Summary:

- Tilray Brands has experienced a significant rally in Q3, up 87.8%, and now up 8.9% in 2023, but lacks a direct benefit from potential cannabis rescheduling in the US.

- The company has shared its financial results for Q4 and announced a beer-related acquisition.

- I believe Tilray is overpriced and suggest there are better options for cannabis investors.

Eugene Gologursky

I last wrote about Tilray Brands (NASDAQ:TLRY) three months ago. In that piece, I predicted that the price could break $1. It did not! Of course, the world for cannabis stocks has changed greatly since late August, when the Department of Health & Human Services revealed that it has advised the DEA to move cannabis from the most restrictive level, Schedule 1, to Schedule 3. Cannabis stocks have exploded higher since then. The New Cannabis Ventures Global Cannabis Stock Index, which includes TLRY, is now up 14.4% in 2023 and is up 48.1% in Q3 so far.

In Q3, Tilray has rallied 87.8% in Q3, and it is now up 8.9% in 2023, just behind the index. The company has no direct benefit from the potential rescheduling, as it has no cannabis operations in the U.S. American cannabis companies should benefit from the potential move by the DEA, as they will no longer be subject to the high taxation imposed upon them by 280E.

When I wrote about the company in late June, it had not yet shared its financial results for Q4. Since then, they have not only done that, but they have also announced a big beer-related acquisition. In this piece, I look at the financials for fiscal 2023, the beer acquisition, and an updated analyst outlook, assess the valuation, and examine the chart.

A Look at the TLRY FY23

TLRY reported its Q4 ending May 31 on July 21st. The company had been expected to generate overall revenue of $153 million with adjusted EBITDA of $19 million, according to Sentieo. Revenue was much higher, increasing 20% to $184.2 million. Adjusted EBITDA grew 93% to $22.2 million, also ahead of expectations.

In Q4, the company reported that cannabis represented only 36% of its revenue, growing 21% from a year ago. The largest segment, its distribution business, represented 39% of revenue and grew 19%. The beverage alcohol business, 18% of revenue, grew 43%, aided by M&A. The fourth business, wellness (hemp food), 8% of revenue, fell 9% from a year ago.

Taking a closer look at its cannabis business, the growth in Q4 was due to growth in net adult-use sales of 32% to $41.9 million. Canadian medical cannabis revenue fell 16% to $6.1 million. International cannabis sales grew 12% to $15.7 million.

For the full year, total revenue fell slightly to $627.1 million. Cannabis sales, 35% of revenue, fell 7%. Distribution sales, 41% of revenue, were down less than 1%. Beverage alcohol sales. 15% of revenue, grew 33%. The hemp food business, 9% of revenue, fell 11%. So, the only part of Tilray that expanded was its alcohol business. Adjusted EBITDA for the year of $61.5 million, grew 28%. While the company is generating a profit by this measure, the operating loss was $1.37 billion, and the net loss was $1.44 billion. Both of these included an impairment charge of $934 million. The company generated an operating cash flow of $7.9 million, which was below its expense of investing in capital and intangible assets of $20.8 million.

For the full year, adult-use cannabis sales of $214.3 million, grew just 2%. This trailed terribly the 13.7% growth in the overall market. Canadian medical cannabis sales of $25.0 million fell 18%, while international cannabis sales of $43.6 million dropped 19%. The wholesale market represented only $1.4 million in FY23, down 79%.

The Beer Acquisition

Tilray will be buying over the next month or so from Anheuser-Busch (BUD) eight brands for cash. The press release from early August did not mention the price, but it did provide guidance that craft beer would represent $250 million of the projected $300 million in beverage alcohol revenue. An SEC filing released that same morning revealed the price: $85 million cash.

I am not sure why investors got so seemingly excited. I do not see how these brands will do better under Tilray’s management than under BUD’s. BUD is the King of Beers!

The Outlook

Ahead of the Q4 report, analysts were expecting Tilray to generate $671 million in revenue during FY24 and to boost that to $745 million in FY25. Adjusted EBITDA was forecast to be $78 million this year and $106 million next year. Now the analysts expect revenue to increase 16% to $729 million in FY24 with adjusted EBITDA growing 15% to $70 million. For FY25, they forecast that revenue will grow 10% to $800 million with adjusted EBITDA of $94 million. The beer buy is boosting revenue but not adjusted EBITDA!

For the upcoming Q1 report that is not yet scheduled but is due by mid-October, the analysts expect that revenue will increase 14% to $174 million, down sequentially, with adjusted EBITDA of $11 million, down sequentially and down 16% from a year ago.

The Valuation

In my write-up three months ago, I lowered my right-now price target from $0.96 four weeks earlier to just $0.64. Despite the stronger-than-expected Q4 results and the better investor sentiment, I am raising my target, which remains way below the current price.

The financials of the company from Q4 do not reflect the beer acquisition or the HEXO buy, and the tangible book value may be lower. Then, the company reported tangible book value of $333 million. The current market cap, which assumes the conversion of the notes issued in May (convertible at $2.66), would be $2.26 billion, and the tangible book value with that conversion would be $483 million, suggesting a ratio of the market cap to the tangible book value of 4.7X. This is way higher than peers. The three LPs that I have included in my model portfolio are Cronos Group (CRON), which I don’t include at this time, and Organigram (OGI) and Village Farms (VFF). Cronos Group trades at a 17% discount to its tangible book value and has no debt, a lot of cash, and a big owner of its stock, Altria (MO). Organigram trades at 0.7X tangible book value and also has a lot of net cash with an outside owner in British American Tobacco (BTI). Village Farms has lifted a lot but is still very cheap. It currently trades at 0.5X tangible book value.

Tangible book value is useful to help assess the downside of a stock potentially in my view, while earnings can guide the upside. Three months ago, my target was based on the downside risk because the cannabis market was falling sharply with peers trading far below the 2.5X tangible book value ratio for Tilray. Now, the price-to-tangible book value is way higher due to the price rise and the decline in tangible book value in Q4. My target three months ago was based on 1X tangible book value, and it worked out to what I called a seemingly low 4.3X projected FY25 adjusted EBITDA for its enterprise value. At the time, it was trading at 9.8X, which seemed high.

With the bear market for cannabis stocks perhaps over, I am shifting my target’s basis from a ratio of tangible book value to enterprise value to adjusted EBITDA. With the projected FY25 adjusted EBITDA lower than three months ago, there is a bit of downward pressure, but I am raising the multiple to 10X. This works out to an enterprise value of $940 million, which suggests a market cap of $724 million, which would be $0.94, slightly lower than three months ago despite a higher valuation assumed. This price, which is 69% lower than the current price, would be 1.5X tangible book value, a massive premium to peers.

The Chart

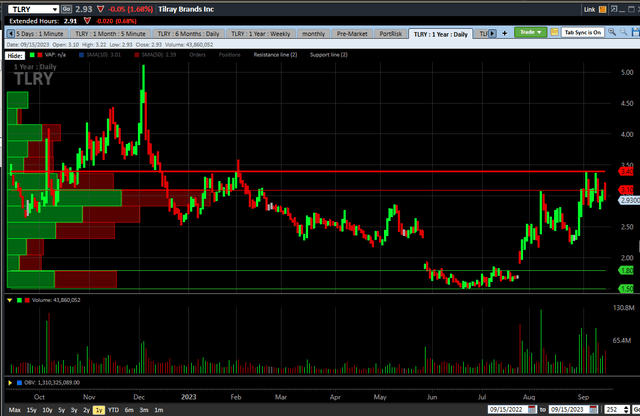

Tilray has rallied sharply over the past two months:

Charles Schwab

The stock gapped up after it was reported in July, and the volume has been very heavy since then. Additionally, the stock extended the rally just a bit after the rescheduling news broke in late August. I see resistance at $3.10 and $3.40 and support at $1.80 and $1.50, the all-time low.

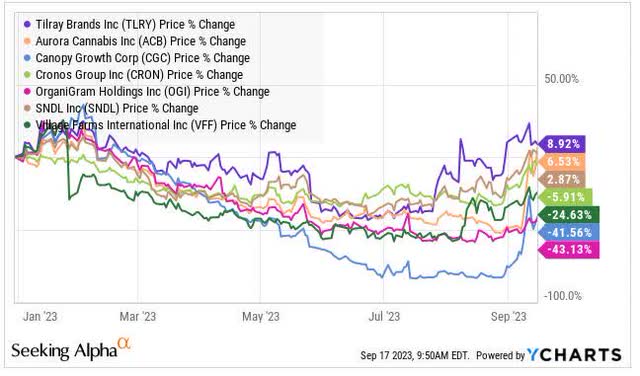

Compared to its Canadian LP peers, the stock has done extremely well in 2023:

YCharts

Three of the stocks have posted gains thus far, with Tilray leading the way. The other two winners, though, are trading below tangible book value, and two of the large decliners are trading at big discounts to tangible book value. As strong as Tilray has been, it is lagging the Global Cannabis Stocks Index.

Conclusion

Tilray Brands has almost doubled since I wrote about it negatively in mid-June. It’s even up just a bit since my negative piece in April. Despite the big rally from the all-time lows, my target is now only slightly higher than three months ago, suggesting that the stock is even more overpriced.

With the potential ending of 280E and the possible passage of SAFE Banking, cannabis investor enthusiasm has returned. The stocks are still down a lot from the peak in early 2021 despite the roaring rally that began in late August. It’s still not clear if cannabis will be rescheduled exactly how HHS has requested, and the time frame remains uncertain. I do not think that SAFE Banking will impact the large cannabis operators too much, as they already have access to banking. So, the enthusiasm may be too high right now, but maybe not. Cannabis stocks do remain very attractively valued relative to where they have been valued historically.

Tilray is not much of a cannabis company, as I detailed above, but it has rallied immensely and appears to be priced way too high at $2.26 billion. There are so many better options for cannabis investors in my view, whether Canadian LPs with better businesses, balance sheets, and valuations or ancillary companies. There are a few MSOs, too, that currently look a lot better despite their rally.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

420 Investor launched in 2013, just ahead of Colorado legalizing for adult-use. We are moving to Seeking Alpha and will let our followers know when that occurs. Historically, we have provided great coverage of the sector with model portfolios, videos and written material to help investors learn about cannabis stocks.