Thermo Fisher: Why Buying Its 0.2% Yield Makes Sense

Summary:

- Thermo Fisher is the perfect dividend growth stock despite its 0.20% dividend yield, which seems like a dealbreaker.

- However, it has all characteristics to deliver outperforming long-term capital gains for its investors without exposing investors to high volatility.

- The company has aggressive M&A growth on top of strong organic sales growth, which is leading to high earnings growth and free cash flow generation.

- Moreover, its business model allows for strong pricing and secular growth in multiple healthcare-related areas.

JHVEPhoto

Introduction

It’s time to cover a truly fantastic dividend stock. In this case, we’re going to take a look at Massachusetts-based healthcare giant Thermo Fisher Scientific (NYSE:TMO), a company with a huge footprint in healthcare and related technologies with a market cap of $220 billion. Founded in 1956, this company isn’t what most people look for when buying dividend companies. Its main priority is not its dividend or buybacks but mergers and acquisitions. Hence, the company yields just 0.20%, which would mean $20 in annual dividends from a $10,000 investment. That’s two Big Macs with fries. However, before yield-seeking investors stop reading, allow me to build a case for a TMO investment. Just like its peer Danaher (DHR), which I own, the company is in a terrific position to continue delivering outperforming total returns for investors. Not only does it protect buyers against inflation but it also delivers high organic sales growth, strong margins, and a low-volatility, high-dividend growth profile that paves the way for significant wealth generation. Even high-yield focused investors will benefit from adding some high-growth stocks like TMO, which is what I will explain in this article.

The Business

I have never covered Thermo Fisher on Seeking Alpha, nor anywhere else. Hence, it’s even more important to take a step back and look at the bigger picture as it’s a company people need to be aware of, in my opinion.

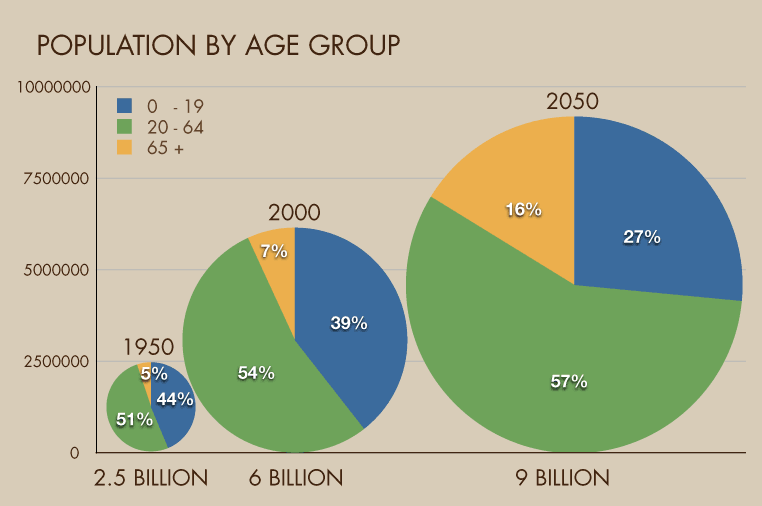

What’s interesting is that a few years ago, I got a call from a (small) biotech fund that was looking for investors. One of the reasons why they believed biotech was the future was the fact that the global population is aging rapidly.

Pinterest (The World Today)

I believe they brought up a great point. Yet I didn’t invest in them for a number of reasons including the fact that I think there’s a better angle to play this trend: healthcare suppliers.

Don’t get me wrong, this isn’t only about an aging population. It’s just one of many reasons to consider healthcare. In this case, I prefer suppliers as some companies like Danaher and Thermo Fisher provide key equipment and supplies that not only help companies develop new drugs and treatments but also give these companies great pricing power.

In the case of Thermo Fisher, we’re dealing with a supplier of equipment and related products that go very deep down the value chain.

For example, in its biggest segment, Life Sciences Solutions, the company:

[…] provides an extensive portfolio of reagents, instruments and consumables used in biological and medical research, discovery and production of new drugs and vaccines as well as diagnosis of infection and disease. These products and services are used by customers in pharmaceutical, biotechnology, agricultural, clinical, healthcare, academic, and government markets. Life Sciences Solutions includes four primary businesses – Biosciences, Genetic Sciences, Clinical Next-Generation Sequencing, and BioProduction.

Its other segments are similar, although they focus on different niches. This includes analytical instruments, diagnostics, and support equipment for laboratories.

When combining all segments, roughly 58% of sales are generated in pharmaceuticals and biotech. Diagnostics and healthcare account for 14% of sales. Academic and government customers accounted for 15% of total sales. Industrial and applied customers brought in 13% of sales.

With more than 100,000 employees, Thermo Fisher operates in what it believes to be market segments with up to $225 billion in sales potential. The aforementioned change in demographics, long-term outsourcing trends, and the threat of future pandemics are all adding to accelerated investments in healthcare.

As a result, the company’s markets see between 4% and 6% in annual long-term growth. Even without gaining market share, these numbers would be terrific for any company.

Thermo Fisher, however, aims to achieve between 7% and 9% organic(!) annual sales growth thanks to its innovative products, emerging market exposure, and unique customer value proposition.

So far, emerging markets account for 19% of total sales ($8 billion). China provides roughly 45% of total emerging market revenues.

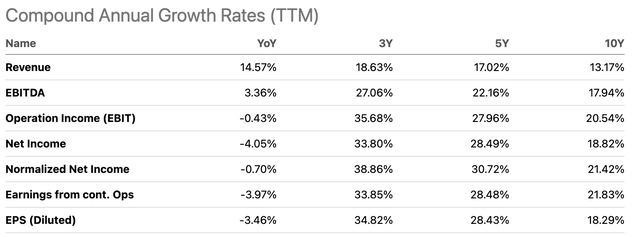

Using Seeking Alpha’s handy overview of historical annual growth rates (including acquired growth), we see that the company has grown its top line by more than 13% per year over the past 10 years. Thanks to higher margins, this resulted in roughly 18% average annual EBITDA growth and close to 19% in annual net income growth. The earnings per share growth rate was slightly lower as TMO does not engage in net buybacks. Gross buybacks are offset by stock-based compensation and M&A activities.

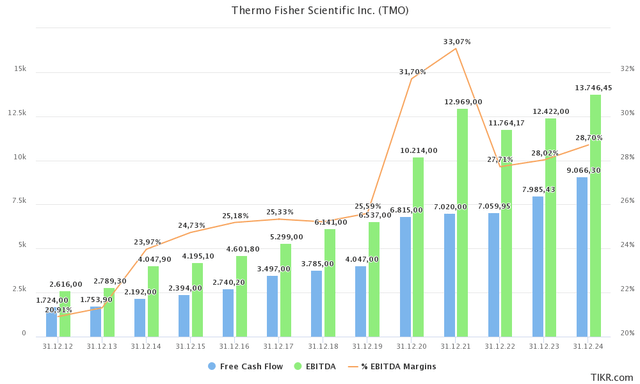

In 2012, the company did $2.6 billion in adjusted EBITDA. Next year, that number could be almost $10 billion higher. This is provided by higher revenues, but also by the fact that EBITDA margins are now expected to grow consistently above 28.0%. After the Great Financial Recession, margins were closer to 20%. Meanwhile, free cash flow generation could break $8.0 billion next year, which is roughly 3.6% of the company’s market cap. That’s based on roughly $2.1 billion in capital expenditures. In 2020, that number was less than $1.5 billion.

This surge is caused by acquired growth. While organic sales growth in high-single-digits (on a long-term basis) is impressive, the company’s main target is to spend capital on M&A over shareholder distributions.

On a long-term basis, Thermo Fisher expects to invest 60-75% of its capital in M&A. It aims to return between 25% and 40% through dividends and buybacks.

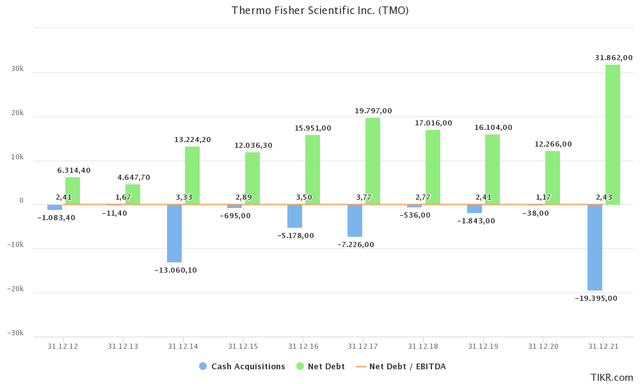

When looking at cash acquisitions, we see that the company has spent an incredible amount on new businesses. Over the past 10 years, close to $50 billion in cash was spent on acquisitions. That’s almost a quarter of the company’s current market cap.

For example, in 2021, TMO bought PPD Inc. for $17.4 billion in cash plus $3.5 billion in net debt. In that year, the company also bought Henogen SA, a Belgian producer of viral vectors. viral vectors (tools designed to deliver genetic material into cells) for EUR 725 million in cash as well as Mesa Biotech for $550 million.

Needless to say, as the company doesn’t produce that much in cash itself, it needs external funding. Net debt ended last year at $31.9 billion as the chart above shows.

However, the net debt ratio was lower (2.43x EBITDA) than it was in the years when the net debt load was roughly half as high.

Next year, net debt is expected to fall to $23.7 billion, or 1.9x EBITDA. That number needs to be taken with a grain of salt as TMO is very likely to buy new companies before the end of 2023. However, it gives you an idea of how quickly TMO can reduce debt after buying large companies.

As a result, the company has access to very attractive rates and a credit rating of BBB+ (one step below the A-range). For example, the company has $1.2 billion in 20-year Senior Notes due in 2041. The current effective interest rate is 2.9%.

With that said, let’s take a look at the dividend.

The Dividend (And Why It Makes Sense)

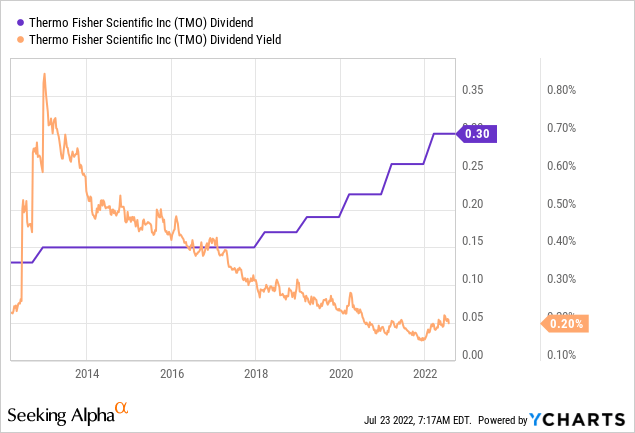

TMO pays a $0.30 per share quarterly dividend ($1.20 per year). In order to receive these dividends, you need to buy a share for $562, which puts the dividend yield at a mere 0.20%.

Initiated in 2012, the company’s dividend has grown by 24.0% per year, which is impressive. The most “recent” hikes are listed below:

- February 2022: 15.0%

- February 2021: 18.0%

- February 2020: 16.0%

When the dividend was initiated, the yield soared to 0.80%. It’s 0.20% now, which means that capital gains outperformed dividend growth.

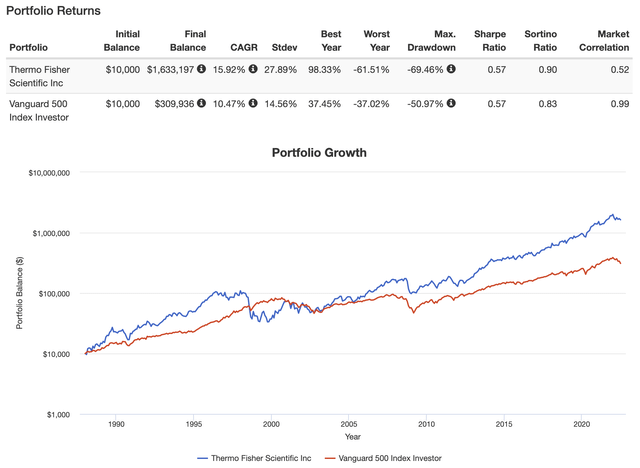

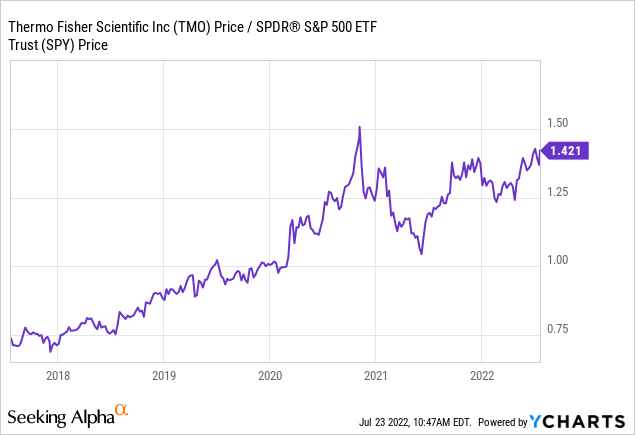

Since 1985, TMO shares have returned 15.9% per year. This beats the S&P 500’s already good performance of 10.5% by more than 500 basis points. Even adjusted for volatility, the S&P 500 does not beat TMO shares.

What we are seeing here is a stock that has a yield too low to make a difference. However, the fact that TMO is a dividend growth stock helps the bull case a lot.

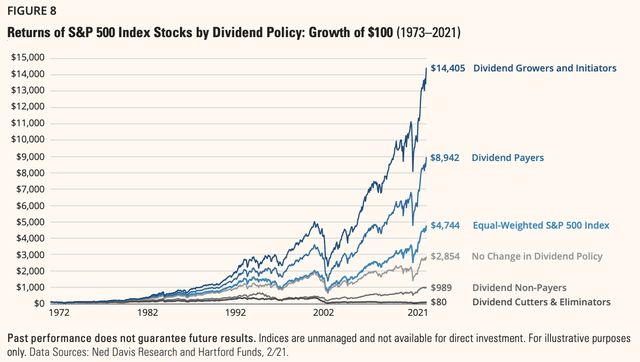

In a number of articles this year, I have highlighted why dividend growth is so important. For example, this one.

Basically, the dividend growth proposition is based on three pillars that FTSE summarized in a handy overview:

Long history of outperformance. As research shows, persistent dividend growers have strongly outpaced broad market benchmarks historically, with significantly less volatility.

The quality connection. Steady dividend growth often goes hand in hand with stable earnings streams, good corporate stewardship and resilient business models—desirable attributes with enduring investment value, particularly for investors with long-term horizons.

Downside defenses. History shows that dividend growth stocks possess relatively strong defensive qualities, which tend to mostly come to the fore during periods of acute market stress.

Essentially, being a dividend payer is a stamp of approval. It means a company makes enough money to reward its owners. There are exceptions of course, like when companies borrow money to pay a dividend, but you get my point.

Additionally, because companies pay a dividend, they bring more “value” to the table, which helps in times of trouble. Hence, it protects companies when markets tank. On a long-term basis, companies with limited downside that are able to keep up during bull markets are able to deliver tremendous outperformance.

Companies that pay a steadily rising dividend are even better as they tend to protect investors against inflation while also proving that they can grow over time.

Hence, on a long-term basis, dividend payers outperform the market. Dividend growers show an even bigger outperformance.

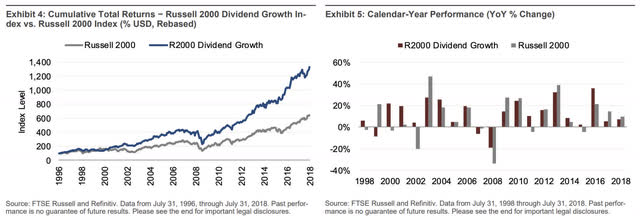

Using FTSE’s data again, we see that the Russell 2000 Dividend Growth index outperformed non-dividend growth stocks during almost all downturns while keeping up well during upswings. Hence, the total return on a long-term basis was/is much higher.

So, what about the valuation?

Valuation

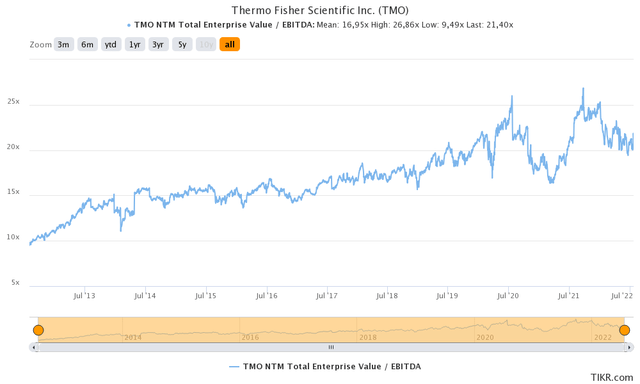

Thermo Fisher has a $220 billion market cap. Next year, it is expected to end up with $23.7 billion in net debt. Minority interest is $180 million with pension liabilities at roughly $500 million. These numbers give the company an enterprise value of $244.4 billion, which is 19.7x next year’s expected EBITDA of $12.4 billion.

It’s not cheap, but it erases the post-pandemic surge in valuation as the stock traded close to 20x NMT EBITDA in big parts of 2019.

On a relative basis, TMO has continued to outperform, working its way up to 2020 highs when looking at the TMO/S&P 500 ratio below. This confirms that the company offers value in times of uncertainty, leading to outperformance.

Takeaway

I like Thermo Fisher a lot. It’s a stock that makes a lot of sense in my portfolio. The only reason I’m not adding it is that I own its peer Danaher and I’m not yet looking to add too many different stocks until I expand existing positions.

The company has a dominant position as a healthcare supplier, it comes with strong secular growth, and even higher growth thanks to its strong product portfolio, and pricing power in times of inflation.

Moreover, with a focus on aggressive M&A, the company is expanding in niche markets. High free cash flow allows it to quickly reduce its debt every time, resulting in a high credit rating and favorable borrowing conditions.

While its yield is very low, I still think it makes sense as a dividend growth stock thanks to its ability to deliver (expected) long-term outperforming total returns without exposing investors to high volatility.

The valuation isn’t deep value, but I think we’re dealing with prices that warrant investments. I would suggest to (new) investors to start small and add over time when weakness occurs. Especially in these economic times, I’m not ruling out more (temporary) stock price declines down the road.

Other than that, I think we’re dealing with a terrific long-term stock here that is poised to generate tremendous wealth for its investors.

(Dis)agree? Let me know in the comments!

Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.