Summary:

- Teva’s Q1 earnings show continued momentum, with a 5% increase in total revenue and a jump in gross profit.

- The Company’s blockbuster drugs, Austedo and Ajovy, continue to show robust growth and contribute to the company’s revenue.

- TEVA’s current ratio fell below 1, with debt management challenges and an operating loss from impairment adjustments.

- Teva is a “Hold” due to increased risk and price growth exceeding 50% since December.

Klaus Vedfelt

Teva’s Q1 2024 Earnings Highlight Growth Amid Challenges

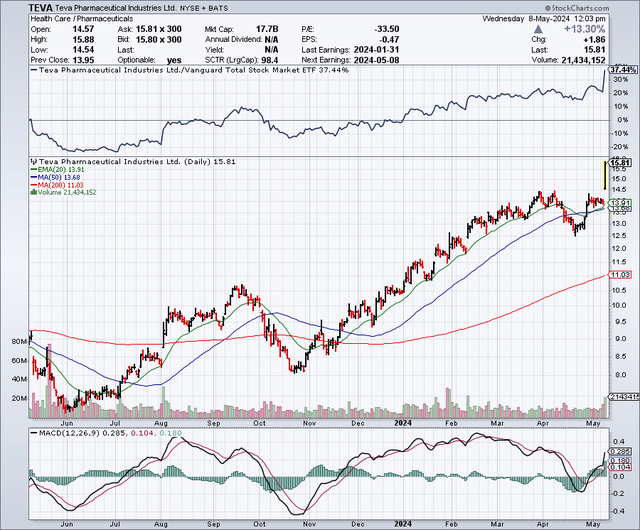

Teva’s (NYSE:TEVA) stock is up 55% since I called for a “2024 revival” in December. Back then, I was confident that their blockbuster drugs (such as Austedo, Ajovy, and Uzedy) would continue to add value, their capital structure would improve (for example, leverage), and their pipeline would produce results.

Yesterday, Teva reported Q1 earnings that support continued momentum as we head towards the second half of this year. The company reported total revenue of $3.8 billion for Q1, which was up 5% year over year. Gross profit jumped from 47% in Q1 2023 to 49.8% in Q1 2024. Teva, however, reported an operating loss of $218 million, primarily attributed to “adjustments for impairment of long-lived assets primarily consisted of $577 million related to the classification of a business in Teva’s International Markets segment as held for sale.” Adjusting for costs like impairments of long-lived assets and amortization of purchased intangible assets, Teva’s operating income (non-GAAP) was $892 million. Finally, Teva reaffirmed their revenue guidance for 2024. They anticipate between $15.7 and $16.3 billion in revenue, with free cash flow between $1.7 billion and $2 billion.

Teva did not make much progress on their debt. Debt totaled $19,643 million as of March 31. This is down marginally from $19,833 million as of December 31. The decrease was primarily due to “exchange rate fluctuations.” The portion of the debt considered short-term (payable within 12 months) jumped to 16% from 8%. So, the company will soon need to pay off a large portion of their total debt. In preparation of this, Teva amended their revolving credit facility to allow a leverage ratio as high as 4x through 2026. Teva’s current leverage ratio (total debt/equity) is 2.6.

Teva’s generic products (including biosimilars) were up 8% ($808 million). Austedo and Ajovy continue their robust growth. Austedo generated $282 million in the US, up 67% year over year. Teva reaffirmed their target of $1.5 billion in 2024. Austedo is one of two VMAT2 inhibitors used for tardive dyskinesia, a market expected to grow to $5 billion in 2030. Ajovy, used for migraine prevention, revenues were up 18% year over year, at $113 million. Its performance in Europe is encouraging. There, it delivered $51 million in revenue and is growing at a rampant pace of 42%. In the US, revenue was flat, but market share edged up, from 24.5% to 27.4% in Q1 2023 and Q1 2024, respectively.

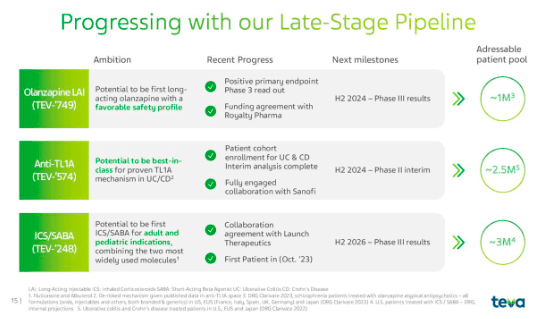

Teva’s late-stage pipeline is bearing fruit. The company points out three products in their earnings presentation: olanzapine LAI (long-acting injection), TEV-‘574 (anti-TL1A), and TEV-‘248

Teva

Olanzapine LAI is a once-monthly subcutaneous injection of an existing antipsychotic. Teva revealed that the LAI was effective and safe in a Phase 3 trial. This asset is interesting because schizophrenia is notorious for low compliance among sufferers. Monthly injections figure to attract prescribers, payers, and patients. Recall that Zyprexa (olanzapine) was once a multi-billion-dollar blockbuster drug for conditions like schizophrenia and bipolar.

For more information on their anti-TL1A drug for conditions like Crohn’s disease, please revisit my last analysis of Teva.

Financial Health

As of March 31, Teva’s cash and cash equivalents total $2.99 billion. Current assets total $12.297 billion, while current liabilities are $13.792 billion. This implies a current ratio of 0.89. Their current ratio was over 1 during the same time last year. A current ratio under 1 will make it challenging for Teva to meet their short-term obligations efficiently.

Based solely on Q1 2024 operating outflows, Teva has nearly 6 years of cash runway. However, this does not account for future changes in revenue, debt repayments, or other factors that may affect the cash flow.

So, the company may have to get creative (e.g., refinance existing debt, sell non-core assets) soon with short-term debts ($3.06 billion) exceeding anticipated free cash flow (~$2 billion).

Market Sentiment

Teva sports a market capitalization of $17.7 billion. In Teva’s case, given their high amount of debt, enterprise value may be a more insightful metric. This stands at $35.37 billion. Consensus earnings estimates for 2024 are $15.86 billion in sales, with low single-digit growth in 2025 and 2026. Teva’s stock has outperformed the broader market, returning 59% in the past year compared to the SP500’s 25%.

Insider trading has seen 767,191 shares sold in the past twelve months. There has been no buying in that timeframe. Institutional activity is mixed. Increased positions total ~61 million shares, while ~75 million shares have been sold. Top holders include BlackRock, Ion Asset Management, and Lingotto Investment Management.

Overall, I’d rate Teva’s market sentiment as “mixed.”

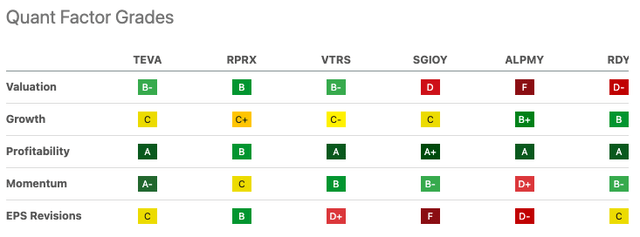

Peer Comparison

With the exception of its stock momentum, Teva does not stand out among its peers. Teva appears to be reasonably valued (5.9 P/E non-GAAP) given its revenue growth (6.17% year over year). Royalty Pharma (RPRX) has comparable revenue growth (5.24% YoY) and a slightly higher valuation (7.27 P/E non-GAAP). However, RPRX has a dividend yield of 2.97% and appears to be less risky (24M beta of 0.71). Teva’s “A” for profitability is supported by its levered FCF margin, which is extremely healthy at 20.79%.

Risk Reward Analysis and Investment Recommendation

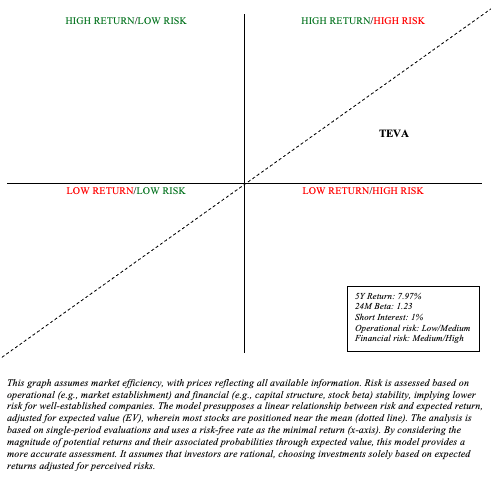

Teva is a little less appealing than it was in December. Since then, its stock has increased by more than 50%, implying that much of the return potential that originally peaked my interest may have already been realized. In the short term, Teva’s financial risk has increased slightly, as evidenced by a current ratio < 1. This was partially offset by the amended revolving credit facility, which offers much-needed flexibility. Moreover, the operating loss in Q1 was simply a matter of accounting. Teva’s robust free cash flow should continue as usual.

Teva is unquestionably a Quadrant 1 investment (high return, high risk). While the future return potential appears to be greater than the risk-free rate, particularly given the potential of Teva’s existing and potential products, I prefer a slightly higher return potential due to the risk.

Author’s visual representation

As a result, I believe it is prudent to downgrade Teva stock to “hold.” Remember, this is from the perspective of a barbell portfolio, in which I advocate for a conservative allocation of 90% of funds in secure assets such as Treasuries and ETFs (broad-market indices), with the remaining 10% invested in high-alpha stocks. So, although I believe Teva is a stock worth holding on to, I wouldn’t be quick to buy or add at these prices.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.