Summary:

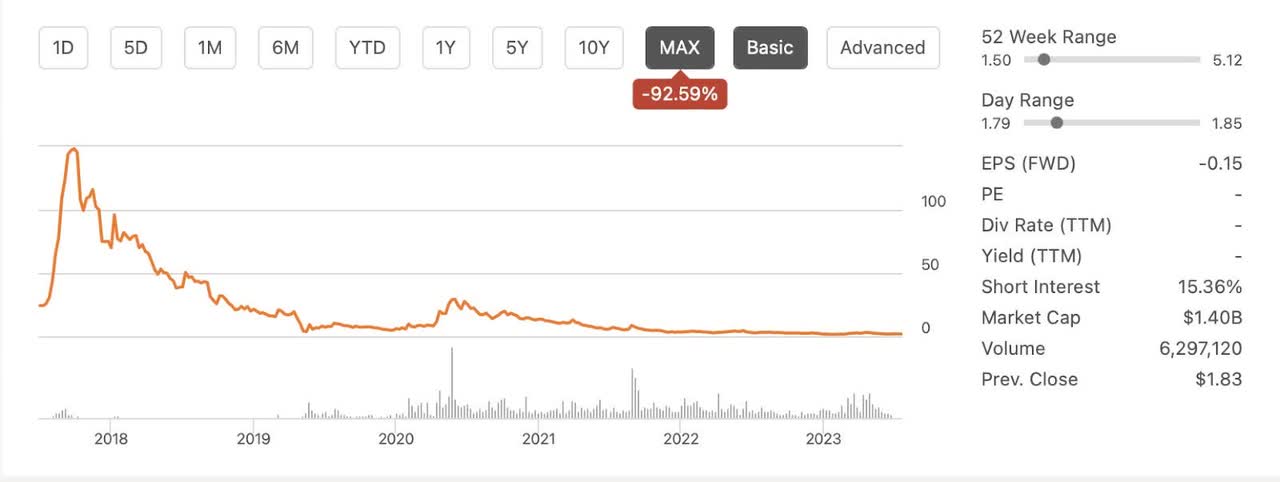

- Tilray’s commitment to spending for growth has led to significant losses for shareholders, with shares losing over 95% of their value.

- The company’s diversification strategy into the cannabis lifestyle and consumer packaged goods sectors has not proven to be profitable or cost-effective.

- Despite its market leadership in various cannabis product categories, Tilray’s excessive spending and lack of focus make it an unattractive investment.

halbergman

I first heard about Tilray Brands (NASDAQ:TLRY) in 2018 when it rocketed from around $24 to over $140. A 16-year-old I knew was convinced that it was an incredible company and he had invested in it. He wanted to know my opinion.

I told him at the time that I had little interest in it because of its tremendous cash burn. Since my young friend had bought it for around $48 and it had doubled, he thought I was crazy for not jumping on board the profit train, but I had seen this show before and I knew what happens when you buy overhyped companies’ spending.

As the share price began to tumble, my young friend encouraged me to get in on the pullback. I politely declined the opportunity because it still was not a compelling value. Since Tilray was diluting shareholders and losing money quarter over quarter, I believed that the stock was worth less than a dollar and even then you might end up losing your investment. My young friend ended up selling his shares for a substantial loss after averaging down a few times. As Tilray has approached a share price of under $2, I decided to take another look.

According to the numbers not much has changed, and one could argue that it has gotten worse. Tilray’s commitment to growth has continued to come at a high cost to shareholders with shares losing over 95% of their value.

Seeking Alpha

Companies like Tilray typically do spend money to grow their businesses, but investors must ask how much is too much and when will the business become profitable. It appears to me for reasons discussed below that profitability is many years away.

As a deep value investor, I often like to buy shares in companies trading at or near multi-year lows. I love to find turnaround opportunities and profit from them. However, in Tilray’s case, it appears that the bad times will continue.

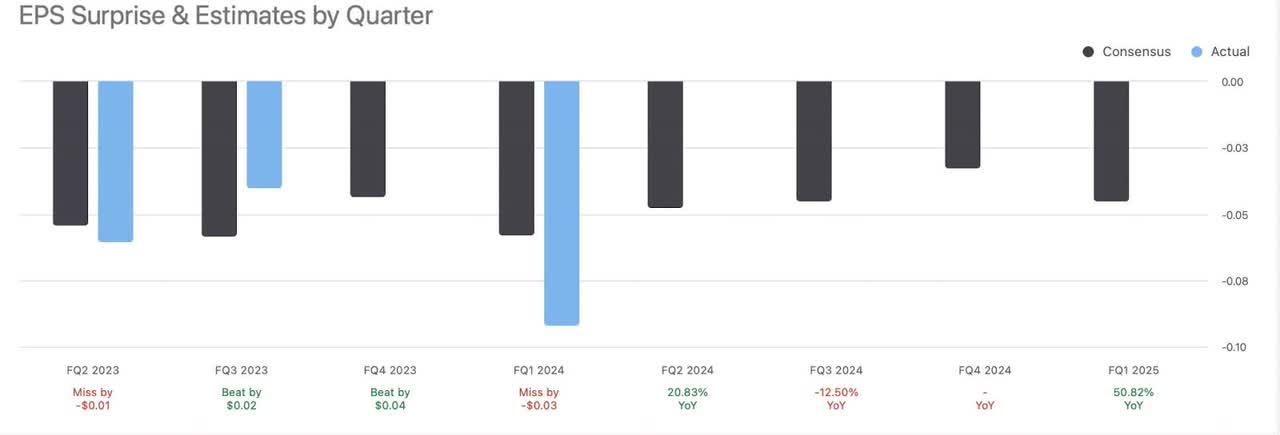

Consensus estimates and current guidance show that Tilray is likely to continue to lose money into 2025. Continued losses, dilution, and lack of focus make Tilray a current sell. I will be monitoring this company closely to find a potential catalyst for a turnaround throughout 2024.

Even as Tilray continues to be a market leader in the cannabis space, it is still not a compelling buy.

Recent Earnings Call Transcript Highlights:

CEO Irwin Simon

Diversification Strategy

Tilray Brands’ strategic diversification into the cannabis lifestyle and consumer packaged goods (CPG) sectors, along with its relentless focus on market leadership and profitability, positions the company for potentially significant growth and shareholder value.

-

“At Tilray Brands, we strategically diversified our cannabis lifestyle and CPG company globally, and we’ve done so for several reasons, including the tremendous growth opportunities we see within the beverage category and across markets like craft beer, ready-to-drink cocktails, non-alcoholic beverages, energy, and nutritional drinks.”

The company’s strategic diversification into the cannabis lifestyle and CPG sectors reflects a forward-looking approach to capitalize on substantial growth opportunities. This diversification allows Tilray to adapt to evolving market conditions while increasing market share in the industries it competes in. It demonstrates a proactive approach to remain competitive and expand its product portfolio, but it also shows Tilray’s propensity to try to spend its way to profitability. At no point has Tilray demonstrated that it can deliver earnings growth or that it can cut costs. If Tilray loses its ability to raise money through further dilution then it will be at the mercy of the credit markets. In my opinion, this could become a major problem in the future.

Profitable Growth and Market Share

-

“Our goal is to accelerate our ability to deliver industry-leading profitable growth and sustainable long-term shareholder value.”

-

“We grew Canadian cannabis revenue by 16.5% in the quarter and remain the leading strongest and most profitable international cannabis LP with approximately a 13.4% share in Canada inclusive of HEXO and Truss, 631 basis points ahead of the next LP.”

The company’s commitment to delivering profitable growth and creating sustainable long-term shareholder value is very questionable given its recent history. The significant growth in Canadian cannabis revenue and its leading position in the international cannabis market highlight Tilray’s successful execution of its strategy, but despite these gains, Tilray’s losses continue to mount. The emphasis on profitability and market leadership should be a positive indicator for investors if only Tilray backed this up with cost reductions and savings.

Market Leadership

-

“Tilray is number one in cannabis flower, oils, concentrates, and THC beverages, and number two in pre-rolls, number four in vape, and the top 10 in all other categories.”

Gaining market share is important as companies like Amazon and Netflix have shown us. The company’s market leadership across various cannabis product categories positions it as a dominant player in the industry. These achievements demonstrate Tilray’s ability to cater to a wide range of consumer preferences and establish a strong brand presence. However Tilray’s market leadership has been fueled by excessive spending as compared to its peers and most consumers of cannabis products are less interested in brand recognition than in price, strain strength, and value.

Diversification in the Beverage Alcohol Segment

-

“We welcomed the newest additions to the Tilray Brands family as we closed on our acquisition of eight beer and beverage brands from Anheuser-Busch.”

-

“In terms of overall segment performance, quarterly revenue for the beverage alcohol business was $24.2 million in Q1, representing a 17% growth from last year, and we’re just getting started in making this segment a more meaningful component of our financials.”

Tilray’s entry into the beverage alcohol segment through acquisitions is interesting. It further strengthens its diversification strategy but it comes at a high cost. The robust revenue growth in the beverage alcohol business reflects the company’s ability to capitalize on opportunities in fast-growing categories. This also demonstrates how Tilray wants to be all things to all cannabis consumers. Tilray’s inability to focus on one successful niche means that even successful business segments could be offset by other segment losses. This expansion into adjacent markets positions Tilray for enhanced financial performance and market presence if and only if the company executes across multiple segments effectively. Plus Tilray faces stiff competition from other cannabis companies like Canopy which also expanding into these sectors.

Wellness Segment

-

“Our wellness segment is delivering higher gross profit on a stable of top-line as it’s adjusted to higher ingredient costs through increased pricing from a year ago.”

-

“Strong consumer interest in hemp products, expanded distribution into Whole Foods and Walmart, and product innovation to meet the needs of the Gen Z/millennial consumer through new hemp [forward] (PH) foods and supplement offerings in CBD wellness beverage like our Happy Flower.”

The company’s wellness segment is showing promising results with higher gross profits despite cost adjustments. Tilray’s ability to respond to consumer trends and innovate within the wellness segment positions it as a player with adaptability and consumer-focused product offerings. The expansion into retail giants like Whole Foods and Walmart reflects the company’s pursuit of broader distribution. This has always been the best possible scenario for Tilray. Increased distribution into mainstream retail is the key to Tilray’s success.

Carl Merton CFO

Positives

Revenue Growth and Diversification

-

“Q1 total net revenue rose to $177 million compared to the prior-year quarter at $153 million, representing 15% growth.”

Carl Merton highlights a significant achievement in Q1, with a 15% increase in total net revenue year-over-year. This impressive growth indicates the company’s ability to generate substantial top-line growth. This aligns with Irwin Simon’s earlier emphasis on the company’s record Q1 net revenue of $177 million.

Segment Diversification and Balanced Revenue Mix

-

“As Irwin Simon already emphasized the inherent benefits of having a diversified business model, it is notable that in both Q1 this year and last year, our cannabis and distribution segment each represented about 40% of our total revenue mix, while beverage alcohol and wellness represented about 14% and 8%, respectively.”

The balanced revenue mix across Tilray’s diverse business segments, highlights that none of these segments overly dominates the company’s revenue. This diversification is a positive aspect of the company’s financial strategy but also demonstrates an inability to narrow down. As previously noted, this diversification reduces the company’s dependence on a single segment, providing stability and risk mitigation but it also can take the company’s focus away from profitable segments.

International Expansion and Geographic Diversity

-

“In terms of our geographical footprint, we are also highly diversified with slightly more than half of our revenue from North America and about 45% from EMEA, with the remainder from other parts of the world.”

Tilray’s international presence and geographical diversity, with over half of its revenue coming from North America and a significant portion from Europe. This diverse global footprint is a positive factor that enhances the company’s reach and growth potential, aligning with Irwin Simon’s focus on international expansion and leadership in medical cannabis. This diversity comes with the downside of having to deal with regulations and oversight from multiple sources. This can become an additional cost burden and challenge.

Gross Profit Improvement in Select Segments

-

“While the overall gross profit decreased, three of the four segments showed improvements in adjusted gross profit and margin. Beverage alcohol and distribution segments, in particular, demonstrated increases in gross profit and margin.”

The improvements in gross profit and margin within select segments, namely beverage alcohol and distribution. These improvements are positive indicators of segment-level performance, as previously mentioned. The focus on higher-margin sales in distribution and changes in the sales mix in beverage alcohol contributed to these improvements. Beverage alcohol is a competitive market with its own regulations and issues. If it is an effective way to grow revenue, we can expect companies to compete in this space. A company specializing in this segment might have future advantages over Tilray once Tilray charts the course.

Net Loss Reduction

-

“The net loss improved to $55.9 million compared to $65.8 million in the prior-year quarter.”

The reduction in net loss is a positive financial outcome, demonstrating the company’s progress in cost management and operational efficiency. Shareholders benefit from this reduction, aligning with Irwin Simon’s statement on a net loss per share basis. This trend needs to continue to make Tilray a compelling investment.

Negatives

Gross Margin Decline in the Cannabis Segment

-

“Cannabis gross profit was $19.8 million, and cannabis gross margin was 28%, compared to $29.7 million and 51% in the prior-year quarter.”

A significant decline in the gross margin of the cannabis segment is a concerning negative aspect. The drop from 51% to 28% indicates challenges in maintaining profitability within this segment. This aligns with Irwin Simon’s emphasis on optimizing cost management and efficient asset utilization, indicating room for improvement. Margins in the cannabis space continue to be compressed. With increased competition, Tilray needs to control costs or it will be beaten out by lower cost producers.

Decrease in Adjusted EBITDA

-

“Adjusted EBITDA was $11.4 million, down from $13.5 million in the prior-year quarter.”

The decrease in adjusted EBITDA is a negative financial outcome, as it signifies a reduction in the company’s earnings before interest, taxes, depreciation, and amortization. This decline indicates Tilray’s challenges in maintaining profitability, which need to be addressed to ensure long-term sustainable growth.

Impact of Excise Taxes on Cannabis Revenue

-

“Cannabis excise taxes… totaled $26.6 million compared to $17.1 million last year.”

The significant increase in cannabis excise taxes is a negative factor affecting the cannabis segment’s revenue. As Tilray increases revenues, governments will continue to squeeze them for more money. It reflects the impact of regulatory obligations on revenue generation. While this challenge is not unique to Tilray, it highlights the need to navigate regulatory complexities effectively and keep costs down.

Impact of Price Compression in Canada

-

“Cannabis net revenue rose 20% or 22% on a constant currency basis, inclusive of $3.1 million due to price compression in Canada, of which virtually all also represented a reduction in EBITDA.”

The impact of price compression in Canada presents a negative factor affecting the company’s financials. While net revenue increased, the underlying effect of price compression on EBITDA reduction highlights a challenging market environment. Addressing price compression is crucial for sustained profitability. As Tilray continues to spend to gain market share, the possibility of profitability becomes more remote if increasing revenues are offset by a reduction in EBITDA.

Negative Operating Cash Flow

-

“Operating cash flow improved by $30.5 million to a loss of $15.8 million from a loss of $46.3 million in the prior-year quarter.”

While there is an improvement in operating cash flow, the fact that it remains in negative territory is a negative aspect. Operating cash flow is an essential metric for assessing a company’s financial health, and a sustained negative cash flow position can be concerning. The company should aim for positive operating cash flow for long-term stability. A quick look at operating income over the past five years below shows how the burn rate is not improving significantly.

Mixed Impact of Acquisitions

While acquisitions like HEXO and Truss contributed to revenue growth, they also had negative effects on gross margin due to the absence of HEXO advisory fee revenue. The long-term value and integration of these acquisitions will be critical for Tilray’s success. Merton mentioned this, saying, “The substantial increase in wholesale cannabis revenue was an opportunistic sale, which helped increase our cash flow from operations, even though it had a negative impact on gross margin and EBITDA.”

Final Thoughts

Tilray appears to have bitten off more than it can chew. No segment in cannabis is too small for them to aggressively pursue being number one. They have spent tons of money trying to be the biggest, best and most recognizable name in cannabis. In the short term, this has allowed them to raise money and caused the 2018 spike in its share price. Since then, the company’s shares have struggled. This strategy of growth at all costs worked for Amazon in a zero-rate environment, but it has not shown that it will work for Tilray.

The big issue is that competition in each segment that Tilray enters is more streamlined and adaptable than Tilray because it is more focused on that niche. Additionally, Government regulations, and taxes also want an increasing part of the pie.

I would personally like to see Tilray lessen costs and focus on profitable segments. I think trying to be all things to all cannabis consumers is a herculean task. Although possible, it will take a long time and there is no guarantee that Tillray will win this race. We see recent large investments by big tobacco and alcohol into smaller cannabis companies as a real threat to Tilray’s ambitions and share price.

For these reasons, I currently rate Tilray as a sell. As always please do your own due diligence before buying any positions and good luck investing. If you liked this in-depth article please give me a follow, a like, and leave a comment below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.