Summary:

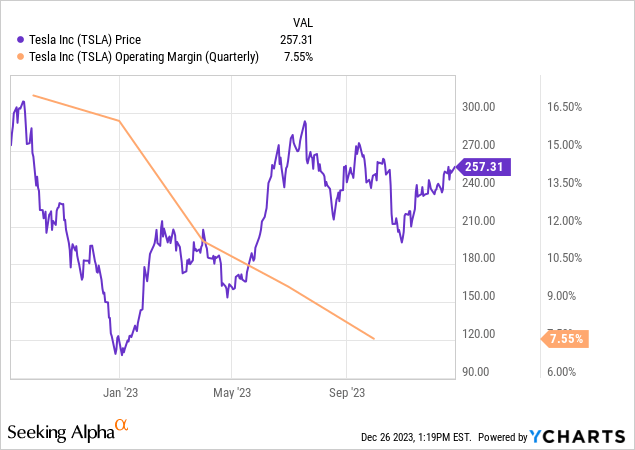

- Tesla, Inc. stock performance has seen fluctuations with gains in 2023, but many investors who bought shares between 2021 and 2022 still face losses.

- Despite cutting prices and squeezing margins, Tesla still lost market share, at least in China.

- We see limited immediate catalysts for significant upward share price movement in 2024, with Tesla expected to trade within its historical range.

FlashMovie

Investment Thesis

Since its impressive rally during the pandemic in 2020, Tesla, Inc.’s (NASDAQ:TSLA) stock price has experienced significant fluctuations, yet it has largely maintained a flat trajectory overall. As the year ends and investors scrutinize their holdings, much attention is given to Tesla’s 110% jump this year. However, this narrative often omits a crucial detail: many investors who purchased shares between 2021 and 2022 are still experiencing double-digit losses. This mixed performance presents a mixed picture, with recent buyers celebrating gains while earlier investors hope for a recovery to past highs.

Our analysis suggests few immediate catalysts are likely to significantly drive the share price upwards going into 2024. We anticipate that Tesla’s stock will continue to trade within its historical range for the foreseeable future.

While some industry peers have pointed to potential upside catalysts such as the launch of the Cybertruck, AI/robotics breakthroughs, and continued growth in its core markets, we assess these factors as having limited immediate impact on the stock’s value. Cybertruck’s market influence, for instance, might be more gradual than transformative. While Tesla’s AI advancements are noteworthy, they are not yet mature enough to be considered a decisive factor in stock valuation going into 2024.

On the downside, factors such as Tesla’s lofty valuation, rising competition in the electric vehicle (“EV”) sector, and potential slowing of growth rates are valid concerns. However, these do not appear sufficiently potent to drive a significant downturn in Tesla’s stock either. This resilience can be attributed partly to Tesla’s strong shareholder loyalty and consumer base that appears optimistic about the company’s long-term prospects, often viewing any price dips as opportunities for investment rather than indicators of long-term decline.

Volumes vs. Profits Amid Rising Competition

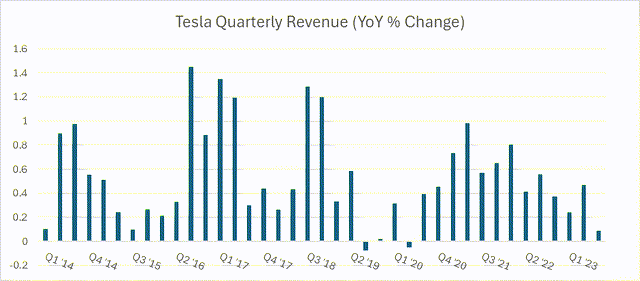

In the third quarter, Tesla recorded a Year-over-Year ‘YoY’ sales increase of 9%, which stands as one of its most restrained growth rates, second only to the sluggish performance of 2019, a period marred by significant manufacturing hurdles. A similar slowdown was seen in Q3 2015, following the Model X launch, as Tesla grappled with the complexities of producing multiple models for the first time, a daunting task for the then-smaller company.

This year, Tesla is grappling with other challenges beyond manufacturing, namely an increasingly crowded and competitive EV market and declining consumer purchasing power, pushing Tesla to cut prices aggressively to sustain volumes, thus impacting revenue and margins.

Tesla. Graph Created by the Author

We believe that the sales trends observed in Q3 2023 will persist, if not intensify, in 2024. Tesla has a narrow product portfolio focused on the high-end of the market, leaving few options for budget-constrained customers who are now grappling with a higher cost of living.

Tesla’s 2022 launch of the Berlin and Texas Gigafactories, currently in their ramp-up stages and undergoing further expansion, adds substantially to the company’s production capacity, now totaling north of 2 million vehicles annually. This increase in capacity necessitates a strategic shift towards maintaining high-volume sales, likely through price adjustments in this current environment. These dynamics reinforce our belief that current pricing trends will continue going into 2024.

On the competition front in China, which represents between 20%-25% of Tesla sales, the market is saturated, with more than 200 registered EV companies. In 2020, capacity was 26.7 million EVs, four times the 2022 production rate, putting pressure on prices. The price war in China, initiated by Tesla earlier this year, is still raging on. Fast-growing EV manufacturer XPeng (XPEV) cut the selling price of its best-selling SUV, the G6, by $1400 this month. This year, Tesla cut the prices of Model Y and 3 more than industry giant BYD (OTCPK:BYDDF). Despite that, Chinese manufacturers have proven formidable challengers to Tesla’s operations in Asia, with Tesla’s market share declining to 10%, down from 13% a year ago.

At the same time, we see 2024 being transformative for the EV sector in the U.S., marked by an unprecedented product launch wave. The U.S. constitutes roughly half of Tesla’s sales. Nearly 50 new BEV models are expected to debut (or fully launch), bringing the total to around 90 models in the U.S. This represents a more than twofold increase from the number of available models at the beginning of 2023, signaling a significant and unprecedented expansion in the EV market. These unprecedented market dynamics will make the competitive pressures that pushed TSLA to cut prices and squeeze margins by 45% this year seem like a walk in the park. Additionally, this intensified competition casts doubt on the optimistic views predicated on Ford’s (F) and General Motors (GM) decisions to scale back their EV production and sales targets last month.

Many of the new BEV models set to debut in 2024 come from well-known brands that already have a strong and dedicated customer base, entering the EV market for the first time. These include popular models like the Range Rover by Tata Motors (NSE: TATAMOTORS), Hummer by GM, and Ram Truck by Stellantis (STLA). These launches mark a significant step for these brands, known for reputation and customer loyalty, bringing the competitive dynamics for TSLA to a new level.

The Range Rover, for example, is as good as it gets in comfort compared to any passenger vehicle class. Meanwhile, Tesla customers are going online to complain about noise and back pain when driving for extended periods.

Tesla’s notable customer satisfaction and loyalty can be attributed in part to its emphasis on delivering an exhilarating acceleration experience, a characteristic rooted in the company’s initial focus on sports and performance vehicles. However, as more EV brands come to market with differentiated features and interior comfort, Tesla may find it harder to compete.

Volvo (OTCPK:VLVLY) is introducing the EX30 and EX90, doubling its BEV all-electric product portfolio with exemplary specs. Mercedes (OTCPK:MBGAF) and Audi (part of the Volkswagen Group (OTCPK:VWAGY)), which have been hemorrhaging customers to Tesla, are introducing six new models (3 each), potentially reversing a trend that has helped Tesla’s growth in prior years.

Dual Setbacks? Open-Access and Closed Launches

Tesla’s move to open-source its charging network is a bold strategy that undermines its competitive edge. This decision grants non-Tesla EV owners access to the extensive Supercharger network, previously a major Tesla exclusive. While this approach allows Tesla access to some of the $5 billion budget for charging network subsidies and is moral, one could argue that it strips Tesla of its unique first-mover advantage in charging infrastructure.

On the other hand, the delay in the Cybertruck full commercial rollout marks a significant setback for Tesla, particularly as it was anticipated to be a major catalyst for growth in 2024, especially now that the competitive dynamics are intensifying. This postponement, now extending into another year, deprives Tesla of a critical growth driver it had been counting on for the upcoming year. Currently, the Cybertruck is Tesla’s sole new model in active development. This delay represents a considerable blow to the company’s growth strategy.

In October, Elon Musk estimated 250,000 vehicles by 2025. However, historically, Tesla has experienced challenges and delays in ramping up production of new models, and estimates for 2024 vary among Wall Street analysts, ranging from 78,000 units (Morgan Stanley’s (MS) conservative estimate) to 230,000 units (Wedbush’s more optimistic forecast). We expect incremental ramp-up in production, with the impact of the Cybertruck rollout being gradual instead of transformative. Consequently, Tesla’s growth will heavily rely on its existing product line-up going into 2024.

The Cybertruck and Cyberbeast involve unique features (paywall) that come with unique engineering problems, further complicating their development process and potential adoption, but more importantly, has led to a significant increase in the selling price. Many news reports highlight the lower price of the Rear-Wheel Drive model set for 2025 delivery instead of the more expensive All-Wheel Drive model set for the 2024 line-up. The starting price of the 2024 model is $70,000, 40% higher than the starting price of F-150 Lighting. These model rollout dynamics reinforce our belief that the impact of the Tesla Cybertruck rollout will be incremental going into 2024.

Tesla’s most recent addition, the Model Y, was introduced in 2019. It remains to be seen how the new revamped Model Y will impact the competitive dynamics, but given that it is produced in China, it will be excluded from the government subsidies in the US starting next month. Moreover, beyond the Model Y revamp, Tesla announced that Model Y Long-Range and Model 3 will no longer be eligible for tax credits, further supporting our cautious outlook on Tesla going into 2024.

The state of Tesla’s current portfolio, with the absence of new models since 2019, also touches on its CEO’s busy schedule, being the head of 5-6 companies, at least three of them with multi-billion dollar operations, including X (Twitter), Space X, and Tesla. The question that comes to mind is whether Tesla’s unimpressive revenue performance reflects an increasingly distracted CEO.

Beyond 2024

The impact of Tesla’s recent price reductions on its brand image is an important consideration. A key component of Tesla’s appeal has been its customers’ sense of community and camaraderie, bolstered by a degree of exclusivity associated with owning a Tesla vehicle. However, these price cuts potentially erode this sense of exclusivity that comes with owning a high-end product.

This also touches on Elon Musk’s goal of growing sales from 1.7 million to 20 million in the next five to six years. Such an ambitious (perhaps too ambitious) goal necessitates expanding the company’s product portfolio into the lower end of the market, which could impact the brand image that fuels its current growth. It would be interesting to see how the company balances market penetration ambitions with brand image. These strategic issues become more pressing as the company grows.

Marketing considerations also come to mind. Tesla’s direct-to-consumer model is often praised for enhancing customer experience and bypassing the traditional dealership model. However, considering the goal of selling 20 million vehicles, the value added by dealerships can’t be overlooked. They offer broader reach, financial flexibility, and risk-sharing benefits. A recent Reuters report revealed unorthodox customer service practices to divert traffic away from Tesla’s service centers, highlighting operational challenges in its current model that dealerships could potentially mitigate.

Shifting gears, the impact of the recent product recalls also could impact the brand’s reputation. Although such recalls are not uncommon, and in Tesla’s case, have limited financial impact due to their digital nature that can be addressed remotely via over-the-air updates, these recalls are significant for two reasons. First is the magnitude, covering more than 2 million vehicles. Second, they relate to flaws in the Autopilot and FSD features. Tesla is fighting allegations of overstating the capabilities of its self-driving features. This is highlighted in court filings from victims of crashes involving Tesla’s Autopilot and FSD systems.

It is also essential to acknowledge that many of the features touted by Tesla Autopilot and Advanced Autopilot have been on the market for years, such as self-parking, assisted driving, lane maneuvering, and automated speed controls that incorporate traffic. The crux of the issue with Tesla seems to be how much it encourages customers to rely on these technologies. We believe that Tesla is pushing the boundaries of existing technology more aggressively than its peers with access to similar full self-driving (“FSD”) capabilities, but who are adopting a more cautious and responsible approach to rolling out similar features. While innovative, this aggressive stance by Tesla increases the risks for its customers and, by extension, the public trust in the brand’s commitment to safety.

Is Growth Rate A Catalyst In 2024?

The relationship between Tesla’s revenue growth and stock performance has shown consistent inconsistency, challenging the conventional wisdom of associating revenue trends with stock price movements. It is clear that factors beyond mere revenue figures significantly influence its share price.

In 2022, Tesla’s revenue climbed by an impressive 53%, yet its stock price plunged by 70%. This contrasts sharply with the 100% surge in the stock value this year against a modest 2% rise in revenue on a trailing twelve-month (“TTM”) basis. Back in 2021, the shares remained relatively stable for most of the year despite a substantial 70% increase in sales. Similarly, in 2018, Tesla witnessed a robust 82% growth in sales, but this did not translate into any significant movement in the stock price.

Looking ahead to 2024, we expect modest revenue growth, supported by an expanding EV market, weighed against increasing competition. However, predicting the stock’s performance based solely on these estimates would be unwise. Tesla’s stock price trajectory seems more closely tied to the market’s long-term perceptions and speculative views regarding the company’s standing in its core automotive business and advancements in Artificial Intelligence.

Tesla’s Dojo microchip designs and the Optimus humanoid robot, while capturing significant public interest recently, are unlikely to present near-term breakthroughs going into 2024. Tesla’s partnership with Taiwan Semiconductor (TSM) to produce the Dojo supercomputer chip highlights Tesla’s efforts in AI machine learning, particularly for video training from its vehicle fleet. While the Dojo microchip is poised to enhance Tesla’s neural net training capabilities and make it cheaper for Tesla to train its FSD models, the crashes, accidents, and recent recalls point that the road to FSD is marred with challenges.

The Tesla Optimus Gen 2, the company’s next-generation humanoid robot revealed earlier this month, has been built in a notably short span of eight months. The first prototype, bumblebee, was revealed in September 2022. This rapid development contrasts Boston Dynamics’ years of refinement on its Atlas robot, a fact that quickly becomes apparent when watching the demo videos of the two.

In any case, Tesla’s venture into AI, microchip design, and robotics is exciting, but these are rapidly changing fields with significant risks, which raises the question of whether outsourcing these technologies might be a better value to investors. The challenges of Intel (INTC) in the semiconductor market serve as a reminder of the risks awaiting Tesla’s new AI ventures.

Summary

In November, Elon Musk blamed high interest rates for Tesla’s mediocre sales growth, but we believe that the company’s challenges are far more complex. The rising interest rates do play a role, impacting consumer spending power and auto loan affordability. However, Tesla’s issues extend beyond macroeconomic factors. The company is navigating a maturing EV market, where increasing competition, evolving consumer expectations, and technological advancements are reshaping the landscape.

Given the high valuation and the lack of clear and immediate catalysts, we expect the Tesla, Inc. ticker to oscillate between a defined wide range in line with the post-pandemic rally range. Investors might want to consider adopting a range-trading strategy as a short-term hedge.

We would consider Tesla for a rating upgrade, provided the company achieves certain milestones. Key to this is Tesla’s ability to effectively navigate the competitive dynamics in its current market. This would be reflected in a substantial increase in revenue and a noteworthy improvement in profit margins in 2024. Additionally, the success in production and better-than-expected reception of the Cybertruck, especially considering the large scale of the U.S. truck market, could be decisive factors in upgrading Tesla’s rating. Additionally, a crucial factor would be Tesla’s strategic shift from a premium car brand to a mass-market vehicle producer. Success here would be indicated by sustained growth in unit sales, most likely via new product launches and an increased market share, particularly in developing and emerging markets.

A potential downgrade in Tesla’s rating could be driven by several factors. First, significant harm to the brand’s reputation could be a critical trigger. This includes an increase in product recalls, particularly related to essential systems beyond auxiliary Autopilot services, such as suspension and steering components. Key metrics of such reputational damage would include a surge in negative media coverage, political scrutiny, and public statements questioning Tesla’s product safety and quality beyond auxiliary services such as FSD and Autopilot.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.