $2.2 billion and non-GAAP net income was $2.5 billion. The company also reported its second highest quarter of regulatory credit revenues, reaching $739 million. This was a slight decline from last quarters $890m mark but far exceeded the $554m from Q3 of last year. Shares outstanding increased slightly to 3.5 billion.

Automotive segment gross profit eclipsed $5b again this quarter, a figure that hasn’t been reached since Q4 of 2022. Gross profits from the energy generation and services segment totaled nearly $1b this quarter, a number that will represent a significant milestone in a future quarter.

Meanwhile, the company’s margin profile improved with operating margin improving to 10.8%, up from the 6.3% mark in Q2. Q3 2023 operating margin was 7.6%. Total GAAP gross margin was 19.8% vs. 17.9% a year ago and 18.0% in the prior quarter. Automotive gross margin was 20.1%. This margin improvement is a significant step in the right direction for the stock since 2023 was a year of broad-based margin decline amidst weak consumer sentiment and a relentless series of price cuts to bolster demand. Margin improvement came from two sources, one being the record low unit cost of $35,100. This is down from $37,500 in Q3 of last year, a respectable 6.4% decrease. This comes at a time when other American EV manufacturers are still selling vehicles at a loss. The company demonstrated respectable OpEx discipline, with both R&D and SG&A expenses declining YoY and QoQ. The company also earned $337m in interest with $429m in interest income and only $92m in interest expense.

Tesla had already reported Q3 deliveries of 462,890 and production of 469,796 vehicles during the quarter, with 3% of deliveries subject to operating lease accounting. This still lags Tesla’s all-time deliveries record was 484,507 vehicles in Q4 of 2023, but is a promising return to growth after two sequential declines. Looking ahead, Tesla reiterated that it plans for new vehicle production for the first half of 2025. The company also said that it deployed and is training ahead of schedule on a 29k Nvidia (NVDA) H100 cluster at Gigafactory Texas, where it expects to have 50k H100 capacity by the end of October. These GPUs are being used for the Full-Self Driving (“FSD”) software platform. GPU purchases were a major contributor to the $1.3b YoY increase in capex this quarter.

The company has a strong cash position of $33.6b and the sequential increase of $2.9b was a result of positive free cash flow of $2.7b. Operating cash flow was $6.3b during the quarter. The company reported a $563m increase in inventories which reached $14.53b in the quarter. The company’s inventory turnover ratio (here I’m using cost of auto revenues divided by inventory instead of auto sales to reflect the direct cost of inventory) was 1.1 during the quarter. This was down marginally YoY from 1.16 and down from 1.14 last quarter. This suggests the company is moving inventory slowly and is low even for an auto company. Despite this, Tesla now touts the three top-selling EVs in the US with the Model 3, Model Y, and Cybertruck. The Cybertruck was the best-selling EV pickup truck in Q3 according to the company. The low inventory turnover ratio is a result of rapidly increasing production capacity, not weak demand.

Overall, this report beat expectations which were quite bearish. The market began doubting whether or not Tesla truly deserved to trade at such ridiculous multiples, while many of CEO Elon Musk’s outlandish goals still seem impossible. The strong performance after-hours illustrates the importance of expectations in stock investing.

The Importance of Expectations

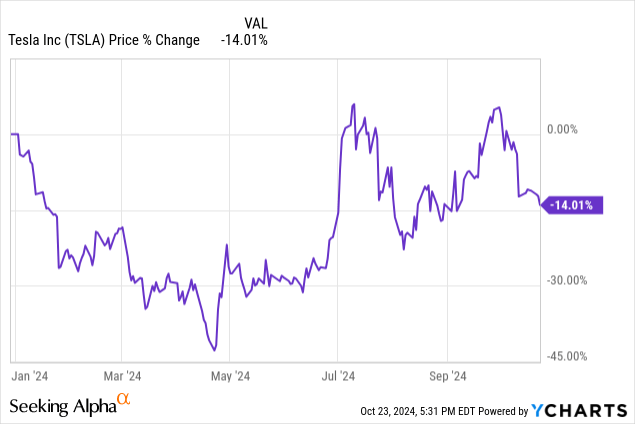

While the company continued to fire on all cylinders, the stock’s price performance continued to bog down investor sentiment. Coming into the earnings report today, Tesla stock was down 14% YTD and roughly flat for the past year. Investors that bought 3 years ago had lost nearly 30% of their principal prior to the after-hours jump.

Expectation beating EPS and optimism surrounding FSD and Robotaxis has resulted in a very warm response from the market. Investors should be becoming more hopeful that this momentum will sustain through Q4 and into a recovering demand environment in 2025.

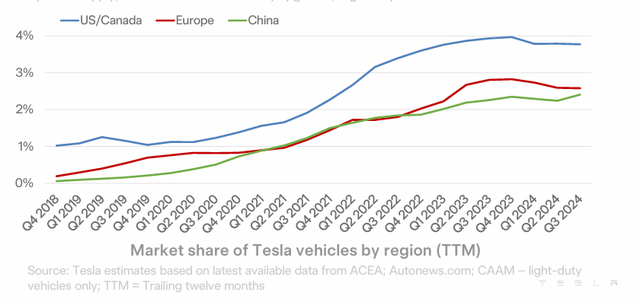

Tesla was punished in 2023 as margins cratered due to price cuts, something that, I believed, was good for the company last year. My thesis in that article was that price cuts are good because they allowed Tesla to sacrifice short-term margins for market share gains. This didn’t quite pan out as Tesla accounted for slightly less EV sales in the US, down from 47.8% in 2023 to 46.8% in 2024 according to this report from insideevs.com. Strong share gains by Honda and Chevy vehicles contributed to this, but the estimated 11% growth in the US EV market means that Tesla is still dominant in this growing market segment. A sharp decline in Model Y sales YoY was offset by the Cybertruck ramp and the Model 3 revamp. Still, the strong trend of unit cost declines supports a very promising outlook for Tesla’s auto segment profitability in the US. Notably, this repot marked the first quarter of positive gross profit for the Cybertruck.

Tesla Q3 Investor Presentation

The company continues to demonstrate operational excellence with a very busy roadmap. It increased physical locations by 16% and added an additional 20% more Superchargers since Q3 last year. I retain my very bullish sentiment on the Supercharger network as the lion’s share of EVs in the US are now NACS compatible. The Supercharger network will grow to be an extremely strong driver of profitable growth for years into the future.

This report should soothe market concerns over waning demand in EVs and sets Tesla up for a very solid 2025.

Investor Takeaway

However, the difficult question of whether or not to buy at these prices remains. The company’s TTM GAAP net income of $6.95b (excluding the $5.7b benefit from income taxes in Q4 2023) brings the P/E ratio to 120 using the after-hours market cap of $836.5b. Meanwhile, TTM sales of $97.15b brings the P/S ratio to 8.6. These multiples are pricing in an extremely optimistic outlook for the future of FSD, Robotaxis, Optimus, and the Supercharger network. This is not a suitable investment for anyone that does not believe in a fully autonomous future.

Investors that maintain a long-term position should find comfort though and it should make long-term holding easier. Tesla is clearly not a company in decline, and while the explosive EV market growth of 2020-2022 seems to be a relic of the past, there is a lot to be optimistic about. The company continued its relentless improvement of unit economics, reached numerous notable manufacturing milestones (including the 7 millionth car produced in the Fremont factory and the 3 millionth in the Shanghai factory), and continues to show extremely promising results with FSD safety compared to human drivers.

Both the vehicle safety report and my fair value estimate are driving my Buy rating for Tesla today. Despite valuation concerns, the promising future of FSD remains an overwhelmingly bullish tailwind for extremely high profit growth over the next 10 years. For long-term buy-and-hold investors, Tesla remains a buy following the Q3 report.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.