Summary:

- Tesla, Inc. reported its Q4 results and beat profit estimates.

- There were major negatives, however: deliveries, margins, and cash flows.

- Tesla has rallied off recent lows and does not look especially attractive as it is battling some operational headwinds.

Justin Sullivan/Getty Images News

Article Thesis

Tesla, Inc. (NASDAQ:TSLA) reported its fourth-quarter earnings results that beat estimates on both lines, which is good for shareholders, of course. However, there were also some notable negatives in the report and the forward guidance that we will delve into in this article.

What Happened?

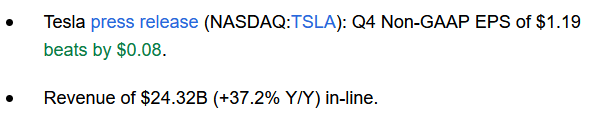

Tesla reported its fourth-quarter earnings results on Wednesday afternoon. The following screenshot from Seeking Alpha shows the headline numbers:

Seeking Alpha

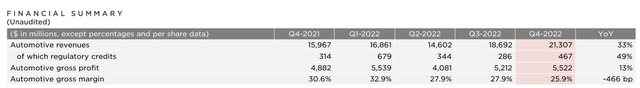

The company grew its revenue by 37%, which was in line with estimates, or slightly ahead of estimates, depending on what one uses as the source for the consensus estimate. Profit estimates were beaten clearly, by around 7%, which was a strong showing. However, investors should note that the fourth quarter was not yet impacted by price cuts to a significant degree yet, which is why profits could come under more pressure in Q1 and beyond, when the major price cuts will impact profitability to a larger degree.

The Good, Bad, And Ugly

Delving deeper into the results, there were some important things to note.

Guidance

The first important item is Tesla’s forward guidance. The company has been calling for 50% annual deliveries growth over a multi-year time frame for quite some time. While (some) bulls have argued that this could be easily achieved thanks to the growth of the overall electric vehicle (“EV”) market, (some) bears have argued that maintaining a very high growth rate for a prolonged period of time will be impossible, as the law of large numbers dictates that relative growth will eventually slow down.

Based on Tesla’s most recent guidance statements from the Q4 report, it looks like they are moving away from the 50%-per-year goal, at least for the time being. The company delivered 1.31 million vehicles during 2022, a 50% increase in that number would result in 1.97 million vehicles being delivered this year. Tesla has, however, guided towards deliveries of just 1.8 million vehicles this year, which is well below the number of vehicles that would need to be sold in order for Tesla to hit its 50% growth target.

While the implied deliveries growth rate of 37% is still strong relative to the average legacy player, its considerably less than what Tesla has achieved in the past. A trend of declining growth could hurt the bullish thesis and justifies a significantly lower valuation. The lower valuation has, at least to some degree, been achieved already, thanks to the share price compression we have seen over the last year.

When it comes to revenue expectations for the current year, investors shouldn’t be too bullish. At constant sales prices, a 37% deliveries increase would make for a revenue increase of close to 40%, assuming an unchanged price/mix. But since Tesla has lowered its vehicle prices considerably over the last couple of weeks, sales growth will likely underperform deliveries growth meaningfully. Price decreases for U.S. models were between 6% and 20%, and price decreases in China were relatively comparable. When we assume that Tesla’s revenue per vehicle declines by 12% due to these price decreases, which seems like a reasonable base case assumption to me, then revenues will grow at a mid-20s rate this year. That’s still pretty strong in absolute terms, but pretty far from what Tesla has done in the past. Importantly, this will also trail the growth performance that is expected from Tesla’s most important competitor, BYD (OTCPK:BYDDY, OTCPK:BYDDF), which is forecasted to grow its revenue by well above 40% this year.

When Tesla continues to underperform BYD in terms of business growth, after BYD has already taken the EV sales crown from Tesla (when we include PHEV sales), that could threaten Tesla’s status as the most important EV stock — investors that are bullish on the EV industry overall might flock towards BYD instead of Tesla in the future, especially since BYD is also trading at a lower valuation (29x 2023’s expected net profit, versus 33x 2023’s expected net profit for Tesla).

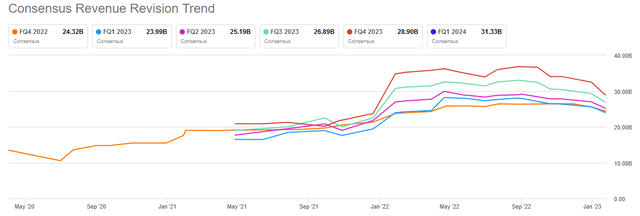

The revenue growth assumption I laid out above, based on the expected deliveries growth, could also result in some estimate cuts. Right now, analysts are predicting 28% revenue growth for Tesla in 2023, but based on the now-announced deliveries estimate, the analyst community might continue to lower its estimates — a trend that has been in place for a while:

As we see in the above chart, estimates for the coming quarters have been trending down in recent months, with the drop accelerating over the last couple of weeks. Until this downward trend stops or reverses, shares could be at risk of further selling pressure as expectations are reset and as price targets are reeled in — this year, the price target has already dropped from more than $300 to just $190, and more of the same could be coming.

Also, investors should consider what Tesla’s guidance implies for growth throughout 2023. In Q4, Tesla produced 439,000 vehicles — a strong result. But if production is kept at that level for a whole year, we get to 1.76 million vehicles. Tesla’s guidance for 1.8 million vehicles this year thus implies that growth throughout 2023, relative to the most recent run rate level, will be very meager — around 2%. In other words, Tesla’s guidance implies that growth versus all of 2022 will still be very healthy, but growth versus the most recent quarter will be close to nonexistent, despite the ongoing ramp-up of some of its factories and despite the price cuts. I think this is a major “problem” for the company that investors shouldn’t neglect.

Margins

Another important item from the earnings release is Tesla’s margins. In Q4, Tesla achieved a gross margin of 25.9%, which is far from bad. The trend, however, is bad indeed:

The margin dropped from 30.6% one year earlier, which makes for a 470 base point decline. In other words, Tesla is now generating 15% less gross profit per dollar in revenue relative to one year earlier. And that is before the recent price cuts have really impacted Tesla’s margins — price cuts in China were announced at the end of the quarter, while price cuts in the U.S. were announced in the current quarter. With margins dropping by close to 500 base points over the last year, and by 200 base points in one single quarter, even before the major price cuts are impacting these metrics, investors should brace for further margin pressure in the foreseeable future. This, in turn, will negatively impact Tesla’s profits, all else equal. Tesla’s margin performance is also noteworthy versus that of its peers:

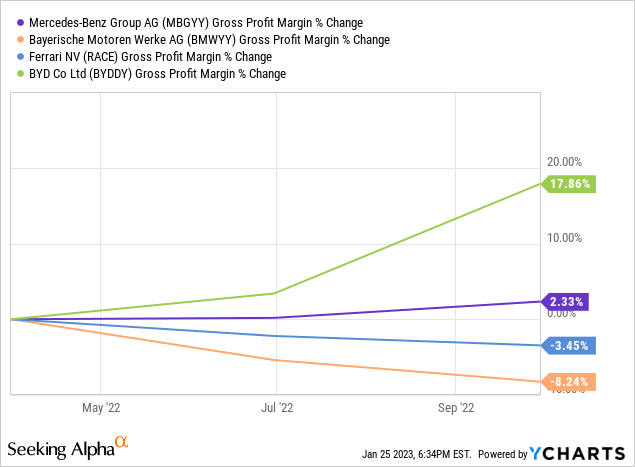

While Tesla’s gross margin declined by 15% over the last year [25.9%/30.6%], its peers have fared a lot better: legacy premium manufacturers Mercedes (OTCPK:MBGYY) and BMW (OTCPK:BMWYY) have reported a +2% and -8% gross margin movement, respectively, indicating that Tesla has underperformed its legacy peers despite higher volume growth — generally, one would expect that volume growth leads to a better margin performance due to improving economics of scale, but that seems to not be the case with Tesla right now.

Importantly, Tesla’s biggest competitor, BYD, saw its gross margin rise by a compelling 18% over the last year — with this EV player outperforming Tesla easily on the margin front, rising commodity prices, e.g., for lithium, are not a good excuse for Tesla, as BYD would be negatively impacted by that as well. Instead, it looks like BYD is executing better and has tighter cost controls, while Tesla is seemingly losing tailwinds from unsustainably high prices that were not going to last forever as competition is ramping up.

Cash flow

Investors aren’t buying into Tesla due to wanting a dividend today, but a company’s cash flow still matters even if that company does not make any dividend payments. It signals a company’s resilience versus downturns and the quality of a company’s earnings.

Tesla has generated free cash flows of $1.42 billion during the fourth quarter, according to the earnings release. This annualizes to around $5.7 billion, which makes for a free cash flow yield of 1.3% at current prices. And yet, the free cash flow result was already boosted by a major increase in Tesla’s accounts payables, which rose $1.36 billion during the quarter, while Tesla’s accounts receivables rose by just $720 million. If AP and AR had risen by a similar amount, free cash flow would have been significantly worse, at just $800 million, or $3.2 billion annualized — which would make for a meager free cash flow yield of just 0.7%.

So while reported profits are strong, Tesla’s free cash generation isn’t. While one can argue that this is due to growth investments, the fact that Tesla is forecasting no meaningful growth in deliveries versus the Q4 run rate level throughout 2023 indicates that growth investments aren’t really paying off — at least that’s what things look like to me right here.

Takeaway

Tesla beat profit estimates easily, which naturally is good. But apart from that, there were many negatives in the earnings report — deliveries guidance is rather weak, for example. That is despite major price cuts, which could imply that there is, in fact, a “demand problem.” Margins are moving in the wrong direction as well, even before the recent price cuts have had a major impact. And last but not least, Tesla’s cash generation isn’t compelling, either.

While Tesla, Inc. stock is less expensive than it was a year ago, Tesla has now rallied considerably from the lows seen a couple of weeks ago. I do not deem Tesla attractive right here, and the not-very-positive Q4 release strengthens my belief that staying away for now could be the best choice.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of BYDDY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!