Summary:

- Texas Instruments recently held its Capital Management Day.

- Two changes stand out regarding Capital Expenditures and Inventory management.

- Organic growth should accelerate due to increased capacity build-out.

- Free cash flows are likely going to be depressed for a few years, which shouldn’t worry long-term owners.

kynny

Texas Instruments (NASDAQ:TXN) is the world’s leading analog and embedded semiconductor company and one of my core portfolio holdings. The company recently held its Capital Management Day (similar to an investor day) and shared some data investors should know. If you want to check out my previous coverage of this wonderful business, you can do so here.

Capital Management Scorecard

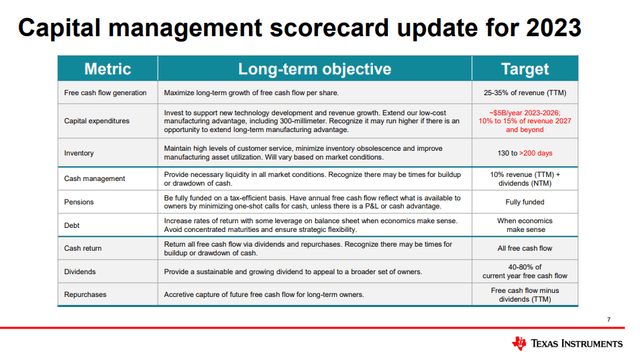

TI shares a scorecard with the essential capital allocation metrics each year. These include three subsegments:

- Operations (Free cash flow generation, Capital expenditures, Inventory)

- Liquidity (Cash Management, Pensions, Debt)

- Return of Capital (Cash return, Dividends, Repurchases)

This year, TI made two changes to its Operations metrics: Capital Expenditures (CapEx) and Inventory Targets. The CapEx target increased meaningfully from 2022’s goal of $3.5 billion/year 2022-2025 and ~10% of revenue 2026 and beyond to $5 billion/year 2023-2026 and 10-15% of revenue 2027 and beyond.

Capital Management Scorecard for 2023 (TXN CMD)

What do the CapEx changes mean?

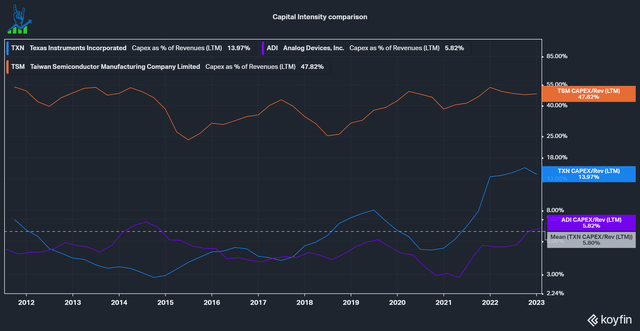

This change has a material impact on the investment case of Texas Instruments: It significantly increases the capital intensity of the business. Capital intensity describes how much capital a business needs to operate and grow. The picture below shows a comparison of TI, its largest competitor Analog Devices (ADI) and the leading semiconductor contract manufacturer Taiwan Semiconductor Manufacturing (TSM). We can see that TI historically has had a much lower median capital intensity of 5.8%. With the guidance of 15%, this increases significantly over its competitor ADI, which outsources most of its manufacturing to TSM.

On the other hand, TI currently manufactures 80% of its chips in-house and wants to increase this to 90% with increased investments in its business. On the other hand, we can see the incredibly high capital intensity of TSM, which primarily operates in the digital semiconductor space. Capital intensity is a primary reason I prefer to invest in the analog space; I wrote more about this topic here.

Capital Intensity comparison (Koyfin)

This increased investment leads to TI increasing its long-term guidance until 2026 and 2030:

Supported revenue is expected to increase to $30b in 2026 (previously $24b) and $45b in 2030 (previously $34b). The company also expects a higher percentage of internal wafers manufactured on 300-mm wafers (80%) and a slightly higher percentage of assembly in-house (90%). This translates to a revenue CAGR in the mid-teens compared to a 9% guidance last year. On top of that, the increased 300-mm and in-house assembly expectations are tailwinds for margin expansion.

Who’s gonna pay for it?

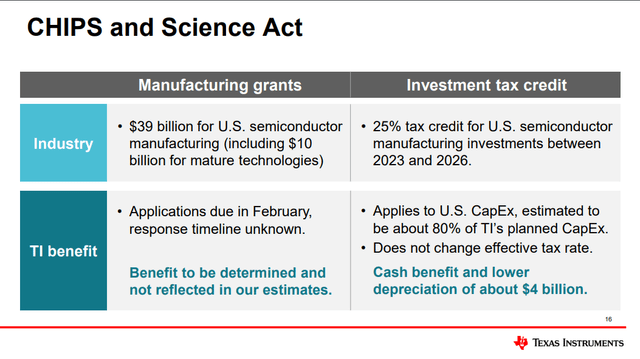

Another big difference to last year’s presentation is that we now have a clearer picture of the benefits TI should reap from the Chips and Science Act. While gross CapEx guidance increased by $1.5 billion, the company also expects to get manufacturing grants and investment tax credits. These grants are up to the government agencies to distribute, so it is speculative to assign a value to them, but I’d assume most of the CapEx increase to be covered by the Chips and Science Act. We must keep in mind that the grants are earned with a delay of around one year, so that we won’t see the benefits in 2023. Over the long-term, and TI thinks for the next decade instead of the next quarter, this will cement its competitive advantages and help it gain more market share.

Chips and Science Act (TXN CMD)

Raising the inventory guidance

The second change in the scorecard regards inventories: The target for inventory days was raised from 190 to >200 days on the upper end. This is a trend that TI has done for several years now. Inventory management is a vital part of a manufacturing business for the following reasons:

- Inventory ties up working capital and thus reduces the efficiency with which capital is used.

- Inventory risks becoming obsolete and can lead to write-offs in the worst case.

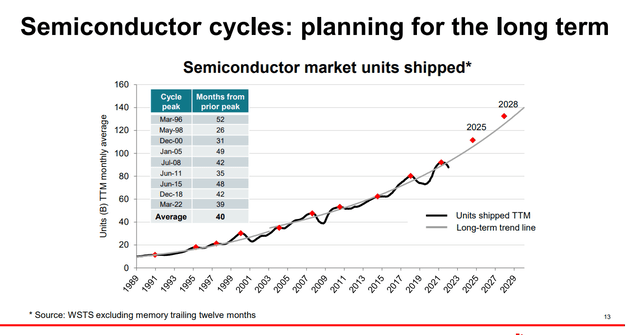

Generally, inventories should be as low as possible to run a business efficiently. Still, the last few years have shown how fragile our global supply chains are and how high the value of a reliable partner that can supply you with parts and keep the production running. Even if you pay a premium for that, nothing is more expensive than a machine in idle. TI has a luxurious position where it can increase its inventory because of its offering: TI offers over 100,000 products to over 60,000 customers with minimal risk of product obsolescence. Around 75% of products can be sold to several customers in different end markets. This leaves them in a better position than, for example, ADI, which sells a lot more specialized custom parts to individual customers. The semiconductor market has cycles and TI wants to be prepared for everything and increase its long-term relationships with its buyers. This competitive advantage is further cemented with its continued adoption of Ti.com; direct sales now account for 70% of revenues (64% in 2021).

TI’s reach of our market channel advantage results in higher growth through access to more customers, projects, sockets per project, and better insight into our customer needs.

Dave Pahl, Head of IR & VP

Semiconductor cycles (TXN CMD)

Valuation

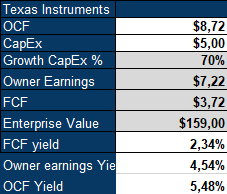

My conclusion from Capital Management Day is that TI continues to think for the long term to achieve its goal of increasing Free cash flow per share over the long term. The last part is critical because the increased CapEx will likely decrease free cash flow in the short term. The advantage of analog semiconductors is that the manufacturing capacity they now build out will probably be able to operate for several decades (of course, with regular maintenance investments) and provide high returns on capital for owners. Let’s now look at TI’s free cash flow and owner earnings. Owner earnings are the actual earnings that go to owners, including growth capex, excluded in normal free cash flow. I use the most simple formula:

Owner earnings = Operating Cash flow – maintenance CapEx

For my calculations, I used TTM Operating cash flow of $8.72 billion, expected annual CapEx of $5 billion and 70% growth CapEx ($1.5 billion maintenance, $3.5 billion growth). This leaves us with a meager FCF yield of just 2.34% and an owner-earnings yield of 4.5%. I expect TI to achieve low teens revenue growth rates over the next decade due to the continued secular tailwinds in its end markets, especially industrial and automotive, are experiencing. Earnings will increase above that due to margin expansion from increased D2C revenue share, in-house manufacturing, and economies of scale. Free cash flow will likely be ugly for a few years, but once the bulk of the capacity is up and running, free cash flows should start surging. This also doesn’t include Chips Act subsidies, which I expect to be >$1 billion a year. Overall, I remain bullish on Texas Instruments stock and keep dollar cost-averaging shares each month. I am ready to load up with additional shares if we see further weakness in the stock price.

Ti Cash flow model (Author’s Model)

Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice.