Summary:

- Tilray’s liquidity base, diversification from beverages, and positive profitability outlook have placed it ahead of its peers.

- Despite a transformative year in calendar 2023, TLRY stock is down 34% year-to-date.

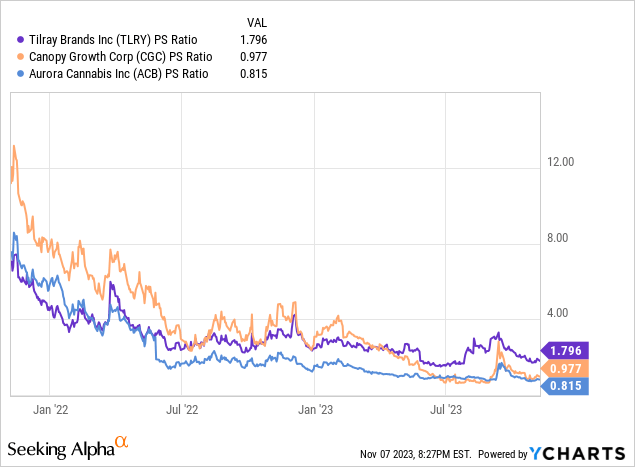

- The stock is trading at roughly 2x the level of its peers on a price-to-sales multiple basis. I expect this premium to remain sticky.

LazingBee/iStock via Getty Images

Tilray’s (NASDAQ:TLRY) liquidity base, enhanced diversification from its growing beverages unit, and an increasingly positive outlook for profitability have placed it far ahead of Canopy Growth (CGC) and Aurora Cannabis (ACB). Despite calendar 2023 being a transformative year for Tilray, the company is down 34% year-to-date and is now swapping hands at a low price-to-sales multiple of 1.8x against an increasingly optimistic macroeconomic backdrop. A Goldilocks economic scenario is my economic base case for calendar 2024 with inflation expected to normalize in the coming year. Against this, the 25 basis point hike in July is likely set to be the final of the current tightening cycle with the market now pricing in a 90% chance that the Fed keeps rates unchanged at their current level at their December meeting.

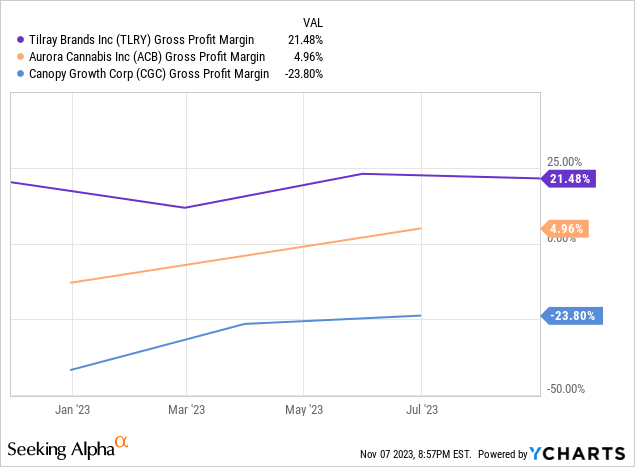

Any future rate cuts would have the inverse effects of the current tightening cycle by reigniting risk-off sentiment and buffeting a price-to-sales multiple that has fallen from over 7x just a year ago. Tilray is the best play on any such reversal to higher mean with a stronger balance sheet than its peers, expanding gross margins, and an increasingly diversified and de-risked operational footprint. To be clear, whilst Tilray faces the same intrinsic challenges as its peers Canopy and Aurora from continued unprofitability and free cash burn, it does not face the same rapidly deteriorating liquidity profile. Canopy and Aurora face the specter of delisting with both trading hands below the $1 minimum listing requirement.

Balance Sheet Strength And Dilution Versus Peers

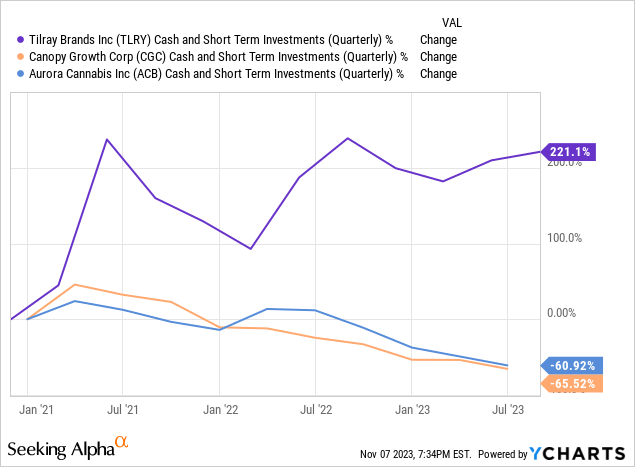

Tilray’s cash and equivalents position stood at $177.5 million as of the end of its fiscal 2024 first quarter ending 31 August 2023. Short-term investments at $287.3 million meant $464.9 million in cash and short-term investments. This was down roughly $30 million, around 5.3%, over the year-ago quarter and came with a long-term debt of $273.3 million. A figure that was down from $558.6 million in the year-ago period. Canopy’s cash position declined by roughly 55% year-over-year for its last reported quarter ending 30 June 2023 whilst Aurora saw its cash position decline by 65% for its last reported quarter covering the same period.

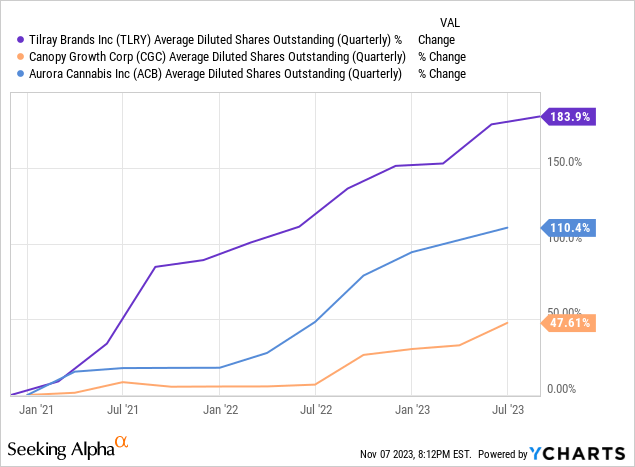

This divergence in short-term liquidity is more pronounced when viewed over 3 years with Tilray’s cash position up 221% versus a decline of 61% for Aurora and a 65.5% decline for Canopy. The secret to the increase in liquidity is of course dilution, but all three tickers have been forced to dilute their common shareholders against a brutally Darwinistic cannabis market where Canadian cannabis sales have broadly flatlined. All three companies are tapping equity sales to support their near-term liquidity demands but Tilray’s stock price and higher sales multiple have formed a moat against current market conditions formed by dire risk-off sentiment. Tilray has been more aggressive on dilution with its shares outstanding up 184% over the last three years versus 110% for Canopy and 48% for Aurora.

The Valuation Premium

Critically, Tilray’s price-to-sales multiple is 2.2x Aurora and 1.83x Canopy. Tilray is also the only ticker trading far above Nasdaq’s minimum listing standards. The aggregation of a sub-1x multiple and lowly priced shares has made equity sales a comparatively more expensive undertaking for Canopy and Aurora. Whilst it is not ideal for Tilray’s shareholders, the current market zeitgeist is a snapshot of sentiment around expectations that interest rates will remain higher for longer even as rates are set to peak. This has catalyzed a broad dash for liquidity for cannabis companies against continued losses and cumulative free cash burn. The risk for bulls is how long this moat will remain. Tilray’s aggressive move into beverages with a series of acquisitions has been flagged by bears as the great aggregation of underperforming brands in a broadly unrelated segment. The criticism might be fair but beverages represent a diversification and gross margin play by Tilray.

Future risk-off sentiment will be difficult to predict but has a formative impact on returns. Tilray’s growing beverages unit will likely see shareholders attach a premium that should see the current divergence in multiples between the three tickers remain. The company recorded first-quarter revenue of $176.95 million, up 15.5% year-over-year and a beat by $2.65 million on analyst consensus. Beverages saw 17% year-over-year growth and drove a 53% gross profit margin. This was a 500 basis points expansion from a 47% gross margin in the prior fourth quarter. Hence, Tilray could see the significant divergence in its gross profit margin versus peers expand as beverages grow to an increasingly larger percent of total revenue. This percentage was 13.5% during the first quarter. Tilray is currently a hold but could form an interesting investment consideration if it meets its guidance to generate positive free cash flows for its full fiscal year 2024.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.