Summary:

- For quite a few quarters now, the Retail businesses of Amazon and AWS seem to live in a perfect symbiosis: If one struggles, the other is there to offer support.

- Q4 earnings showed that, in 2023, the turn will be on the Retail business to take the burden off the shoulders of AWS.

- Has the Retail business become strong enough to take on this role? And how weak is really AWS? Let me show my take on that in the following analysis.

Kardd/iStock via Getty Images

Introduction and investment thesis

Since the beginning of the pandemic, the day-to-day business at Amazon (NASDAQ:AMZN) has turned upside down and the ripple effects of this are still visible today. The impacts on the two main businesses of the company, Retail and AWS, have been entirely different.

Looking at the Retail business it experienced peak margins in the first quarter of 2021, when demand remained unexpectedly strong outpacing the growth in costs to a great extent. This has been quickly followed by large investments in fulfillment and transportation, resulting in increasing depreciation expense and thus decreasing operating income. This has coincided with labor shortages leading to wage hikes and further deteriorating margins in the business. Finally, all this has been amplified by the surge in inflation leading to further cost pressures, not to mention a weakening economy resulting in softening demand. For a detailed analysis on this topic, see my previous article on the company: “Amazon: My Margin-Call“. In the end, this has resulted from even the North America business becoming a money-losing one for several quarters now.

Meanwhile, driven by the post-pandemic rush to the cloud, AWS sales growth has accelerated further during 2021 with operating margin staying around an impressive 30%. With this Amazon’s AWS unit was able to counterbalance the hardships evidenced in the Retail business to some extent. In my opinion, this has been both the result of a conscious management and some luck that the world changed the way it did.

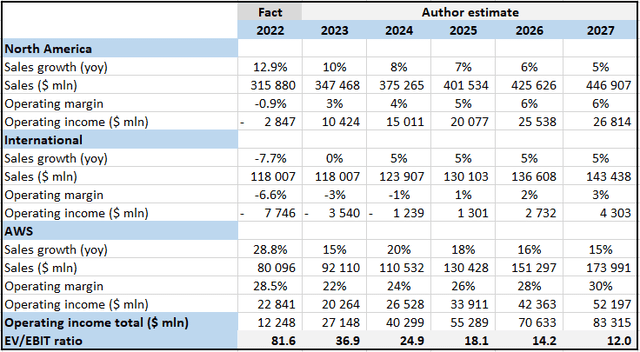

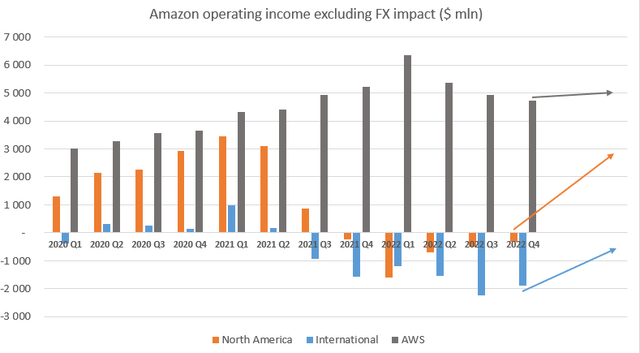

With this, I have arrived at my investment thesis: I believe this dynamic between AWS and the Retail business is in the middle of a change that will be more pronounced as we move further into 2023. The Q4 quarter has been a strong catalyst for this process in my opinion, which I will outline more detailed in the upcoming paragraphs. To summarize what has been said so far, I have brought the following chart:

Created by author based on company filings

The divergence between AWS and Retail (Retail = ~North America + International) operating income is quite conspicuous from 2021 Q3. From 2022 Q1, there seems to be a slight turning point when AWS operating income peaked, and the Retail business began to grow into its spare capacities. As symbolized by the different arrows pointing to the future, I believe this trend will be more pronounced in the upcoming quarters, making Amazon a business standing on two strong feet again. How this process could evolve and what implications this has on the company’s valuation forms the core part of my upcoming analysis.

AWS shocker: Andy Jassy joins earnings call to defend the business

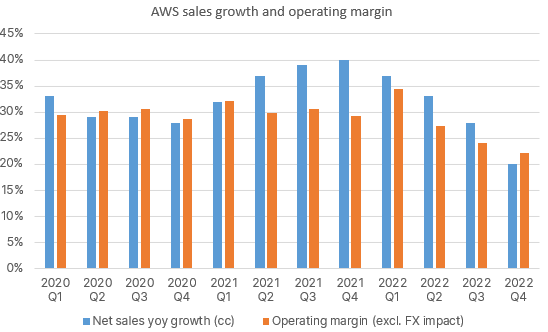

Q4 earnings provided a real negative surprise regarding AWS making headlines everywhere in the financial media. Sales growth slowed significantly further that was coupled with a weakening operating margin:

Created by author based on company filings

From the chart above we can see that just after a few quarters that AWS fired on all cylinders, sales growth has significantly slowed down reaching 20% yoy growth in constant currency for the 2022 Q4 quarter. On top of that, management added on the Q4 earnings call that sales growth in the unit tracked at the mid-teens in January, so further slowdown is expected from these levels. With this, I believe this is the first real slowdown in AWS growth in Amazon’s history, outpacing the drop to ~30% yoy growth levels seen during the pandemic by far.

Investors can now witness the financial flexibility Amazon provides with its cloud service. Customers can quickly dial back spending if circumstances justify it enabling more efficient cost control in difficult economic times. I strongly believe that although this comes with short-term pain when looking at Amazon’s top and bottom line, on the long run it’s another strong argument in favor of transitioning to the cloud. I think the main reason behind Andy Jassy, President and CEO, making his earnings call debut exactly now was to describe this phenomenon and to defend the AWS business. Here is what he had to say (a bit extensive, but it’s worth it):

I think most enterprises right now are acting cautiously. You see it with virtually every enterprise, and we’re being very thoughtful about streamlining our costs as well. And when you are being cautious, you look for ways that you can find — you can spend less money. And where companies can cost optimize or, in some cases, they may be used to doing analysis over 90 days of information and they say, “Well, can I get away with it for 2 weeks, doing 2 weeks’ worth,” it’s not necessarily the best thing long term. But a lot of companies will do that when they’re in uncertain economic situation.

And the reality is that the way that we’ve built all our businesses, but AWS in this particular instance, is that we’re going to help our customers find a way to spend less money. We are not focused on trying to optimize in any one quarter or any one year, we’re trying to build a set of relationships in business that outlast all of us. And so if it’s good for our customers to find a way to be more cost effective in an uncertain economy, our team is going to spend a lot of cycles doing that.

And it’s one of the advantages that we’ve talked about since we launched AWS in 2006 of the cloud, which is that when it turns out you have a lot more demand than you anticipated, you can seamlessly scale up. But if it turns out that you don’t need as much demand as you had, you can give it back to us and stop paying for it. And that elasticity is very unusual. It’s something you can’t do on-premises, which is one of the many reasons why the cloud is and AWS are very effective for customers.

I think — and I’ve spent a fair bit of time with the AWS team on this, and we look closely at what we see. We have a very robust, healthy customer pipeline, new customers, migrations that are set to happen. A lot of companies during times of discontinuity like this will step back and think about what they want to change strategically to be in a position to reinvent their businesses and change their customer experiences more quickly as uncertain economies emerge, and that often means moving to the cloud. We see a number of those pieces as well.

And we’re the only ones that really break out our cloud numbers in a more specific way. So it’s always a little bit hard to answer your question about what we see. But we, to our best estimations, when we look at the absolute dollar growth year-over-year, we still have significantly more absolute dollar growth than anybody else we see in this space. And I think some of that’s a function of the fact that we just have a lot more capability by a large amount, with stronger security and operational performance and a larger partner ecosystem.

So I think it’s also useful to remember that 90% to 95% of the global IT spend remains on-premises. And if you believe that, that equation is going to shift and flip, I don’t think on-premises will ever go away, but I really do believe in the next 10 to 15 years that most of it will be in the cloud if we continue to have the best customer experience, which we have to work really hard at an event which we’re working to do. It means we have a lot of growth in front of us in the AWS business. Andy Jassy, President and CEO – Q4 earnings call

The comments of Andy reinforce the thesis in my opinion that short-term pain must be taken for scoring long-term gain. The magnitude of that pain is surely surprising, but looking over the long run growth prospects are still compelling. What Andy referred to in the last paragraph with most of IT spending still going to on-premises shows that cloud transitioning – although going on for several years now – is still in its early innings. Looking at different estimates of 3rd party research firms shows that during this decade, a CAGR of at least 15% is projected for the global cloud computing market, which reinforces this thesis. It also suggests to me that the deterioration in topline growth should be close to a bottom at the current ~15% yoy levels.

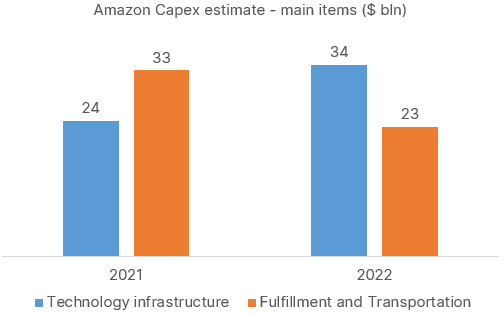

Beside the current, unprecedented slowdown in sales growth, margins are also deteriorating at AWS, making the disappointment of investors even worse. On the one hand, this could be the natural result of slowing topline growth as not all costs decrease proportionally with slowing revenue growth. However, on the other hand, a not negligible part of this has been the result of increased investments into AWS in 2022. Based on earnings call transcripts the year of 2021 was characterized by increased investments into fulfillment and transportation, which has been followed by increased investments into technology infrastructure (mostly related to AWS) in 2022:

Created by author based on earnings call transcripts

Currently, based on the company’s most recent 10-K filing the remaining useful life of servers stands at 5 years, while the same for network equipment at 6 years. Based on this, the additional ~$10 billion investment into these items in 2022 should generate approximately $0.4-0.5 billion additional depreciation expense throughout 2023 per quarter. Looking at most recent quarters, this makes up ~10% of quarterly FX-adjusted operating income for AWS, which equals ~2.5%-points in operating margin. For Q4 I believe most of this effect has passed through the income statement suggesting a bottom should be close for margin deterioration in the AWS unit.

I believe, the current setup is somewhat similar for AWS than it has been for the Retail business not long ago: Sales were growing at an unexpectedly strong pace, which led management to decide to make further investments into future growth. Then, just after a few quarters, sales growth began to fade unexpectedly, resulting in overinvestment in the given area. Finally, it takes a few quarters until the business grows into the spare capacities. These few quarters are ahead of us for AWS in my opinion, but behind us, if we look at the Retail business. Based on this it will be interesting on the 2023 Q1 earnings call what Capex plans management has for 2023 as it could strongly influence the path of margin recovery during the year. I suspect that based on the current softer demand environment, they will be more cautious than in 2022.

Based on this analysis, I think that AWS will take the back seat in 2023 with only gradually improving operating income from quarter to quarter. Although this should weigh on the share price in the upcoming months, I believe it will be counterbalanced soon by the material improvement in the Retail business.

Amazon Retail: A roaring comeback on the corner

The visible improvement in Retail margins (see a detailed discussion on this topic in my previous article on Amazon) couldn’t have been more well-timed, although due to some one-off items, it wasn’t clearly visible for the first sight in the Q4 numbers. Before going on, I want to note that, in the following discussion, I want to narrow my focus on the North America business as most of the changes in Retail I’ll discuss are happening in this space, not to mention its decisive contribution to total operating profit. Also, most one-off charges taken in Q4 are related to this part of the business.

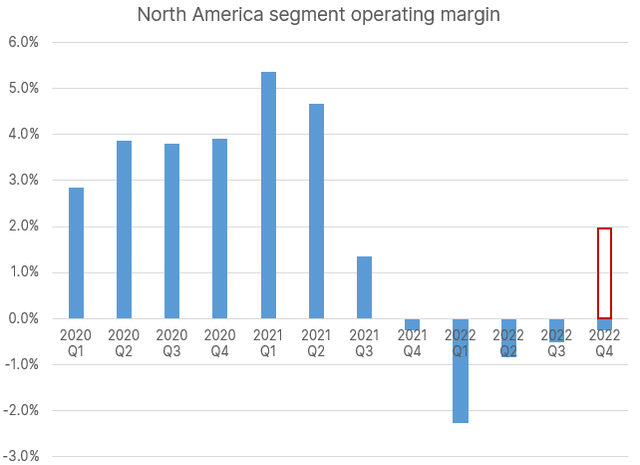

In the graph below, I have portrayed how North America operating margin developed since the beginning of the pandemic:

Created by author based on company filings

There was a huge run-up that I already mentioned previously, which was followed by a sharp reversal resulting in the business becoming unprofitable. A turnaround began in the first half of 2022 that became more evident in the most recent Q4 quarter. When we adjust for the ~$2.7 billion one-off charges that according to management were mostly related to the North America business (on the chart I have estimated that 80% of these were linked to this unit) operating margin would have been 2% in the quarter (marked in red).

These one-off charges were related to the lay-offs Amazon announced recently, to store closures and to self-insurance liabilities. None of these seem to impact the business materially in the upcoming quarters, as even the severance charges for those employees who left the company in January have been recorded for the Q4 quarter. With this, the improved margin outlook for the Retail business should flow through operating income entirely in the upcoming quarters.

Most of this improvement can be tied to efficiency gains in the fulfillment and transportation network, and based on management comments there is more to come in 2023:

And we expect that, again, a lot of the improvement will be in North America operations costs. We made good headway in 2022. We always want to make more, and we’re going to be working on this definitely through 2023 and beyond. But we hope to make and expect to make big improvements in 2023. – Brian Olsavsky, CFO

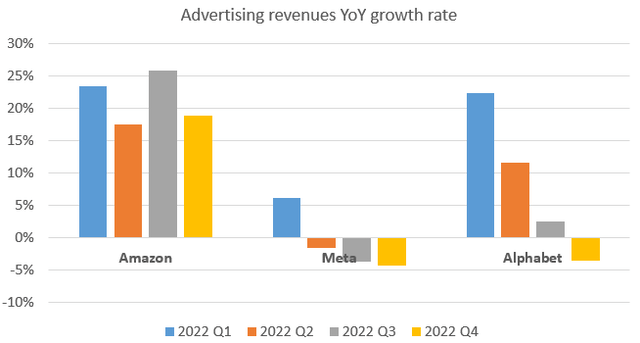

On top of that, advertising revenues are holding up surprisingly well compared to competitors, which should also support margin expansion:

Created by author based on company filings

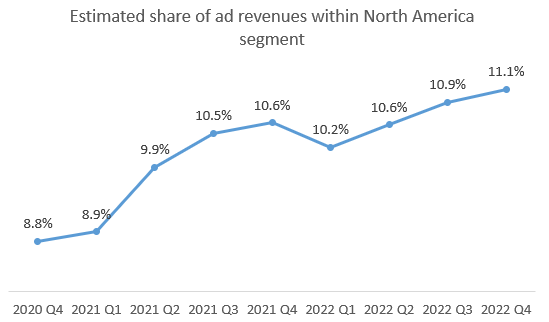

Looking at Meta (META) and Alphabet (GOOGL) advertising revenue growth rates there is a pronounced slowdown in recent quarters. However, looking at ad revenues of Amazon we don’t see a similar pattern, rather a stable growth dynamic. Even if we would make an FX adjustment that impacts its competitors to a much greater extent, this pattern would still hold. Thanks to this stable growth, the ad business is making up an even larger portion of North America net sales:

Author estimate based on management comments and company filings

For the chart above, I have supposed that 90% of ad revenues are tied to the North America segment, based on management comments that the vast majority of ad revenues are tied to this business unit. The margin of the ad business is a hard-to-determine and heavily debated topic, but I suppose that close to half of ad dollars could flow through operating income. Based on this, a 1%-point increase in the share of ad revenues within the North America business (which was typical for the previous years) should equal a ~0.5% increase in total operating margin. I believe that this effect could be a lasting one, especially in the light that Amazon is still in the early innings to utilize some of its advertising assets like Freevee, Twitch, Fire TV, or Amazon Music.

Meanwhile, the share of units sold by third-party sellers increased further to 59% in the Q4 quarter, showing that the main customers for the company’s ad business are representing themselves more strongly on the platform by the time. On top of that, the recent wide-scale roll-out of Buy with Prime could reinforce the growth in ad revenues as well.

With this, the combination of continued efficiency gains and steadily growing ad revenues provides a nice set-up for Retail margins going into 2023, in my opinion.

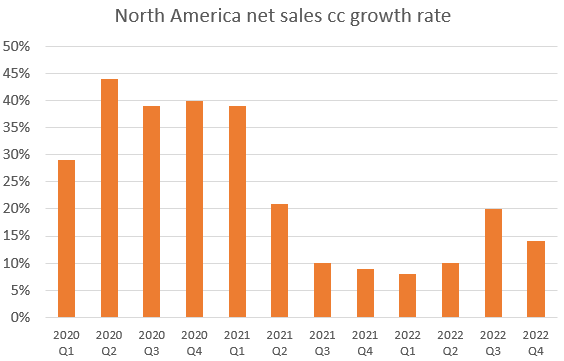

Looking at topline, growth in the North America business seems also encouraging:

Created by author based on company filings

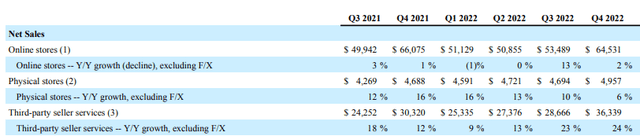

After an artificially inflated (in 2022 Prime Day was held in Q3 compared to Q2 in 2021) 20% yoy growth number in Q3, the North America business printed 14% cc yoy growth in Q4, which was quite a positive surprise in my opinion. Besides strong growth in ad revenues, this has been the result of further accelerating revenue growth in third-party seller services, which showed accelerating growth on a yoy basis:

Amazon 2022 Q4 earnings release

The good thing in this is that third-party seller services are the most profitable business unit when comparing it to Online stores and Physical stores making another positive contribution to operating margin growth.

I believe that this strong sales momentum in the most profitable business units of the North America segment combined with further cost reduction initiatives makes the Retail business strong enough to aid Amazon’s bottom line in times when its well-oiled profit engine (AWS) shows signs of cracking. What this means from a valuation perspective is the subject of the upcoming paragraph.

Current valuation is cheap even with conservative estimates

To give some perspective on the valuation of Amazon shares, I have chosen the EV/EBIT ratio as it is based on operating income, the most widely followed profitability metric for Amazon. For the sake of simplicity, I assume that EBIT and operating income are the same, although there could be some differences in practice.

In the table below readers can see my rather conservative assumptions regarding the sales growth rate and operating margin for the North America, International, and AWS businesses for the next five years. I have used 2022 reported revenues and operating income as a basis and calculated these metrics for the upcoming five years based on my sales growth rate and operating margin assumptions.

For the North America business, I have assumed that the sales growth rate experiences a gradual slowdown in the upcoming years with operating margins improving only gradually after a strong comeback in 2023. For the International business, I expect the company to reach breakeven somewhere between 2024 and 2025 with sales increasing 5% every year after a flat 2023. Finally, for AWS I have assumed that the January mid-teen sales growth rate articulated by management will be typical for 2023 with some re-acceleration in 2024 and a gradual slowdown afterwards. For operating margin, I have assumed that it will take 5 years until the company reaches the ~30% level again. My estimates are intentionally conservative (in my opinion) as I wanted to show that even under these circumstances the shares of the company are undervalued.

At the bottom of the table, I have aggregated operating income from the three segments and calculated the respective EV/EBIT ratio for each year based on Amazon’s current enterprise value of ~$1 trillion:

Based on the refreshed collection of Damodaran’s enterprise multiples the current average EV/EBIT ratio for U.S. stocks with positive EBITDA is around 18.7, if we exclude financial companies, who distort this valuation framework to some extent. I think this is a fair measure for comparison as I personally do not regard the current valuation environment as inflated as it has been just one year ago, rather close to normal.

From the table above we can see that Amazon would trade at the market average multiple only in 3 years’ time with its estimated 2025 operating income of $55 billion. I think it wouldn’t be realistic that the shares of Amazon trade at the market average in three years’ time already as its business would have much more upside potential than the market in general. This tells me that shares should outperform the market over the upcoming years.

Currently, if we look at the multiple of 12 for 2027 it implies a ~35% discount to the current average market multiple of 18.7. If Amazon shares would trade 55% higher, this would take the 2027 valuation multiple to the current market average. So, if shares outperform the market by ~55% over the upcoming 5 years and the current average valuation multiple holds they will be still just equally valued with more fundamental growth potential left.

Based on this, I think the shares of Amazon are a very good investment for the upcoming years, especially that the next few years could be characterized by strong margin expansion, which is not sufficiently priced into the shares, in my opinion.

Risk factors

The main risks regarding an investment in Amazon shares are tied to AWS, in my opinion. The growth of the business is currently in a steeper slowdown, making it hard to determine where the bottom could be. If topline growth slows further from the January mid-teens rate, it could be a negative catalyst postponing the recovery in the share price.

A further decline in AWS margins is also a possible risk factor, which could be triggered by continued aggressive Capex spending in the business. I suggest investors to look out for hints from management on this topic on the next earnings call.

Finally, if the negative effect of the current global economic slowdown hits the Retail business to a larger extent, it could also slow down the recovery.

Looking at these risk factors, all seem to be transitory in nature, which is a good sign for long-term investors in my opinion. Currently, I see no greater structural risks that could materially impact the long-term growth prospects of the company.

Concluding remarks

AWS has been the profit engine of Amazon for several years now. The time has come for the business to take a breather and pass the baton to the Retail unit this year. When the two join their forces in 2024 again, no stone will be left unturned.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.