Summary:

- Recently introduced German cannabis laws will make it easier to obtain medical and therapeutic cannabis products.

- Tilray being the market leader in Germany bodes well for its future revenues, considering its distribution segment represents 41% of its total revenues.

- Tilray’s alcohol segment is growing as a percentage of revenue, which is a positive sign for future profitability thanks to its high margins.

- My price target for Tilray is $4.67 by the end of 2025, representing 175% upside from the current valuation.

rgbspace

On February 23rd, German lawmakers passed a cannabis legalization bill allowing the recreational use of cannabis. However, the law included strict rules that will make it difficult to buy the drug. This has caused public cannabis equities with operations in Germany, including Tilray Brands, Inc. (NASDAQ:TLRY) to drop on the news as the German version of cannabis legalization is very different from the Canadian version. As is, Tilray is down by nearly 6% since the news.

That said, I believe the market’s reaction has overlooked the new law’s impact on the German cannabis market since it will be easier for doctors to prescribe cannabis. Considering Tilray’s 25% market share in the German medical and therapeutic cannabis market, the expected growth of this market should increase its distribution segment’s revenues exponentially, which already accounts for 41% of the company’s total revenues as of the end of FY 2023.

Moreover, Tilray’s alcoholic beverages segment is seeing substantial growth as it continues to add brands under its umbrella. As a result, the alcohol segment’s share of Tilray’s total revenues has been increasing over the years. Considering that the craft beer market is expected to grow at a CAGR of 10.6% by 2032, I expect this segment to be a main contributor to Tilray’s profitability in the future thanks to its high margins. Based on these factors, I’m rating Tilray as a buy with a price target of $4.67 per share by the end of 2025, implying 175% upside from current levels.

Opportunity Presented By German Cannabis Legalization

Although cannabis legalization in the US is a longshot at this point, the recent law change in Germany offers Tilray an extremely large opportunity since it already has a strong presence there. One of Tilray’s key segments is distribution which generates revenue primarily from Tilray Pharma, its German-based distributor, which distributes cannabis products to 13 thousand pharmacies.

This segment has represented 41% of Tilray’s total revenues in FY 2022 and 2023, while so far in FY 2024 it represents 37% of the company’s total revenues. With that in mind, I expect this segment to further grow in the coming years as the new German Medical Cannabis Act included a fundamental change as it removed cannabis from the list of prohibited substances in the Narcotics Act. As such, doctors in Germany can prescribe medical cannabis more easily to patients and not only as a medication of last resort.

Tilray expects this fundamental change to more than double its revenue opportunity and increase its cannabis production in Germany by 5 times. With that in mind, Tilray already has a market share in the German medical cannabis market. In 2022, Tilray’s distribution segment generated $259.7 million in revenues, while total medical cannabis spending was $796.8 million, per Statista. This means that Tilray’s market share was around 33% in Germany.

However, Tilray’s distribution segment generated $258.7 million in 2023, a slight 0.4% decline YoY. Given that Statista’s data show that medical cannabis spending in Germany amounted to more than $1 billion in 2023, the decline in Tilray’s distribution revenue means that the company’s market share in Germany declined to 25%. Assuming Tilray maintains its 25% market share in Germany, its revenues from the distribution segment could be projected as follows for the next 4 years.

|

Year |

Distribution Revenue |

German Cannabis Market Size |

Market Share |

|

2022 |

$259,747,000 |

$796,800,000 |

33% |

|

2023 |

$258,770,000 |

$1,037,000,000 |

25% |

|

2024 |

$311,825,000 |

$1,247,300,000 |

25% |

|

2025 |

$363,100,000 |

$1,452,400,000 |

25% |

|

2026 |

$414,325,000 |

$1,657,300,000 |

25% |

|

2027 |

$466,050,000 |

$1,864,200,000 |

25% |

*German cannabis market size projections from Statista.

Diversification Strategy Will Brew Profits

While some alcohol companies ventured into cannabis due to the drug’s cannibalization of alcohol among young consumers, Tilray has done the opposite by acquiring craft beer brands to offset the negative impact of the challenging Canadian cannabis market. Tilray’s latest deal in the alcohol segment was acquiring 8 beer and beverages brands from Anheuser-Busch (BUD) which positions the company as the 5th largest craft beer brewer in the US with a 5% market share.

As a result of these acquisitions, Tilray’s alcohol revenues increased 117% YoY in Q2 FY 2024 and 92% QoQ. This has led Tilray’s revenues from the alcohol segment to represent 19% of its total revenues in the first half of FY 2024 compared to 15% in FY 2023 and 11% in FY 2023.

|

Year |

Total Revenue |

Alcohol Revenue |

% of Total Revenue |

|

2022 |

$628,372,000 |

$71,492,000 |

11.38% |

|

2023 |

$627,124,000 |

$95,093,000 |

15.16% |

|

2024 |

$370,620,000 |

$70,567,000 |

19.04% |

*Author compilation from earnings reports.

The revenue growth of the alcohol segment is pivotal for Tilray’s profitability prospects, since it is the company’s highest margin segment. In FY 2023, the alcohol segment’s gross margin was 53% in FY 2023, excluding a $4.4 million fair value step up adjustment under purchase accounting (PPA) for beverage alcohol inventory sold in the year and 53% in Q1 FY 2024.

However, the segment’s gross margin declined to 34.3% in Q2 FY 2024. Management attributed this margin compression in the Q2 report to the newly acquired brands which have lower margins than Tilray’s historical performance as these breweries are currently underutilized.

That said, Tilray has a plan in place to boost the margins of the newly acquired brands by fully integrating these brands with its existing brands, most notably Montauk. As such, I believe Tilray’s alcohol segment’s gross margin could return or even exceed the 53% it reached in 2023 and Q1 2024. Therefore, growing the alcohol segment will be key to Tilray’s profitability in the future in my opinion and reaching its target of $68 to $78 million adjusted EBITDA in FY 2024.

The following table shows the gross margins of the alcohol segment since Q1 FY 2022.

|

Quarter |

Alcohol Revenue |

Alcohol Gross Margin |

|

Q1 22 |

$15,461,000 |

56.90% |

|

Q2 22 |

$14,544,000 |

59.29% |

|

Q3 22 |

$19,597,000 |

58.71% |

|

Q4 22 |

$21,890,000 |

58.23% |

|

Total 2022 |

$71,492,000 |

58.29% |

|

Q1 2023 |

$20,654,000 |

47.47% |

|

Q2 2023 |

$21,395,000 |

46.62% |

|

Q3 2023 |

$20,640,000 |

48.34% |

|

Q4 2023 |

$32,404,000 |

64.95% |

|

Total 2023 |

$95,093,000 |

53.43% |

|

Q1 2024 |

$24,162,000 |

53.37% |

|

Q2 2024 |

$46,405,000 |

34.25% |

*Author compilation from Tilray’s earnings reports excluding fair value step up adjustment of $4.4 million in FY 2023 and $2.2 million in FY 2022.

Valuation

Since Tilray is a growth company, I believe its value should come from future revenues. Therefore, my price target for Tilray is based on its forward P/S ratio. Currently, Tilray is trading at 1.57 times its FY 2024 sales and 1.43 times its FY 2025 sales. Compared to the sector median of 3.93, Tilray is trading at a 60% discount compared to 2024 sales and 64% discount relative to 2025 sales. Based on this, my price targets for Tilray are as follows.

|

Year |

Projected Revenues |

P/S |

Price Target |

Upside |

|

2024 |

$804,600,000 |

1.57 |

$4.26 |

151% |

|

2025 |

$884,910,000 |

1.43 |

$4.67 |

175% |

Risks

There are 2 risks to my bull thesis on Tilray. Although I believe the potential margin expansion brought by the alcohol segment will be the key to the company’s profitability, the price compression in the Canadian cannabis market could apply downward pressure on the cannabis segment’s gross margins, which could offset any gains made by the alcohol segment. The following table highlights the decline in the cannabis segment’s gross margins since Q1 FY 2022.

|

Quarter |

Cannabis Revenue |

Cannabis Gross Margin |

|

Q1 22 |

$70,449,000 |

42.95% |

|

Q2 22 |

$58,775,000 |

43.41% |

|

Q3 22 |

$69,178,000 |

46.45% |

|

Q4 22 |

$39,120,000 |

36.50% |

|

Total 2022 |

$237,522,000 |

43.02% |

|

Q1 2023 |

$58,570,000 |

50.72% |

|

Q2 2023 |

$49,898,000 |

37.20% |

|

Q3 2023 |

$47,549,000 |

46.66% |

|

Q4 2023 |

$64,413,000 |

65.54% |

|

Total 2023 |

$220,430,000 |

51.12% |

|

Q1 2024 |

$70,333,000 |

28.17% |

|

Q2 2024 |

$67,114,000 |

30.76% |

*Author compilation from earnings reports.

The second risk to my thesis is dilution. Over the years, Tilray has been dependent on capital raises through dilutive convertible notes to fund its growth initiatives. As such, its outstanding shares increased substantially from Q1 FY 2022 to Q2 FY 2024 as shown in the following table.

|

Quarter |

OS |

|

Q1 22 |

460,658,653 |

|

Q2 22 |

466,522,611 |

|

Q3 22 |

497,708,464 |

|

Q4 22 |

536,390,766 |

|

Q1 23 |

611,402,319 |

|

Q2 23 |

615,494,626 |

|

Q3 23 |

618,007,938 |

|

Q4 23 |

703,257,224 |

|

Q1 24 |

730,289,573 |

|

Q2 24 |

742,725,148 |

*Author compilation from earnings reports.

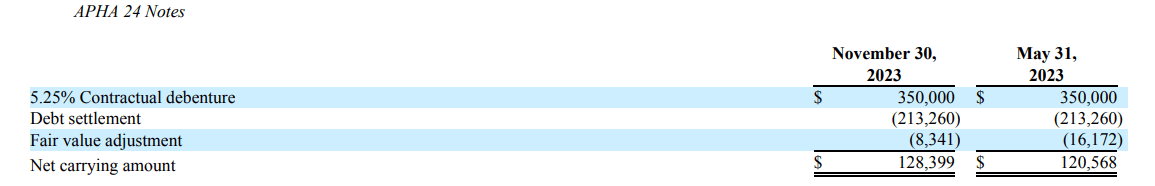

With that in mind, Tilray has an upcoming maturity date of June 1st, 2024 for $128.4 million in convertible debt under the APHA 24 notes. Given that the notes have a conversion price of $11.2 per share, it’s unlikely the noteholders will agree to convert the debt into shares, which is why I expect the company to repay the debt in cash. However, considering Tilray’s cash balance of $143.3 million, the company may resort to a capital raise to meet its obligations or refinance the debt which would increase its interest expenses, impacting its bottom line in the process.

Q2 2024 Earnings Report

Conclusion

With a market cap of $1.2 billion, I believe Tilray’s risk to reward ratio is compelling, which is why I’m rating Tilray as a buy with a price target of $4.67 per share by the end of 2025. I expect the company to reach such a valuation due to the expected surge in demand for medical cannabis in Germany in light of the new cannabis regulations in Germany, given Tilray’s strong presence in that market. Moreover, Tilray’s alcohol segment will be a key contributor to its profitability prospects in the future due to its high margins. That said, investors should thoroughly consider the risk factors I mentioned in the article before investing in the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.