Summary:

- AT&T Inc.’s fiber business is expanding around the country, and with presence in numerous cities, incremental expansion should cost less.

- The company’s debt load has been reduced substantially YTD and the company has the FCF to continue that.

- Management has spent a number of years bouncing around on its goals, from massive share buybacks as a conglomerate, to spinoffs, but we expect the recovery to continue.

- Options represent a unique way to purchase the company below its 52-week lows, reducing your risk versus investing today.

- In a volatile market, we expect there to be several buying opportunities for investors who keep an eye out.

wdstock

Throughout our time writing on Seeking Alpha, there’s been one consistently frustrating category of investment. Those are investments with great financials that we eventually move on past because management is incapable of making the decisions needed to bring the rewards that we expect. AT&T Inc. (NYSE:T) has consistently flirted with that line. Many long-time readers are sure to agree.

On top of that, the company’s share price has recently outperformed with the company’s stock more than 33% above its 52-week lows. Despite that, we see some opportunity in the company, and as we’ll see throughout this article, the company is uniquely positioned to continue delivering substantial returns for investors.

Changes

Since we’ve already discussed AT&T and its recent earnings, the main purpose of this article is to focus on what’s changing at the company and our view. Among the chief changes here is the company’s new focus on its fiber business, which in our view is one of the most exciting reasons to invest.

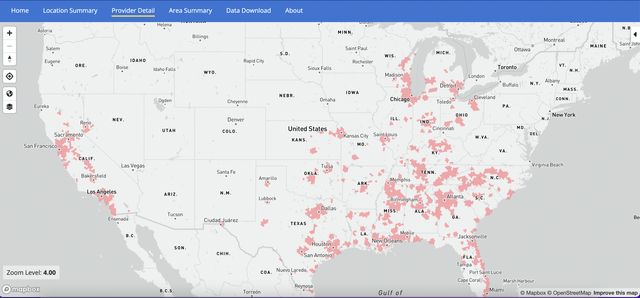

We use AT&T Fiber at our home and are a substantial fan of it. However, the company’s fiber business is still young and there’s several key things we want to point out. The first is that only 9.7% of the population still has a direct link / coverage. In those red areas, there’s many areas that don’t yet have AT&T Fiber.

However, with AT&T Fiber already having a strong presence in those cities and the surrounding areas, we expect that the additional effort required to connect those customers will be lower cost. The second is that there’s still substantial new room to expand as well. The company hasn’t touched the north-east seaboard, home of the largest population cluster.

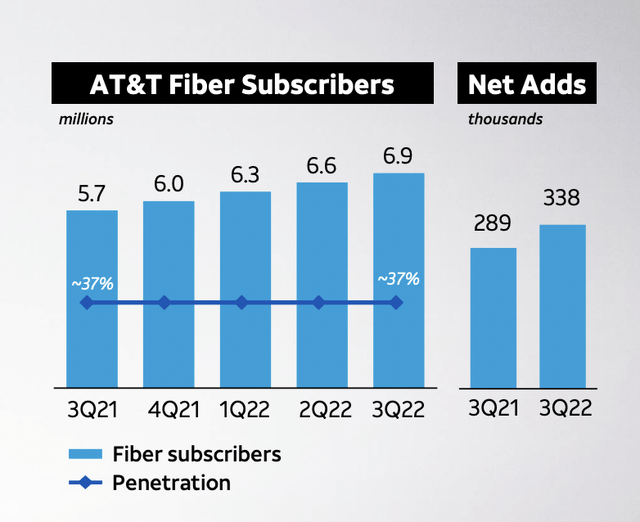

The company has managed to consistently not only grow its fiber subscribers, but grow them at an existing rate. However, what’s most interesting to us is that as the company adds new locations its penetration rate goes up. If you have a good product in the market, our expectation would be if you stop expansion completely, penetration rate should go up.

Maintaining the rate while adding new locations is a clear sign that that’s what’s happening. The company is continuing to invest in fiber and with every 1.5 million customers (the annual add rate) representing roughly $1+ billion in fresh annual revenue, we expect this to be a continued source of growth for the company.

Demand Strength And A Soft Landing

Historically, engineering a soft landing has been incredibly difficult. That’s something that the FED is working to do with current inflation rate issues.

The most recent batch of economic data with a 7.1% annualized inflation rate and a 0.1% monthly rate is promising, and the FED is expected to implement a 0.5% interest rate increase this week is a slowdown from several 0.75% monthly increases. However, regardless of promising data, historically soft-landings have been difficult.

AT&T from its side says that demand remains strong, and the demand for major customer products like iPhone remains strong as well. We’re optimistic that AT&T won’t see a recession that drives up customer demand, however, whether or not that happens remains to be seen.

Debt, Debt, And More Debt

Unfortunately for AT&T, the company continues to deal with total debt of roughly $130 billion, which costs the company roughly $5 billion in annual interest. It can afford the interest, but it drains the company’s cash pile, and it doesn’t count the risks of rising interest rates or that the debt will need to be paid off at some point.

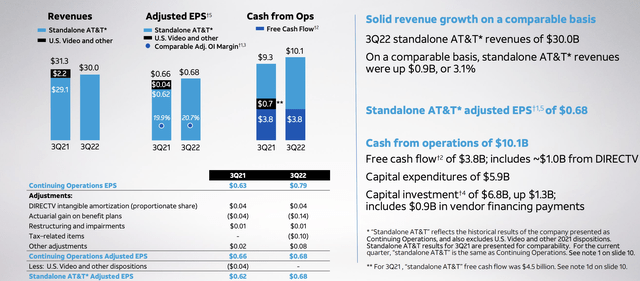

However, AT&T does have the financial strength to reduce that debt burden. The company’s 2022 expected free cash flow (“FCF”) is $14 billion, and the company’s dividend commitment is $8 billion leaving $6 billion. That’s enough for an almost 6% dividend yield as the company repays debt. That debt repayment alone is another several hundred $ million in saved 2023 interest.

Until the company is re-evaluated by the market, especially at a higher share price in a higher interest rate environment, we’d like to see it aggressively repurchase debt which it has continued to do so. It’s also worth noting that the company’s revenue increased by several % YoY and the company’s FCF includes massive capital investments to the tune of > $20 billion / year.

We expect that to continue to support the company’s FCF and growth going forward. The company is continuing to target almost $20 billion in 2023 FCF, which would double the cash available for debt pay down. Should AT&T decide to make it the goal, we believe the company could get its debt toward $0 by the end of the decade.

Debt pay downs here could be a major catalyst for the company.

Options Investment

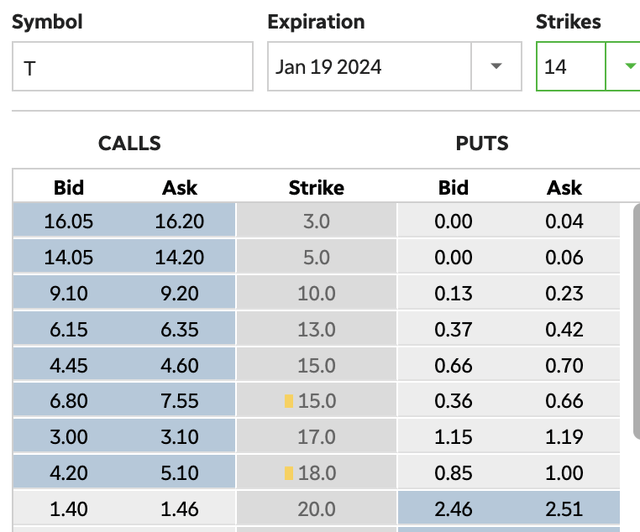

For those interested in investing, who aren’t ready to make the leap, we recommend taking a look at the company’s option chain.

The company is currently trading at $19 / share, however, investors can sell a PUT for a $15 strike price, just over a year out, at roughly $0.68 / share. That’s an almost 5% yield (but keep in mind for most brokerages you don’t need to explicitly set aside cash, just have it available in your margin balance). Should the option get exercised, you get your stock below 52-week lows net.

Especially in a volatile market, any downturns could present a great time to sell some options as the price of PUT option insurance rises.

Our View

AT&T is in the midst of what can be considered its 3rd transformation in the past half a decade. If nothing else that’s an indication of an uncertain management. However, potentially, the company seems to have finally figured out its goals and what it wants going forward. It’s simplified its portfolio to focus on its core businesses.

Going forward, we expect AT&T to be able to generate increasing shareholder rewards. The company has an almost 6% dividend which will sustain shareholders as it works to clean up its balance sheet and shareholder return plans. Putting all of that together, we expect AT&T Inc. to be a valuable component of any portfolio.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.