Summary:

- Tesla, Inc. stock is currently in decline, with analysts lowering ratings and negative news emerging, but the long-term strategy may yield positive results.

- The strategy of lowering prices to make vehicles more affordable is causing concern in the market, but it aligns with Tesla’s goal of popularizing electric driving.

- Tesla’s advantage in autonomous driving and AI, as well as its charging network and additional services, provide opportunities for future growth and profitability.

jetcityimage

Currently, the sentiment surrounding Tesla, Inc. (TSLA) stock mirrors that of late 2022, with the stock in continued decline, analysts lowering their ratings, and negative news persistently emerging. It’s undeniable that Tesla will encounter challenges in the coming quarters, and its financial performance may not be stellar.

However, the market seems to overlook Tesla’s long-term oriented strategy, which I believe will yield results in due course. Similar to the situation in 2017-2018, when Tesla faced skepticism and its financials appeared bleak, subsequent years proved the decisions made were correct and led to positive outcomes. I see parallels in today’s scenario.

In my opinion, what is most penalizing the market is the strategy being pursued in the automotive industry, but in this article, I will try to explain why I believe it is the correct long-term strategy. Therefore, I believe that if we are patient and have our focus set further than what the market is currently seeing, we may be facing an extraordinary opportunity to buy Tesla stock with a very favorable potential/risk ratio for investors.

What are the market fears surrounding the automotive market?

In my opinion, what is causing Tesla’s stock to undergo this significant decline in recent weeks is the downward revision of expectations for 2024. While it’s true that this year will mark the end of sales growth nearing 50%, I don’t believe this is as negative as the market is currently discounting. The strategy is to lower the prices of their vehicles to make them more affordable for the public. This will inevitably erode margins, and it would be concerning if this weren’t accompanied by a significant reduction in vehicle manufacturing costs.

Nearly a year ago, Tesla held its Investors Day, and although the stock dropped 10% that day and the market didn’t show much interest, that day Tesla laid out the foundations of its strategy for the coming years. From battery manufacturing to assembly lines, in those almost four hours of the event, it was explained in detail how they would achieve their goal of reducing the manufacturing cost of their cars, particularly focusing on the upcoming Tesla Model 2/C (This is the purported name for Tesla’s next, more affordable vehicle, codenamed “Redwood.”)

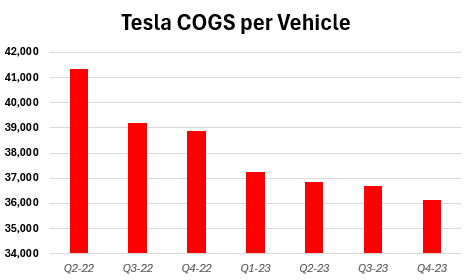

So, considering that Tesla’s primary objective right now is to popularize electric driving, it makes perfect sense to try to minimize production costs as much as possible, as this will also allow them to reduce the prices of their vehicles. Obviously, this process is gradual and cannot be achieved overnight. Currently, we are at a stage where the price has dropped more than the production costs. However, it’s likely that the prices of the Model 3 and Model Y won’t decrease much further, whereas the costs will continue to decrease for quite some time. In the following table, we can see how the costs of goods sold per vehicle have decreased over the past few quarters for the company.

Author’s calculations

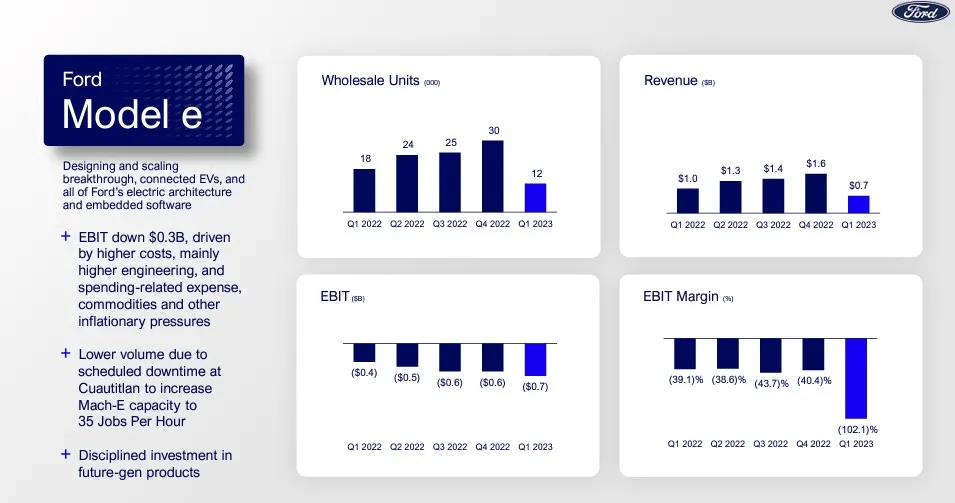

Furthermore, within this strategy, Tesla is executing a purge of its competition. Given that it is practically the only manufacturer with positive margins in electric vehicles, reducing the price of its vehicles is something impossible for competitors to imitate. This is because any attempt to lower prices would only worsen their already negative margins. For instance, we see that Ford’s margin per electric vehicle sold is dismal, and that of most of its competitors is equal to or even worse.

Therefore, Tesla is placing most of its direct competitors in a dilemma. On one hand, they could lower the price of their vehicles to compete with Tesla, which would worsen their margins and increase losses. On the other hand, they could keep their vehicle prices higher than Tesla’s, but this would mean that the quality-price ratio would be worse, considering that Tesla vehicles are arguably the best in the electric vehicle market.

Ford Investor Relations

Another factor that will obviously impact the growth of sales in the automobile market is the high interest rates. When interest rates rise, one of the most affected markets tends to be the automotive market, as most purchases are made with credit that has become more expensive. So, even though it may not be the main reason, it will also affect growth in the coming quarters. Although it is also true that interest rates are expected to gradually decrease in the short term, I don’t believe it will be enough to offset the two years they have been at high levels.

Therefore, if I were to summarize, this point would be that the market is concerned because sales growth in the automotive sector is expected to be lower than anticipated. However, apart from the higher interest rates, this is also due to a long-term strategy with which Tesla aims to gain market share and push its competitors to the limit. From my point of view, what we need is patience. I believe the strategy is correct and will ensure that Tesla continues to have the largest market share in electric vehicles for many years, and that with the cost-saving plan, margins will grow along the way.

This strategy makes more sense if we understand the cross-selling that Tesla aims to achieve with its products, with the car as the central axis of its ecosystem. Something very similar to Apple with the iPhone.

Autonomous Driving and AI

Tesla is undoubtedly one of the most advanced companies in terms of developing models for autonomous driving. Their position is highly advantageous compared to others in this field for three reasons:

-

They have more data than anyone else: Tesla has millions of cars on the road collecting real-world data to train their AI models. For many years, they understood that having vast amounts of data was crucial for this, and since then, they have been gathering data from all the cars in circulation and learning from it.

-

They have their own data center: With Dojo, Tesla is not only the company with the highest computing capacity in the automotive market but also one of the largest in the world. Additionally, Tesla is starting to manufacture its own chips for customized training of its artificial intelligences, which implies greater specialization and cost savings.

-

All their vehicles have the ability to run their AI: Since practically the first models Tesla introduced to the market, all of them have been equipped with the necessary hardware for autonomous driving. Therefore, the day the software is completed, the entire Tesla fleet will be able to execute it. This is something that almost no other manufacturer is taking into account and will be crucial in the future.

If we analyze these points, we see how the strategy of lowering the prices of their vehicles also fits much better. More affordable prices for their vehicles imply a greater number of units on the road, which means collecting more data and being able to train their models better and faster. When these are ready to be launched into production, there will be a greater number of vehicles that can execute the model, and therefore, a larger target audience.

Services

In addition to full autonomous driving, Tesla has other ways to monetize its vehicle fleet. Firstly, there are traditional sources used by conventional manufacturers, such as spare parts sales or financing provided by Tesla itself. However, more interesting are the additional services, such as its network of charging stations. In fact, Tesla is unique in that it not only manufactures the cars but also owns its own charging stations, acting as its own “gas stations.”

Tesla’s charging network is not only the most extensive but also the highest quality in the world. And naturally, as the number of Tesla vehicles in circulation increases, the profitability of this infrastructure will also increase. Furthermore, Tesla is in the process of opening its charging stations to vehicles from other manufacturers. This initiative clearly highlights Tesla’s competitive advantage over its rivals, as the latter have chosen to collaborate with Tesla instead of attempting to replicate its infrastructure.

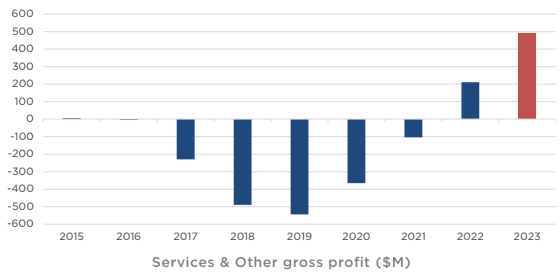

This process of opening up the charging stations is already underway in several European countries, and it is expected to continue over the course of this year and the next, gradually opening up to different manufacturers in the United States as well. Although it has taken years to make this charging infrastructure profitable, as reflected in the following graph, operational leverage in the services sector is significant. This is because the maintenance costs of the charging network are comparatively low compared to its initial deployment. Therefore, as the use of this infrastructure becomes more widespread and more vehicles from Tesla and other brands access it, profit margins experience a considerable increase. I believe that in the coming years, we will see the services sector playing a much more prominent role in Tesla’s total profit.

Tesla Investor Relations

Conclusions

If I had to summarize this article in one word, it would be “patience.” I believe Tesla’s strategy of reducing prices is the right one when considering the long term. Lowering prices will not only put pressure on its competitors but also bolster other potentially more profitable areas of its business. All this without taking into account Tesla’s other business lines. Apart from automotive, Tesla is involved in the energy and solar panel business, robotics, and artificial intelligence.

Assessing Tesla is truly challenging, as most of these business lines have yet to reach their full potential and are difficult to quantify, much like trying to predict the automotive market in the coming years. However, I believe the current prices we are seeing in Tesla provide enough margin of safety to assign it a buy rating. Tesla employs the best engineers in the world, led by what I consider to be the greatest entrepreneur in history, while they work in some of the sectors with the highest growth and future potential.

Personally, Tesla stock is my second largest position in my portfolio, and I have been adding to it over the past few weeks. I think if we focus on the long term, Tesla’s future is bright despite the potential periods of slower growth and greater short-term complications.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.