Summary:

- I have been negative on Tilray Brands for quite some time and remain so.

- FY25-Q1 was way below expectations, and the outlook has been diminished.

- The stock looks expensive to peers, and the chart is scary.

chaofann

I have been writing for Seeking Alpha since 2007, and I have been writing cannabis stock articles every week since late 2022. My first piece on the sector then was a discussion of why cannabis investors should warm up. I didn’t call out any stocks then, but I was captivated by how much prices had fallen since the beginning of 2021.

I became more negative about the sector after the rally early in 2023, and I am now a lot more bullish again due to the pending rescheduling of cannabis by the DEA, which will wipe out the onerous taxation known as 280E. This tax on American cannabis companies taxes gross profits rather than net income.

Of course, this may not happen, but it does seem likely. There is no timeline for when it will be finalized. The DEA is hosting a hearing on December 2nd, and there will be another part of that hearing in January or February that will include testimony from industry participants and health officials.

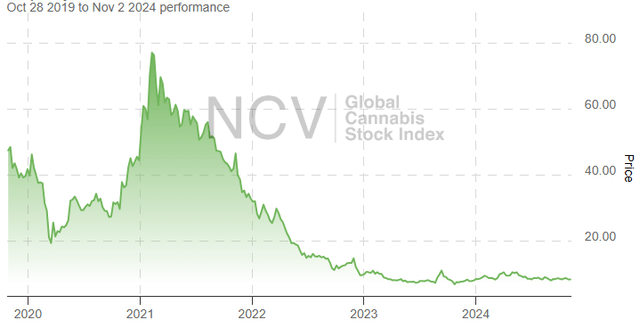

The market has dropped a lot since my piece in late 2022. The New Cannabis Ventures Global Cannabis Stock Index closed on 11/01 at $8.41, and this represents a drop of 36.2% since that article was published on Halloween. The 5-year chart shows how much the sector has declined, though it is above the all-time low that was set a little over a year ago:

When I published this article, Tilray Brands (NASDAQ:TLRY) was trading near $4, and it posted an all-time low less than two years later in October, when they reported their fiscal Q1 financial results. The stock is very popular still on Seeking Alpha as measured by the number of followers (138K) and with traders and investors it seems. The stock trades on the NASDAQ and is “low”, so this is not surprising to see.

I first wrote about Tilray here in April 2023, more than five months after that warming up idea that I shared. I warned investors to stay away when the stock was at $2.60. I have written a lot about the stock very negatively. In this review of the stock, I look at the Q1 results, update the analyst outlook, assess the valuation and review the chart, and I explain why I remain negative on the stock.

Tilray Revenue Plunges

In FY25 Q1, analysts had expected the company to report overall revenue of $227 million, with adjusted EBITDA of $14 million. On 10/10, the company reported that revenue was $200 million, which was below expectations and down 13% sequentially. Due to acquisitions, the revenue was up 13% from a year ago, though the company doesn’t provide an organic revenue figure. Adjusted EBITDA was also lower than had been expected at $9.3 million, down 13% from a year earlier and down 68% sequentially.

Tilray is more than a cannabis company, its original core focus. Through mergers and acquisitions, it now operates 4 segments. Cannabis remains one, and the others include Beverage, Distribution and Wellness. In cannabis, the company operates in Canada and exports to a few markets. The Beverage business has been beer, though the company will soon introduce THC beverages from industrial hemp in the U.S. The Distribution business, which it picked up when it bought Aphria, was CC Pharma, a pharmaceutical distribution company that Aphria bought in early 2019. The Wellness business was acquired by Tilray in 2019 as well, when it bought Manitoba Harvest, a hemp food company.

Looking at the Q1 results by operating segment, beverage sales soared, more than doubling to $59.2 million, which represented 29.6% of overall revenue. Net cannabis revenue was $61.2 million, down 13% despite M&A and representing 30.6% of revenue. Distribution revenue of $68.1 million fell slightly and represented 34% of sales. The remaining $14.8 million, just 7.4% of revenue, was from hemp food, and it grew 11%.

The company releases gross profit by segment, and each segment did expand. The company does not share adjusted EBITDA by segment. The share-count increased sharply as the company reduced debt, so the adjusted EBITDA per share did decrease. During the quarter ending 8/31, the company sold 36.7 million shares using its At-the-Market shelf at an average price of $1.86 per share. Operating cash flow was terrible during the company, as the company’s operations consumed $35.3 million, compared to using $15.8 million a year earlier. With the proceeds from the stock sale, the company was able to reduce net debt to just $42.1 million. Tangible book value ended Q1 at $565 million.

The Analysts Reduce Their Outlook for Tilray

With Q1 worse than expectations, analysts reduced their revenue and adjusted EBITDA outlooks for Tilray. Ahead of the report, AlphaSense had a FY25 consensus revenue of $930 million. Now, the analysts project FY25 revenue will grow 15% to $904 million. For FY26, the consensus has moved from $1.006 billion to $966 million, up 7% from FY25.

Looking at the adjusted EBITDA, analysts were expecting FY25 to be $76 million and FY26 to be $118 million, and 11.7% margin. Analysts currently project adjusted EBITDA in FY25 to rise 14% to $69 million. Their outlook for FY26 is that it will grow 64% to $113 million, a margin of still 11.7%.

Tilray has never reported substantial positive diluted EPS, and the analysts continue to forecast challenges. For FY25, they currently project a loss per share of $0.11. They expect it to improve modestly in FY26 to -$0.10. Both of these estimates are slightly better than what had been expected at the beginning of 2024.

Tilray Remains Expensive

Two months ago, when I wrote that investors should expect Tilray to keep declining, I discussed $1.07 as a potential price ahead. I based this on 10X projected adjusted EBITDA for the next year ahead. With the slightly lower adjusted EBITDA projections and the higher share-count, I am getting a year-end forecast now of $0.97.

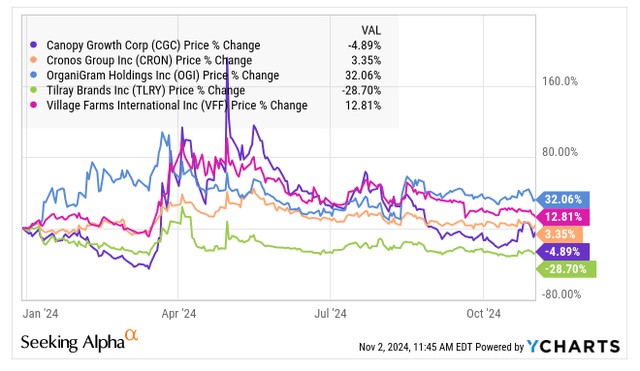

I continue to find it hard to value Tilray. 10X may be too high of a ratio. In that last piece, I compared it to some Canadian LPs that I think look better, and this remains the case. Organigram (OGI) trades currently at 10X, but it has no debt and a lot of cash along with a strategic investor. While Tilray trades at 2.7X tangible book value, Organigram trades at a slight discount at 0.9X. I think a better comparison is Village Farms (VFF), which trades at 0.5X tangible book value and what appears to be 6.3X potential adjusted EBITDA for 2025. Like Tilray, it is diversified beyond cannabis. Tilray stock does have better liquidity.

Of course, Tilray is more than a cannabis stock. I have compared it to Boston Beer Group (SAM), which I follow as a potential investor. I have owned it but don’t currently, and my wife currently does own some. SAM is debt-free with some cash and substantial inside ownership. For 2025, it currently has a PE of 24X off of depressed EPS that are rebounding but still way below the 2020 peak. The enterprise value to projected adjusted EBITDA for 2025 is 11.3X. Tilray trades more expensively right now at 16.6X.

An All-Time Low Was Set By Tilray

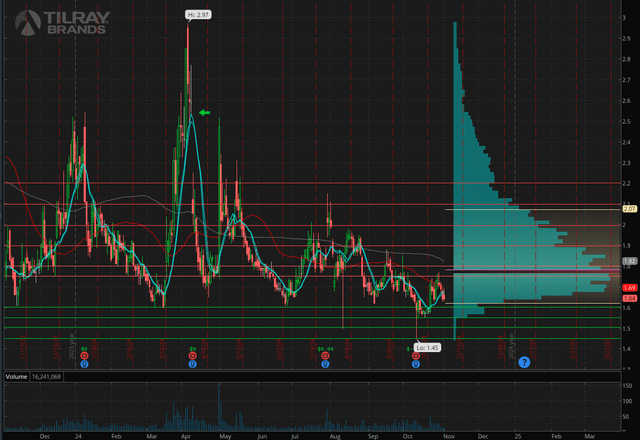

I had been expecting a new all-time low for Tilray, and I was right, but only briefly! The stock did break $1.50, the low that had been set in June 2023, falling to $1.45 after the earnings report, but it quickly shot up and worked its way as high as $1.77 near the end of October. The stock had traded in early April 2024 as high as $2.97, so that low on 10/10 was a drop of more than 50% from that peak. Here is the chart from the past year:

The volume has remained a lot lower than it was earlier this year, and that reversal on 10/10 did not have stand-out volume considering it was the day they reported earnings.

To me, this chart looks heavy. I do have some support levels, but I see resistance levels too. My first resistance level of $1.75 is above the falling 50-day moving average.

Year-to-date, TLRY is down 28.7%, while the Global Cannabis Stock Index has advanced 3.7%. Compared to the 5 LPs that I follow most closely, it really stands out negatively for its performance:

Why I Remain Negative on the Stock of Tilray

While TLRY has dropped a lot, it remains expensive in my view. While I like cannabis stocks a lot now, Tilray Brands isn’t much of a cannabis company. It’s more of an alcohol company. Growth there has been through acquisitions, and investors have no reason to think that Tilray will do better with brands than Anheuser Busch or Molson, who have sold some to it.

Tilray has done a horrible job of M&A in the cannabis industry, and it has failed to meet its own expectations on revenue, adjusted EBITDA or market share. The Canadian cannabis market has matured, and there are better operators there. The hemp food business is small and not too interesting, and the pharmaceutical distribution business has very low profitability and has shown a lack of growth for a long time. I do like what Tilray is doing with new THC beverages in the U.S. in certain states, but it remains to be seen how this will work out.

So, while Tilray remains very popular with traders and some investors, the operational performance has been below what has been expected with expectations falling. The stock still seems overvalued to me, and I expect it could break $1.00. I am a big fan of many cannabis stocks right now, just not this one.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

420 Investor launched in 2013, just ahead of Colorado legalizing for adult-use. We have moved the service to Seeking Alpha. Historically, we have provided great coverage of the sector with model portfolios, videos and written material to help investors learn about cannabis stocks, and we are excited to be doing it here!