Summary:

- When based on present fundamentals, Tesla, Inc. is priced for growth and appreciation, as we anticipate 20% upside from current levels.

- Expect Tesla earnings surprises in the way of deliveries, as larger-scale producers with more expertise are positioned to take market share away from up-starts.

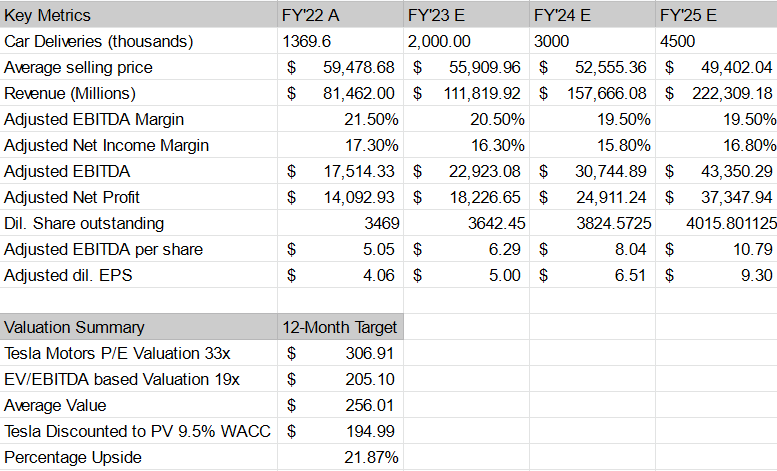

- We project revenue of $222 billion, and derive our price forecast based on a combination adjusted EBITDA/earnings multiples.

- Elon Musk might combine his businesses into a superstructure entity like Google, which could be valued at $10 Trillion + by 2033.

- Absent substantial M&A activity, Tesla doesn’t achieve a valuation that’s in excess of Apple and Saudi Aramco.

JasonDoiy

Tesla, Inc. (NASDAQ:TSLA) had what many would consider a very strong quarter in quite a while, as TSLA in Q4 2022 beat on revenue and earnings without as much ludicrous commentary as usual from Elon Musk on the earnings call. Investors responded favorably, adding +25% to the stock price over the past five trading sessions. We value the business at $195/share and expect upside on new announcements and ongoing execution absent any material shortages for supplies in the supply chain. TSLA’s solid performance in the afterhours session continued into Thursday’s trading session for an additional +10% gain, bringing the BEV (battery electric vehicle) maker’s market cap to $500 billion.

We value TSLA stock using a mix of adjusted EBITDA and P/E multiples on FY ’25 revenue of $222 billion, and anticipate an additional 20% upside, maybe more depending on hype/optimism tied to product roadmap and deliveries. Tesla reported Q4 ‘22 revenue of $24.32 billion versus consensus $24.16 billion, and adjusted dil. EPS of $1.19 versus $1.13, beating estimates by 5.3%.

We noted a drop in profitability, which was driven by lower ASPs, but the announcement of some higher margin categories like the Tesla Cybertruck and Tesla Semi Truck makes us extremely optimistic that the net profit margin erosion won’t be as severe, even with volume car production on Model 3/Y putting pressure on average selling prices.

We also liked that Elon Musk referenced the Cybertruck on the Q4 2022 earnings call:

“Yes, Cybertruck will have Hardware 4. And to be clear, for 2023, Cybertruck will not be a significant contributor to the bottom line but it will be into next year.”

So, Cybertruck is on track, and Rivian Automotive, Inc. (RIVN) finally has to meet its electric competitor in 2023.

Investment thesis summary

We anticipate that there’s a compelling case for why Tesla could deliver 1.8 million to 2 million cars in 2023. Tesla is not as supply constrained, and production is starting to normalize reducing the shortages experienced at the onset of the pandemic. TSLA’s gaining share on pricing and new customer adoption, with market penetration at a low enough base to suggest a material vehicle opportunity, which is reflected in our analysis.

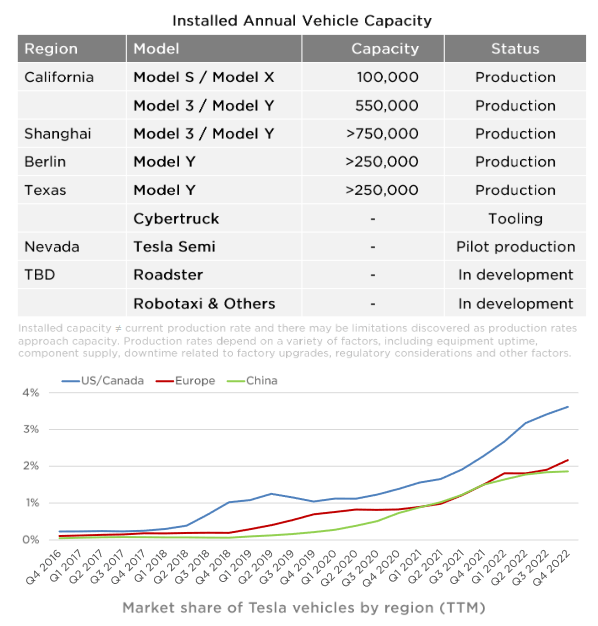

Figure 1. Vehicle production capacity

Tesla (Tesla)

Elon Musk expects 1.8 million car deliveries, but with ramp-up of various facilities, and some announced production/volume gains within existing production sites, there’s a bias towards 200k volume beat, which we embed in our model to help capture any delivery surprises on heightened demand due to gas price sensitivity and electric vehicle credits.

We anticipate production surprises going forward, and production ramp-up to scale to levels of conventional automakers using purely BEV technologies. Value-added components like autonomous driving keeping the ASPs higher even at larger volumes by 2025.

We anticipate that our profit forecast becomes conservative, as TSLA doesn’t have many of the legacy costs of other vehicle OEMs tied to pensions, and has a more established/efficient production line in the BEV space to sustain better profitability. We also anticipate Tesla to make a leap on profitability when battery technologies improve and the cost of battery cells reduces the bill of materials even further.

Figure 2. Summary of financial model

Analysis by Trade Theory (Trade Theory)

We recommend TSLA and provide a $195 Price Target, implying 22% upside from current levels. While we don’t enjoy the CEOs character or attitude in public or his comments on Twitter, we cannot deny that the business is positioned for substantial growth, as we value TSLA using a blend of historical growth based multiples, tech EV/EBITDA multiples, and average the value on FY’ 25 estimated adjusted dil. EPS of $9.30. We then discount our assumption by 9.5% or firm’s WACC (weighted average cost of capital) to then arrive at a $195 price target.

We expect the company to grow sales to $222 billion on 4.5 million vehicle deliveries at an average selling price of $49 thousand dollars, which translates to a business that will be valued at $1.2 trillion by 2025. Absent any material changes to the business like the merger and combination of various businesses… there’s realistically no path to achieving a $4-$5 trillion valuation over the next 3-5 years.

What is Elon Musk trying to communicate?

We find ourselves stumped right now; how does Elon Musk anticipate that he’s going to eclipse two of the biggest companies on earth and ignore his closest competitors, all while getting questioned in court within the same week, regarding the separate incident of his tweet announcing taking the company private at $420 per share with the help of the Saudi fund (a deal which later got revealed to be preliminary rather than “secured”). Twitter users polled would much rather have a different owner than Elon Musk.

It’s almost comical at this point, because it’s almost as bad as watching an entire nation of fans sour on a sports team owner and request a change in ownership, except there’s hardly anyone on planet earth that could afford to buy such a large tech company, let alone pry it from the second-richest person on earth after he pried it away from Jack Dorsey. The bird stays in Elon’s portfolio, and we expect the portfolio to come together in some sort of death star construction.

We think Elon Musk is absolutely serious about eclipsing both companies in value

Now some might have skipped this part of an earlier earnings call, laughed, or something. But, Elon Musk envisions the company becoming bigger than Apple and Saudi Aramco combined on a market capitalization basis in the future. He literally said that on Q3 ‘22 earnings, and then he never mentioned anything about it again on the Q4 ‘22 earnings call.

After the shakedown in the courthouse, we’re not surprised that he’s not making such wild statements on the Q4 ‘22 earnings call. And as a consequence, the stock does better as a result by rallying +5% in the after hour session following Wednesday’s earnings announcement at close.

If we combine Apple Inc. (AAPL) at $2.25 trillion, and Saudi Aramco at $1.94 trillion, it would combine to a $4.19 trillion market cap. At present, Tesla’s market capitalization is $500 billion, which implies that his sales pitch this year is quite simple: the company will increase in value from $500 billion to $4.2 trillion in total market capitalization.

On his path to $4.2 trillion, Musk’s gone on to denounce every competitor by failing to even acknowledge that a distant number two even exists. We think the distant number 2 automaker is Lucid Group, Inc. (LCID), but then again, maybe Elon’s right, and we’re wrong, who knows?

What Elon Musk has said for the past two quarters makes us chuckle a little:

George Gianarikas from Canaccord Genuity asks Elon Musk, I’m curious how you see the current competitive landscape changing over the next few years. And who do you see as your chief competitors five years from now?”

Elon Musk responds, “Five years is a long time. As with the Tesla order part, AI team, until late last night and just we’re just asking guys like, so who do we think is close to Tesla with — a general solution for self-driving? And we still don’t even know who would even be a distant second. So, yes, it really seems like we’re — I mean, right now, I don’t think you could see a second place with a telescope, at least we can’t. So, that wouldn’t last forever. So, in five years, I don’t know, probably somebody has figured it out. I don’t think it’s any of the car companies that we’re aware of. But I’m just guessing that someone might be right out eventually, so yes.”

So, Apple shareholders, and Tim Cook, have to somehow acknowledge that Elon Musk and Tesla Inc. is going to eclipse them in value, but Elon Musk can’t point to anyone else catching up to Tesla Inc. and his path to global dominance? The CEO is unwilling to admit outright what an analyst is suggesting indirectly as a means of reaching such a crazy goal.

Elon Musk and George Glanarikas from last quarter, Q3 ‘22 earnings call, from Seeking Alpha transcripts:

George Gianarikas from Canaccord Genuity, “And just as a follow-up, this is for Elon. With your pending acquisition of Twitter and your stakes in SpaceX and Neuralink and Tesla, how much would the combined companies benefit from operating under a single super structure, if at all, like a Google Alphabet?”

To which Elon Musk eagerly tries to deny the possibility of the mega merger, “It’s not clear to me what the overlap is. It’s not zero, but it’s — I think we’re reaching. I’m not worried about it. I’m not an investor. I’m an engineer, a manufacturing person and a technologist. So, I actually work and design and develop products. That’s what I do. So, it’s not a — we’re not going to have a portfolio sort of investments over it. So, I don’t know. I don’t see obvious sort of some — get combined under an umbrella, at least right now.”

Now, keep in mind, both AAPL and Aramco are likely to grow in value at the average S&P 500 Index (SP500) growth rate at minimum, so not only does Tesla have to overshoot the $4.2 Trillion number, but also account for the growth rate of both companies. So, if $4.2 trillion has a return rate of 12% for the 10-year period, Tesla Motors would need to reach a valuation of $13 Trillion assuming those two companies continue to grow in-line with the S&P 500 average.

How does Tesla Inc. reach $13 Trillion in value over the next 10 years?

Elon Musk could assemble his entire portfolio of businesses that he’s built or advised on to become a super conglomerate. If Tesla were to combine all the entities it would mirror the Death Star construction from Star Wars Episode 6, with a rebel faction of DOJ regulators, the last holdout from stopping global domination.

And we don’t mean this in sarcastic humor, but really that’s the only hint we’ve got at $500 billion appreciating to $13 trillion over the course of 10 years. If Elon Musk does decide to merge everything into a conglomerate and takes a backseat like Warren Buffett (Berkshire), Bill Gates (Microsoft), Tim Cook (Apple), Sundar Pichai (Google), Jeff Bezos (Amazon)… it would look as good or bad as the picture we carefully assembled below.

Figure 3. The Empire Might Strike Back…

Image is author’s interpretation of current events (Trade Theory Illustration)

This sounds a bit crazier than the usual Elon Musk we’ve come to know over the years. But, let’s roll with the punches here, because about 6 or 7 years ago, somebody laughed on a conference call when he said Tesla was going to reach $700 billion and ended up with an $800 billion peak valuation. We’re not going to make that mistake; instead we’re going to try and entertain the super genius’s craziness with our crazy interpretation of what he’s thinking.

We have a hard time imagining how Tesla, Inc. on its own amounts to the valuation growth needed to satisfy the $14 trillion value we estimate is needed to eclipse the combined value of Apple and Saudi Aramco by 2033. It almost sounds way too ambitious by most measures, but if we think carefully about the ramifications of Elon Musk combining the separate businesses he’s built into a sort of superstructure, it would benefit one person primarily: Elon Musk. Which is why we don’t believe the comments he made to the analyst about not wanting to assemble a portfolio.

Now, if you think about the way the businesses are structured right now, they offer no immediate synergies, and some would argue that they perform better as separate companies. But, it also limits investors to separately traded vehicles, and those businesses are linked to Elon Musk. Apple wouldn’t be as valuable of a company without diversifying into more products and categories inclusive of services and even payment technologies, music, and entertainment.

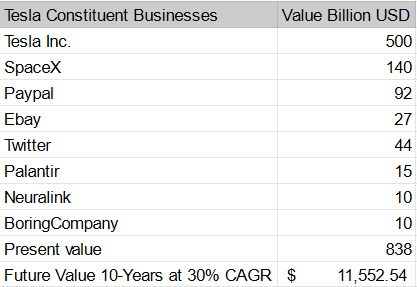

Value of a super Tesla entity at present?

When we look at the validity of merging into a super structure, we think it makes sense for a number of reasons.

1) Scale. TSLA’s market opportunity in vehicles, though large, represents saturation risk at some point in the future.

Figure 4. Consolidated value of Elon Musk involved businesses

estimate by Trade Theory (Trade Theory)

If TSLA goes conglomerate, it would compose a number of opportunities like social networking, payment technology, neuro technology, space exploration and mining, space broadband, online auction marketplace, government computing contracts, and so forth.

2) Unique portfolio has substantial synergies due to founder and board level cooperation to ensure consolidation as all the businesses are related to Elon Musk.

3) Space exploration extremely valuable, with SpaceX valued at $137 billion, and expansion into biotech extremely valuable with Neuralink representing more than $10 billion market cap opportunity on medical device technologies. When combined with the existing or former publicly traded companies, PayPal (PYPL), eBay.com (EBAY), Palantir (PLNT) and Twitter (TWTR) the consolidated enterprise value could at some point compete with and exceed the combined value of AAPL and Aramco, though it would take an aggressive growth rate of 30% off the base of 9 or 10 different companies combined into a single entity.

Never doubt Elon Musk

Though we might come across as playful and sarcastic, perhaps we want to pride ourselves on seeing around corners as to what happens next. While we like the organic growth metrics, and the projected run rate to an eventual production volume of 5 million to 10 million vehicles making BEVs reach production scale similar to the big 3 autos in America, we see that scenario valuing Tesla, Inc. stock at $195/share currently with a path of beats taking us past $200 per share this year.

Profitability is driven by the higher ASPs and consumers conforming to a more inflationary/higher priced environment. Even with those assumptions, we factor about +20% upside, maybe more upside on some expectation beats throughout the year. M&A activity could increase the size of the business at some point, and we think TSLA will combine businesses as the BEV business starts to mature and becomes less profitable.

Tesla, Inc. stock already carries significant upside. Near-term opportunities tied to the car business, energy storage, financing, and insurance should provide enough meat for shareholders over the next 12 months. But, over a longer time frame, people will begin to wonder if Tesla can reach a value that’s in excess of Apple and Aramco.

So, if Elon says it’s possible, then who are we to say it’s not? Instead, we opted to match his craziness, as we reassert our positive stance on Tesla, Inc. throughout the entirety of this article.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.