Summary:

- Share price charts don’t lie. Tesla is a clear winner over Toyota both in the long term and also the past six months.

- In 2022, Tesla’s operating margin of 16.8% was second to Ferrari (24%) while Toyota was ranked 10th (7.2%).

- Toyota still seeks to prolong cars with an internal combustion engine and hydrogen vehicles, while Tesla is focused on the BEV (battery electric vehicle).

- Tesla is building a substantial stationary battery business along with its car business, which in Q1 2023 produced the world’s best selling car (Model Y), the first time a BEV has achieved this. Toyota’s plans outside of making cars are vague.

- I argue that in times of great change, companies that focus on the future of a major transition are a better bet than companies seeking to maintain the status quo.

RoschetzkyIstockPhoto/iStock Editorial via Getty Images

I watch the dramatic changes as the world gets serious about electrifying transport. It’s clear that BEVs (battery electric vehicles) have reached critical mass and the scale of adoption of BEVs in all forms of wheeled transport is massive and increasing fast. Notwithstanding the clear evidence of success of the BEV, Toyota (TM) continues to plan production of cars with an ICE (internal combustion engine) and its BEV plans are still embryonic. I’ve noticed a number of articles arguing that Toyota is a better investment option than Tesla (NASDAQ:TSLA). Seeking Alpha invites other views, so here’s my high level take on why I’m a Tesla investor and not a Toyota investor.

A history of investing in Tesla and Toyota in charts

Charts strip away the hype and obfuscation. They tell in a snapshot how your investment is doing. It’s always instructive to look in different time windows to see how things change with time.

Five-Year Chart Tesla Vs. Toyota

Starting with a five-year window, it’s clear that Tesla’s outperformance started in 2020, with 2020 and 2021 showing the meteoric rise of Tesla. This was followed by a sustained fall from late 2021 through to the start of 2023. During this period there were several times when the share price recovered. Over the five-year period, Tesla was up 1026%, while Toyota showed a modest 24.5% rise.

Tesla versus Toyota 5-year chart (Seeking Alpha)

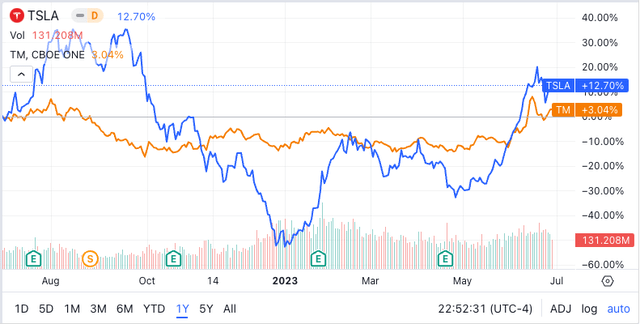

12-Month Chart Tesla Vs. Toyota

In the past year, Tesla has been volatile with share price up as much as 35% and down as much as 52%, to end the year up 12.7%. Toyota was less volatile with the share price up 7.8% and down 15.4% to end the year up 3.0%.

Tesla versus Toyota 1-year chart (Seeking Alpha)

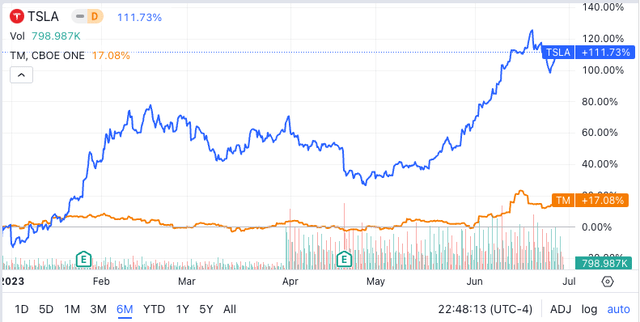

Six-Month Chart Tesla Vs. Toyota

The past six months have seen a major share price recovery for Tesla, while Toyota has shown a modest gain. Tesla had a short initial fall of 13%, then a sustained rise to peak up 126% and finish the six-month window up 112%. In the first five months of this six-month period, Toyota’s share price barely changed and in the past month the share price peaked up 23% to end the month up 16.8%.

Tesla versus Toyota 6-month chart (Seeking Alpha)

The above three charts make clear the rewards that ownership of shares of Tesla or Toyota have delivered to investors over different time periods. Considering the past six months it’s curious to me that recent articles comparing Toyota and Tesla could argue that Toyota is winning in comparison with Tesla. Being a new Tesla investor in January 2023, it’s not hard to feel good about Tesla.

Several recent articles have dug deeply into a comparison between Tesla and Toyota, with for example in one case a focus on Seeking Alpha’s Quant ratings. The Quant Valuation Grade presented in detail suggests that Tesla is a disaster, failing (F) on 14 criteria and with a D- rating on the remaining three characteristics examined. Using the same 17 criteria, Toyota was not scored on 5 characteristics and it was scored on 2 characteristics that Tesla was not scored on; it received 2 A-, 1 B+, 4 B-, 1 B, 1 C+, 4 C and 1 C-. In other words Tesla did not score better than Toyota on any of the 17 criteria scored. I notice that a number of companies that I follow receive poor Quant ratings and often this results from an emerging company being compared with a company with mature products. I think there’s a problem with Seeking Alpha’s Quant when Tesla fails Toyota on every single Value criterion scored.

The bizarre thing about the Valuation comparison is that Tesla and Toyota are scored for six aspects of EV (electric vehicle) metrics. The point is that Toyota sells effectively no electric vehicles using the definition of an EV used by the rest of the world. Toyota talks a lot about electrification, which in Toyota’s view is a car with an ICE (internal combustion engine) and a small battery. This is not an EV. Facts matter even for a company that spends millions marketing an image rather than a factual position.

Operating margin is one way of assessing the competitiveness of a car maker. A recent report concerning 2022 results, ranked Tesla (16.8%) second to Ferrari (24%), with Toyota 10th (7.2%). Interestingly Tesla also was ranked 2nd in 2021 but with a lower operating margin (12.1%) while Toyota was ranked 6th in 2021 with a 10.4% operating margin. While Tesla’s operating margin increased in 2022, Toyota’s operating margin fell.

A look at Tesla and Toyota beyond being just car makers

Toyota had the world’s largest sales of cars in 2022, but it has a bigger view of itself than cars. Likewise, Tesla is very clear that it’s about decarbonization not only of wheeled transport, but also stationary energy storage as a key part of the decarbonization of power with renewables.

I argue that Tesla is serious and it’s building a substantial business in stationary battery storage that contributes to its bottom line. The stationary storage business is growing faster than its (electric) transport business. Toyota talks a lot about modern cities and hydrogen, but effectively Toyota is a vehicle manufacturer with little clarity about what its business will look like in its Woven Cities program.

The above is important because it goes to how investors need to look at Toyota’s and Tesla’s respective businesses.

Tesla’s business addresses where the world is going

Tesla has articulated its understanding of the climate emergency from the beginning of its business and the recent Master Plan 3 day was a clear up to date coverage of where it stands in the process of electrifying both transport and assisting with renewable power production through large-scale battery storage products.

Tesla’s Model Y was the world’s best-selling car in Q1 2023 and this is the first time that a BEV has achieved that position. Release of Tesla’s 80 ton Semi BEV late last year was the beginning of the electrification of heavy wheeled transport. Tesla’s strategy has been to consistently break new ground and then argue that regulators need to address vehicle emissions because the innovations are available. The latest example of this is Tesla’s pushing the EPA to tighten emissions standards on heavy-duty trucks earlier in June.

The story is the same in the big battery sector where Tesla is pushing massive expansion of lithium-ion batteries to assist in the decarbonization of electricity grids. This major push for big batteries is an area that Elon Musk claims will become bigger than its vehicle business.

Tesla has ambitions to build 20 million cars (all BEVs) annually by 2030. Innovations revealed at the Master Plan 3 day suggest that this isn’t entirely a dream.

Tesla’s vision is based on real technical developments and building major manufacturing facilities. Tesla’s vision aligns with where the world is headed with the electrification of wheeled transport.

Toyota’s Business Overwhelmingly About Products From the Past

While claiming to produce more “electrified” vehicles than any other company, Toyota is clearly resolutely seeking to continue the manufacture of vehicles with an ICE for as long as possible, with elaborate claims about why hybrid ICE vehicles are a better climate solution that BEVs. Toyota has used superb marketing and lobbying to hinder BEV adoption in many countries and it continues today on this path. The promise about a battery breakthrough for production in 2026 is delay without providing any confidence that it shall have a BEV product by that time, despite a recent article trumpeting this projection as a triumph.

Toyota continues to promote hydrogen as a realistic possibility for zero emissions. Just a week ago at Le Mans 100th anniversary, Chairman Akio Toyoda announced a new hydrogen-engine (not fuel cell powered!) race car. Go figure.

At Toyota’s 119th General Shareholder’s meeting on 14 June, the question was asked “Can Toyota beat Tesla?” I leave readers who have the time to watch the above presentation to reach their own conclusions about Toyota’s readiness to compete with Tesla on BEV manufacture and sale. President Kato of the BEV Factory at Toyota responded that he loves BEVs. He made a point of saying this twice in his response. I didn’t get a sense that Toyota has a clear plan yet. As well as establishing a BEV factory Toyota is establishing a hydrogen factory.

Toyota has a strong philosophical commitment to “producing happiness for all” with a vision for “creating mobility for all.” A recent technology update included a major focus on hydrogen cars.

Here’s a summary from Toyota’s latest technology update:

“Let’s change the future of cars! Toyota has overcome what were thought to be difficult challenges with its technological capabilities and has developed numerous vehicles that are ahead of the times and paving the way for the future, such as the Prius, now synonymous with hybrid vehicles, and the Mirai fuel cell vehicle. Let’s change the future of cars. We will continue to lead in creating a future society by using the power of technology to transport our customers into the future and connecting cars to society.”

There’s no mention of the BEV and the future is still encapsulated as involving hybrid vehicles and fuel cell (hydrogen) vehicles.

Why electrification of transport and power is urgent

This is not the place to discuss the climate emergency. This issue is really well covered by the IPCC reports which are the summary of the findings of effectively all of the world’s climate scientists. There’s a huge amount of information in many IPCC reports. I argue that if you wish to invest in transport and energy, it’s really important to understand what’s happening and why exit from fossil fuels is urgent.

Just about all companies acknowledge the climate emergency and the need to exit fossil fuels. Tesla “gets” it and has been a leader in the change in both transport and stationary energy storage. Toyota is a laggard and has a lonely position as a vehicle manufacturer resolutely continuing ICE manufacture at a time when almost all car makers are actively planning an exit from the ICE.

Conclusion

Investment means putting hard-earned cash into a bet on the future. It’s important for you and your financial advisor to look at a potential investment from different angles, some of which might not be part of your world view. I’m a bit of a novelty freak who likes to invest in emerging companies breaking new ground. So I put a lot of effort into trying to understand where things are going and to think about how a possible investee company will cope with a changing world. This means I’m less focused on comparing companies with products that are well-established, and where investment success leans heavily on how management copes with a battleship that has a well-established direction. When reading this article the above explanation may help readers understand why I’m on the side of Tesla in comparison with Toyota. However, I part company with Toyota with regret because I’ve been a very happy Lexus car owner for 24 years. It took Toyota explaining that I needed a choice about my style of vehicle and then not offering a BEV for me to choose to change brands. I live in the Australian bush and Tesla was not a good option for the rough roads I experience and so I’ve opted for a BYD (OTCPK:BYDDF) Atto 3 BEV as my recent purchase. The first 10,000 kilometers have convinced me that BYD offers choices that Toyota doesn’t offer and doesn’t plan to offer in the near future.

My take on the comparison between Tesla and Toyota is that Tesla is making up products to fit where the world is headed, and indeed the company is largely responsible for making the electrification of wheeled transport today’s clear solution. I’ve briefly explained why I accept the science that says that the electrification of wheeled transport is an urgent issue, with lots of evidence that global governments are beginning to understand how dangerous the situation is. For the above reasons, I don’t see Toyota as a safe place for my investments. I’m invested in both Tesla and BYD and feel comfortable with these investments.

I’m not a financial advisor but I follow closely the electrification of transport and the decarbonization of electric grids. I hope my perspective is helpful for you and your financial advisor as you contemplate investment in these sectors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, BYDDF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.