Summary:

- I don’t think the current recovery rally in Tesla, Inc. stock will last long as it is not backed by the company’s most important fundamentals as far as I can see.

- Q2 consolidated delivery figures became the ultimate catalyst for Tesla to start the recovery rally, as it reported 443,956 deliveries for Q2, surpassing the consensus of 437,812.

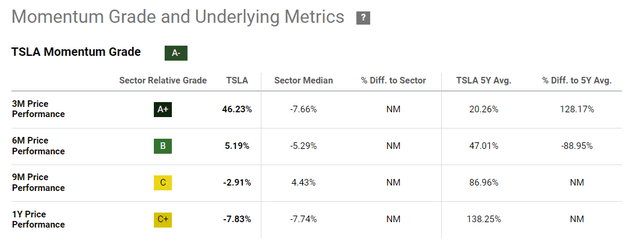

- In the short term, I expect Tesla stock to start testing its way out of the recent price consolidation. The seasonal data points to a weak momentum shortly.

- Given the serious overvaluation (40.5x P/E forecast for 2028), I see some pretty serious downside ahead.

- I’ve therefore decided to leave my “Sell” rating unchanged today. Sell the rip.

Magnus Kvandal

Intro & Thesis

If you’ve been following me for a while, you’ve probably read some of my previous 15 articles on Tesla, Inc. (NASDAQ:TSLA) stock. I downgraded the stock back in April 2024 when a share was trading for $185. I made the case for not buying the dip, and since then, TSLA’s performance can be compared to that of the S&P 500 Index (SP500, SPY) thanks to the rally we’ve seen over the past three weeks alone.

Despite this phenomenal strength and the growing positive sentiment around TSLA, I don’t think the current recovery rally will last long as it is not backed by the company’s most important fundamentals as far as I can see.

Why Do I Think So?

As is typically the case with a thesis update, it’s essential to be guided by the latest financial data. Therefore, I suggest taking a closer look at Tesla’s Q1 2024 results, even though they are likely already fully reflected in the current stock price given the time since their publication.

In Q1, Tesla’s overall revenue declined by 9% to $21.301 billion. TSLA’s Automotive division revenue was the key “negative driver” as it fell by 13% to $17.378 billion, while Services and Other revenue rose 25% YoY to $2.288 billion. The consolidated gross profit margin continued its downward trajectory, slipping from 19.34% last year to 17.35%, according to Seeking Alpha data. As we can see, the Auto margins saw a slight dip from 18.9% to 18.5%. However, as the CFO noted during the latest earnings call, when excluding the impact of the Cybertruck and the ramp-up costs for the Model 3 in Fremont, the margins actually improved slightly. This was thanks to cost reductions and revenue from the new Autopark feature for certain U.S. vehicles.

In Q1 2024, Tesla delivered 386,810 vehicles, including 17,027 Model S and Model X and 369,783 Model 3 and Model Y, marking a 9% decrease from Q1 2023. We know that the Shanghai factory has been running at full capacity since Q4 last year despite previous production lulls, but this fact didn’t help Tesla to maintain its market share in China, which continued to shrink in June:

Tesla’s share of China’s new energy vehicle (NEV) market, which includes both battery electric vehicles and plug-in hybrids, fell to 6.92% in June, down from 11.16% last year. However, on a sequential basis, Tesla’s sales in China are up 7.33% from May, when the Elon Musk-led company sold 55,215 vehicles.

Source: Benzinga [July 8, 2024], emphasis added.

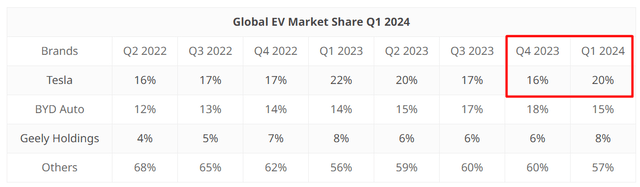

On the bright side, the launch of Cybertruck sales has enabled the company to increase its global market share to 20%, according to CounterPoint Research. That’s 2% less than in Q1 FY2023, but on a QoQ basis the growth looks significant indeed.

Tesla’s revenue from Energy Generation and Storage grew in Q1 by 7% YoY to $1.635 billion due to high demand for Powerwall and Megapack products. However, such a low growth rate doesn’t indicate to me any outstanding demand in the market, to be honest. Anyway, this demand is now “leading Tesla to scale up production in a dedicated Megapack facility.” Although perhaps my skepticism is unfounded because Tesla achieved a record high for stationary storage deployments at 9.4 GWh in Q2, nearly double Morgan Stanley’s forecast (proprietary source, July 2024 data).

As we know, the company faced enormous operational challenges, including shipping disruptions in the Red Sea and an arson attack at Gigafactory Berlin; both challenges have been resolved, according to the management commentary. Q2 delivery numbers indicate that it’s indeed the case, as the company delivered 33,000 more units than it produced in Q2, resulting in a 7-day reduction in days’ supply of inventory. This reduction provided a $1.5 billion boost to working capital (way higher than many analysts expected in the recent past). Overall, the Q2 consolidated delivery figures became the ultimate catalyst for TSLA to start the recovery rally, as it reported 443,956 deliveries for Q2, surpassing the consensus of 437,812.

My current view on Tesla is quite mixed. On one hand, the company is clearly feeling strong pressure from its Chinese peers and the pricing war keeps damaging the margins. On the other hand, Tesla remains the largest EV maker in terms of global reach and brand strength. I agree with Argus Research analysts who noted recently (proprietary source, May 2024) that Tesla is navigating between 2 major growth phases now: the global expansion of the Model 3/Y platform and advancements in autonomy and new product introductions.

However, I have some reservations about Argus’ other assessment. While the EV industry growth has slowed, they believe Tesla will overcome short-term demand and production challenges, ultimately emerging as a stronger and more efficient EV producer in both the short and long term. I think that despite Tesla’s strong long-term prospects (I sincerely believe in Tesla for the next 5–10 years), the short-to-medium term future does not look as promising. In any case, I can’t say that we have enough reason to believe otherwise.

Morgan Stanley remains cautious about Tesla’s ability to match last year’s delivery numbers, noting that Tesla would need to grow 2H 2024 deliveries by around 6% YoY to maintain volume. I don’t think this will be as easy to do as it might seem at first glance.

One major area of concern I see is vehicle pricing and the automotive non-GAAP gross margin. This could be taken as optimistic for future prices that inventory levels fell, but 0%/low financing incentives and lower production in Q2 are likely to be margin headwinds according to Goldman Sachs analysts (proprietary source, July 2024). Moreover, margins may come under more strain due to potential tariffs later this year.

Another significant risk is the timing for new lower-cost models or variants. As we know, Tesla plans to begin shipping these new models as early as late 2024 or 2025. So, given the tight timeframe and the use of existing manufacturing lines, these new models may initially incorporate design elements from the Model 3 and Model Y.

The degree to which these new features and costs will be differentiated and how it all may lead to a growth slow is a big question right now. I think the company can, without even noticing it, cannibalize part of its existing traffic in this way.

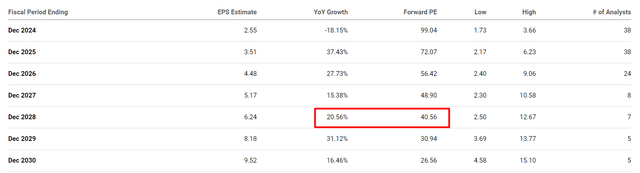

It also confuses me that Wall Street is forecasting 20% earnings per share growth (CAGR) over the next 5 years and TSLA is expected to trade at 40.5x earnings at the end of 2028.

Seeking Alpha, TSLA, the author’s notes

I don’t see much point in building a DCF model to question such a high premium. Of course, we can assume that robotaxis will take over the world, AI-powered solutions in autonomous transportation will change the game and all that, but none of that can happen overnight in my opinion. The company’s stock needs to have a margin of safety that allows it to grow comfortably even at a somewhat high valuation. Take Nvidia (NVDA) as an example – even after a phenomenal rally, it eventually traded below 20x the forwarding P/E ratio, leaving many skeptics (myself included) hanging. But with Tesla, we see that it has no such margin of safety – the rally of the last few weeks is based only on hope and is not confirmed by the fundamentals.

TrendSpider Software, TSLA weekly, notes added

In the short term, I expect Tesla stock to start testing its way out of the recent price consolidation. The seasonal data on stock trading since 2010 points to a weakening of buyers in late summer – early fall.

Therefore, I recommend selling the current rip in TSLA stock.

Where Can I Be Wrong?

Actually, I’m taking a significant risk in rating Tesla a “sell” today given its recent momentum, as much of the company’s downturn may already be priced in due to its cyclical nature, meaning current margin issues may not persist. Wall Street is already anticipating a decline in EPS over the next 1 quarter only. Thus, an unexpected downturn may not materialize, and the next earnings announcement (on July 23rd) could change the outlook if Elon Musk and his team present some major positive developments. Furthermore, Tesla’s long-term efforts to diversify its business and expand its ecosystem may ultimately prove my medium-term, currently pessimistic view on growth potential to be unfounded.

Perhaps I’m also wrong in calling Tesla as an overpriced stock because the company has many supporters who are willing to pay a very high premium for its growth prospects. This may continue.

The Verdict

Although, I think Tesla is a solid pick in the long term – more on this in my old articles – I’m still skeptical about the current hope in the air for a quick business recovery. I really like the company’s approach to diversify and build a full-fledged energy-efficient ecosystem around its brand, but I don’t like the trend in gross/EBIT margins and the very high competition that is getting stronger. Although the company managed to resist its rivals effectively in Q1 and apparently also in Q2, 2024, the trend towards cheaper electric cars continues. Nobody knows how low Tesla’s gross margin can go until this is no longer a pressing issue for the company. Given the serious overvaluation (40.5x P/E forecast for 2028), I see some pretty serious downside ahead. Goldman Sachs sees a downside potential of ~16.6%, but given the recent price increases, I think this could be even higher.

GS [proprietary source, July 2024]![GS [proprietary source, July 2024]](https://static.seekingalpha.com/uploads/2024/7/9/49513514-17205281471981018.png)

I have therefore decided to leave my “Sell” rating unchanged today.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!