Summary:

- Thermo Fisher’s sales and earnings headwinds from declining Covid testing is finally nearing an end.

- The core business outside of Covid is growing at 14% organically this year and the long-term plan of 7-9% growth looks achievable.

- The company can grow faster than the market due to its one-stop shop for contract research, bioproduction, diagnostic tools, and analytical instruments.

- The pullback in the share price to around $500 puts TMO back in the buy territory.

Gannet77/E+ via Getty Images

Covid Testing Gives Way To Core Growth

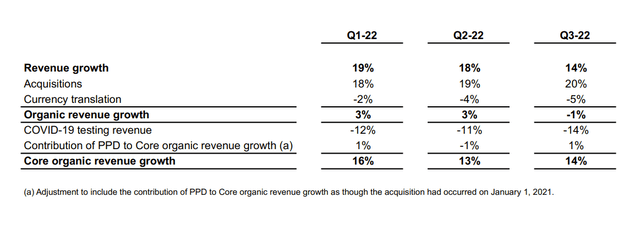

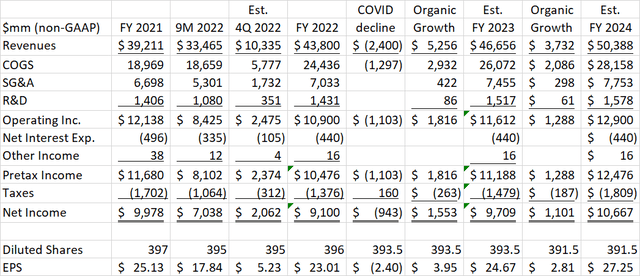

As I predicted back in February 2022, Thermo Fisher Scientific (NYSE:TMO) took a breather in 2022 from its strong Covid-driven results of the prior two years. On the 3Q earnings call, management guided to 2022 earnings of $23.01 per share, down from $25.13 in 2021. Thermo’s $7.3 billion of Covid testing revenue in 2021 made up about 18% of sales that year. For 2022, the company is on track to have only $2.8 billion of Covid testing revenue, or about 6% of this year’s sales. Looking at quarterly results, this revenue stream is tapering off quickly, with $0.44 billion in 3Q and an estimated $0.1 billion in 4Q.

The good news is that the core business is delivering growth that will carry the company forward. Earlier acquisitions and organic capex in the bioprocessing business and the purchase of clinical research provider PPD is allowing Thermo to capture market share with Pharma and Healthcare end markets. Meanwhile, Thermo’s older analytical instruments business is seeing high-teens percentage sales growth with industrial and applied customers.

Looking forward, there is not much more room for Covid testing revenue to decline, so the core growth will now be more apparent. After pulling back from nearly $600 at the time of my last article, the company now looks cheap based on this growth.

One-Stop Shop

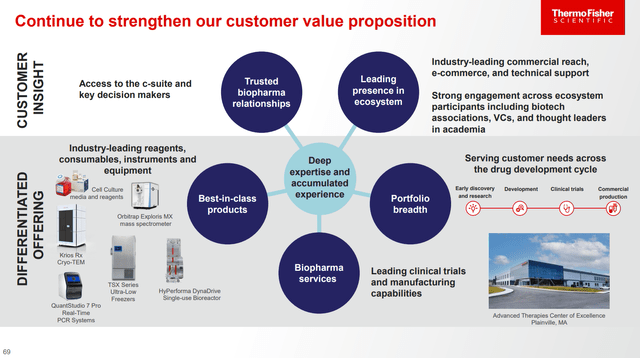

As stated in the May 2022 Investor Day presentation, Thermo Fisher sees overall demand in its end markets growing at 4-6% per year. One obvious driver of growth comes from the demographic trend of aging and the desire in emerging economies to spend more on health care. However, pharma and biotech companies are also doing more outsourcing and partnerships in both research and manufacturing. Even outside of health care, there is a demand for Thermo’s analytical instruments to support growth in semiconductor manufacturing and advanced materials processing for the clean energy transition.

Thermo believes it can exceed the average end market growth and capture market share, growing 7-9% per year. The company’s size and global reach allow it to be a one-stop shop for customers at many points along their value chain, from contract research all the way to manufacturing and packaging. Having so many different touch points accessible to Thermo allows the sales force to serve their customers more efficiently and puts Thermo at top of mind for new projects.

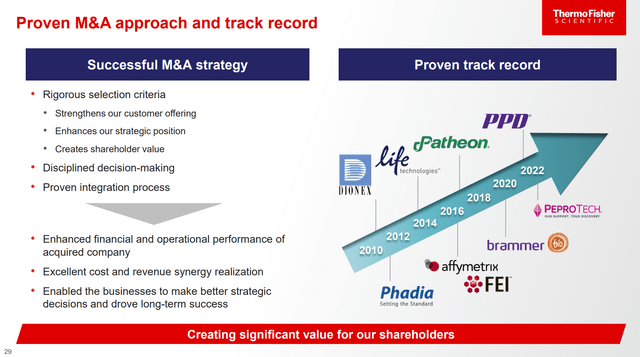

As it grows sales, Thermo’s PPI business system also helps to create a single company culture and set of business processes. This has allowed Thermo to integrate new acquisitions quickly and achieve merger synergies better than the average company.

With these added operating efficiencies, Thermo can turn its 7-9% revenue growth into 10-12% EPS growth, as estimated by the average annual growth rate from analyst EPS projections.

Financial Model

Management does not provide any guidance for 2023 until it reports 4Q earnings in January. There is a risk the company will provide conservative guidance due to macro issues, but 12% core revenue growth excluding the final decline in Covid testing revenue would be a slight decline from 2022 growth. I then model 8% organic sales growth in 2024, in-line with the midpoint of the long-term plan. While I also allowed cost of goods to increase by the same amount, operating leverage should allow SG&A and R&D to grow about half as fast. Thermo will be paying down debt from the PPD acquisition over the next few years, but they should still be able to reduce share count by about 2 million per year which would cost about $1 billion each year.

The resulting EPS of $24.67 in 2023 and $27.25 in 2024 represent year-on-year growth rates of 7.2% and 10.5% respectively. With Thermo’s proclivity for M&A, there is always a chance that there could be additional inorganic growth in later years.

These estimates have improved since my February article and are now closer to analyst consensus estimates of $24.04 in 2023 and $27.14 in 2024.

Valuation

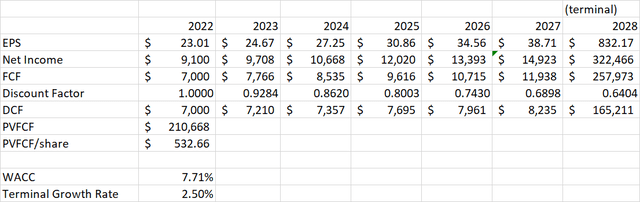

A quick and dirty DCF analysis shows that Thermo is now in buy territory after its pullback this year. I get my weighted average cost of capital from GuruFocus which updates the WACC daily based on the risk-free rate and the stock’s Beta. Currently, the stated WACC is 7.71%. I assume 12% EPS growth through 2028 followed by a decline to terminal growth rate of 2.5% per year. This is probably conservative, but I consider this as my “margin of safety” in the valuation. Based on recent history, Net Income conversion to free cash flow has been around 80%. I use this to translate EPS projections into future free cash flows.

| 2019 | 2020 | 2021 | 2022 | |

| Net Income (non-GAAP) | $ 4,975 | $ 7,812 | $ 9,978 | $ 9,100 |

| Free Cash Flow | $ 4,083 | $ 6,823 | $ 6,809 | $ 7,000 |

| FCF Conversion | 82% | 87% | 68% | 77% |

Putting it all together, I get a DCF valuation of $532.66 per share.

Capital Management

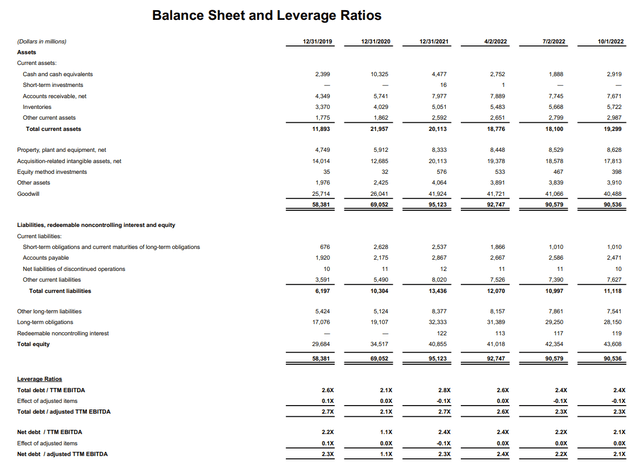

Thermo Fisher has been a judicious user of debt to fund its acquisitions. The company has kept its net debt/EBITDA levels low, using some of its free cash flow to pay down debt after big acquisitions, as EBITDA increases. Even now after the PPD acquisition, net debt/EBITDA is a comfortable 2.1 times.

The company has been able to finance this debt at low rates, with many euro-denominated debt issues. Thanks to the strong dollar, debt declined $1 billion last quarter without the company paying any of it off. Additionally, higher interest rates have allowed the company to earn more interest on its cash balance while paying fixed interest rates on debt. As a result, interest expense is little changed from last year and is almost 20x covered by operating income.

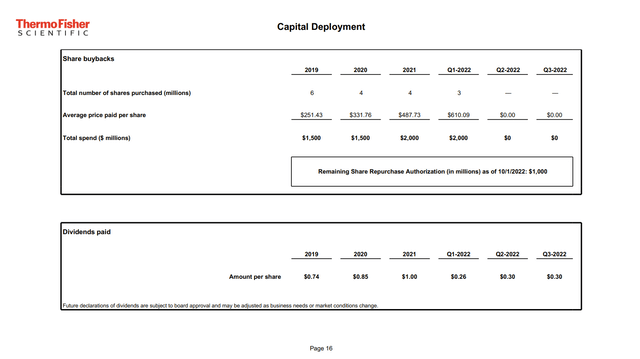

Thermo is definitely not an income stock but it has been growing its small dividend at mid-teens percentages each year. The company has also been buying back a steady $1.5 to $2 billion worth of shares each year, seemingly regardless of price. This is a questionable way to run a buyback program, but the good news is that the company does tend to slow down the buybacks following big acquisitions. That is why I forecasted only $1 billion per year the next few years following the PPD deal.

Conclusion

Thermo Fisher is now valued at about 21.7 times 2022 earnings, 20.3 times 2023, and 18.3 times 2024. This is a reduction of about 5 P/E turns since my February article. Also TMO stock has underperformed peers Agilent (A) and Danaher (DHR) since then, so Thermo now looks cheaper than peers on a P/E basis. Thermo showed strong core growth in 2022 which has been obscured by declining Covid testing sales. With little room for Covid sales to decline further, the core growth will be more apparent in future years.

After the nearly $100 pullback since February, Thermo now looks buyable based on DCF analysis, even as higher interest rates have pushed up the cost of capital. Thermo’s dominant position in the industry and skill at growing both organically and through M&A give me confidence the growth can continue.

Disclosure: I/we have a beneficial long position in the shares of TMO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.