Summary:

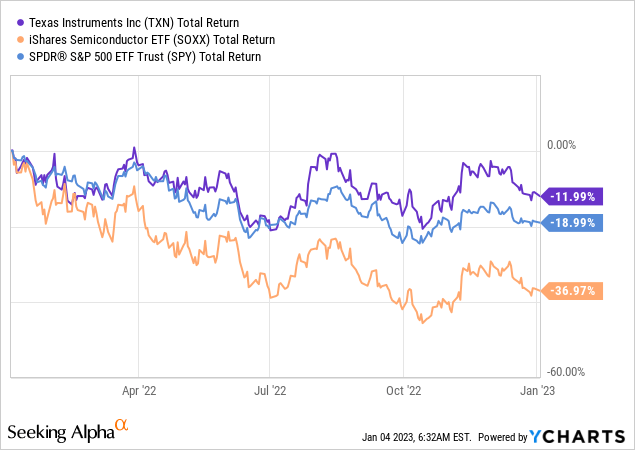

- Texas Instruments shares have significantly outperformed both the S&P and SOXX over the past year.

- The company’s reputation for stellar capital allocation is being hurt by management’s preference for share buybacks over growth and dividends.

- I examine Texas Instruments’ current valuation and dividend strength to see if it is a buy at current levels.

- While its future looks bright, I recommend waiting to add shares until the economic outlook becomes clearer.

William_Potter

Texas Instruments (NASDAQ:TXN) is down only 12% over the past year compared to -19% for SPY and -37% for its largest sector ETF SOXX. It delivered solid earnings throughout the year, and its analog chip business largely escaped the slowdown suffered by leading-edge chip producers like NVDA and AMD. With the CHIPS Act set to benefit domestic foundries, TXN’s future looks bright. However, their most recent lower-than-average 8% dividend hike paired with a huge buyback announcement hike left some investors scratching their heads about the company’s priorities.

TXN is frequently praised for its superb capital allocation and fiscal discipline, but like any great business, there is always room for improvement. In this article I’ll examine TXN’s current valuation and dividend strength to see if the stock is a buy at current levels, and I’ll also suggest an alternative approach for the company that I believe would benefit shareholders far more than the massive buyback plan they recently approved.

TXN: A Complacent Cashflow Machine

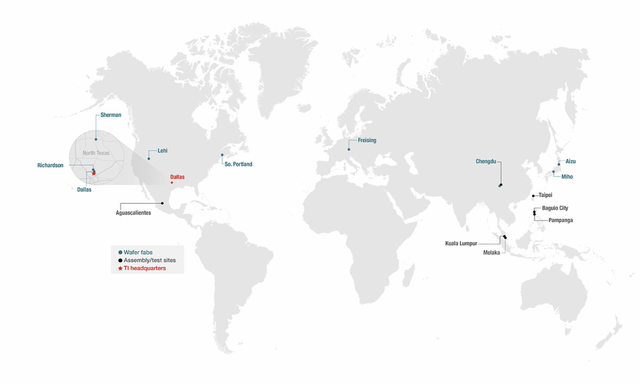

There’s no denying that Texas Instruments has done a great job of delivering shareholder value over the years. It has remained hyper focused on developing and selling analog and embedded chips and now has 12 wafer foundries worldwide. It should be a beneficiary of the recent $280 billion CHIPS & Science Act that aims to boost domestic chip research and production, although exactly how and to what extent remains to be seen.

Manufacturing Footprint (Texas Instruments)

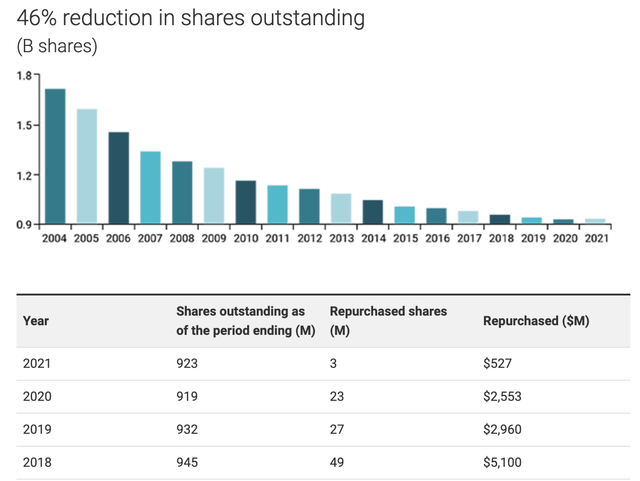

However, in my long-term income-focused view, TXN has a glaring problem that shareholders would be right to criticize. Management’s focus on share buybacks, while effective at reducing share count over the years, does nothing to support the company’s long-term growth or put more cash in future investors’ pockets. Current shareholders may or may not benefit from buybacks depending on the prices they buy and sell at, but personally I would much rather see the company using their significant cash flow and payout headroom to create long-term value and attract new long-term shareholders.

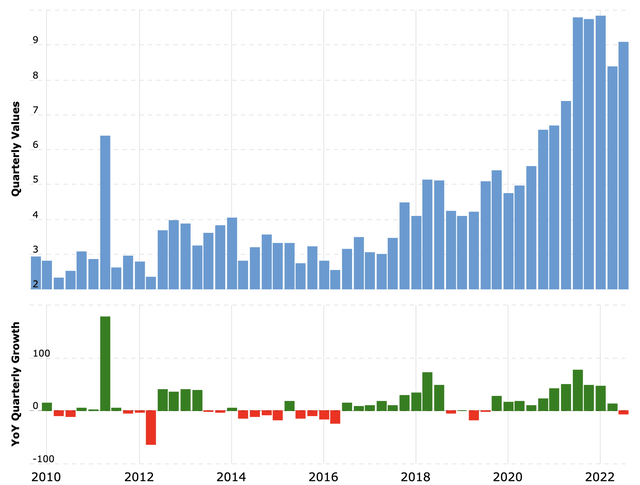

As I’ll also discuss below, management has now approved over $23B in share buybacks for a company with a $150B market cap and a dividend payout that will total about $4.6B in 2023 versus just under $9B in projected earnings. Its cash on hand has grown to over $9B, up from $2-3B levels earlier in the past decade.

TXN Cash On Hand (Macrotrends.com)

In short, I think Texas Instruments is a cashflow machine that has gotten lazy about how they put that cash to work, and just because returns have been good doesn’t mean they can’t get better going forward.

I’ll save the deep dive into how this capital could be better used for a different article, but the two most obvious ways to me are either A) by increasing its dividend payout ratio to maintain its double-digit dividend growth (or issuing special dividends if double-digit growth truly isn’t sustainable), directly returning cash to shareholders instead of having it disappear via share buybacks that may or may not have any actual benefit for future shareholders; or B) by making acquisitions that would improve TXN’s growth profile and therefore expand its trading multiple.

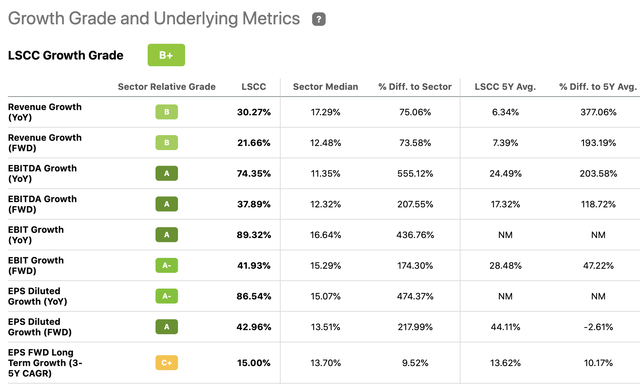

To me, an ideal M&A candidate would be Lattice Semiconductor (LSCC), another “boring” chipmaker that consistently delivers stellar growth and also avoided the sector slowdown in 2022. Their FPGA solutions have many integrations with TXN’s product line, the price is right with LSCC’s market cap standing at only $8.8B, and Lattice’s growth rate is roughly double that of TXN, clocking in at 30% revenue growth and 40% earnings growth in 2022 and forward estimates of 20% revenue growth and 15% earnings growth over the next few years.

Of course, it trades at a higher sales and earnings multiples, but I think the boost it would give to TXN’s growth profile and its ability to maintain a higher dividend growth rate would be worth paying a premium for, especially after LSCC’s main competitor Xilinx was recently acquired by AMD, leaving Lattice as an obvious future takeout target.

Dividend Strength

I usually look at valuation before analyzing a company’s dividend, but in this case, I think TXN’s dividend outlook provides useful insight into its current valuation.

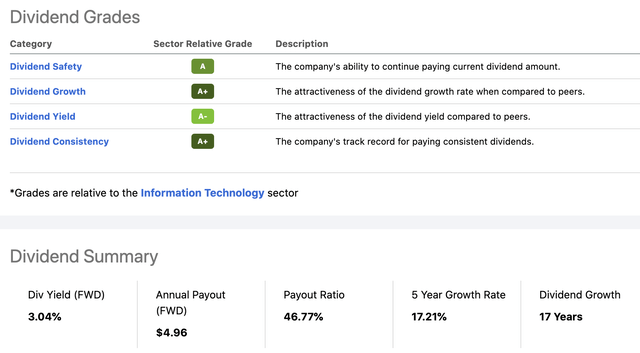

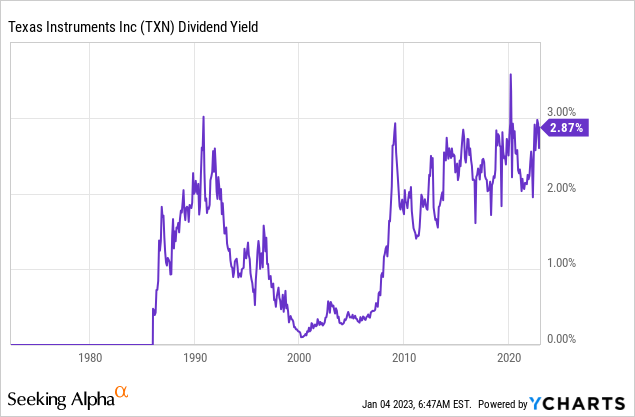

TXN’s current yield of 3.04% is significantly higher than its 5-year average yield of 2.47% and at the top of the historical range since inception. Rarely has it ever returned this much cash to shareholders, which taken on its own would suggest that the stock is a screaming buy.

Likewise, Seeking Alpha scores its dividend nearly perfectly across the board, with its payout ratio of 49.1% also much lower than its 5-year average ratio of 57.1%, showing that while the yield is high, it is still well-covered by TXN’s earnings and cash flow.

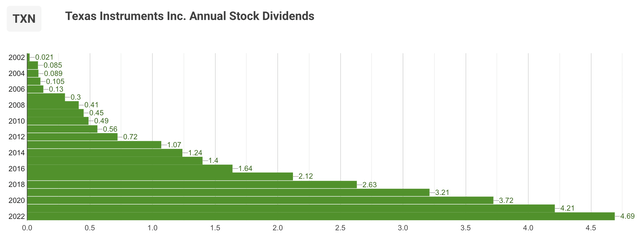

This is where the picture gets a bit murkier. While we can see that TXN’s 5-year dividend CAGR is a whopping 17.2%, its most recent dividend hike for 2023 came in at only 8%. Granted this came with a massive $15 billion buyback authorization on top of its existing $8 billion program — totaling over 15% of the company’s market cap! — but still the dividend hike left much to be desired on the heels of the company’s great year and its record of double-digit raises.

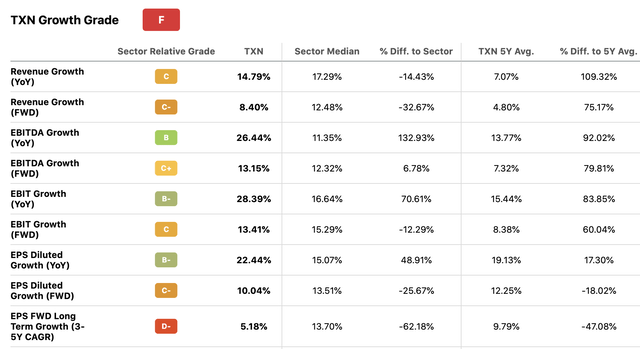

While buybacks may or may not materialize at such insane levels, we can see from TXN’s projected growth why the company would want to set lower expectations going into a possible recession. After a stellar year of 14% revenue growth and 22% earnings growth, Texas Instruments’ forward revenue growth estimate is only 8.4% with long-term EPS growth coming in even lower at 5.2%.

While TXN has a great deal of payout headroom, the forward estimates do not support the sustained double-digit dividend growth shareholders have enjoyed in the past. And in a new high-interest-rate environment, a 3% yield for a fantastic stock that is nevertheless part of the volatile and risky semiconductor sector is not as enticing as it was just a year or two ago.

Looking at TXN’s historical payout record, we can see that its impressive 20-year dividend growth streak has had both slow and fast periods, and I worry that the latest single-digit hike along with a deteriorating economic outlook signal that TXN is entering another slow-growth phase. This also happened after the last major market crashes in 2002 and 2008, when TXN entered relatively slow dividend growth phases from 2003-2006 and 2009-2011. While I’m always hoping for unexpected surprises to the upside, going forward I think investors should not expect double-digit dividend hikes from the company anytime soon.

Valuation

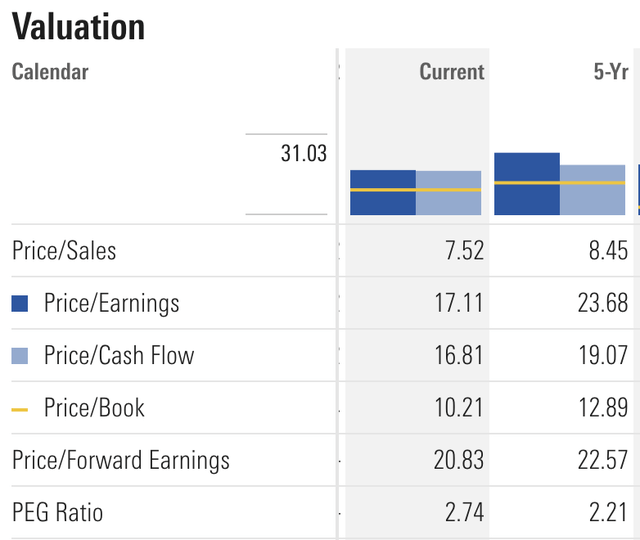

We can see that the slowdown in growth is born out in TXN’s current valuation. The stock appears to be undervalued based on this year’s fantastic earnings growth, with PS, PE, PB, and Price to Cash Flow all 20-30% below their 5-year averages, its earnings growth ratio is now about 20% higher, suggesting that shares do not deserve to trade at the same premium they’ve enjoyed for the past few years.

Considering that the lower valuation metrics appear justified by TXN’s lower projected growth, I view shares as fairly valued at their current price near $163.

Conclusion

TXN is certainly a great company and a solid long-term holding for conservative investors looking for a combination of growth and income. Its dividend is extremely well-covered by its earnings and projected growth, and it appears to be fairly valued by historical standards.

With that said, I think shareholders would be right to demand a wiser use for TXN’s growing cash hoard than massive share buybacks. Even if buybacks are timed well, TXN is a volatile stock that is prone to crashes that can wipe out the benefit of buybacks in a year like 2022, and buybacks don’t benefit current or future investors as much as maintaining exponential double-digit dividend growth or acquiring a faster growing wide-moat business that could increase its long-term valuation and bring exciting diversification like Lattice, in my view.

Considering TXN’s fair valuation and historically high yield, I think it is certainly fine for long-term holders to add shares here. However, current odds favor a mild recession in 2023, so I think investors initiating a large position would be wise to wait a couple quarters before pulling the trigger, or at least to cost average in during that time. Although more resilient than most stocks in its sector, TXN will still likely follow semiconductors downward if there’s more economic pain to come and/or if the Fed waits longer than expected to pivot on interest rates. Jerome Powell seems to want to see pain in the labor market before showing any dovishness on rates, but job growth has remained quite resilient so far, so I think caution is the best stance until something gives.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.