Summary:

- The economy is crumbling – right?

- Bank of America is benefitting from rising interest rates, yet delinquencies and loss rates remain below pre-pandemic levels.

- The company has essentially reached its target CET1 ratio, giving it flexibility to more aggressively buy back shares.

- With the stock trading at around 10x earnings, shares are offering compelling value as one waits for multiple expansion.

Ian Forsyth/Getty Images News

If the market is struggling, then Bank of America (NYSE:BAC) isn’t showing weakness. That is surprising considering that this is a stock still trading at conservative valuations, even with the balance sheet as strong as ever. BAC has seen material benefits from rising interest rates while loss rates and delinquencies remain below pre-pandemic levels. Unlike peer JPMorgan (JPM), BAC has essentially reached its target CET1 ratio more than a year ahead of schedule. That means that investors can expect share repurchase activity to pick up moving forward as the company has the flexibility to both strengthen the balance sheet and reward shareholders. This is a name which I expect to generate material multiple expansion over the long term – all while maintaining a high shareholder yield.

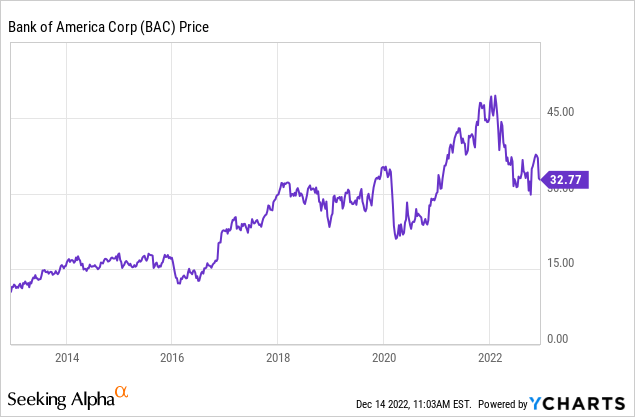

BAC Stock Price

BAC remains lower than recent highs – largely due to worries about a weakening economy.

I last covered the stock in June, where I rated the stock based on valuation and the generous return of capital to shareholders. The stock is down a bit since then – but the fundamental picture remains as promising as ever.

BAC Stock Key Metrics

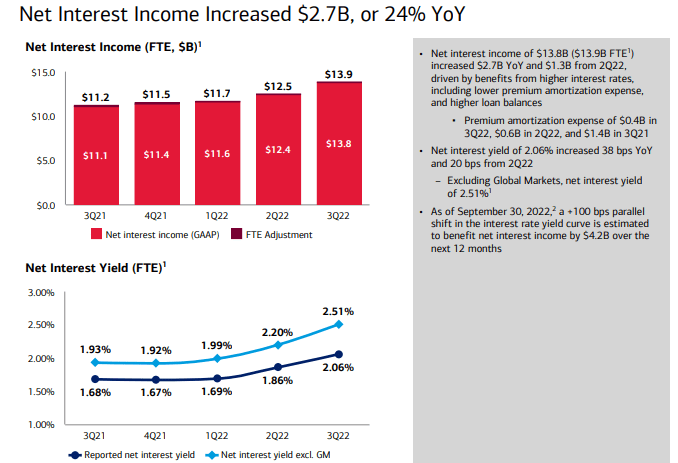

The latest quarter saw net interest income increase dramatically by 24% year over year to $13.9 billion. The net interest yield also increased significantly to 2.51% – the highest level since 2018.

2022 Q3 Presentation

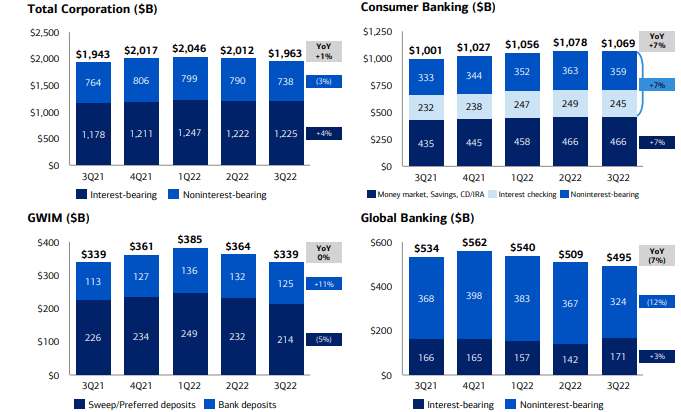

BAC did see total deposits decline sequentially yet again, which is quite typical in periods of interest rate volatility – at the very least, the company faces pressures from higher interest rates at competitors as well as perhaps some customers investing more capital into the markets.

2022 Q3 Presentation

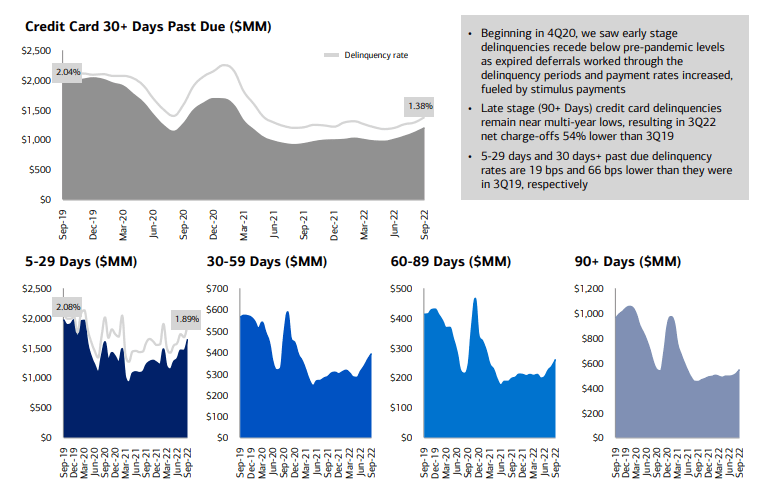

Yet one must be wondering, it cannot all be good, right? BAC cannot simply be enjoying higher interest rates without huge repercussions in credit performance, right? If the answer to those questions is no, then that is not yet showing up in the results. Delinquency and loss rates remain well below pre-pandemic levels, though they continue to normalize.

2022 Q3 Presentation

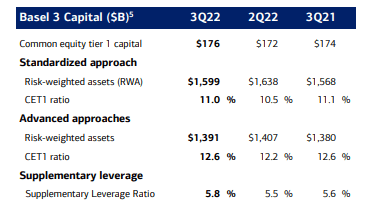

Like other banks, BAC has needed to increase its CET1 ratio to prepare for economic weakness. While the company only has a 10.4% minimum requirement, it has increased its CET1 ratio back to 11% in the quarter.

2022 Q3 Presentation

BAC paid out $1.8 billion in dividends and repurchased $450 million of stock. That repurchase activity is lower than what it could have been (the company earned $7.1 billion in net income in the quarter) and was predominantly done to offset shares awarded under equity-based compensation.

On the conference call, management noted that its CET1 ratio target remains 11.4% by 2024 – and the company is already basically there. Management implied that they should be able to increase the aggressiveness of its share repurchase program as they balance strengthening the balance sheet and rewarding shareholders.

Management guided for net interest income to be at least $1.25 billion higher in the next quarter. They had initially guided $1 billion of NII growth in both Q3 and Q4 for a total of $2 billion – but the new guidance implies $2.6 billion or more in NII growth.

Is BAC Stock A Buy, Sell, Or Hold?

Times are very good for BAC, even if it is not showing up in the stock price. Why is that?

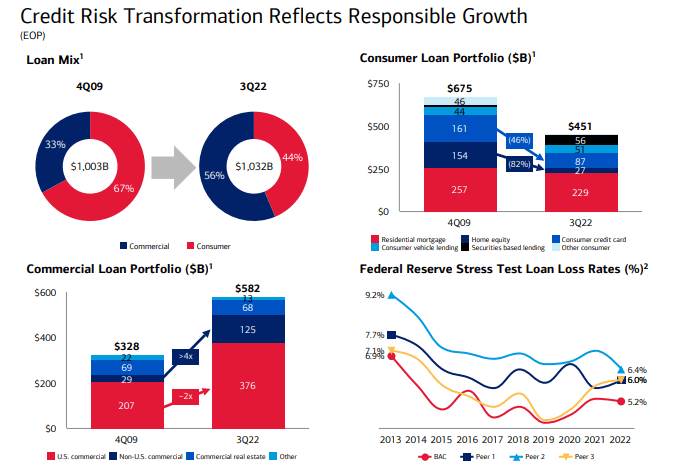

Perhaps investors are still scared after the beatdown that occurred during the Great Financial Crisis. But it should be noted that BAC is a vastly different company than before, with a significantly higher CET1 ratio and a greater exposure to commercial loans.

2022 Q3 Presentation

Due to the GFC, BAC’s balance sheet has been regulated to a pulp and is arguably the safest it has ever been.

Yet all that talk might be too pessimistic, even. Management notes that it still isn’t even seeing signs of slowing spending growth in the face of inflation and recession talks:

A perspicacious analyst might wonder whether talk of inflation, recession and other factors would fructify in a slower spending growth. We just don’t see here at Bank of America. Year-to-date spending of $3.1 trillion through September is up 12% compared to last year. Second, as you look across the period, you can see in the trend of year-over-year spending. As we entered the pandemic, we saw spending decline and click or recover and grow across the quarters. And while still strong in September 10%, spending growth has slowed just a bit from the 12% year-to-date pace, which shows you that early in the year was a faster year-over-year growth rate, but still strong. And the first two weeks of October show that strength is still growing at 10%.

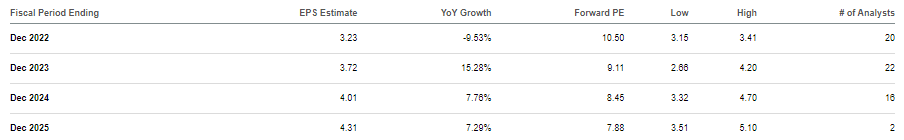

In spite of the fundamental strength, the stock still trades at around just 10x earnings.

Seeking Alpha

This is a company which has historically returned all of its earnings to shareholders through dividends and share repurchases. I expect the company to return to doing just that within a few quarters once its CET1 ratio gets to the 11.4% range. Over the long term, I can see BAC eventually trading up to around 15x to 20x earnings, implying at least a 50% potential upside from multiple expansion alone. That valuation would arguably still be conservative, considering I could see this name growing at a 3% to 5% clip even while distributing all of the earnings to shareholders.

What are the risks? I’d hate to say it, but the GFC caught many by surprise, and there’s always the risk that something like that is just around the corner. That said, I do not find such a risk to be so likely – instead, the main risk in my view is competition from digital banks which are able to offer higher deposit yields due to lacking in-person operational overhead. BAC may see its net interest yield decline even in the face of rising interest rates if it is forced to increase deposit yields. BAC may need to continually innovate or offer concessions to consumers in order to justify paying lower deposit yields for what is arguably a commoditized product. Still, though, the valuation arguably is pricing this in – and more – making the stock a compelling buy amidst a choppy market.

Disclosure: I/we have a beneficial long position in the shares of BAC, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks portfolio.

Growth stocks have crashed. The time to buy is when there is blood on the streets, when no one else wants to buy. I have provided for Best of Breed subscribers the 2022 Tech Stock Crash List, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!