Summary:

- In this article, we discuss Thermo Fisher, a low-yielding, fast-growing dividend stock. Hence, I start with a discussion of why low-yield investing can still add value to your dividend portfolio.

- Thermo Fisher has a wide-moat business model, strong pricing power, anti-cyclical customers, and strong industry growth, which it is likely to outperform.

- While the dividend yield is low, dividend growth is high and backed by high safety and a healthy balance sheet.

JHVEPhoto

Introduction

I’m on thin ice with some readers, as I keep calling some stocks with a yield of less than 1% good dividend stocks.

One of them is Thermo Fisher Scientific (NYSE:TMO), hereafter referred to as Thermo Fisher and TMO. I’m obviously kidding when I say that I’m on thin ice. However, some people have gotten a bit upset after I called low-yielding stocks good dividend investments in the past. I get that, as a yield below 1% doesn’t make a huge difference versus a non-dividend-paying stock. However, there are some great benefits that come with fast-growing dividend stocks. Thermo Fisher is a great example of that. The company has a profile of high dividend growth thanks to a wide-moat business model that comes with pricing and M&A benefits.

I recently made the company part of one of my model portfolios, as I am convinced that TMO is one of the best total-return dividend stocks on the market.

In this article, I will walk you through my thoughts and the decision to make the company a part of one of my model portfolios. If I didn’t own its largest peer Danaher Corp. (DHR), I would have added the TMO ticker to my dividend growth portfolio as well.

So, let’s get to it!

Low Dividends. Why Bother?

I completely get behind the frustration some people have when I call a stock with a yield of 0.3% a good dividend stock. After all, when people buy dividends, they (more often than not) aim to generate a decent income – often from the start.

Investing $10,000 in a 0.3% yielding stock will get you $30 per year before taxes. $10,000 is a decent amount of money. $30 is not.

Personally, I enjoy receiving dividends. After all, it allows me to reinvest it in other investments. However, I also enjoy buying businesses that have the potential to outperform the market by a wide margin. These stocks are almost always businesses with the ability to generate fast growth.

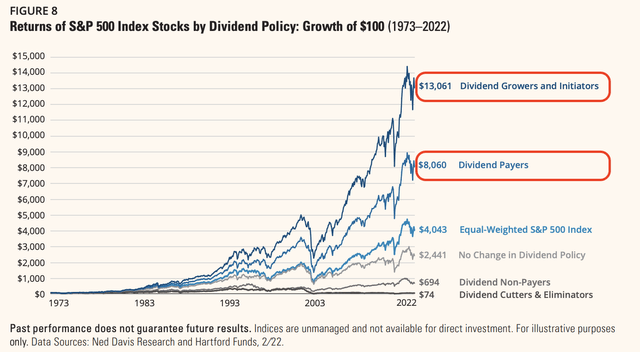

In general, dividend growers tend to outperform the market. As I wrote in a recent article, this is often caused by the stability and earnings quality they bring to the table. During bear markets, investors often prefer to sell low-quality stocks. This means that even if dividend growers aren’t always able to outperform the market during bull markets, they still are likely to outperform the market on a long-term basis (throughout multiple cycles).

Especially companies with high and consistent dividend growth get the job done.

Also, look at the bad performance of non-payers in the chart above.

In 2009, a scientific paper found the same results. I used these results in the aforementioned article as well.

- Consistent dividend payers have outperformed the wider market on an equally weighted basis for 1986-2006, particularly when the minimum requirement is set at ten years of continuous growth.

- These stocks have lower variance of returns and have suffered smaller drawdowns over shorter durations.

- Market-capitalization weighted portfolios did not offer the same benefits as equally weighted portfolios, possibly due to a loss of diversification as a few large stocks dominated.

- Zero-dividend firms have demonstrated relatively poor returns and higher volatility than dividend-paying firms.

The reason I’m bringing this up again is that the TMO share price perfectly confirms these theories. If I were to write a textbook on this, I would include TMO.

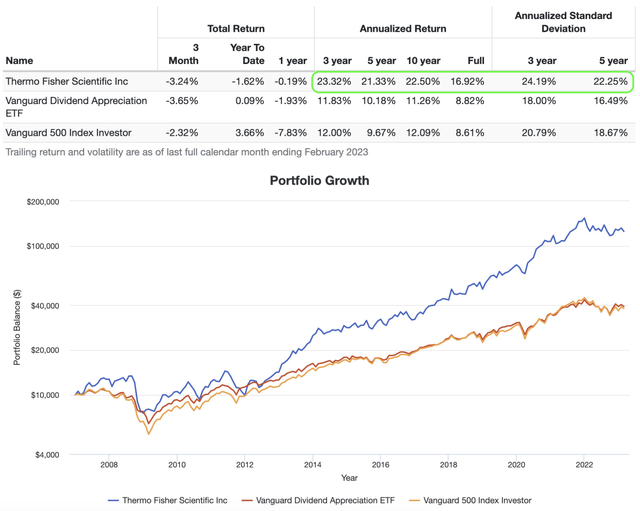

As indicated by the figures below, TMO has consistently outperformed the market. TMO shares have outperformed the S&P 500 and the Vanguard Dividend Appreciation ETF (VIG) dating back to 2007 and earlier. This success has been achieved with steadiness and minimal volatility. In the last three years, TMO shares have exhibited a standard deviation of less than 400 basis points above the S&P 500’s standard deviation, which is truly remarkable.

Portfolio Visualizer (Author Annotations)

With that said, TMO has figured out how to consistently offer the quality that investors require to improve their portfolios.

Its outperforming growth rates are backed by a wide-moat business that comes with strong pricing power and growth opportunities.

The Superior Thermo Fisher Business Model

M&A fueled growth with a superior, wide-moat business model.

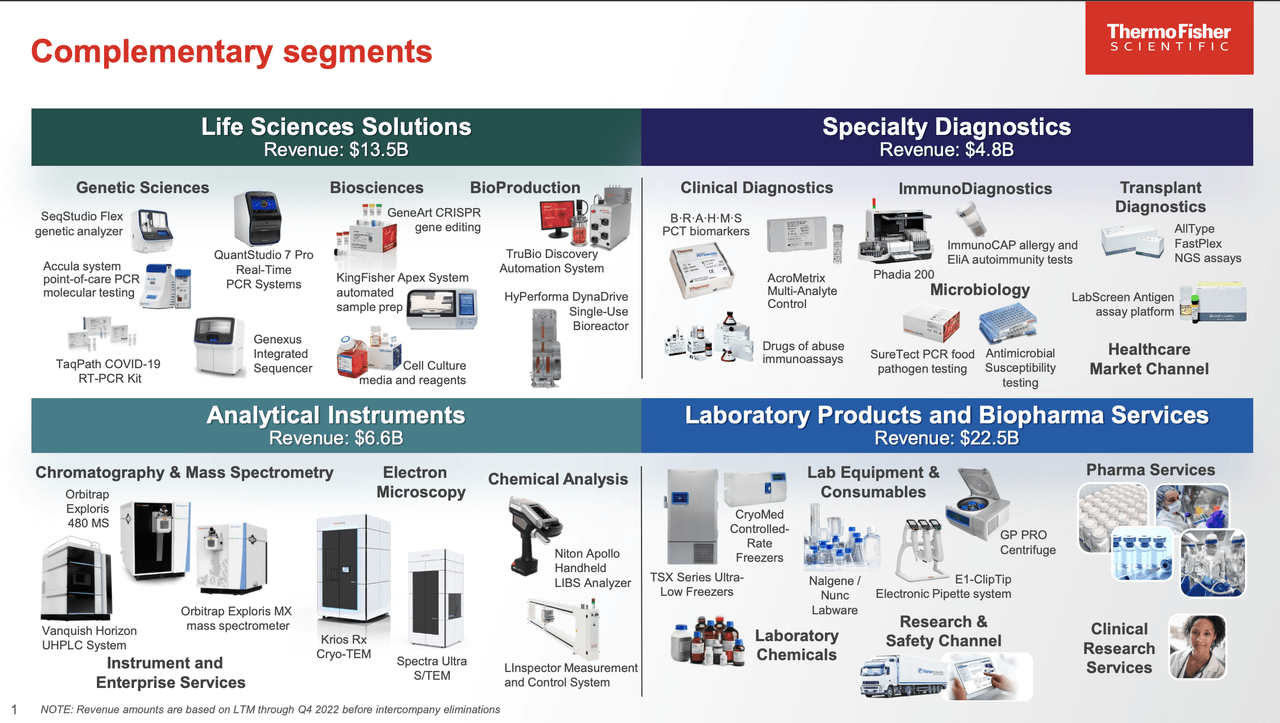

Headquartered in Walkham, Massassuchetts, Thermo Fisher is one of the largest healthcare suppliers in the world. With a market cap of more than $210 billion, the company provides analytical instruments, reagents, consumables, software, and services to a wide range of industries, including pharmaceuticals, biotechnology, clinical diagnostics, environmental monitoring, and food safety.

The company was formed in 2006 as a result of a merger between Thermo Electron Corporation and Fisher Scientific International. Its portfolio includes instruments such as mass spectrometers, chromatography systems, microplate readers, and gene sequencers, as well as reagents, consumables, and software for data analysis and management.

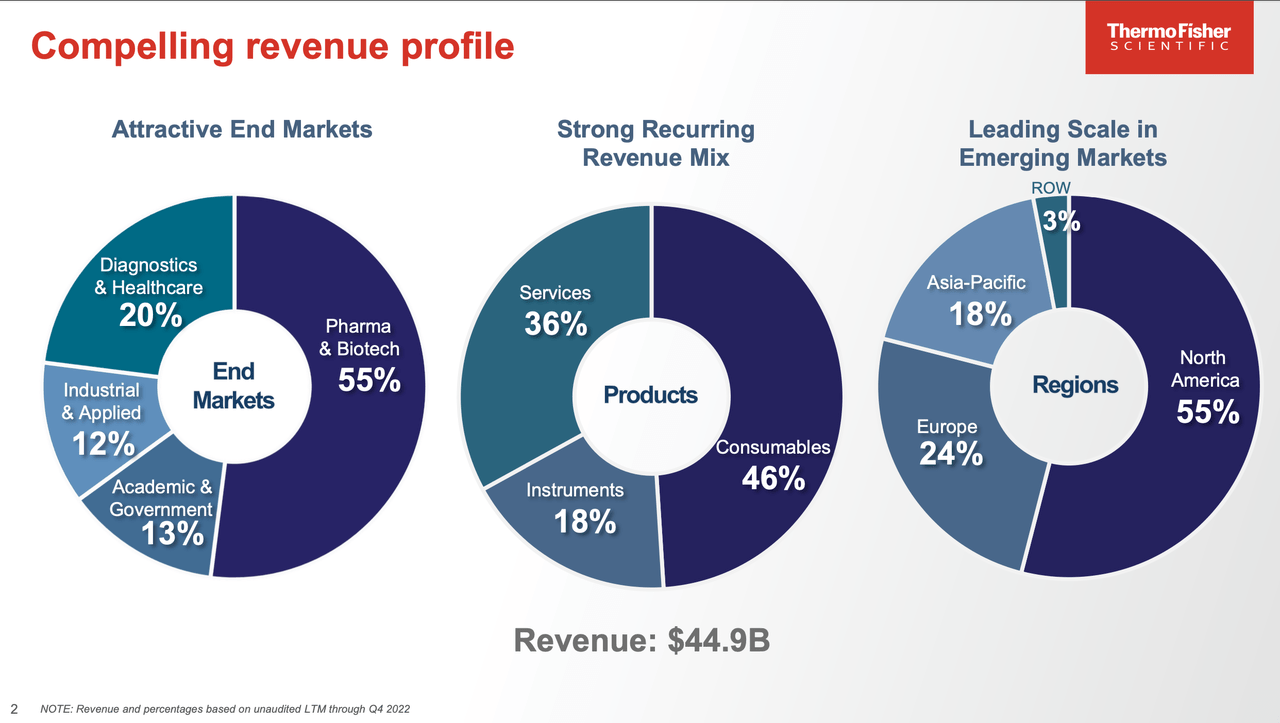

Roughly half of its sales are generated in the United States.

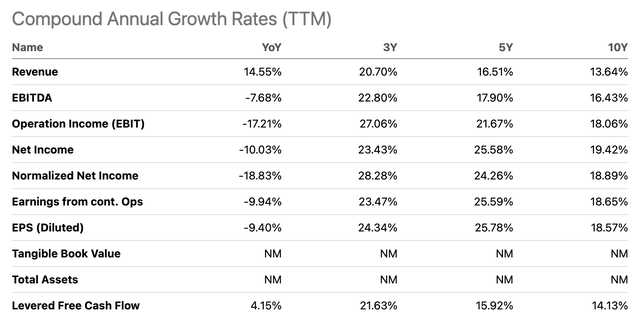

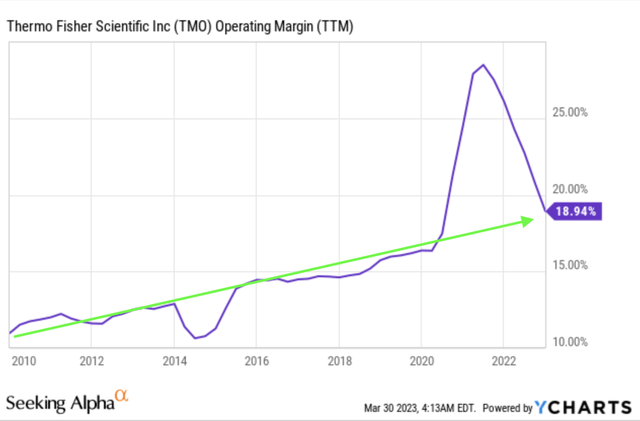

Looking at the table below, we see that Thermo Fisher’s growth rates are something to write home about. While post-pandemic numbers have been rather weak, the company has still grown its revenue by 13.6% per year over the past ten years. EBITDA has risen by 16.4% per year during this period, thanks to consistently improving margins.

While margins have come down after the pandemic peak, the company is still seeing a steep uptrend in operating margins. Over the past 13 years, operating margins have expanded by roughly 18 points, which is a big deal.

YCharts, Seeking Alpha (Author Annotations)

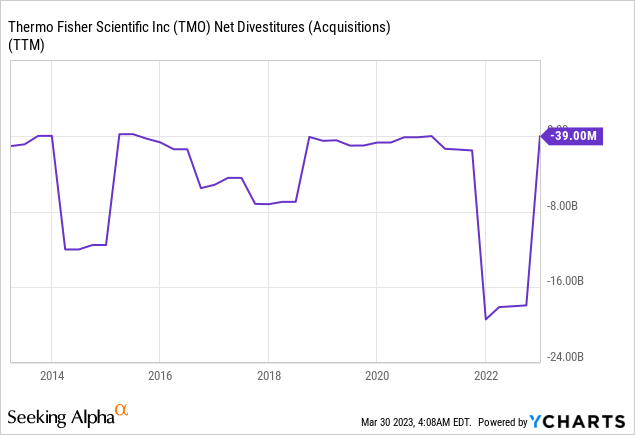

Almost needless to say, the company’s growth isn’t organic. As the graph below shows, the company has engaged in some major (cash) deals in the past ten years.

-

PPD, Inc. – In April 2021, Thermo Fisher Scientific acquired PPD, a leading global contract research organization (“CRO”), for $17.4 billion. This is the largest deal in the company’s history.

-

Mesa Biotech – In December 2020, Thermo Fisher Scientific acquired Mesa Biotech, a point-of-care molecular diagnostic company, for $450 million.

-

Qiagen N.V. – In July 2020, Thermo Fisher Scientific completed its acquisition of Qiagen, a leading provider of sample and assay technologies for molecular diagnostics, applied testing, and academic research, for $11.5 billion.

-

Advanced Bioprocessing – In March 2020, Thermo Fisher Scientific acquired Advanced Bioprocessing, a provider of patented lipid nanoparticle (“LNP”) and mRNA technology for in vivo delivery of gene therapies, for an undisclosed amount.

With that said, there’s more to it than aggressive M&A.

Because the company is a healthcare supplier, its customers are anti-cyclical, meaning they are unlikely to reduce demand during recessions. During the Great Financial Crisis, sales in TMO’s market fell by only 3%. During last year’s Morgan Stanley Annual Global Healthcare Conference, the company mentioned that its business model has become even more resilient since then.

When I think about how the company, how we’ve evolved our mix by executing our strategy, the company is — has a more favorable set of end markets than we did back at the end of the 2000s. And today, pharmaceutical and biotech which is the least economically exposed end market, represents just under 60% of our core revenue. And back then, it was about 1/4 of our core revenue. And our consumables and service business is about 85% of our revenue. Back then, it was about 2/3 of our revenue. So the company’s mix has evolved and that positions us to navigate whatever the world throws at us.

This business model also comes with pricing power. After all, the company has a wide moat, its competition is somewhat limited, and its customers are often well-funded. Hence, in the same conference, the company mentioned having between 50 to 100 basis points of pricing power every year.

Thanks to the aforementioned benefits, the company is sticking to a very ambitious long-term growth target, which was reiterated during this month’s Annual Healthcare Conference from Cowen.

Essentially, TMO aims to grow organic (excluding M&A) revenues by 7% this year, which could be continued on a long-term basis, given industry fundamentals.

The assumption is that the markets they serve will revert to more normal conditions after the pandemic, with a growth rate of 4% to 6%. If the markets continue to perform as they have in the previous two years, Thermo Fisher will likely exceed their 7% growth rate. However, if the economy turns down or there are other external factors, their growth rate may be lower. Overall, management believes that it’s reasonable to assume a 4% to 6% market growth rate to achieve their 7% growth target.

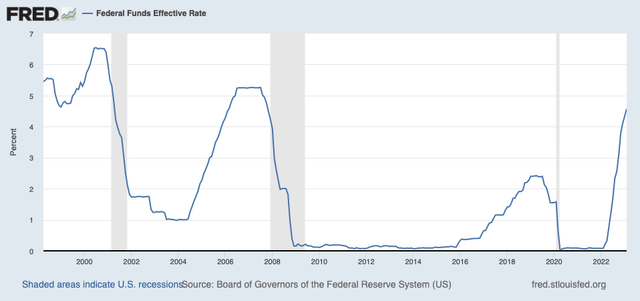

Moreover, the company discussed future M&A opportunities. After all, we’re now in a high-rate environment. Aggressive M&A is much easier when rates are close to zero.

Federal Reserve Bank of St. Louis

During the conference, Thermo Fisher discussed the favorable M&A environment for well-capitalized companies with a track record. While valuations are down, financing costs are up, making it harder for private equity and less established buyers to meet return hurdles. Thermo Fisher has a competitive advantage in this environment, as they have not lowered their return metrics over the past 20 years and can win contested transactions.

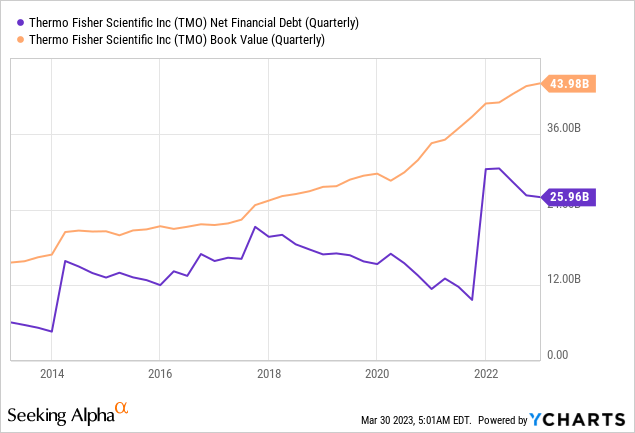

Thermo Fisher currently enjoys an A3 credit rating and a 1.9x net leverage ratio using 2023 net debt and EBITDA estimates. Moreover, the company is expected to do $7.0 billion in free cash flow this year. This translates to a 3.3% free cash flow yield. Next year, that number could be $9.3 billion (4.3%). As the company’s dividend yield is below 0.3%, the company has a lot of room to quickly reduce debt.

After every (M&A-related) surge, the company quickly reduces net financial debt, resulting in an almost uninterrupted surge in book value equity.

The company’s objective is to invest $50 billion in acquiring new companies over the next few years. However, during the aforementioned conference, the company emphasized that it won’t pursue deals solely to boost growth. In case the M&A activities are low, the company will instead increase shareholder distributions.

Speaking of these distributions, let’s take a closer look at the dividend.

The TMO Dividend

This won’t come as a surprise, but TMO has a very low dividend yield.

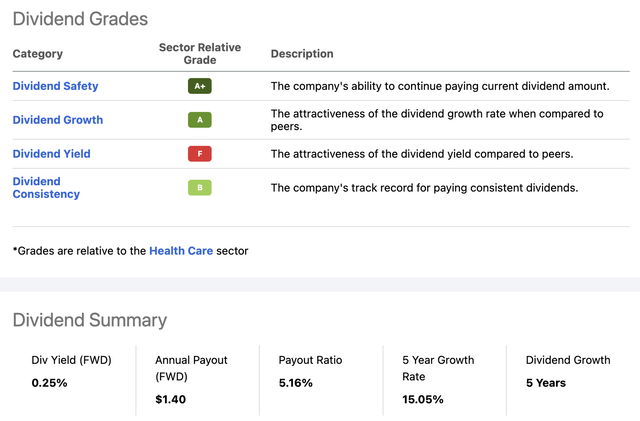

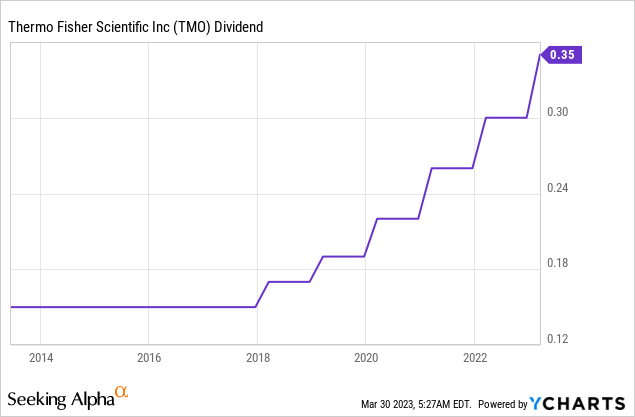

According to the company’s dividend scorecard, it ranks well on dividend safety and growth metrics. However, its dividend yield receives a failing grade. Following a 16.7% increase in February 2022, the company’s quarterly dividend payout is $0.35 per share. This equates to a yield of just 0.25%.

With that said, dividend growth is high. Over the past five years, the average annual hike was 15.0%. In 2018, the company started to hike again. Since then, it has hiked its dividend consistently.

Moreover, dividend safety is high. The non-GAAP payout ratio is just 5.4%. The industry median is 26%.

So, what about the valuation?

Valuation

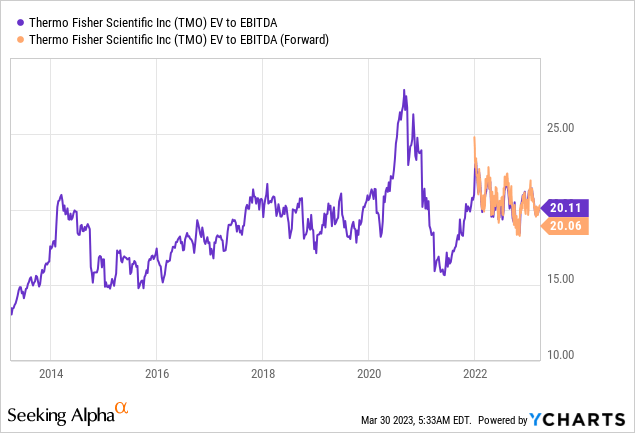

Using the company’s $214 billion market cap, $23 billion in 2023E net debt, and $12 billion in expected 2023 EBITDA, we get a forward EV/EBITDA ratio of 19.8x (20.0x according to the chart below). That number is fair but far from undervalued.

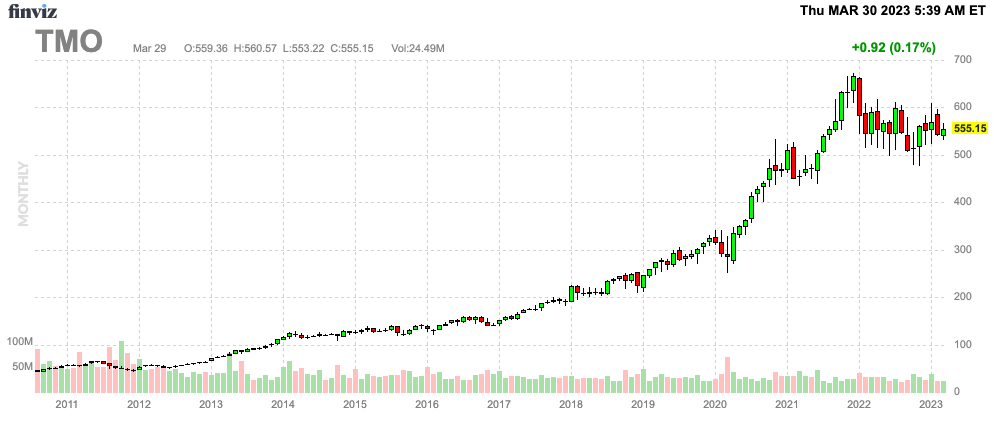

The company’s current share price is $555. The consensus target price is $650 (+17%), which I believe is fair.

FINVIZ

That said, Morgan Stanley (MS) just came out with an overweight rating of $670. As reported by Seeking Alpha:

We firmly believe in TMO’s ability to outgrow its peers and end markets driven by a combination of increasing exposure to high-growth verticals (specifically biopharma, following the Patheon/PPD acquisitions) and geographies (including China),as well as a relentless focus on share gains fueled by the breadth, depth and reach of their portfolio.

Takeaway

In this article, we discussed a dividend stock with one of the lowest yields that’s currently on my radar. Despite its low yield, Thermo Fisher is included in one of my model portfolios due to its remarkable ability to add value. The company has a solid business model with a wide moat, substantial pricing power, customers that are resistant to economic cycles, and strong industry demand tailwinds. Additionally, its balance sheet can support M&A activity even at high rates.

As a result of these strengths, TMO shares have delivered impressive total returns with relatively low volatility. I anticipate this trend will continue for many years or even decades to come.

Currently, the company’s valuation appears reasonable. If I did not already own its largest peer in my dividend portfolio, I would consider purchasing TMO shares on any future market correction to improve the risk/reward ratio.

Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice.