Summary:

- The company has a promising future and will be backed up by numerous tailwinds that will boost long-term growth.

- This year will be demanding, as the market is decelerating and the company is going through an investment cycle.

- My entire investment thesis is intact, as the long-term is not affected by the actual downtrend.

- I rate the stock a buy with a target price of $175, as great long-term returns will easily be achieved.

Editor’s note: Seeking Alpha is proud to welcome Engineering Quality Investments as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

PhonlamaiPhoto

Texas Instruments (NASDAQ:TXN) is a semiconductor manufacturer with almost 100 years of experience focused on analog chips. Those chips turn real-world signals (such as temperature, pressure, images, and power) into digital information. They are, therefore, fundamental in every technological system. Because of this, TXN will be an essential player in the coming global digitalization, generating significant returns for shareholders for a long time.

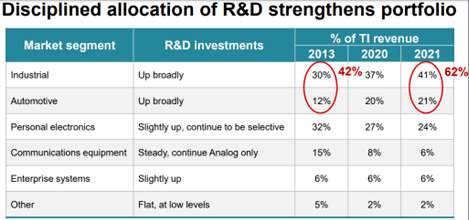

Their portfolio is made up of more than 80,000 different products sold to 100,000 clients in six different markets. They are focused on developing the industrial and automotive segments, which represent 41% and 21% of revenues, respectively.

Strong Tailwinds Will Boost Growth

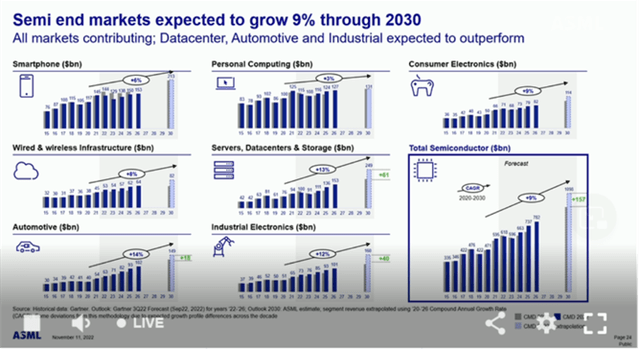

The chips industry is expected to undergo a high level of growth. Furthermore, estimates are going up each year. Effectively, the global semiconductor market is expected to grow at a 9% annual rate until 2030, up from the expected 7.5% from last year. However, the market is divided into different segments, some of which have higher estimated growth than others:

Some segments stand out: automotive, data centers, and industrial, with a 14%, 13%, and 12% expected annual growth rates, respectively. Those numbers are encouraging, considering that 70% of TXN’s revenue comes from these segments. But this is not a coincidence. Years ago, the management team decided to focus their resources on industrial and automotive segments, as well as developing analog and embedded chips (see slide 17 of the company’s February 2022 investor presentation).

Source: TXN’s investor relations

Automotive and Industrial Leading the Way

As we’ve just seen, automotive and industrial are the segments in which the company is focusing the majority of its resources.

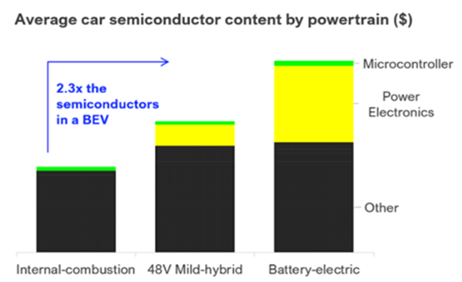

The automotive market is expected to grow at a 14% CAGR until 2030. While car sales are pretty cyclical, the use of chips in this segment is progressively increasing. In effect, every modern car has a range of 3,000 and 5,000 semiconductors, whereas the number was 10 times lower 10 years ago. The growth can be even higher, considering that the autonomous cars market is expected to grow at a 38% CAGR.

Source: IDTechEx Research Article

On average, an electric car has 2.3 times the chips that a car with an internal combustion engine has. Thus, the trend is very favorable for TXN. These chips are used in various systems:

- Screens and infotainment systems are progressively catching on and require a lot of different chips.

- Car manufacturers are forced to include advanced driver-assistance systems in their cars because of safety reasons. These systems are made of cameras and sensors made of analog and embedded chips.

- Data – such as temperature, power, and voltage – must be controlled.

These roles can only be taken by analog chips, combined with embedded, given that they understand real-world data and turn it into digital data. These are the ones that TXN builds.

On the other hand, the industrial segment requires more chips than ever. Little by little, we are transitioning towards a fully automized manufacturing process. TXN’s industrial chips’ range of use goes from manufacturing to healthcare systems, a wide range of services. Again, in this market, analog chips are a must, as they are numerous in robots and industrial machines (they are the ones that can control faulty products and when a device has to grab a unit, for example).

TXN will strike while the iron is hot. Everything is gradually being digitalized, and analog chips are fundamental in every technological system to ensure a connexion between the real and digital worlds.

Substantial Infrastructure Investments to Support Long-Term Growth

To satisfy future demand, from 2021 onward, the company is strongly investing in building a wider fab network. Three new fabs are expected to start production before the second half of 2025. Two fabs were acquired in 2021. The first one has already begun production. The second one will start production at the beginning of this year. Finally, they completed the acquisition of a piece of land as well, which has the potential to build four different fabs on it. The first of those will be ready to start production at the start of 2025. All of these fabs will ensure the long-term growth that will take place in the next 10 to 15 years. TXN expects each of those fabs to satisfy a demand of $5 to $6 billion annually (closer to the latter). Therefore, the company could easily increase its revenue by more than $15B in the coming years.

Not only will this investment lead to revenue growth, but it will also lend a hand with margin expansion.

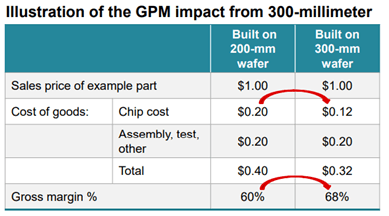

Source: TXN’s investor relations

This graphic shows that a chip built in a 300-mm wafer is $0.08 cheaper than a chip built in a 200-mm wafer, which causes an 800bps gross margins increase.

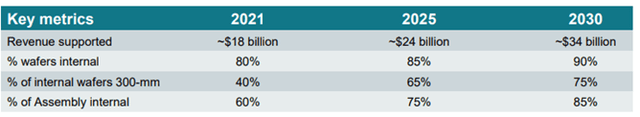

Source: TXN’s investor relations

On top of that, in 2021, chips built in a 300-mm wafer represented 40% of the total chips fabricated. However, the percentage of chips made in a 300-mm wafer is expected to reach 75% of the total fabricated chips in 2030. This is joined by a substantial increase in the number of chips assembled internally. All of this will originate a cost reduction, resulting in margin expansion.

The CHIPS Act Is Icing on the Cake

The CHIPS Act is a policy that tries to strengthen American chip manufacturers. The government will hand out $200 billion to boost R&D. In addition, companies investing in infrastructure will benefit from a 25% tax reduction on their investments. Then, TXN will receive cash to invest in R&D, and get a tax benefit in every new fab, prompting capex savings. The company expects to spend around $3.5 billion in capex annually from 2022 to 2025. Then, capital expenditures should find themselves at about 10% of revenue. Nevertheless, I expect the company to save at least $1B of its capex investment, resulting in an annual capex closer to $3.2 billion from 2022 to 2025.

Excellent Capital Allocation to Maximize FCF Per Share Growth

As it has always been, TXN’s main objective is to maximize long-term FCF per share growth.

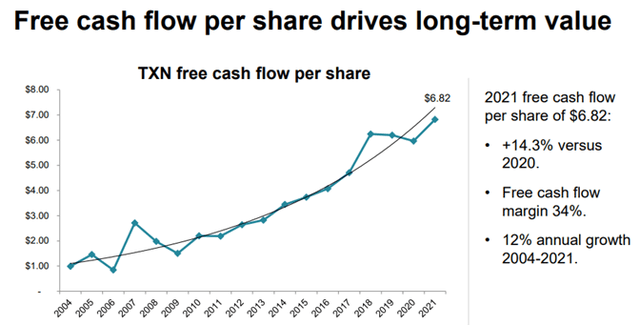

Source: TXN’s investor relations

From 2004 to 2021, TXN has grown its FCF per share at a 12% CAGR. FCF will be cut down this year, resulting from strong capex investments. Nonetheless, those investments will ensure the future growth of the company.

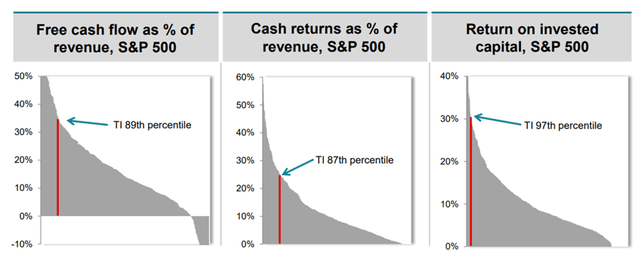

Still, long-term FCF growth can only occur with a top-drawer capital allocation, which maximizes returns on invested capital. This is very positive, as the company is ahead of the pack in terms of ROIC.

Source: TXN’s Investor Relations

One of the advantages of TXN’s business model is that it is much less capital-intensive than manufacturing digital chips, for example. Thanks to this, astonishing long-term returns on invested capital are assured, and every investment is secure.

A Best-in-Class Management Team

One of ambitions of the managers is to change and adapt the business in a constantly changing world. Indeed, they are the ones who decided to focus on analog and embedded chips, and industrial and automotive markets. It was a top-notch decision that showed that they could correctly make their minds up if complex situations showed up.

Moreover, alignment with shareholders is at the top of their list. Their goal is to act as if they were shareholders who would be holding their shares for decades and trying to maximize long-term returns, which has more than successfully been achieved. What’s best is that the growth and long-term returns of the company determine part of the compensation. The insiders ownership is lower than what I would like, but the cash returned to shareholders, with both dividends and share buybacks, proves the alignment.

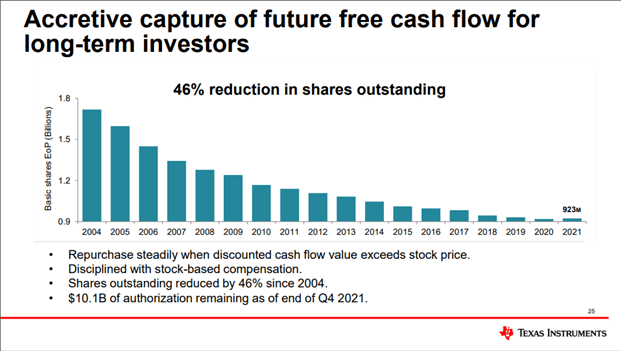

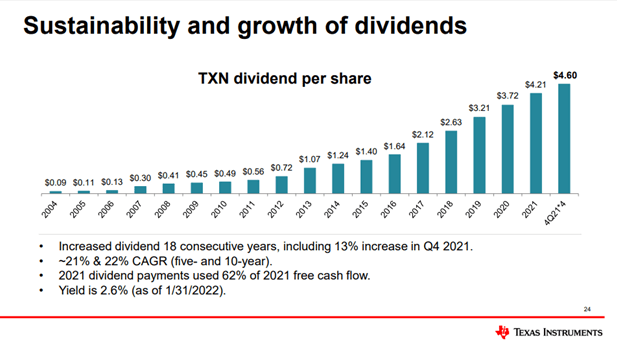

Source: TXN’s investor relations Source: TXN’s Investor Relations

Thanks to their extraordinary capacity to generate cash, they have reduced the number of shares outstanding by 46% over the last 20 years. In addition, they distribute a very generous dividend, with a 2.8% yield currently.

New CEO Could Be a Risk, but Isn’t

Last week, TXN announced that Haviv Ilan will replace the current CEO, Rich Templeton, after almost 20 years of tenure. Ilan is a 54-year-old veteran of the company. Indeed, he has been working there for 24 years. In 2020 he was appointed as COO, a vital role in the company, and the same role Templeton was in before becoming CEO. This change could be worrying, given that Templeton has led the company during these 20 years of success.

Ilan has worked side by side with the latest CEO, and they share the same philosophy. We’ve also gathered that the company’s objective will remain the same. At the very least, Ilan has Templeton’s endorsement, which is reassuring. Besides, he knows the culture of the business and shares the vision of the latest CEO. Templeton remaining at the company as chairman of the board is also reassuring.

Valuation

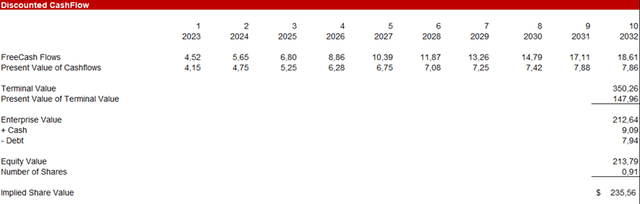

Companies like TXN are mispriced when they are valued using DCF analysis. DCFs typically estimate 10 years of growth and then use a terminal growth rate (TGR) of 2% to 3%. Yet, with high-quality businesses growing for more than 10 years, we should use a higher TGR.

I estimate revenues will grow at a 7.3% CAGR, including the effect of this year decrease. Long-term EBIT margins could reach the mid- to high 50s. Capex will be what I have already stated. The CNWC will negatively affect FCF in the short term, as higher inventories are needed to satisfy future demand. Then, with mid-40s FCF margins in the long term, FCF will grow at a 12% CAGR. I am using a 9% discount rate and a 3.5% TGR.

This leads us to an implied share price of $235, which would be 34% upside, above almost every estimate. I want to insist that the further out we place our time horizon, the higher the value is. That’s why this price is in the higher range of estimates. Still, I think shares will unlikely reach that price this year.

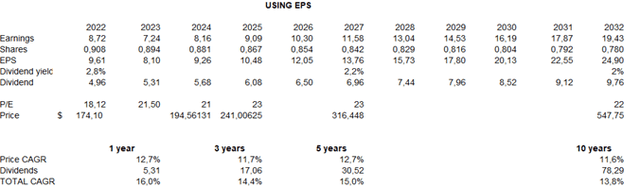

TXN P/E Ratio Valuation / Author’s creation

Using the P/E ratio, you now could buy the shares at 18x NTM earnings and 21.5 times LTM earnings. From my point of view, those multiples could be higher for a company with such a great future.

Five years from now, the stock could easily be valued at 23x earnings, considering the average P/E ratio was 21x earnings during the last 10 years and the company was not expected to grow as much then as it is now. In 2027, with an expected growth rate of over 10% CAGR, returns on invested capital over 30%, and a dividend yield over 2%, 23x earnings seems more than fair. Assuming that the company buys back 1.5% of its shares each year, five- and 10-year returns could be around 15% and 14%, respectively.

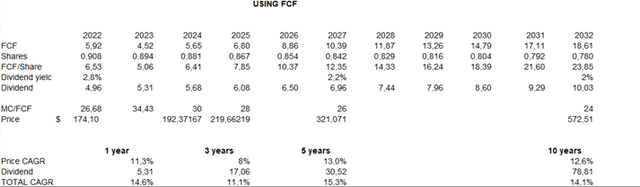

TXN FCF/Share Valuation / Authors Creation

In the shorter term, I think we should value the company with the P/E ratio, as the company is now going through a capex cycle. Nonetheless, from three years onward, we should use FCF/share, as it determines a stock’s long-term value. In 2027, at a 3.8% FCF yield (something rational, taking into account that they will be growing FCF at an annual rate of over 15%), the returns would already be higher than when valued with a P/E ratio.

I consider that buying the stock at a price between $170 and $175 is a good buy seeing that long-term returns over 13% should be easy to achieve. I would opt for a buying price of $170 instead, as we would be safe in case of a short-term downtrend. However, this difference is almost negligible in the long term. If things go on as they should, I think the stock should at least trade close to $191 by the end of the year, taking into account FY2024 analysts’ EPS estimates of $9.1.

It’s worth noting that I was pretty conservative with this valuation. In fact, the global semiconductor market might grow faster than predicted. Furthermore, the company usually outperforms analysts’ estimates. Since 2006, results have beaten the forecast 15 out of 16 years by an average of 4%, a significant figure.

Risks

Risks are mainly related to short-term market trends. I would classify this investment as very safe if we focus on the long term, but many people cannot neglect short-term risks.

The global market growth is expected to slow down this year. In the case of TXN, the company has stated that this year will be tough to swallow in terms of short-term performance. They attribute this downtrend to the current cycle, in which demand is decreasing, as there is a general will to do away with high-level inventories. Furthermore, capex, inventories and R&D are increasing. TXN owns the majority of the fabs in which they build their chips. As a result, manufacturing does not stop when demand is low, which leads to margin compression and an increase in inventories. However, this is short term only, as this scale enables them to boost their long-term results with margin expansion. Also, high-level inventories are not a risk, given that analog chips’ obsolescence risk is almost nonexistent. In fact, TXN still sells chips built 40 years ago.

During the latest conference call, the company guided EPS between $1.63 and $1.9 in the next quarter. If the most pessimistic case occurs, the decline would be over 30% YoY, which would be agonizing. Analysts estimate that Q1 and Q2 results will be the worst. However, the company should weather the storm. From Q3 onward, revenues should return to normal levels, as demand has to be satiated in the future. I think 2023 EPS should be close to $8.

Were these worrying assumptions to happen, long-term growth would still be intact. Effectively, powerful tailwinds will back up the market for many years, and the company is in a great position regarding the future. The current situation is common throughout the industry, and every business insists on its transitoriness. Indeed, management is more confident than ever about their future. They do not focus on the short term, and long-term prospects have only grown.

Conclusion

TXN has great potential, as it will be backed up by solid tailwinds, adding to its strong investments. My long-term investment thesis is still intact, as they will overcome this cycle, guided by a top-tier management team.

Because of this, I fix TXN with a price target of $175 and rate the stock as a buy, although things can get worse this year. However, my thesis focuses on the long term, and 13% returns are easy to achieve buying at that price. If the company presents terrible results this year and its price drops, I will line my pockets by buying more shares.

Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.