Summary:

- Tilray recently reported improved financial and operational metrics, signaling a sustainable, if arduous, path towards profitability.

- The acquisition of eight beer and beverage brands from Anheuser-Busch diversifies Tilray’s U.S. beverage alcohol segment and overall business and adds to its overall appeal.

- We finally consider the stock a buy. Given the high risk profile, it is likely best to dollar average and start with a small position.

halbergman

Tilray Brands, Inc. (NASDAQ:TLRY), a leading global cannabis-lifestyle and consumer packaged goods company, reported financial results for the fourth quarter and fiscal year ended May 31, 2023 on July 26. A significant improvement of various financial and operational metrics suggests the company is finally on a sustained, if arduous, path toward profitability. A recent agreement to acquire eight beer and beverage brands from Anheuser-Busch, further diversifies Tilray’s growing U.S. beverage alcohol segment and adds to the overall business’s appeal. The company has yet to build a moat, but CEO Irwin Simon, who founded The Hain Celestial Group, Inc. (HAIN), a leading organic and natural products company, in 1993, and in 25 years grew the business to $3 billion in net sales (thus has a solid track record), appears to articulate an increasingly compelling value proposition. A further assessment of risks and valuation calls show that the company’s stock is finally a buy. I have wanted to write a bullish article on the stock for years, only now am I able to.

Recent Financial Developments Start to Ascertain The Bullish Case

Per the latest quarterly report, net revenue increased 20% to a record $184 million in the fourth quarter of 2023 compared to the prior year quarter. Reporting segments for cannabis, beverage alcohol, and distribution each individually grew revenue, signaling momentum across the business. Gross profit was $67 million and gross margin rose to 37% from 33%. Cannabis net revenue increased 21% (29% on a constant currency basis). Cannabis gross margin increased to 61% from 53%, reflecting contributions from the HEXO acquisition. Beverage alcohol and distribution net revenue increased 43% and 19%, respectively.

Net loss shrank to $120 million in the fourth quarter from $458 million in the prior year quarter. Adjusted EBITDA rose 93% to $22 million. Operating cash flow went from -$21 million to $44 million, and adjusted free cash flow swung from -$24 million to $43 million. The company has finally turned operating cash flow positive, signaling a major reversal in fortune.

On a yearly basis, on a constant currency basis, net revenue was $668 million, up 6% from the prior fiscal year. Gross margin rose to 23% from 19%. Cannabis net revenue was $220 million, slightly down, with cannabis gross margin of 26% compared to 18%. Beverage alcohol net revenue increased 33% to $95 million. Beverage alcohol gross margin was 49% compared to 55%, reflecting lower contribution margins from recent acquisitions. Distribution net revenue was stable year over year (but, on a constant currency basis, up 10%).

Cost optimization continues to be a key driver. The company achieved $22 million in annualized run-rate savings; total annualized cash cost-savings since the closing of the Tilray-Aphria transaction reached $128 million.

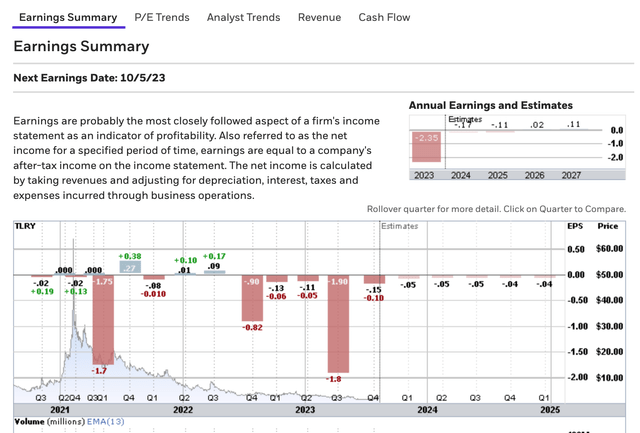

The company is not out of the woods. Net loss of $1,443 million for fiscal 2023 compared to net loss of $434 million in the prior year. Adjusted net loss of $130 million compared to net loss of $183 million. The earnings summary below does show that, after a rough 2023, Tilray is expected to approach breakeven in 2024-25 and turn profitable in 2026.

Adjusted EBITDA rose 28% to $61 million in 2023 from $48 million in 2022, marking the fourth consecutive year of positive adjusted EBITDA and in line with guidance.

At the end of Q4 ’23, Tilray had $207 million in cash and $242 million in marketable securities, thus rather healthy financial liquidity of ~$450 million. It achieved positive adjusted free cash flow across all operating segments in 2023.

For its fiscal year ended May 31, 2024, the Company expects to achieve adjusted EBITDA targets of $68 million to $78 million, representing growth of 11% to 27% as compared to fiscal year 2023. It also expects to generate positive adjusted free cash flow. Management’s guidance for adjusted EBITDA is provided on a non-GAAP basis and excludes non-recurring items that may be incurred during fiscal 2024 (i.e., restructuring charges, etc.).

In sum, Tilray’s lean business model and disciplined, strategic SG&A spending, strengthen the firm’s financials and help build momentum toward profitability in what essentially remains an early growth stage industry.

No Moat Yet but Tilray Is Building a Unique Business Case

Legacy Aphria’s acquisition of Legacy Tilray created a large player with a leading Canadian market share, significant U.S. CBD and beer operations, and a growing international footprint.

Despite challenging cannabis market conditions in Canada, Tilray maintained its #1 cannabis market share position in 2023. Following completion of the HEXO transaction in June 2023, the firm’s market share in Canada has reached ~13% and the Company holds the #1 market position across all major markets.

Tilray leverages its cultivation and distribution capabilities across Portugal and Germany to grow its leading market share in medical cannabis in the countries in which it currently distributes and achieve early-mover advantage in new countries as cannabis legalization proliferates across Europe.

The creation of brand-driven intangible assets could help the firm establish pricing power and generate economic profits, but the industry is in its early stage and no one brand has come close to establishing unique brand equity. Further, advertising is possible in venues where only adults are present, but is heavily constrained even in rather liberal countries like Canada, which suggests there are meaningful barriers to brand equity development.

Tilray does not have exposure to the U.S. THC cannabis market due to federal prohibition. Upon federal cannabis legalization in the U.S., Tilray seems well-positioned to leverage its U.S. leadership position and strategic strengths across distribution and brands to include THC-infused products to drive significant additional revenue in adult-use cannabis.

This said, changes in U.S. federal regulations will likely result in intense competition in the cannabis market, which, in turn, will probably limit the potential return on investment/marketing spend for any single player. Consumer products companies usually build brand recognition through advertising; Tilray may face strict advertising limitations early on, similar to those incurred by tobacco in the U.S..

No wonder the company has sought to diversify its business and management has insisted on making Tilray a consumer products goods company, not just a cannabis shop. In 2023 Tilray boosted revenue and adjusted gross profit in its beverage alcohol segment by 33% and 24%, respectively. The U.S. consumer product goods portfolio (i.e., outside cannabis) does exhibit growth potential.

In this light, that the expected sales volume of the acquired brands from Anheuser-Busch (see deal announced on August 7, 2023) will elevate Tilray to the 5th largest craft beer business position in the U.S. can only seem welcome. The transaction is expected to close in 2023 and generate craft beer pro forma revenue of $250 million. The purchase price to be paid in all cash was unfortunately not disclosed as of the writing of this report (so it is difficult to assess its impact on Tilray’s cash level and potential stockholder dilution scenarios down the road). Distribution relationships through the Anheuser-Busch system have the potential to solidify Tilray’s distribution footprint. The transaction is expected to be EBITDA positive to the overall Beer business, with synergies being identified for profitability enhancements. The sales growth profile of the acquired brands has yet to be ascertained, although it seems important to recognize that the M&A deals initiated by current management have so far panned rather well.

The company does not enjoy a bona fide competitive moat. One of the most likely sources of competitive advantage might be intangible assets derived from regulation or brand equity development. Cultivators need government licenses to operate. At least theoretically, companies with licenses could potentially be immune from outside competition, helping ascertain pricing power. However, a regulation intangible only applies if governments restrict the number of licenses granted; otherwise, excess supply is likely to pressure prices. It is anybody’s guess how liberal governments will be in issuing such licenses.

Evaluation of Risks

Tilray’s overall business seems increasingly compelling, but investing in its stock is high risk, as there are a number of uncertainties. The probability of value destruction for stakeholders remains steep enough that any retail investor interested in going long should proceed incrementally, i.e., start with a rather small position.

There are several challenges to economic profit. First, given that the cannabis industry remains in the growth stage, it may require years of significant investment before many of the industry players will be able to achieve profitable growth (although, admittedly, having been EBITDA-positive for some time now, Tilray is way ahead of most of its rivals). An extended capital expansion cycle through the next few years means Tilray may not generate significant profits for some time.

There are also a number of ESG risks, in particular those of increased regulation to curb adverse health effects or constrain indoor production and electricity usage (using lamps to provide artificial sunlight and cooling to offset the heat generated).

Another acute risk is the (often sluggish) pace of legalization. Tilray’s home market of Canada legalized recreational cannabis in October 2018. However, even there, the pace of dispensary and new products rollouts started at a slow pace, resulting in demand bottlenecks. Tilray does not have direct exposure to the U.S. THC cannabis market, but it has convertible notes and warrants for up to 21% of U.S. multistate operator MedMen. Also, legacy Tilray acquired Manitoba Harvest, a U.S. CBD producer. The recent Anheuser-Busch deal adds to the U.S. footprint. Although there is growing public support, legalization remains politically divisive with most Republicans (in the U.S.) supporting states’ rather than federal rights. Of course, any win on the legalization front could serve as a catalyst for the stock (i.e., Germany, etc.).

Higher taxes and the illicit market constitute another key risk, with the potential to further erode profit generation. With national, state, and local governments facing budget conundrums, the emergence of cannabis as a legal product is increasingly perceived as a potential funding source. Governments, with full control over licensing, may attempt to maximize benefits. Cannabis is very likely to face higher taxes, and producers may struggle to pass them on to the end-customer, the only saving grace being that the existence of an illicit market prevents overly aggressive taxing in the legal market. When governments raise taxes excessively, consumers tend to turn to the illicit market. Indeed, a major challenge for the industry is to convince black market customers to purchase legally. Years of government efforts have done little to smother illegal cannabis.

Finally, Tilray’s balance sheet is rather healthy with cash and equity rising steadily over the past 10 years. Medium leverage is offset by low near-term debt maturities and a low debt/equity ratio. Balance sheet risk is thus best characterized as rather low.

Contrasted Valuation Shows The Stock Can Be a Bargain, but Only for Long-Term, Risk-Tolerant Investors

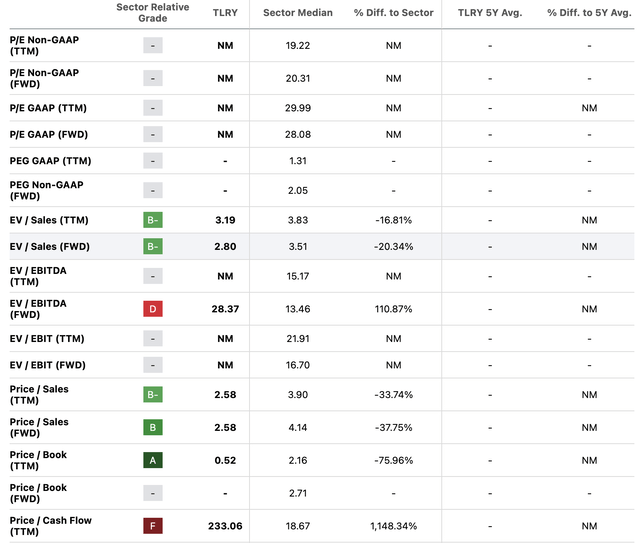

As is made clear in the table below, Tilray has rather low Enterprise Value over Sales and Price over Sales (both trailing 12 months and forward). Enterprise Value over EBITDA and Price over Cash Flow are rather misleading gauges, as the firm’s price and value are very low and both cash flow and even, albeit to a lesser extent, EBITDA, only recently turned positive.

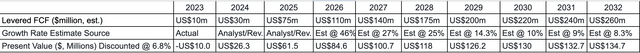

Based on Discounted Cash Flow analysis, Tilray Brands’ estimated fair value seems to be much higher (close to 55% higher, at minimum) than current price. It is difficult to quantify the impact that the Anheuser-Busch deal will have on Tilray’s levered free cash but it is likely to be significant. The following analysis does try to add to most analysts’ estimates to start to account for the deal. It is also rather easy to make the assumption that management will continue to use M&A’s (i.e., non-organic growth) to build the business and reach profitability; estimates of the next ten years of cash flows may thus significantly outperform. In sum, we view analyst estimates as a mere, often rather inadequate, starting point to extrapolate free cash flow (even when derived from the last estimate or reported value).

A dollar today is more valuable than a dollar in the future, and the sum of future cash flows is discounted to today’s value, as follows:

(“Est” = FCF growth rate, as estimated by author)

Present Value of 10-year Cash Flow (PVCF) = US$904.7m

After calculating the present value of future cash flows in the initial 10-year period, we need to calculate the Terminal Value, which accounts for all future cash flows beyond those 10 years. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 2.1%. We discount the terminal cash flows to today’s value at a cost of equity of 6.8%.

Terminal Value (TV)= FCF2032 × (1 + g) ÷ (r – g) = US$260m× (1 + 2.1%) ÷ (6.8%– 2.1%) = US$5.65b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$5.65b÷ ( 1 + 6.8%)10= US$2.93b

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is US$3.835b (or $904.7m + $2.93b). To get the intrinsic value per share, we divide this by the total number of shares outstanding (approx. 700m) and arrive at a fair value of around $5.47. Compared to the current share price of US$2.52 (as of 8/15/23), the company appears quite undervalued at an approx. 55% discount to where the stock price trades currently.

Important Assumptions

Given that we are looking at Tilray Brands as shareholders, the cost of equity [defined as Risk-Free Rate of Return + Beta × (Market Rate of Return – Risk-Free Rate of Return] is used as the discount rate, rather than the weighted average cost of capital (WACC), which pertains to debt. In this calculation we’ve used 6.8%, based on a levered beta of 0.8.

Critical inputs to a discounted cash flow analysis are the actual cash flows and the discount rate. Part of investing is coming up with one’s own assessment of a company’s future performance and resulting levered free cash flows, which can be quite arbitrary. But it is possible, if not likely, that accretive M&A deals will boost free cash generation over the next decade, resulting in an even higher stock price.

This said, it is best to be aware of the fact that the 14 analysts offering 12-month price forecasts for the stock of Tilray Brands Inc have a median target of 2.38, with a high estimate of 4.25 and a low estimate of 1.90. The median estimate represents approx. a 5% decrease from the last price of 2.52.

Conclusion

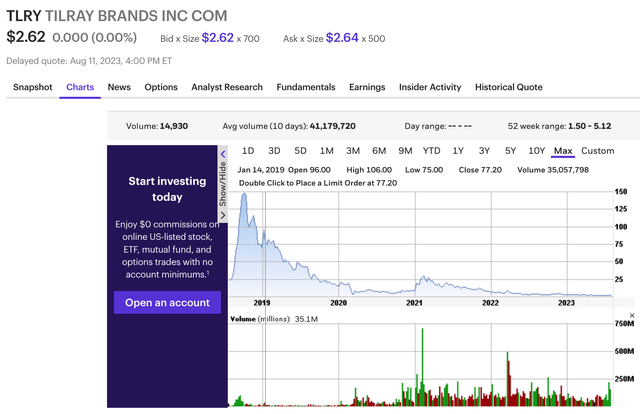

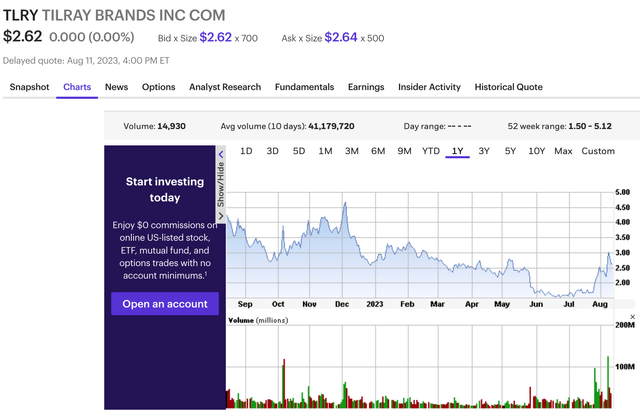

Investing in Tilray’s stock is a high-risk venture. Tilray has recently diluted shareholders, still has a long road ahead toward profitability, and operating cash flow, while gaining momentum, has yet to fully cover debt. The company is not expected to become fully profitable before another 3+ years. But Tilray is clearly moving in the right direction. It is forecast to reduce losses next year, has sufficient cash runway for more than 3 years based on current free cash flows, and provides good value based on various metrics. Technicals are also compelling. Recent good news have ignited a new, powerful uptrend, after a double bottom formation delineated over the past three years, as illustrated below (first bottom of $2.43 reached in March 2020, second bottom of $1.50 reached in June 2023).

For those well-versed in technical analysis, a cup with a handle (right side constructed subsequent to latest earnings report) and a break out of it in powerful volume (ignited by the deal with Anheuser-Busch) seem to constitute a rather compelling launchpad. A consolidation seems underway.

The company may be at the cusp of a powerful uptrend. But, given the risk profile delineated above and time prerequisites to reach profitability in an otherwise challenging stock market (specially for non-profitable outfits), it is best to dollar-average and build a long position incrementally.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TLRY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.