Summary:

- Tesla is the world’s largest electric vehicle company and a technology pioneer in the energy and autonomous vehicle industry.

- The company recently reported its production and delivery numbers for the fourth quarter of 2022, which came in below analyst estimates.

- Tesla stock is undervalued intrinsically after a huge sell-off.

- Musk informed his employees via email to not worry about the “stock market craziness” and still believes Tesla will become the “most valuable company in the world”.

jetcityimage

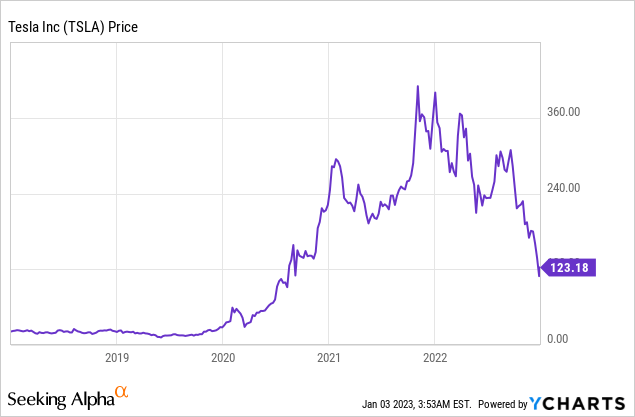

Tesla (NASDAQ:TSLA) is a technology titan and the world’s largest electric vehicle company. The business has recently been making headlines for all the wrong reasons. Its stock price has been butchered by 69% from its all-time highs in November 2021, despite its revenue and profit doubling since last year. The decline in share price looks to have been driven by many macroeconomic factors such as the rising interest rate and high inflation environment, which has compressed the valuation multiples of all “growth stocks”. In addition, a looming recession has been forecasted and there have been reports of a planned production cut for January, at Tesla’s Gigafactory in Shanghai. Tesla recently reported its fourth-quarter production numbers, which significantly outpaced deliveries and missed analyst estimates. I believe the production cut will now be likely and prudent for the first quarter of 2023, given the lower demand for Tesla vehicles. However, the company still has many positives such as the $7,500 EV tax credit and its innovative technology. In this post, I’m going to break down its fourth-quarter deliveries in granular detail and review its valuation, let’s dive in.

Fourth Quarter Delivery Update

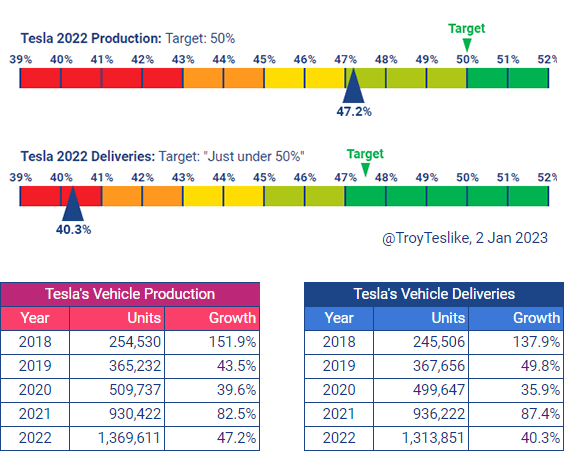

Tesla reported its production and delivery numbers for the fourth quarter of 2022. From the table below, we can see Tesla reported total production of 439,701 vehicles, which significantly outpaced deliveries of 405,278. Both were record numbers, with deliveries beating third-quarter results of 343,830 units.

Production Tesla Q4 (Q4, Production data Tesla)

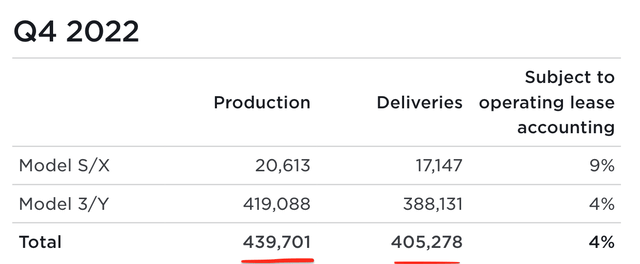

It should be noted that despite record numbers, its delivery metric missed both management and analyst estimates. In December, Tesla’s management reported an expected figure of 418,000 vehicles, and analysts had an average figure in mind of 427,000 vehicles. Tesla’s Q4 delivery number of 405,278 fell well below both of these estimates. This was the second sequential quarter of delivery estimate misses and a sign of weakening demand for the Tesla product. For the full year of 2022, Tesla reported 1.3696 million vehicles produced, with deliveries of 1.3139 million. Again, production outpaced delivery, but the gap was less for the full year.

Tesla Production/Delivery (2022 Tesla)

The great graphic below shows Tesla’s 2022 production growth was 47.2%, which fell below management’s target of 50%. This is not a significant miss and means the majority of the gap between production and deliveries was likely driven by lower demand. Tesla deliveries grew by 40.3% year over year, this is a respectable number, but well below its target of “just below 50%” growth.

Production and Delivery (Data from Troy Teslike Industry Analyst)

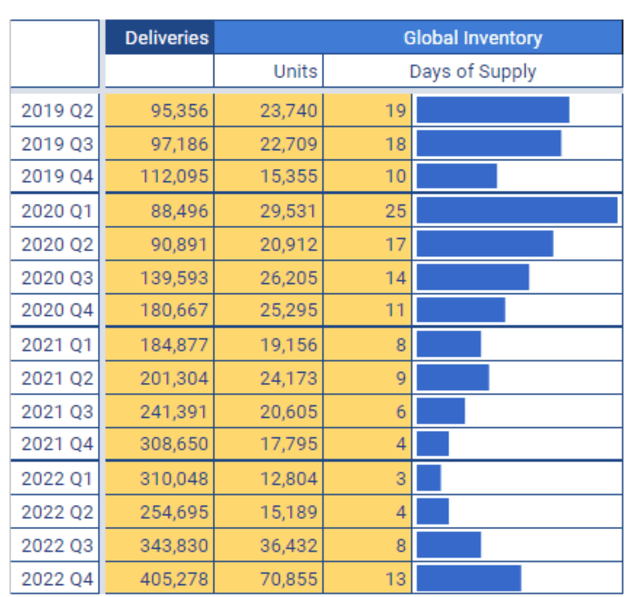

Tesla doesn’t report its inventory by units, but it does release its days of supply. In this case, Tesla has approximately 71,000 vehicles in its inventory, which equates to around 13 days of supply. This is the highest level of inventory ever and matched with supply, is close to the “recessionary” levels of Q3, 2020. This data is calculated from a combination of “in-transit” and unsold inventory. In this case, the majority of the inventory looks to be in China, with ~25,500 unsold Model 3/Y in China. There are just 2,500 unsold Model S/X in North America. In addition, there are ~36,000 vehicles in transit in Europe and the APAC region.

Inventory estimates (Troy Teslike data)

The supply/demand ratio between production and deliveries indicates lower demand for Tesla vehicles. This would also make sense given Tesla previously slashed its prices in China, in an effort to help spur demand.

Throughout Tesla’s lifecycle, it has been in the process of chasing demand, and in fact, could not produce enough vehicles for its die-hard customer base. This is usually a positive sign from a “product-market fit” standpoint and means demand for Tesla’s product was on fire. However, this dynamic was also caused by the challenges of mass production. Elon Musk has stated in the past it’s “relatively easy to produce a prototype”, but scaling production is the “challenge”.

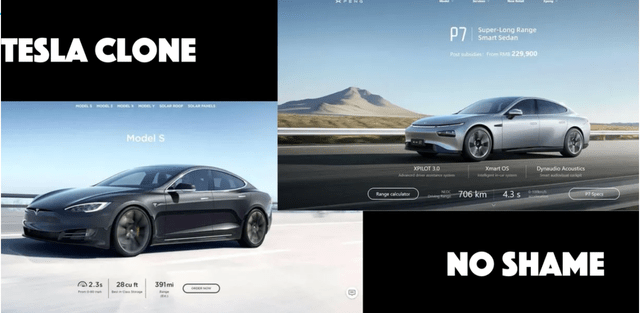

Between April and July of 2022, Tesla Shanghai had a huge production delay due to the “zero-covid” lockdown policy of the country. Then, in early December, Tesla reduced factory shifts and delayed new hires, which are all signs of lower demand. There have also been reports of Tesla reducing its production in January in Shanghai. I believe this makes sense given a combination of macroeconomic factors and increased competition in China. Let’s not forget China is home to a range of “Tesla-like” electric vehicles such as the luxury EV provider NIO (NIO), which offers battery swap technology. In addition, XPeng (XPEV) offers similar-looking vehicles to Tesla. In China, it is common to see a salesperson with both a Tesla and XPeng, side by side, pointing out how the XPeng is “better” in various ways. The XPeng P7 has been called a “Tesla Clone” by reporters and Tesla is even suing the company for alleged Intellectual property infringement.

Tesla vs XPeng (Website “copy”, Electrek)

The Chinese government is also the elephant in the room. Currently, Tesla looks to be included in its EV tax break scheme. However, in the past, the Chinese government has favored cars with battery swap technology only, excluding Tesla.

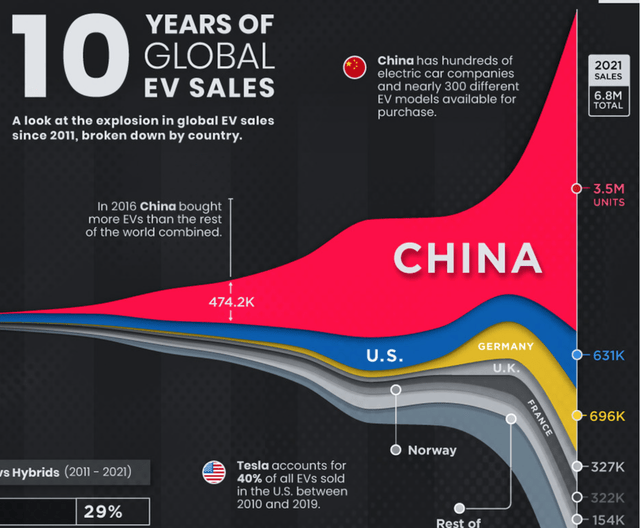

The “Inflation reduction” act by the U.S. government looks to end the “reliance” on Chinese batteries, with its $7,500 EV tax credit scheme. This is a positive for U.S. EV sales but it may cause retaliation from China with a similar policy excluding U.S.-made EVs. Data is limited on the market share of Tesla in the Chinese EV market, but reports from Q1, 2022 indicate Buffett-backed BYD (OTCPK:BYDDF) has 27.8% market share. This was followed by SGMW with 10.3% share and Tesla was third with 7.8% market share. China is the world’s largest EV market, so it is still all to play for and I believe the demand issues in China are more macroeconomic.

China EV market (Visual Capitalist)

Tesla is still on the pulse of the Chinese consumer and offers unique localization for the market. For example, in early 2022, the company launched wireless Karaoke microphones for the car, which sold out within just one hour, on the back of red hot demand.

Tesla Mic China sells out within one hour (Tesla)

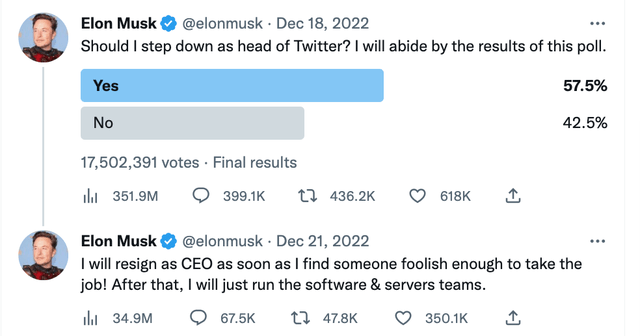

In related news, it was announced on January 3rd that the boss of Tesla China, Tom Zhu will be “promoted” to manage the U.S. factories and Europe. This may also be seen as a re-shifting of Tesla’s China strategy or just a short-term plan as Elon Musk is spending time as the CEO of Twitter. A positive for Tesla is Elon Musk is likely to step down, as the head of Twitter. This is after he launched a poll, in which 57.5% of his followers voted in agreement with this. It also would make a lot of sense given running a social media platform and governing free speech is a delicate matter. I believe this is not best suited to Elon Musk’s fast-acting and logical approach.

Advanced Valuation

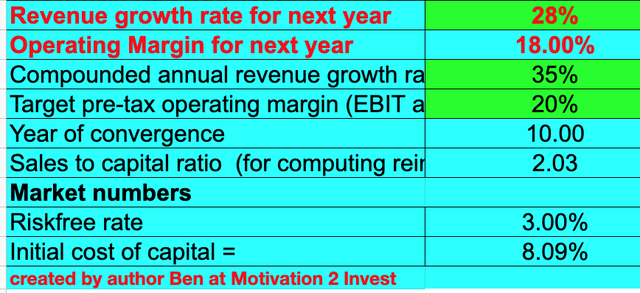

In my past post, I discussed Tesla’s third-quarter financials in great detail after the company beat both top and bottom-line estimates. Rather than repeat myself, I will just revisit my valuation model with revised estimates, using the Q4 delivery numbers as a leading indicator for revenue. I have forecast 28% revenue growth for next year, given the lower expected demand in China and global macroeconomic challenges. However, in years 2 to 5, I have forecast revenue growth rate of 35% per year, as I forecast the long-term trend in EV industry growth to continue. Tesla plans to release its full financials for Q4, 2022 on the 25th of January. So I will give a detailed financial update then.

Tesla stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have capitalized R&D expenses which have lifted net income. In addition, I have forecasted a 2% increase in operating margin over the next 10 years. This is fairly conservative given the rate of innovation at tesla and new products being developed using technology that is already developed. For example, at Tesla AI Day, the company announced that it would use its full self-driving car computer, as a base for its humanoid robot called Optimus.

Tesla Optimus Robot (Tesla AI Day)

The artificial Intelligence [AI] industry is forecast to grow at a rapid 20.1% CAGR and be worth over $1.39 trillion by 2029. Recently, we have seen technologies such as DALL.E 2, Midjourney, and ChatGPT go viral online. Interestingly, the AI model ChatGPT was created by the OpenAI institute, which was backed by Elon Musk. Therefore, I do imagine Musk could leverage his relationship to utilize the most advanced versions of the technology for its Optimus robot. Tesla recently announced its Investor Day for 2023 will be on March 1st, and thus, I imagine more updates.

Tesla stock valuation 2 (created by author Ben at Motivation 2 Invest)

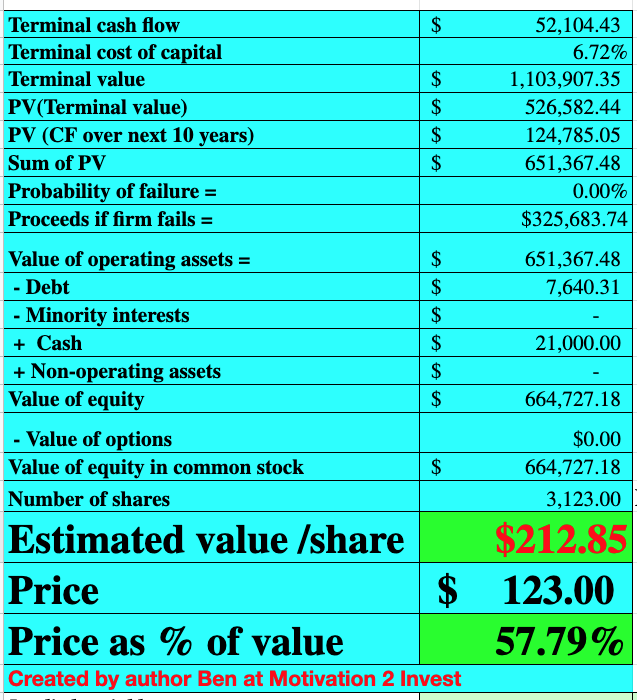

Given these factors, I get a fair value of $212.85 per share, the stock is trading at $123 per share at the time of writing and thus is over 40% undervalued.

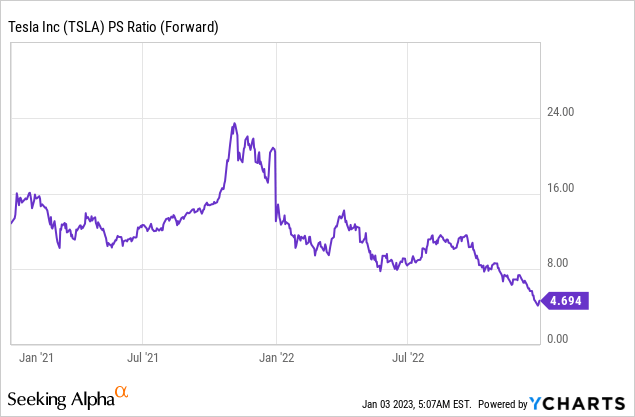

Tesla also trades at a Price to sales ratio of 4.69, which is 41% cheaper than its 5-year average.

Risks

Recession/lower demand

As mentioned prior, Tesla has reported lower-than-expected deliveries, which I believe is due to lower demand driven by the macroeconomic environment. Tesla has finally started to ramp up production across all its factories. Berlin is reported to have ramped up to 2,000 cars per week but is experiencing labor shortage issues and battery manufacturing challenges. This could actually be a blessing in disguise in the short term, as with analysts forecasting a deeper recession in Europe, I would expect lower demand for vehicles on the continent. The silver lining is I believe this to only be a short-term issue for Tesla, the long-term secular growth in the EV industry is forecast to continue.

Final Thoughts

Tesla is a technology titan, which has continued to generate strong financial results over the past few quarters. The recent Q4 delivery numbers indicate slowing demand, but I believe this is only a short-term issue. Tesla has gradually aimed to vertically integrate its company, which should help ease supply chain problems long term. Its stock is undervalued intrinsically at the time of writing, and thus, it could be a great long-term investment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.