Summary:

- Coca-Cola’s annual return of 6.3% since 2004 lags behind the S&P 500, but recent strategic shifts have led to a 9% return.

- The company’s focus on digital innovation, global market expansion, and strong pricing power make it a solid choice for steady returns.

- Despite underperformance compared to the S&P 500, Coca-Cola’s strong balance sheet, dividend growth streak, and innovative strategy position it well for the future.

Irochka_T/iStock via Getty Images

Introduction

6.3%!

That’s the average annual return of the Coca-Cola Company (NYSE:KO) since January 2004.

That’s not a great return, especially considering that this 3.1%-yielding stock isn’t your typical “cash cow” where income is so high that capital gains are secondary.

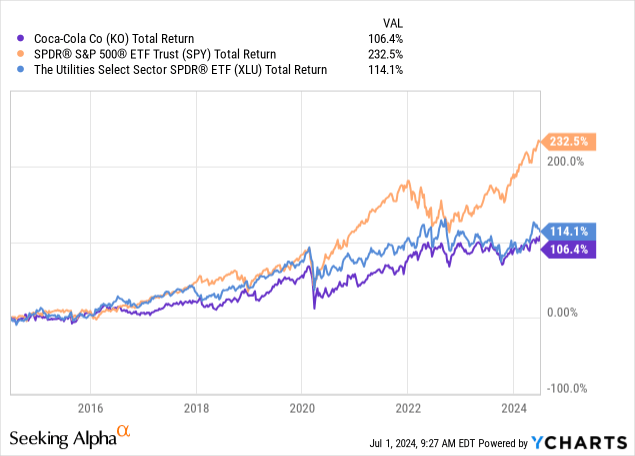

Over the past ten years, Coca-Cola has returned 106%, including dividends. This performance lags a mile behind the 233% return of the S&P 500 and even fails to beat the (with all due respect) boring utility sector (XLU).

This is one of the reasons why I hadn’t covered Coca-Cola before 2020, when I wrote my first article on the soda giant.

However, I have become increasingly bullish, with my most recent article on January 5 being titled “Why Coca-Cola Could Go From Significant Underperformance To +10% Annual Returns.”

[…] what sets Coca-Cola apart is its strategic pivot – a digital revolution and a targeted focus on untapped global markets. Q3 showcased robust results, affirming its adaptability and market resilience.

Crucially, the company’s commitment to a leaner, innovation-driven model promises something special.

Since then, KO shares have returned 9%. Although this is below the S&P 500’s 17% return, it beats the 7% year-to-date performance of the consumer staples ETF (XLP) by a decent margin.

In this article, I’ll update my thesis and explain what I expect from Coke going forward.

So, let’s get to it!

The New-And-Improved KO Is Impressive

When I started my dividend growth portfolio, I bought PepsiCo (PEP) instead of Coca-Cola. That’s mainly based on its exposure to snacks. While PEP and KO are rivals, I do not believe the Pepsi-Cola vs. Coca-Cola battle is worth a lot of discussion.

Both companies have made clear what they want to focus on. Coca-Cola picked sodas. PepsiCo went for snacks – while still maintaining consistent growth in its smaller soda business.

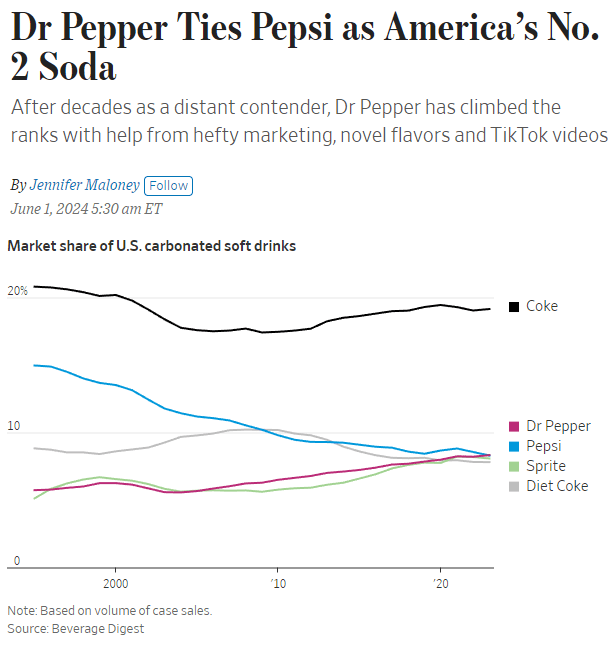

As we can see below, Coca-Cola absolutely dominates its segment. The company has even grown its market share since the Great Financial Crisis, taking market share away from Pepsi, which has mainly grown through pricing in this market.

The Wall Street Journal

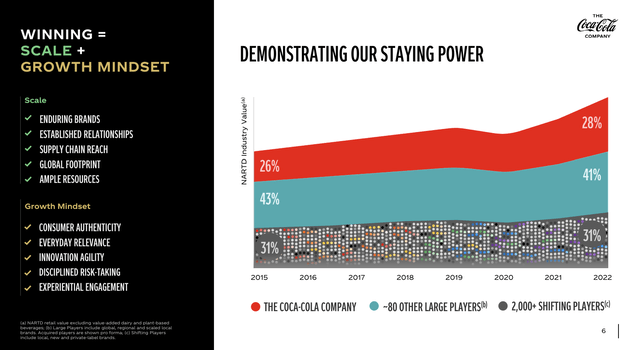

Zooming out, the company is almost as large as its 80 biggest competitors in the markets it serves – and the more than 2,000 players after that.

Coca-Cola Company

It also matters that the company is growing without the need for M&A.

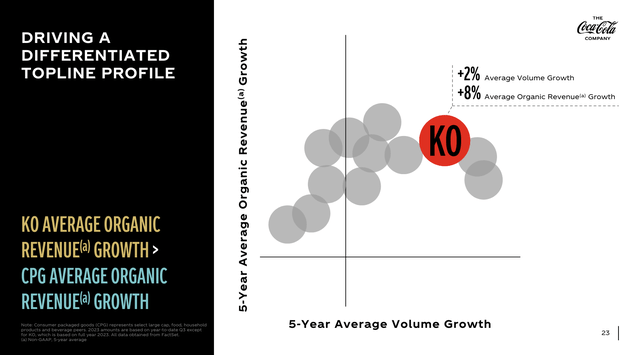

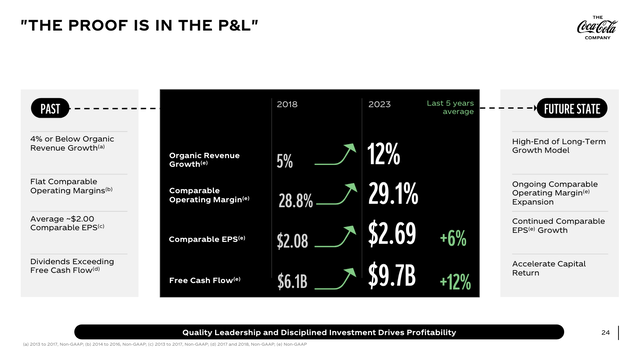

Over the past five years, the company has grown with 2% average volume growth and 8% average organic revenue growth, which is among the best in the consumer packaged goods space.

Coca-Cola Company

During last month’s Annual dbAccess Global Consumer Conference, the company said its success of consistent growth in challenging environments is based on a few factors, including its ambitious mindset and strategic clarity.

They have maintained a consistent strategy focused on following consumer trends and converting these insights into actionable strategies across diverse global markets.

We’ve talked for many years about following the consumer and the opportunity that, that creates. And I believe that the last 3 to 4 years, we’ve seen tremendous consistency with how we convert that opportunity into value in many different markets around the world. And that conversion is very, very much related to our ability to execute and to execute on a daily basis. We have a — it’s a daily business. – KO at dbAccess Conference

While this may sound like corporate talk, the company’s numbers back it up. Using the numbers below, we see the company has become much more streamlined with an improved growth profile.

Coca-Cola Company

A big factor in this is marketing.

Personally, I’m very close with someone who has done business with Coca-Cola on a very high level in the past. While we (obviously) never discussed insider info, he always told me how smart Coca-Cola’s marketing team is and how efficient Coca-Cola is managing its brand portfolio.

During the aforementioned conference, Coca-Cola confirmed this, as it emphasized its post-pandemic investments in marketing, supported by digitalization and the integration of artificial intelligence.

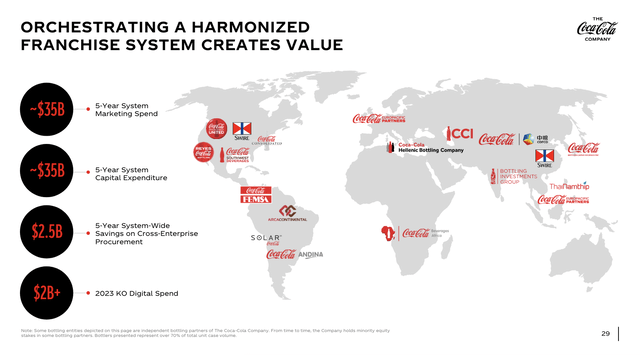

Throughout its global franchise system, it has a $35 billion five-year marketing spending budget.

Coca-Cola Company

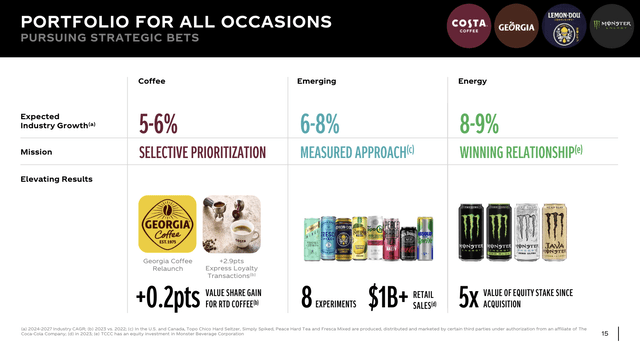

Another key factor is its portfolio. When I was a kid, Coca-Cola mainly had Coke, Fanta, and Sprite. While these are still key brands, Coca-Cola has implemented a “total beverage” strategy, which focuses on specific consumer needs and preferences.

That makes sense, as global tastes are different.

Back when I was an intern at one of Europe’s largest consumer goods companies, they told me they slightly changed the fragrances of products for specific markets.

Coca-Cola Company

This includes markets like India, where the company faces challenges to grow market share.

Last but not least, Coca-Cola is improving its own operations, using something called “RGM,” which stands for revenue growth management.

It is using technology and data analytics to improve pricing, packaging, and distribution.

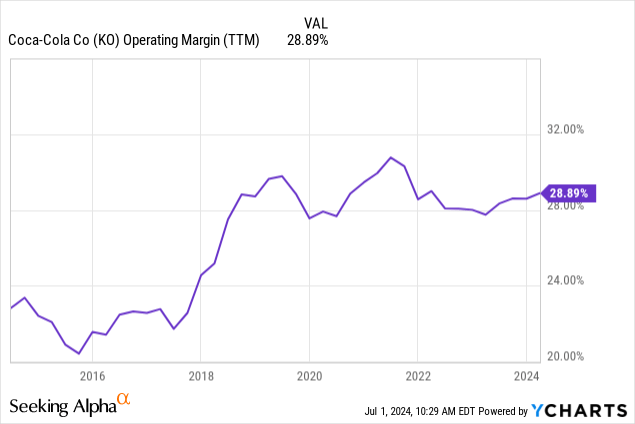

Including outsourcing to bottling companies, the company has significantly grown its margins over the past ten years, as the overview below shows.

So, what does this mean for shareholders?

The Bull Case Looks Good – But Not Spectacular

One thing that is important to mention is the company’s strong pricing power. Especially in this environment, many companies struggle due to consumers cutting back on spending.

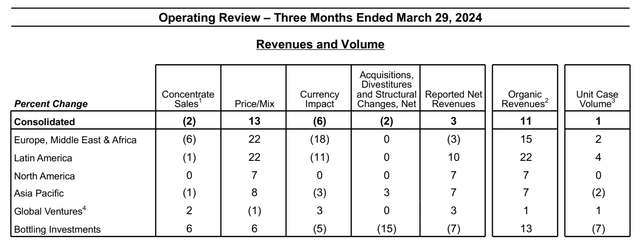

In the first quarter, the company saw 11% organic revenue growth, supported by 1% higher unit case volume and a 13% improvement in price/mix!

Coca-Cola Company

Furthermore, with regard to the first part of this article, the company noted that new products, including innovative products like Coke Spiced and Minute Maid Zero Sugar, have done well with consumers.

Meanwhile, initiatives like the 2-brand strategy for sports drinks with POWERADE and BODYARMOR are gaining traction, supporting market share growth.

It also maintains a fantastic balance sheet with a net leverage ratio of 1.6x EBITDA, which is below its target range of 2.0-2.5x EBITDA. This comes with an A+ credit rating, one of the best ratings in the world.

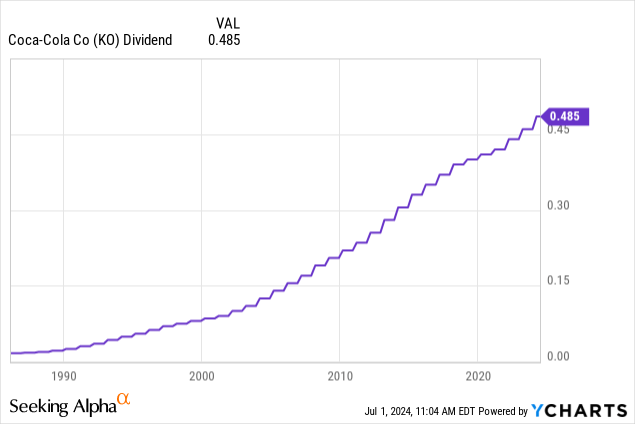

This supports what has become a dividend growth streak of 62 consecutive years. Currently yielding 3.1%, KO has a 68% payout ratio and a five-year CAGR of 3.7%. The most recent hike was on February 15, when the company hiked by 5.4%, which is above its longer-term average.

Accelerated dividend growth makes sense, as KO is upbeat about its future.

In the first quarter, the company revised its 2024 full-year guidance, expecting 8-9% organic revenue growth, potentially leading to 11-13% EPS growth (on a currency-neutral basis).

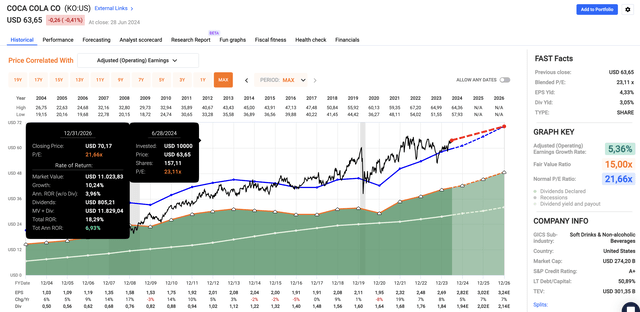

Using the FactSet data in the chart below, analysts expect the company to grow EPS by 5% this year, potentially followed by 7% growth in both 2025 and 2026. This includes currency changes.

As KO currently trades at a blended P/E ratio of 23.1x, a return to its normalized 21.7x multiple would pave the road for a theoretical annual return of 6.9% through 2026.

FAST Graphs

If the company is able to maintain its five-year normalized P/E ratio of 25.0x, it could return 12.9%.

Although I believe that a slight premium is warranted, I don’t expect a 25x multiple to last, as its growth rates do not support it.

However, after the recent rally, I expect KO to deliver consistent returns in the high single-digit range, providing investors with safety and income.

While this isn’t enough to get me to switch from PepsiCo to Coca-Cola, I will stick to my Buy rating, expecting KO to deliver consistent returns for many more years to come, likely outperforming the consumer staples sector.

Takeaway

Coca-Cola’s 6.3% annual return since 2004 isn’t thrilling, especially compared to the S&P 500.

However, the company’s strategic shift towards digital innovation and global market expansion has shown promising results, with a 9% return since my last article in January.

In general, I believe Coca-Cola’s consistent growth without major M&A, smart marketing, and diverse product portfolio underlines its potential.

Despite its underperformance relative to the S&P 500, Coca-Cola’s strong pricing power, balance sheet, and dividend growth streak make it a solid choice for steady returns.

In general, while I don’t expect KO to beat the market on a long-term basis, I have little doubt it will be able to beat the consumer staples sector.

Pros & Cons

Pros:

- Steady Dividend Growth: Coca-Cola has a 62-year dividend growth streak, currently yielding 3.1% with a payout ratio of 68%.

- Strong Balance Sheet: With a net leverage ratio of 1.6x EBITDA and an A+ credit rating, financial risks are very subdued.

- Innovative Strategy: The company’s digital initiatives and focus on untapped markets have resulted in market share gains.

- Pricing Power: KO has proven pricing power, which sets it apart in this challenging consumer environment.

Cons:

- Underperformance: KO’s 106% return over the past decade lags significantly behind the S&P 500’s 233% return. While I’m upbeat about KO, future outperformance is far from guaranteed.

- Limited Growth Potential: Despite strategic initiatives, KO’s growth rates don’t justify a high P/E premium.

- Stiff Competition: Competition is always an issue in the fast-moving consumer space.

- Market Dependence/Consumer Trends: KO’s growth is heavily reliant on its ability to effectively navigate very diverse global markets and consumer trends.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.