Tesla: Weak Q1 Report, But Cheaper Models Give Hope

Summary:

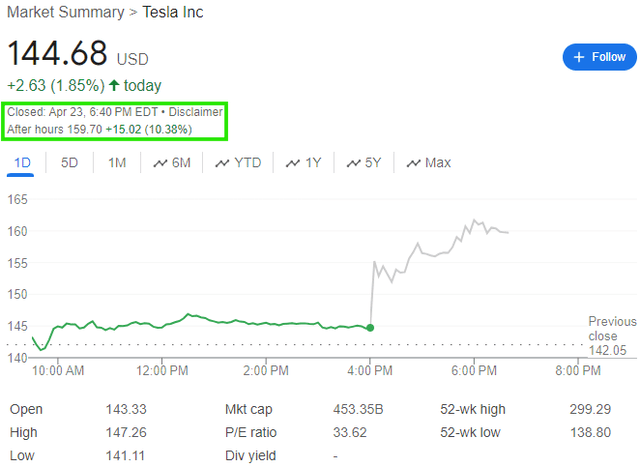

- Tesla missed top and bottom line estimates for Q1 2024; however, TSLA stock is jumping up double digits in the after-hours session.

- Going into earnings, TSLA stock was oversold, and the announcement of a new, cheaper vehicle is likely boosting investor sentiment.

- The demand environment for Tesla is unlikely to improve in the near term, but Musk is apparently back at Tesla and driving changes to turn things around.

- From a long-term investor’s perspective, the Q1 report counts for little. Tesla is a reasonably valued bet on autonomous driving, and I like the idea of accumulating more shares during this drawdown.

Omar Marques/Getty Images News

Introduction

After avoiding Tesla from April 2023 to January 2024, I upgraded Tesla, Inc. (NASDAQ:TSLA) to a “Buy” in my previous report, looking beyond near-term risks and towards long-term reward:

Based on fundamentals and technicals, I view Tesla’s near-term risk/reward as skewed to the downside. In my view, investors with a 1-2 year investment horizon should continue to avoid Tesla. On the other hand, I like the idea of restarting accumulation for investors willing to look beyond a couple of years due to Tesla’s favorable long-term risk/reward. At my investing group, we like to operate with a 5+ year time horizon, which is why we will restart slow, staggered accumulation in TSLA stock at our next bi-weekly deployment. To be clear, we understand that Tesla could drop more than 50% from current levels in the event of a hard landing. The plan is to dollar-cost average for the next couple of years even if Tesla keeps spiraling lower during this low-growth period for the EV giant.

Key Takeaway: Due to a significant shift in long-term risk/reward, I now rate Tesla a modest “Buy” at ~$180 per share, with a strong preference for slow, staggered buying over the next 12-24 months.

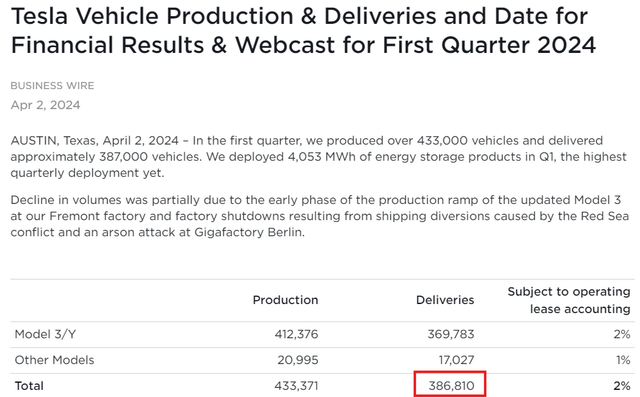

Since the publication of this report, Tesla’s stock has declined to the mid-$100s, with the EV giant missing delivery estimates for Q1 2024 by a mile earlier this month -> delivering only 386.8K vehicles (-8.5% y/y) against the consensus street estimate of 454.2K vehicles:

As of this writing, Tesla’s stock is down more than 40% year-to-date and 65% from its all-time highs. From a technical perspective, TSLA stock looks broken, but that’s not even the tip of the iceberg, as Tesla’s financial performance is deteriorating rapidly. With Tesla sacrificing profit margins to maintain sales volume in a “normalized” interest rate environment, its earnings and cash flow generation have fallen off a cliff (and turned negative in Q1). Furthermore, despite instituting multiple price cuts over the past several months, Tesla’s delivery numbers have been disappointing, and looking at Q1 performance, I think it is time for everyone to accept that “Tesla has a demand problem“.

Furthermore, Tesla has a well-documented leadership and corporate governance problem in the form of a distracted CEO who’s seeking a $56B pay package. Given Tesla’s current malaise, I think the EV giant would benefit from a CEO focused solely on running Tesla; however, as a shareholder, I am feeling better about Tesla’s leadership now that Musk is apparently refocusing his attention and spending more time on Tesla. Recently, Musk delayed his trip to India for “heavy obligations to Tesla,” and there’s evidence that he is ringing in changes at the EV giant, with a 10% workforce reduction and some executive turnover. Now, cost-cutting at Tesla is not the same as cost-cutting at Meta (META) or Alphabet (GOOGL), as this workforce reduction could hurt production (revenue & profits); however, Tesla getting leaner is good news.

Big Update On Vehicle Lineup

Now, Musk’s antics on X (formerly Twitter) may have alienated some buyers; however, the issues run deeper. Tesla’s auto vehicle lineup is aging, and the company finds itself stuck between growth waves during a period where EV adoption trends have slowed drastically.

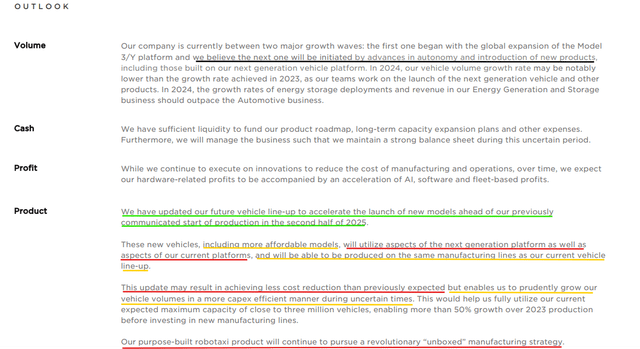

While Tesla’s next-gen platform [Model 2 – $25K mass consumer EV] was seen as the next leg of growth for a while, Tesla’s leadership seems to have put Model 2 on the back burner in favor of robotaxis [FSD] and a new cheaper vehicle built on the same manufacturing platform as Model 3/Y [with some aspects of the next-gen platform]. To tide over the 2-3 year gap between its projected growth waves, Tesla is apparently coming out with a new cheaper vehicle model in H2 2025. While this half-house measure doesn’t necessarily alleviate the macro-induced near-term demand problem, it should ease investor fears around medium-term volume growth and boost sentiment among a deflated shareholder base.

Tesla Q1 2024 Shareholder Deck

On the back of this vehicle lineup update, TSLA’s stock has popped up by ~10.5% to ~$160 per share; however, I must admit that Tesla’s Q1 report is plain bad [declining revenues, inventory buildup, negative FCF], and the selling pressure could quickly come back in the subsequent trading sessions.

Let us now go over Tesla’s Q1 2024 numbers and re-run the EV giant through TQI’s Valuation Model to see if it is still a sensible idea to accumulate more TSLA stock in the coming weeks and months.

Brief Review Of Tesla’s Q1 2024 Report

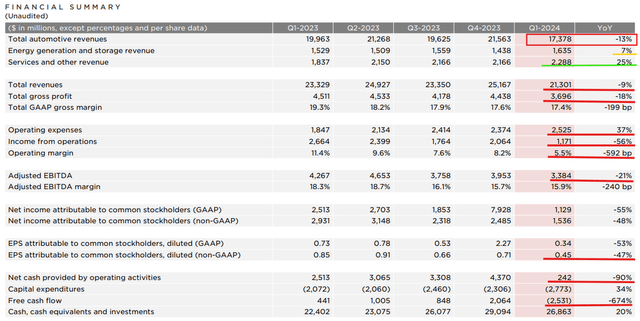

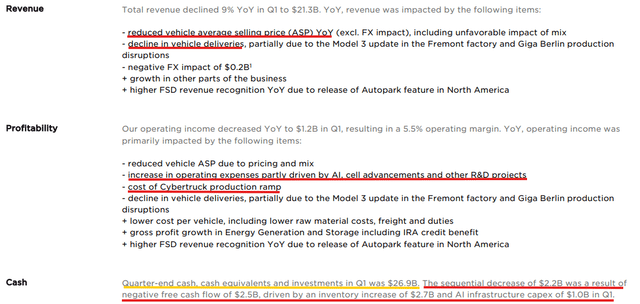

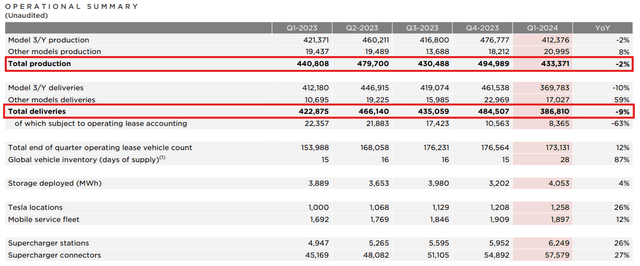

For Q1 2024, Tesla reported revenues of $21.3B and non-GAAP EPS of $0.45, missing consensus estimates on both the top and bottom lines.

Driven by lower vehicle sales and lower ASPs, Tesla’s revenue growth (-9% y/y) turned negative in Q1 2024, and GAAP gross margins declined further to 17.4% (vs. 17.6% in Q4 2023) [below management’s guardrail of 20%], reflecting the negative impact of pricing activity. Due to an unforeseen inventory buildup of $2.7B and a $1B AI Capex spend during Q1, Tesla’s operating margins fell to 5.5%, and quarterly free cash flow turned negative. In Q4, Tesla burned $2.5B. While Tesla still has a $26.8B cash cushion, the liquidity situation could get dicey pretty quickly in the event of a hard landing in the economy.

Tesla Q1 2024 Shareholder Deck Tesla Q1 2024 Shareholder Deck

Amid a series of price cuts from the EV giant, Tesla’s top-line growth rates decelerated rapidly throughout 2023, and the business is now shrinking in absolute terms! Given Tesla’s hugely disappointing Q1 delivery performance and an EV demand lull, the implied >0% y/y growth in vehicle production for 2024 seems unreasonable at this time.

Tesla Q1 2024 Shareholder Deck

While Tesla’s management expressed confidence in reversing the Q1 inventory buildup in Q2 2024, I don’t see the demand environment improving considerably since interest rates are likely to stay “higher for longer” in the absence of a recession:

In the event of a soft landing, interest rates are likely to remain elevated, i.e., Tesla’s vehicle demand and margins stay suppressed. Conversely, in the event of a hard landing, interest rates may go down quickly (improving affordability); however, auto demand will likely fall in that environment (as consumers tend to postpone or cancel big ticket purchases in uncertain economic environments), potentially forcing Tesla into even more price cuts, i.e., continued margin suppression. As a Tesla shareholder, I really hope Musk & Co could cut costs fast enough to improve margins; however, I wouldn’t bet on near-term margin expansion at Tesla.

Source: Tesla: Learn From The Past, Think Of The Future (Rating Upgrade)

Therefore, Tesla’s vehicle production will likely have to come down to match demand.

Now, according to its leadership’s commentary, Tesla was likely to experience slower sales growth until the launch of its next-gen vehicle (emphasis added):

Our company is currently between two major growth waves: the first one began with the global expansion of the Model 3/Y platform and the next one we believe will be initiated by the global expansion of the next-generation vehicle platform. In 2024, our vehicle volume growth rate may be notably lower than the growth rate achieved in 2023, as our teams work on the launch of the next-generation vehicle at Gigafactory Texas.

Source: Tesla’s Q4 2023 Earnings Deck

With Tesla now shooting for the launch of new, cheaper models based on the existing Model-3/Y platform in the second half of 2025, the next-gen platform [Model 2] is unlikely to see the light of day for another 3-5 years. This is a significant negative development, in my view, since Tesla’s next wave of rapid top-line growth was dependent on the mass $25K EV. Can Tesla launch a new, cheaper vehicle in this price range with existing platforms? Maybe, but margins on that model are unlikely to meet the guardrail of 20% gross margin.

Now, Tesla’s Energy Storage and Services businesses are growing at a healthy clip with a better margin profile. Unfortunately, these businesses are not big enough to move the needle just yet, and futuristic projects like FSD and Optimus are unlikely to pay off anytime soon.

Therefore, I believe Tesla is set for a prolonged period of tepid growth and weak profitability. That said, this quarter, the next one, or the next one, changes nothing for shareholders as TSLA stock is a long-duration bet on autonomous driving, and Musk couldn’t have made it any clearer:

If you don’t think Tesla can solve autonomy, you shouldn’t be investing in Tesla stock.

– Elon Musk, Tesla CEO [Q1 2024 earnings call]

In Tesla Stock: An Asymmetric Buying Opportunity Arises Out Of Insider Selling, Demand Concerns, And A Scary Recession Playbook, I highlighted the risks of Tesla’s recessionary playbook, rendering TSLA stock a binary bet on FSD. And with Tesla’s leadership prioritizing robotaxis, the investment thesis relies more on autonomous driving [FSD] than ever before.

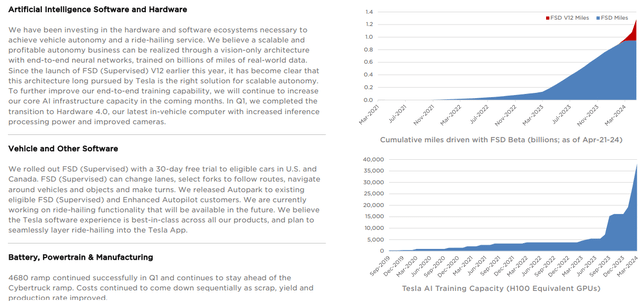

On the earnings call, Musk said that Tesla plans to build and operate its robotaxi fleet once FSD achieves full level 5 autonomy. According to my research, FSD V12 was a significant upgrade, but we’re still some ways away from full autonomy. To get to full autonomy with its vision-only architecture, Tesla is spending huge amounts on AI Infrastructure and recently reduced the price of FSD to $99 per month and $8000 upfront to increase the pace of real-world driving data collection. Personally, I view these moves positively as more data now can help solve for autonomy quicker.

Tesla Q1 2024 Shareholder Deck

As I have said in the past, Tesla FSD may or may not achieve full autonomy; however, if there’s a company that can solve autonomous driving at scale, it’s Tesla. For now, the heavy investments being made into the robotaxi [FSD] are hurting financials, but I think the long-term reward justifies the risk.

Final Thoughts: Is Tesla Stock A Buy After Q1?

As a long-term investor and Tesla shareholder, I understand the pain Tesla shareholders have been feeling amid the recent sell-off. Today’s post-ER bounce will help calm some nerves, but I think investors should prepare for more pain as near-term business performance is unlikely to improve drastically.

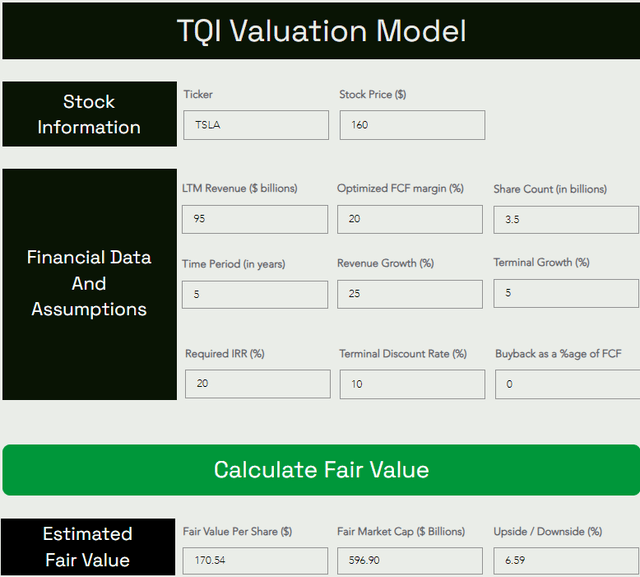

While Tesla is set to experience slower growth and continued margin pressures for the next couple of years, we must continue to take a long-term view of the business to determine its fair value. As such, I am sticking with our long-term growth and steady-state margins assumptions.

Here’s my updated valuation for Tesla:

TQI Valuation Model (Free to use at TQIG.org)

At $160 per share, Tesla’s stock is undervalued by ~5%. Given weaker-than-expected Q1 results, TQI’s fair value estimate for Tesla has moved from ~$174 to ~$170, which is something to take note of.

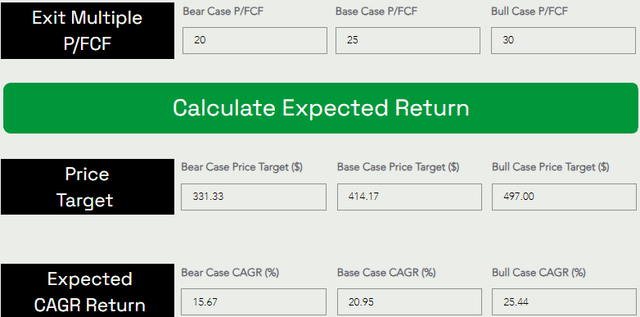

Assuming a base case exit multiple of ~25x P/FCF, I see Tesla stock going from ~$160 to ~$414 per share over the next five years at ~21% CAGR.

TQI Valuation Model (Free to use at TQIG.org)

Considering Tesla’s recent financial performance and uncertain business outlook, I still view Tesla’s near-term risk/reward as skewed to the downside. However, as a long-term investor, I see Tesla exceeding my investment hurdle rate of 15% over the next five years. Henceforth, we will be sticking with my DCA plan for Tesla in light of its Q1 report.

Key Takeaway: I rate Tesla a modest “Buy” at ~$160 per share, with a strong preference for slow, staggered buying over the next 12-24 months.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We Are In An Asset Bubble, And TQI Can Help You Navigate It Profitably!

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.