Summary:

- Tilray actually reported solid FQ4’23 results with a strong revenue beat.

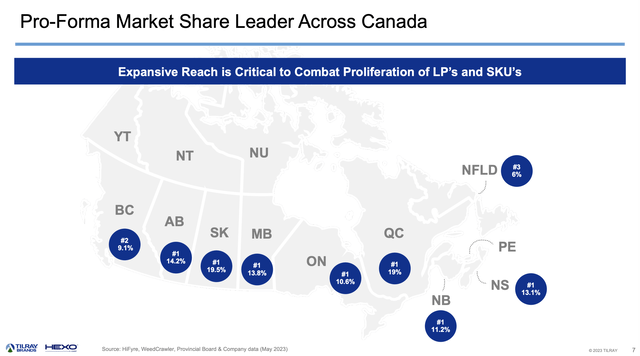

- The Canadian cannabis company recently closed a merger with HEXO setting the company up with a leading 13% market share in the adult-use cannabis market.

- The stock still isn’t a Buy with the limited adjusted EBITDA margins due to a large portion of the business focused on a low-margin distribution business.

wildpixel

After a brutal couple of years, Tilray Brands (NASDAQ:TLRY) has possibly turned the corner. The Canadian cannabis company closing the HEXO acquisition has potentially helped consolidate an overly competitive market in Canada. My investment thesis is more Neutral on the stock until Tilray shows the ability to fully execute on integrating the two businesses.

Improving Business

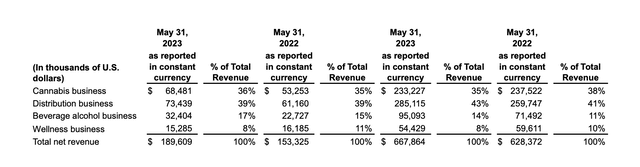

Tilray reported FQ4’23 results last week, with revenues beating estimates by a wide $30.2 million. The results were for the period ending May 31, so the numbers don’t include the operations from HEXO with the acquisition closed at the end of June.

The Canadian cannabis company reported revenues jumped to $189.6 million in constant currency after a period where revenues were flat to down despite a major merger with Aphria years ago. All of the segments, including the key cannabis and beverage alcohol units, saw strong growth in the last year.

Tilray FQ4’23 Earnings Release

The numbers are shocking for a company long struggling to grow. Even maybe more important, Tilray reported a breakeven EPS due to much higher gross margins following years of unacceptably low margins.

For FQ4, the cannabis gross margin was 61% and the beverage alcohol business hit 55%, though lower than 60% last year due to acquisitions. The overall gross margin was 37%.

Tilray produced positive operating cash flows of $44 million in the quarter and adjusted free cash flow of $43 million. The cannabis company has completely changed the operating equation from burning millions in cash each quarter to now generating positive cash flows with adjusted EBITDA in FQ4 of $22 million.

The cannabis company has so many adjustments to reach the EBITDA number that the confidence in the quality of the EBITDA figure is low. The addition of the HEXO numbers will further clutter the financials in the next quarter.

Hitting Bottom

The May quarterly numbers support Tilray hitting bottom. The planned acquisition with HEXO has been in the works for a while and possibly contributed to some reduced competitive pressure in the Canadian market.

The pro forma market share level in the country is only ~13% in the adult-use cannabis market. The company will only have slightly below 11% market share in the key Ontario market and still below 20% in Quebec.

Tilray/HEXO Merger Presentation

A lot of past mergers in the Canadian cannabis space have only led to market share losses once the acquisition was integrated. While these deals always promise synergies, a lot of the time, competitors aggressively claim share while the entities merging work on integration plans.

The deal forecasts ~$27.0 million in annual cost savings for a HEXO business that only reported $16.0 million in quarterly sales for the April quarter. Sales have fallen dramatically in the last year, possibly contributing to the gains at Tilray.

Regardless, Tilray forecasts FY24 adjusted EBITDA of ~$73 million for 19% growth with positive free cash flow for the year. Investors will definitely want to scour over the numbers once HEXO is included in the business in FQ1’24.

The company has a cash balance of ~$448 million, offset mostly by debt of $358 million. Analysts forecast FY24 revenues of $721 million, with the stock trading at 2x sales targets.

As discussed before, the distribution business accounts for nearly $300 million in annual revenues and provides limited gross profits. Tilray is only guiding for $73 million in adjusted EBITDA for somewhere around a 10% margin, but the distribution business very much limits the upside here.

The stock already trades at over 20x adjusted EBITDA targets. For this reason, Tilray doesn’t have much upside after already jumping to $2 on the improving financials.

Takeaway

The key investor takeaway is that Tilray has likely hit bottom, but the business hasn’t improved enough to warrant a Buy rating, especially after the rally off the lows of $1.50. The Canadian cannabis business is finally viable over the long term, but the stock still isn’t a Buy with integration risks ahead and a very competitive market with Tilray only controlling 13% market share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.