Summary:

- Micron’s stock leads the memory market cycle, requiring constant review due to rapid industry changes and sometimes surprising quarterly guidance.

- At a recent analyst conference, management shifted from strengthening bit shipments to flat for FQ2, raising concerns about market weakness despite rising prices.

- While flat bit shipments aren’t alarming yet, continued guidance like this into FQ2 would be concerning.

- However, the chart suggests the peak of the stock might be in for this cycle, further supporting the idea that the business and the stock don’t align.

alengo

It’s no secret the industry Micron (NASDAQ:MU) operates in, and its stock doesn’t always line up. In fact, I’ve outlined in detail before how the stock peaks in advance of the business fundamentals and bottoms ahead of the memory environment bottoming. Both the stock and the industry require constant review because this industry moves quickly. One quarter to the next can be a surprise in terms of guidance and the state of the DRAM and NAND industry. And so, with the business clearly now trending in the right direction, how does one make sense of Micron’s “lagging” chart? Well, the clarity I get by analyzing the business while concurrently analyzing its chart may put some pieces of the puzzle together for you.

Many of you have followed me over the years knowing I cover all things tech, but now I have a soft spot for semiconductors, particularly Micron. I’ve called the turns in Micron’s business and chart over the years, with this past bottom in late 2022 my most accurate. You might wonder how – was it a fluke, or were there indicators both fundamentally and chart-wise? The answer is yes, it’s both, and it’s not one without the other, but the chart side has brought me an edge. With Micron hitting new highs over the last few months and since pulling back nearly 45% at the depth of the selloff in early August, it makes one wonder whether the chart’s peak is already in, even if the fundamentals have yet to even take off.

This article answers that question.

A Check On The Fundamentals

I’ll start by reviewing the business and memory market fundamentals, as any weakness here can lead to hesitant investors. No one wants to be caught riding the memory cycle down on the backend.

The All Important Bits Shipped

In this regard, not much has changed in the last two quarters. However, there’s been a slight shift in the outlook for near-term bit shipments. If you’ve read me for any length of time, you’ll know bit shipments are one of the biggest keys to understanding the memory cycle – where it bottoms, where it tops, and how it progresses. So when I hear a change in guidance for bit shipments, my ears perk up.

What I expected to be a low-key, hum-drum analyst conference earlier this month provided a slight shift in guidance regarding bit shipments.

The bottom line is, management guided for a “strengthening” of bit shipments for the November quarter on the FQ3 call a few months ago.

We forecast shipment growth to strengthen modestly in the November quarter.

– Mark Murphy, CFO, Micron’s FQ3 ’24 Earnings Call

However, at the KeyBanc analyst conference where Micron presented about three weeks ago, the tune changed slightly from modestly strengthening to flat for the FQ1 November quarter. That also follows guidance for FQ4 to be flat. So, instead of one flat quarter, it’s now two flat quarters lined up.

We forecast bit shipments to be flat sequential in the November quarter, for both DRAM and NAND.

– Mark Murphy, CFO, KeyBanc Capital Markets Technology Leadership Forum (minute 4:39)

The KeyBanc analyst followed up because it caught his attention. The CFO’s answer to his question revolved around pricing and how it’s still moving up, so the company is walking away from deals. Of course, no deal means no bits shipped. Indeed, this isn’t the only situation, and Micron is making many good-priced deals this fiscal year, as the earnings report can attest to. However, the lingering snub of buyers unwilling to accept higher prices says something about the end market they’re a part of.

Now, this is both not important and important at the same time.

It’s not important because guiding two quarters out on bit shipments has much less visibility. Therefore, I don’t hold them to something six months out with a guide like that. There’s a margin of error for using “modestly,” as used in this particular guide.

But why is it important still?

Something management wasn’t expecting changed in that same visibility, enough to shift the guide to something lower while still being in the quarter before it. It’s also important because the decision is in management’s hands to take or leave the price negotiated now, as it has taken pricing control back from customers at this part of the cycle due to the strength and trajectory of memory pricing. Subsequently, walking away from deals allows for it to have inventory to sell later at better pricing.

However, pricing better hold up for another quarter or two beyond these walkaways to get the price it’s looking for – otherwise, this is a significant risk (I’ll get to price shortly). If pricing doesn’t, it didn’t sell what it could have, and now it owns that inventory at likely higher production costs.

So, is something like this enough to sway the cycle?

No, not exactly.

If it’s a one-off guide isolated to a quarter, there’s nothing to be concerned about other than minor adjustments to revenue estimates for FQ1. However, if the flat bit shipments continue, the implications are the market is weaker than management has let on. Even then, though, flat is not horrible. As pricing continues to climb, the flat bits each quarter are making more per bit, so revenue and gross margins continue to climb.

But, like I said at the beginning of this article, bit shipments tell the tale, and pricing, as it does, lags the market’s true colors. I’m not saying the memory market has peaked, nor has management, but you don’t want to hear a string of flat bit shipped quarters, better pricing or not, at this stage of the cycle. So, an FQ2 guide (February quarter) of flat bits would make me uneasy.

Pricing Holding Up Its End Of The Deal

Outside of volume (bits shipped), the price per bit is the other significant factor driving the financials. This area hasn’t had much let up since pricing began firming in FQ1 ’24. As high bandwidth memory – HBM – has taken over the scene, many legacy fab lines have been converted to dedicating a bit of supply to HBM3e.

Due to the complexity involved, it takes three times as many bits to produce the equivalent HBM as mainstream DRAM. This leads to structurally less supply in other end markets such as PC, mobile, and industrial. Thus, instead of bit growth through node transitions, as has been the case over the last several years, supply is decreasing overall. Now, even as signs of PC and mobile apparently show weakening, according to one analyst house, these aren’t as impactful as supply is shrinking as fast or faster to keep the supply demand balance in Micron’s favor.

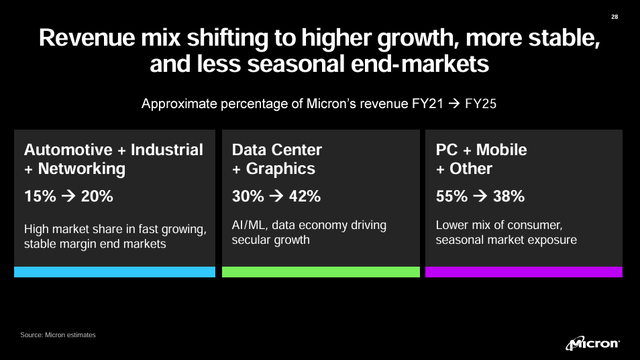

But more than that, even if there’s temporary weakening in some areas like consumer and enterprise PC and mobile, not only is the content in each increasing, but its effect on the DRAM business as a whole has significantly reduced over the years. In 2022, the company expected PC, mobile, and “other” to become less than 38% of overall revenue (including NAND).

Micron’s Investor Day 2022 Presentation

Considering the rapid onset of AI in late 2022 and early 2023, HBM and its investments were pulled in and likely reached these revenue targets ahead of the FY25 target. I expect PC and mobile to make up less than 38% at this point and thus don’t have the same impact as perhaps implied by analyst headlines. In fact, the result of whatever weakening is happening in these end markets is likely the slight shift in a bit of guidance I outlined earlier. If that’s all the effect this sector weakness has on it, I’d say there’s plenty of buffer in the revenue mix to offset it. Moreover, pricing is expected to continue climbing into 2025, according to Micron’s management and outside analyst houses like Trendforce.

Overall, while there are ebbs and flows in specific end markets, the overall outlook remains reasonably strong. However, it could be stronger if not for walking away from deals (as in, if customers were amenable to Micron’s higher pricing). The risk is those deals never come back around because the memory supply and price environment deteriorate before getting there. If so, the company is stuck with a higher cost of goods inventory and no buyers.

But we’re not there yet to be considering that. It’s just a tail risk for now.

Overall, there’s still enough pricing pressure and resiliency in high-growth markets like servers and AI to overcome perceived weakness in other areas, already known to be lagging behind the rest of the memory market.

Matching It To The Chart

Now, let’s look at how the memory cycle is aligning with the stock’s cycle.

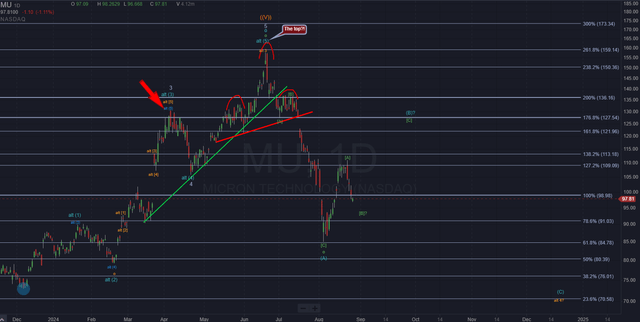

Several months back, I was tracking what I expected to be a top in a third wave on Micron’s chart. I was expecting a pullback similar to the one we’re seeing now before one final rally into all-time highs. However, as this decline continued deeper, I had to shift my analysis to consider the top was already in at $157.

Allow me to give you the high-level view.

In April (red arrow), I initially considered this the end of wave alt [5] of alt (3) of alt 3. Therefore, I was expecting waves alt (4) and alt (5) of alt 3 to lead to a top near $155. From there, a relatively shallow retrace in alt 4 would give way to a higher high near $170 in alt 5.

Author’s chart

However, that’s not how it played out. And honestly, it was fairly clear it wasn’t going back then (judging in hindsight). And that’s because of the Fib levels.

See, the Fib levels of this entire rally from December 2022 (right where I called the bottom) point to wave 3 topping at just over the 176.4% level, a typical extension for third waves. It’s at this point when the chart was saying, “That’s all the wave 3 you’re going to get.” Then, once the corrective structure of wave 4 developed and reached just below the 127.2% extension (typically, I see it go to the 100% extension), it was obvious it was getting ready for wave 5. And so it did, reaching above the typical 200% extension and putting in overtime for almost the 261.8% extension.

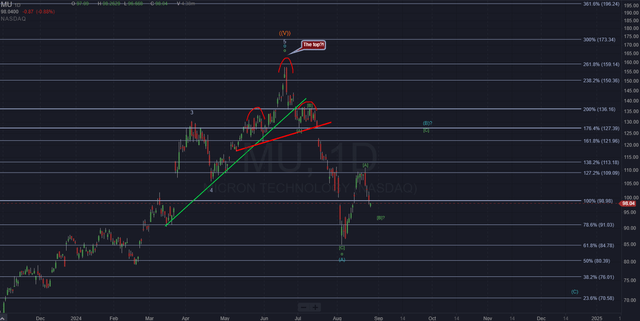

Here’s a cleaner version of the chart showing just that:

Author’s chart

Therefore, that high is most likely the top for this cycle (yes, I hear you).

This brings us to this very deep selloff and bounce we’re experiencing now.

Due to the depth of this selloff, this appears to be a correction of a higher degree, and therefore, I’m expecting still lower lows to come. Currently, the stock is working wave (B) of this correction. Should we get a typical wave C within wave (B), I expect a bounce to around $125- $128 over the next few weeks. But from there, wave (C) is lurking, which could easily bring the stock to $70 over the weeks and months following the completion of (B). Yes, even as the fundamentals look pretty good. The timing looks suspiciously aligned with an earnings report catalyst for that wave (C) drop, so perhaps there’s some worse news than I’ve already analyzed in this article.

This means I’ll trim my MU holdings more as this wave (B) approaches its target. After it completes, there’s a risk of nearly 45% downside.

Reconciling The Two

So you might wonder how on earth Micron will be $70 when its EPS growth is through the roof. Well, fundamentals and sentiment (what chart analysis susses out) don’t have to align at times. And when that (C) wave completes, it may just be completing a larger A wave. That means a B wave rally could ensue for all of 2025, giving the impression it’s rallying alongside the financial growth and fundamentals. Now, B waves don’t generally exceed the prior high, but they can. So we could see a typical retracement back to the $125-$140 area or even a poke above the prior $157 highs before a large C wave takes over, and we see even further lows than what I’ve outlined today.

Micron investors, lend me your ears: Don’t be married to the stock, and don’t be caught (again, for many of us) up riding the downcycle. The memory industry’s downcycle doesn’t align with the chart; it never has. Just because it appears to be super early this time doesn’t change that fact. I’m taking off more risk as this bounce completes, and will likely hedge the rest of the position with puts once the C wave begins sometime in the coming months.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join The Top AI And Tech Investing Group

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Second, if you want more of this two-fold analysis, step up to being a paid subscriber to my Investor Group Tech Cache with a two-week free trial and read more of this type of analysis on other tech stocks and assets.