Summary:

- In this article, I start by providing a theoretical foundation that explains why owning low-yielding stocks makes sense.

- Thermo Fisher is a low-yielding dividend growth stock with the ability to outperform the market with a low-volatility profile.

- Its product portfolio helps the company to withstand cyclical risks, supply chain woes, and high inflation.

JHVEPhoto

Introduction

It’s time to discuss one of the best stocks money can buy: Thermo Fisher Scientific (NYSE:TMO). The company does have a yield close to zero percent, yet it’s a terrific dividend stock for a number of reasons. The company has a fantastic business model allowing it to withstand severe economic storms, high inflation, and supply chain woes – we are currently dealing with all of this. Thanks to these qualities, the company has a history of strong dividend growth, outperforming capital gains (by a mile), and a low-volatility profile, which makes investing large sums of money quite interesting. I own the company’s largest peer Danaher Corp. (DHR) and I’m considering adding TMO as buying quality dividend growth and low volatility is the best way to generate long-term wealth.

In July, I covered the company’s core business and opportunities as well as its low yield. In this article, I will incorporate current events including comments from the Morgan Stanley Healthcare conference that show that TMO is well-equipped against challenges like supply chain difficulties, high inflation, and slowing economic growth.

So, let me walk you through my thoughts!

Starting with some theoretical background.

Why Dividend Growth Makes Sense – Despite A Low Yield

I always like to combine companies with a macro thesis or a theoretical background. Especially when covering very low-yielding dividend stock, I believe it’s important to provide the necessary background.

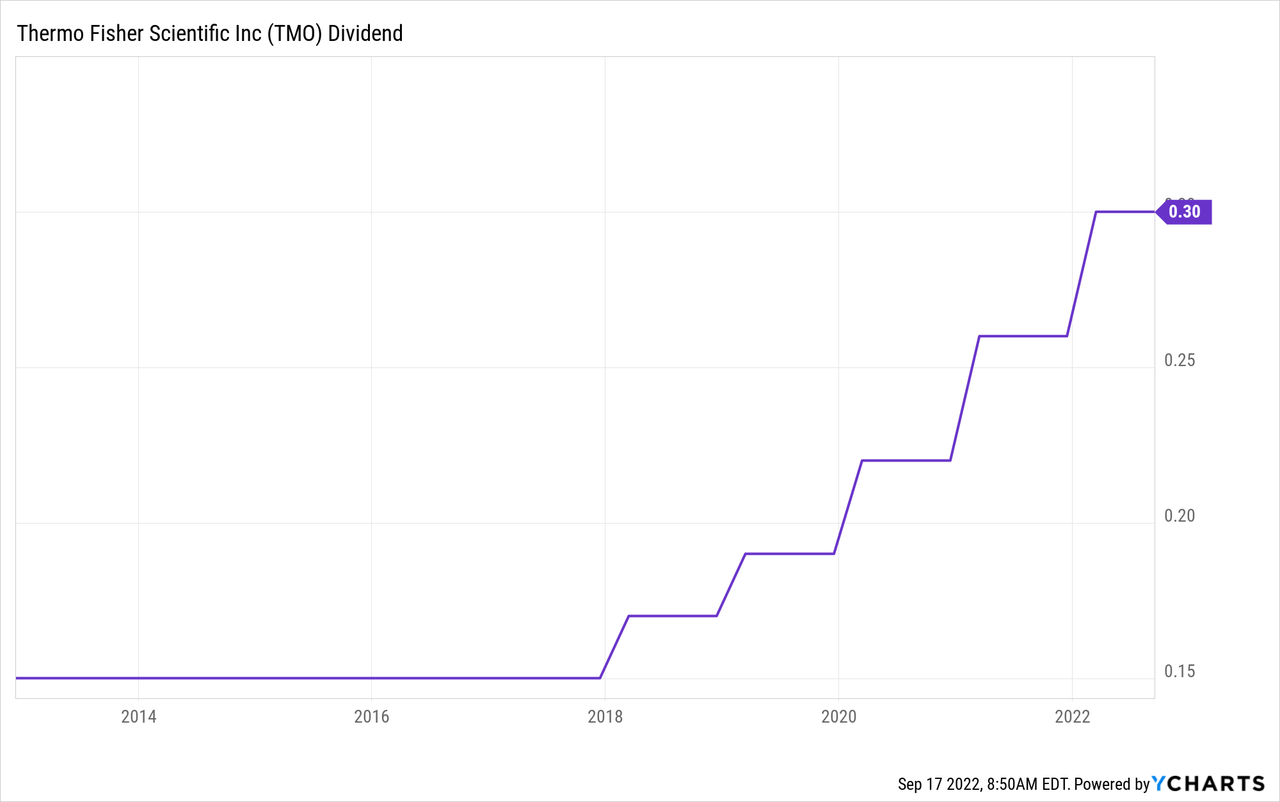

Thermo Fisher is currently paying a $0.30 per share per quarter dividend. That’s $1.20 per year. In order to get that, investors need to hold a share, which is currently trading at $540. That’s more expensive than a PlayStation 5, resulting in a yield of just 0.22%.

In other words, a $10,000 investment would end up paying $22 per year.

It is clear that Thermo Fisher isn’t the stock you want to buy when looking for high income – or income in general. Personally, I like buying a decent yield. However, I also like owning high-quality stocks that let me sleep like a baby, especially when the market is volatile and bombed my uncertainty and macroeconomic issues, which is currently the case.

While I will get into that in this article, let’s look into the reasons why dividends are important in the first place. Morgan Stanley hit the nail on the head when it found that dividend payers return way more than non-dividend payers.

A recent study by FactSet shows that dividend-paying stocks outperform their non-paying counterparts by a dramatic amount. From 1991 through 2015, non-dividend paying stocks earned just +4.18% return per year while dividend paying stocks significantly outperformed with a +9.7% average annual return.

Essentially, this is caused by dividends being a “stamp of approval”. Operating a business is hard. Distributing cash is harder. Doing it consistently while growing dividends is even harder. Companies paying a dividend show that they are able to compete while letting shareholders benefit in the process. That’s great quality and something shareholders can rely on, especially when recessions cause uncertainty to skyrocket. Moreover, dividend growth stocks often protect dividends against inflation, which adds to the “quality” aspect of an investment.

In a 2022 paper, Hartford Funds compared dividend stocks to Volvo cars, which I think was quite fitting:

Dividend-paying stocks are like the Volvos of the investing world. They’re not fancy at first glance, but they have a lot going for them when you look deeper under the hood.

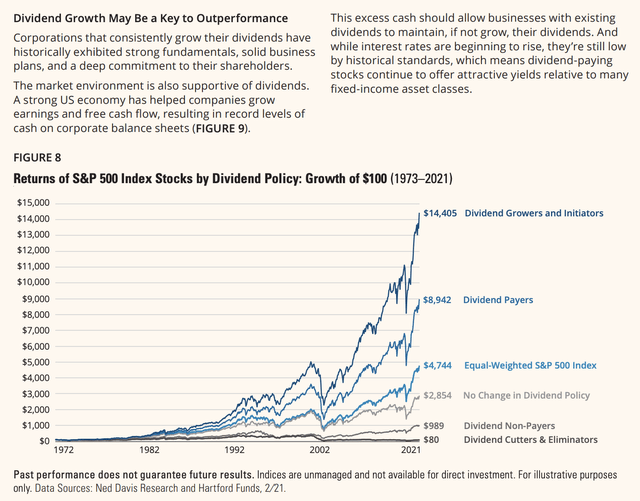

The same research paper showed that both dividend payers and dividend growers outperformed the equal-weight S&P 500 index by a mile on a long-term basis. Moreover, the paper mentions the “quality” aspect in the text above the chart below. Being a dividend grower is basically a sign of strong fundamentals. Also, and this is important, companies that pay dividends need to be more careful with their cash flows. They need to make smarter decisions to protect the dividend and to make sure that investments allow for future dividend growth. It’s truly a fantastic controlling mechanism, I think.

Hartford Funds

Moreover, the quality aspect protects investors a bit during bear markets. Don’t get me wrong, most dividend stocks will also suffer when markets tank. However, odds are they do better as investors will rather sell non-dividend paying companies or companies that struggle, in general, when re-risking their portfolios. These companies are often non-dividend paying companies.

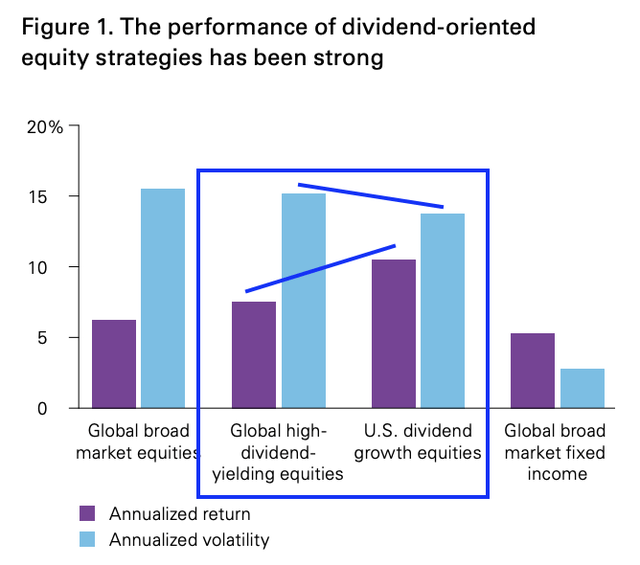

As the chart below shows, both dividend growth and high-yield stocks outperform the broader market while doing it with less volatility. While I do own a number of rather volatile stocks, I am a big believer in investing in low volatility because it tends to provide outperformance without a lot of drama. This is especially important when selling investments somewhere in the future. Low-volatility stocks are much more reliable.

Vanguard

Now, you know why I cannot stop talking about low-yielding dividend stocks.

Thermo Fisher – High-Quality Dividends

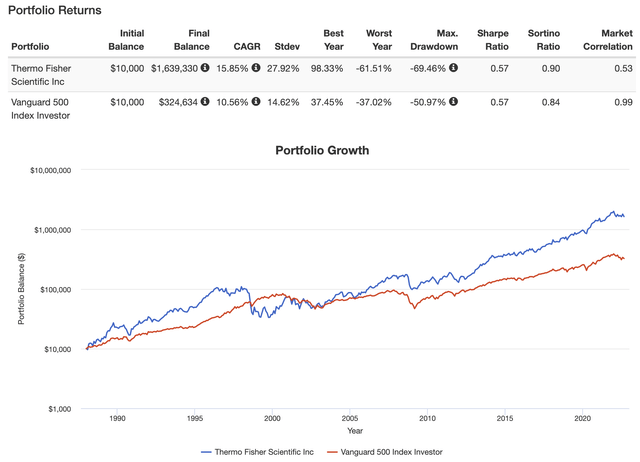

Before we dive into financial numbers and whatnot, let me show you that Thermo Fisher has indeed proven to be a source of low-volatility outperformance. Going all the way back to 1988, the stock has returned 15.9% per year. This beats the S&P 500 by more than 500 basis points. The standard deviation was 27.9%, which is rather high compared to the S&P 500. Yet, TMO still beat the S&P 500 on a volatility-adjusted basis (Sharpe/Sortino ratios).

Portfolio Visualizer

Moreover, the somewhat high volatility of TMO was caused by the company being somewhat young in the 20 years prior to the 2000s.

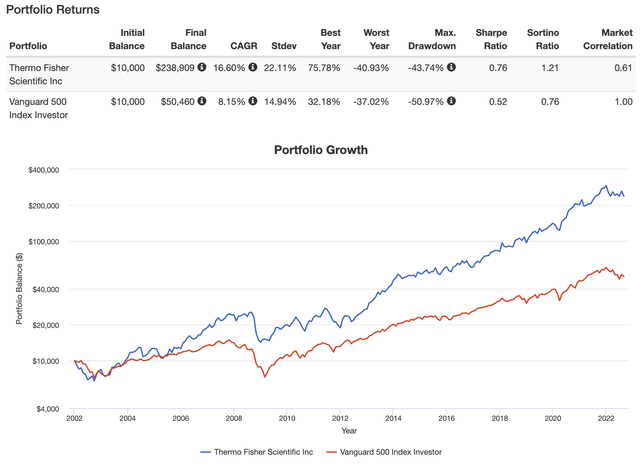

Over the past 20 years, the company has returned 16.6% per year. The standard deviation has come down to 22.1%. Even the worst drawdown was “just” 44%, that’s more than 600 basis points better than the S&P 500’s performance during the Great Financial Crisis.

Portfolio Visualizer

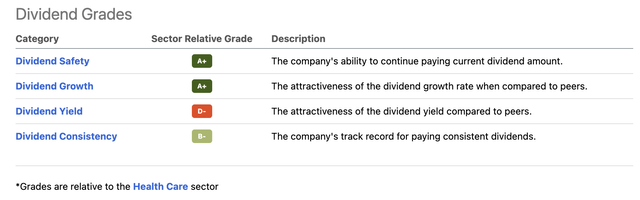

With that said, the “worst” thing about TMO is its yield as we already briefly discussed, yet it’s also the only thing that might bother a potential investor. Looking at the Seeking Alpha dividend scorecard, we see that the company scores extremely high on dividend safety and dividend growth compared to its healthcare sector peers.

Seeking Alpha

The 10-year average annual dividend growth rate is 16.1%, which is impressive. These are the most “recent” hikes:

- February 2022: 15.0%

- February 2021: 18.0%

- February 2020: 16.0%

The payout ratio is rather low, which explains why dividend safety is scoring so high. Using $18.80 in earnings per share over the past four quarters and the aforementioned $1.20 annual dividend, the payout ratio is a mere 6.4%.

A Top Tier Business Model

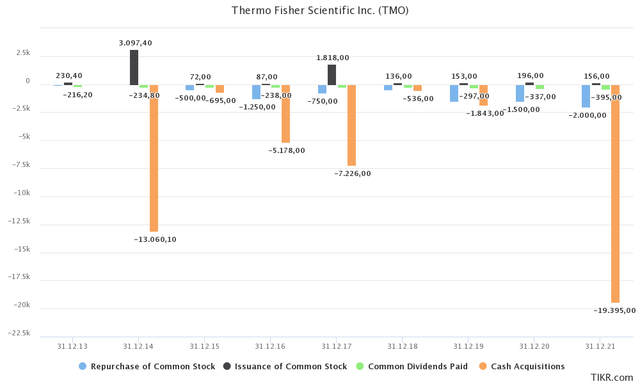

With a sub-10% payout ratio, Thermo Fisher obviously has other priorities than to get rid of its cash through dividends. Below, I listed some of the ways to get rid of cash: stock repurchases (also issuance of stock), common dividends paid, and cash acquisitions.

TIKR.com

Thermo Fisher has a genius business model, which is based on high free cash flow generation, which is then used to buy more growth (acquisitions), which then generates more free cash flow used to repay debt.

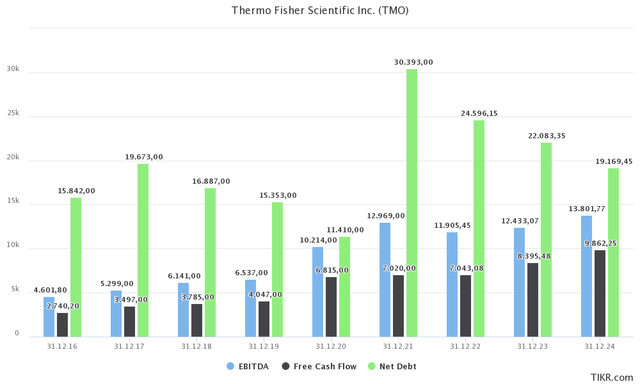

The graph below shows that spikes in net debt always lead to lower debt levels in the years that follow as free cash flow is growing rapidly. Between 2016-2024E, free cash flow is growing by 15.5% CAGR. That’s truly impressive. Next year, the implied FCF yield is 4.0%, which is rather high. This allows for a quick debt reduction to $22.1 billion according to analyst estimates. That would imply a 1.7x net leverage multiple. Hence, it is no surprise that the company has a BBB+ debt rating. I believe it won’t take long until the company enters the A-range.

TIKR.com

With that said, let’s dive a bit deeper as I haven’t even explained what Thermo Fisher does exactly – almost 1,300 words into this article.

Thermo Fisher is basically a healthcare supplier. It sells equipment for Life Science Solutions, Specialty Diagnostics, Analytical Instruments, Laboratory Products, and Biopharma Services.

For example, in its biggest segment, Life Sciences Solutions, the company:

[…] provides an extensive portfolio of reagents, instruments and consumables used in biological and medical research, discovery and production of new drugs and vaccines as well as diagnosis of infection and disease. These products and services are used by customers in pharmaceutical, biotechnology, agricultural, clinical, healthcare, academic, and government markets. Life Sciences Solutions includes four primary businesses – Biosciences, Genetic Sciences, Clinical Next-Generation Sequencing, and BioProduction.

With more than 100,000 employees, the company is a powerhouse in the industry with what it believes is a $225 billion total addressable market. The company sees between 4% to 6% in annual long-term growth. Achieving these growth numbers would be a good deal. However, TMO is growing by 7% to 9% in this industry – organically! This is thanks to its innovative products, experienced sales force, and a great relationship with customers.

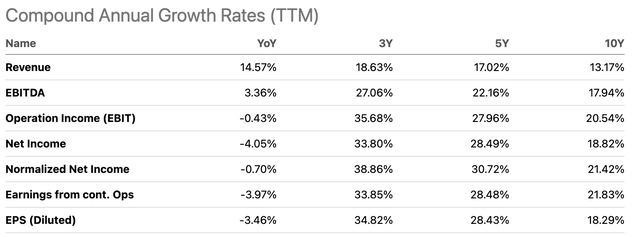

Using Seeking Alpha’s handy overview of historical annual growth rates (including acquired growth), we see that the company has grown its top line by more than 13% per year over the past 10 years. Thanks to higher margins, this resulted in roughly 18% average annual EBITDA growth and close to 19% in annual net income growth. The earnings per share growth rate was slightly lower as TMO does not engage in net buybacks. Gross buybacks are offset by stock-based compensation and M&A activities.

Seeking Alpha

With this in mind, let me show you some comments from the recent Morgan Stanley Annual Global Healthcare Conference where Thermo Fisher mentioned a few things that are extremely important given ongoing supply chain problems, slowing global growth, and high inflation.

First of all, the company is extremely resilient. This is based on its own abilities and the fact that healthcare is anti-cyclical to a large extent. During the Great Financial Crisis, sales in TMO’s market fell only 3%. The rebound afterward was much stronger. Moreover, the company’s product mix has become much more favorable compared to almost 14 years ago:

When I think about how the company, how we’ve evolved our mix by executing our strategy, the company is — has a more favorable set of end markets than we did back at the end of the 2000s. And today, pharmaceutical and biotech which is the least economically exposed end market, represents just under 60% of our core revenue. And back then, it was about 1/4 of our core revenue. And our consumables and service business is about 85% of our revenue. Back then, it was about 2/3 of our revenue. So the company’s mix has evolved and that positions us to navigate whatever the world throws at us.

Moreover, in Europe, the company still sees positive organic growth despite severe economic challenges. It has also gotten rid of natural gas in its facilities, which will be a huge benefit if rationing is applied during the winter months.

The same goes for the (still ongoing) shortages in semiconductors, electronic parts, and related. The company was able to maintain strong organic growth as it has great relationships with suppliers. After all, the company is a giant with preferred customer status at many suppliers – which is something I assume given the results.

This basically means that when inventories fall, suppliers provide the best supplies to their preferred customers. These are mainly large corporations with innovation and pricing power. While this data isn’t public, I assume that TMO has this buyer status with all core suppliers.

The company also has strong pricing power. According to the company:

And in a given year, we would get 50 to 100 basis points of price every year. And that’s part of our economic formula in terms of high single-digit organic growth and you say you’re getting 0.75 point on price. So that’s the norm.

Moreover:

And we — in the first half, we were running 2 to 3x the high end of our historical rate in terms of pricing. And we expect an additional about $100 million of price in the second half of the year just based on some of the inflationary pressures that are out there. And when I think to the future, we will price appropriately based on the economic environment.

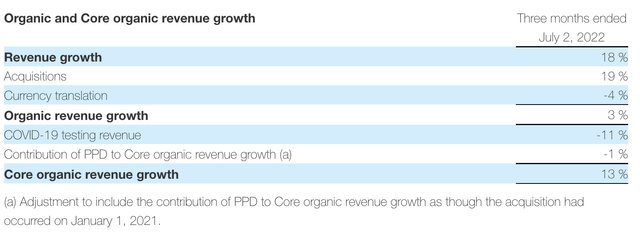

Now, to give you some numbers, the company is doing very well indeed. In 2Q22, the company saw 3% organic revenue growth. Core organic revenue growth was 13%. Especially genomic research demand added to the company’s sales. In China, the company benefited from COVID-19-related sales, which more than offset headwinds related to the country’s lockdowns. That’s a big win for Thermo Fisher and another sign of the company’s resilience. As a result, the company raised its full-year guidance.

Thermo Fisher Scientific

Full-year revenue guidance has been raised by a whopping $700 million to $43.15 billion. This would be a 10% revenue growth over 2021. 2022 adjusted EPS has been raised by $0.28 to $22.93 per share. According to the company:

This higher outlook primarily reflects the strength of our core business and additional contribution of COVID-19 testing revenue, which are more than offsetting the increased foreign exchange headwinds, demonstrating how well we operate with speed and scale to enable our customer success and navigate dynamic macro environments.

Moreover, core organic revenue growth is expected to be 11% instead of 9%.

So, to combine the last comments, the company has:

- Stable, anti-cyclical target markets.

- Efficient supply chains.

- Great pricing power.

- A great balance sheet (higher rates risks)

- Financial numbers that keep “ignoring” ongoing economic weakness.

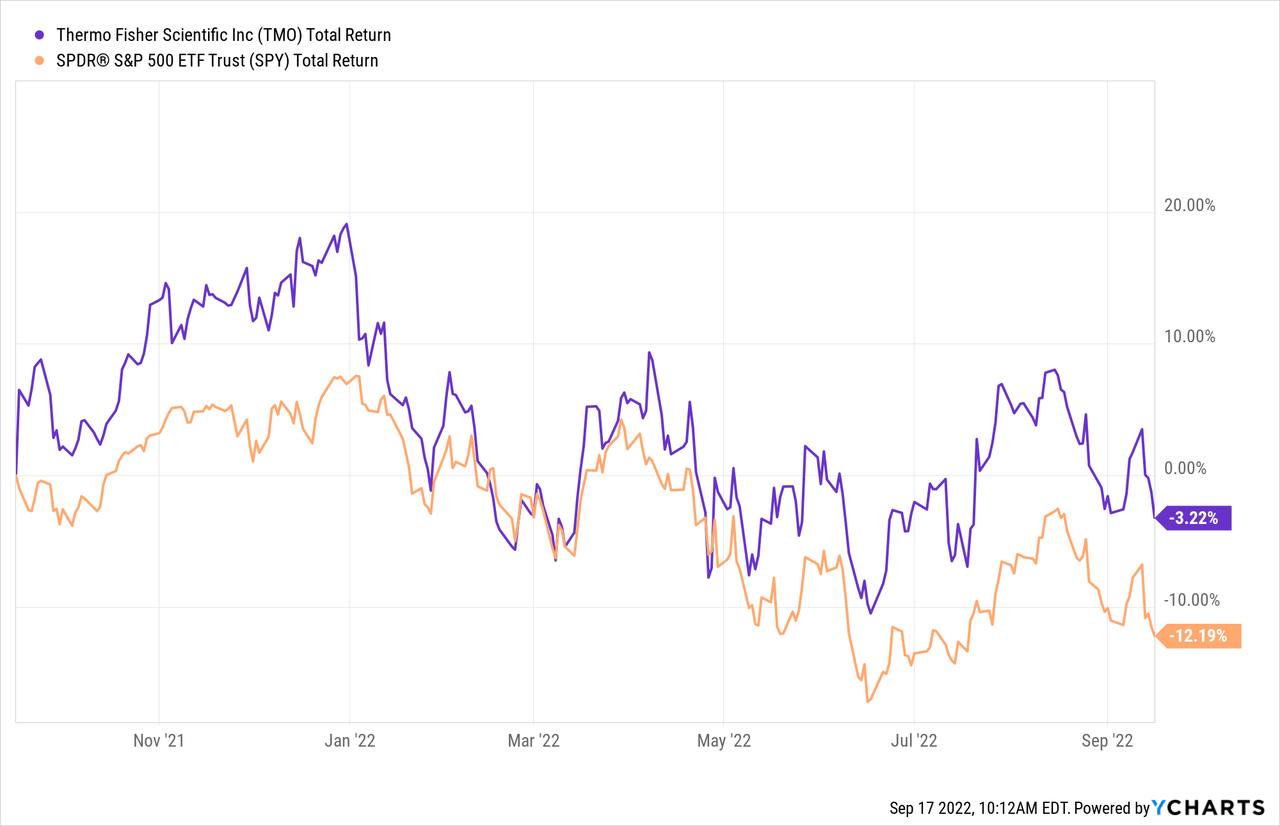

It was able to outperform the market by almost 10 points over the past 12 months as the market is suffering from cyclical weakness, weak supply chains, inflation, and higher rates. In other words, all the issues that TMO is able to deal with rather efficiently.

TMO Stock’s Valuation

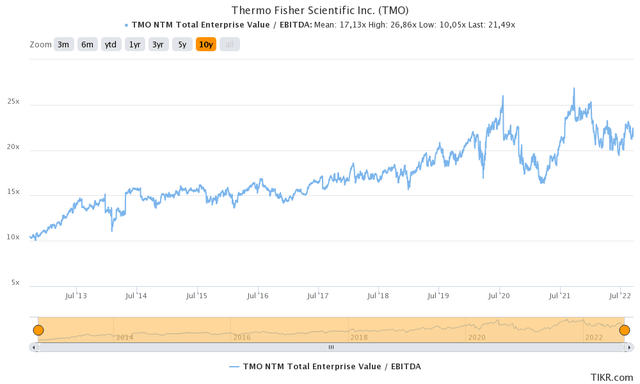

Thermo Fisher has an implied enterprise value of $234.1 billion using its $212 billion market cap and $22.1 billion in expected 2023 net debt. That’s roughly 18.9x 2023E EBITDA of $12.4 billion.

This is not cheap, by any means, but it erases the entire post-pandemic valuation expansion.

It’s also far from overpriced for a company with strong, double-digit EBITDA and free cash flow growth, which has a business model that comes dangerously close to money printing.

This valuation is also lower compared to my prior article. The market has weakened, and Thermo Fisher’s fundamentals have not.

TIKR.com

So, here’s how I would deal with TMO:

Takeaway

Thermo Fisher is one of the best dividend stocks money can buy despite its 0.2% yield. The company has a low payout ratio of less than 7% but high dividend growth provided by rapidly rising free cash flow, a healthy balance sheet, and the aforementioned payout rate.

For now, the dividend isn’t a priority. The company is mainly interested in growing its business through organic growth and strategic acquisitions that provide it with an ever-increasing footprint as a healthcare supplier.

Thanks to its qualities as a fast-growing dividend stock, the company offers long-term outperformance and a low-volatility profile, which is key when building long-term wealth.

This is further supported by its ability to withstand inflation, supply chain problems, and cyclical economic weakness.

The recent 2Q22 results are a great example of this. Core revenue growth expectations have been raised as even the Chinese lockdowns are not hurting the company’s top line. Higher pricing is protecting margins, allowing the company to raise its EPS forecast as well.

The valuation reflects the company’s potential. Although TMO shares do not look “cheap”, I believe the valuation is fair and I suggest interested investors buy a small position and add gradually whenever weakness occurs. I believe that ongoing market developments will provide us with more weakness in the months ahead. I’m applying this strategy to most of my investments.

(Dis)agree? Let me know in the comments!

Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.