Summary:

- I am upgrading Tilray Brands from Strong Sell to Neutral due to its massive price decline and balanced valuation outlook.

- TLRY has dropped 48.3% in 2024, significantly underperforming the NCV Global Cannabis Stock Index and other Canadian LPs.

- Despite a deteriorated analyst outlook, TLRY’s fundamentals, including reduced debt and potential in the American cannabis beverage market, offer some optimism.

- While TLRY’s valuation seems okay, better opportunities exist in other Canadian LPs and MSOs, making it a less attractive investment.

small smiles

I have been negative on Tilray Brands (NASDAQ:TLRY) (TSX:TLRY:CA) rather consistently for a long time, and I am upgrading it now from Strong Sell to Neutral. I last wrote about it in early November, discussing its price as still too high. Since then, it has dropped by 27.4%. Of course, lots of cannabis stocks have gone down since November 1st! The New Cannabis Ventures Global Cannabis Stock Index, which includes TLRY and five other Canadian LPs, has declined 16.5% since then.

In this upgrade piece, I try to explain why I am no longer as bearish as I have been. I look at the chart, follow that with a discussion of its fundamentals, and evaluate the stock on a valuation basis, comparing it to peers.

TLRY Has Posted a Massive Decline

Tilray Brands has moved to an all-time low, and it has dropped 48.3% in 2024 so far. The NCV Global Cannabis Stock Index posted a 52-week closing low on 12/13, but it held the October 2023 all-time closing low. It has dropped 13.4% in 2024, so a lot less than TLRY.

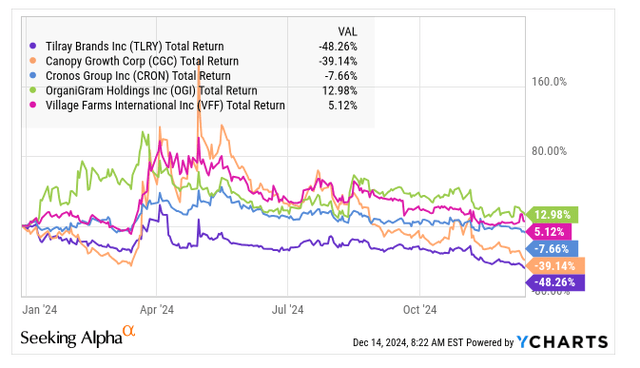

TLRY is diversified, as I have discussed in other articles. It started off exclusively as a cannabis company, but that segment isn’t the majority of the company. New Cannabis Ventures has hosted a Canadian Cannabis LP Index, and it is down 25.7% year-to-date, much less than the TLRY decline. I follow 5 Canadian LPs closely, and TLRY is down the most in 2024:

YCharts

I have discussed how popular TLRY and Canopy Growth (CGC) are with investors (as measured by the number of followers at Seeking Alpha and other measures), and I believe that the negative action in these two stocks has weighed on investors holding other Canadian LPs. What’s interesting about 2024 is that Organigram (OGI) and Village Farms (VFF) have managed gains, which is much better than peers or even the entire cannabis sector. The two other Canadian LP stocks in the Global Cannabis Stock Index are up 8.5% and down 9.5%, both better than TLRY and the overall Canadian LP sub-sector and the overall sector.

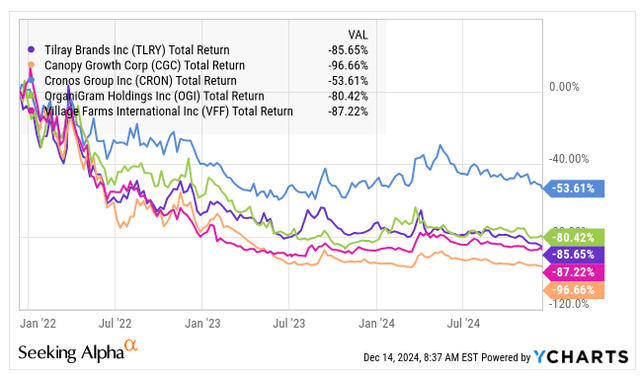

Looking at a longer time-frame, TLRY performance has been middle-of-the-pack for these 5 Canadian LPs over the past 3 years:

YCharts

Of course, these stocks are all down a ton over the past three years. The S&P 500 has returned over 35%!

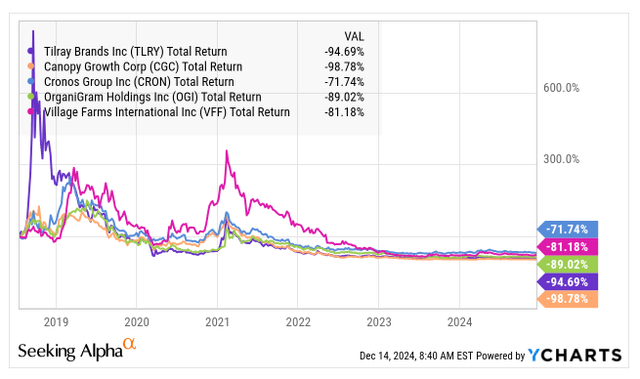

Looking further back, the stocks peaked a little bit before three years ago. Since TLRY, the last of these to go public, began trading in 2018, it has dropped 95%:

YCharts

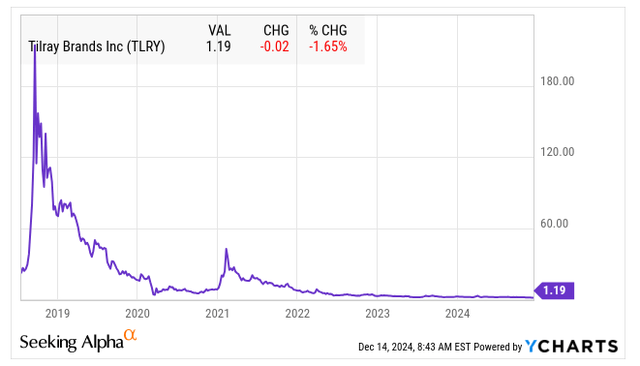

TLRY peaked after its IPO at $300, so it is down over 99% since then:

YCharts

With the stock making an all-time low, there is no support level. I think that some may defend it at $1.00, perhaps. If it were to trade to tangible book value, a level that has not provided support to Cronos Group or other LPs, it would trade at about $0.60. I see resistance currently at $1.25. There is an open gap to $1.71 that was created the day after the U.S. elections in November.

The Tilray Fundamentals Look Okay

I have already discussed the FY25-Q1 financial results in that last article. The best part of the update was the revelation that shares have been issued and debt has been paid down. The company ended the quarter with net debt of $42.1 million, which is down substantially from where it was a few years ago. At the end of FY21, the company reported net debt of $450 million. While the debt is down, so has been the operating cash flow, which was -$35.3 million in Q1. The company’s Q2 just ended on 11/30, and it will likely report the quarter in the first half of January.

How it performs in the cannabis market matters, but it is not all that matters. When I wrote that piece at the beginning of November, analysts were projecting FY25 revenue of $904 million with adjusted EBITDA of $69 million and FY26 revenue of $966 million with adjusted EBITDA of $113 million. I have shifted from AlphaSense to Koyfin (very happily!), and the current projection is that overall revenue in FY25 will still be $904 million, up 15%, with adjusted EBITDA projected to be $69 million still, up 14%. For FY26, the outlook is for revenue to grow 6% to $958 million and for adjusted EBITDA to gain 28% to $88 million. Analyst estimates for EPS remain negative for both years ahead.

So, the analyst outlook has deteriorated a bit since early November, but it remains positive. Of course, this is a company that has faced downward revisions for quite some time.

Tilray Brands Has a Defensible Valuation

In April 2023, I wrote my first piece on TLRY and suggested that readers should stay away, advice that proved good. I suggested that the stock was trading at twice the level it should be trading, and it has declined by 54%. This is a huge loss compared to the NCV Global Cannabis Stock Index drop of 14%.

As I have discussed previously, it can be difficult to value the company due to its diversification. Is it a cannabis company? Is it an alcohol company? Is it a pharmaceutical distribution company in Europe? Yes! The company has done a lot of M&A, but the FY25 adjusted EBITDA outlook is lower than it was in April 2023, when analysts were projected adjusted EBITDA of $121 million. So, the lower outlook partially explains the decline, but it has been primarily a reduction in valuation. In that piece, I suggested that the stock should have then been $1.32 based on 2X enterprise value to projected revenue. It currently trades at 1.2X the projected FY26 estimate.

I have discussed several other valuation metrics, including price to tangible book value, which is currently 2.0X, and enterprise value to projected adjusted EBITDA, which is currently 14.5X the one-year forward estimate. This isn’t great, but it’s not terrible. There are cheaper peers.

In my last piece on TLRY, I suggested that it could break $1.00. Well, it still may, but the upside and the downside are in better balance now. I shared a target $0.97 based on an enterprise value to projected adjusted EBITDA of 10X. This would currently be $0.81 due to the lower outlook. If the company can boost its operating cash flow, investors may be willing to pay more. Looking out to late August 2025, a year ahead of FY26, the stock could do better.

While the adjusted EBITDA outlook, which has been reduced already, could come down, an enterprise value to projected FY26 adjusted EBITDA of 10X, would yield a price of $0.90, up from the updated $0.81 but down substantially from the current price. 12X would work out to be $1.08 still 9% lower. I am not yet suggesting a higher multiple should be used, but 15X would yield $1.37, and 20X would yield $1.84. Better cash flow generation and confidence in the projected outlook could improve sentiment and boost the valuation multiple.

Why I Am Neutral on TLRY

I like Canadian LPs and currently include three of them in my model portfolio that I share with subscribers of 420 Investor. The weight of that sub-sector is currently 23.8%, which is slightly higher than the 22.5% index exposure. The three Canadian LPs that I own include two that are in the Global Cannabis Stock Index and one that is not. Cronos Group and Organigram, which are both in the index, trade below tangible book value and have large strategic partners that hold big stakes. I have written about Organigram, which is currently 16.3% of the model portfolio, recently, suggesting that it could soar in 2025. The third LP is Village Farms, and, like Tilray, it is diversified beyond cannabis. Unlike TLRY, it trades at a lower enterprise value to projected adjusted EBITDA and at a massive discount to its tangible book value. I remain negative on Canopy Growth. I wrote about it the week after I wrote about TLRY, and it has dropped 26.7% since then. I continue to believe that investors should avoid Canopy Growth.

As much as I like Canadian LPs, which operate legally on a federal basis and have opportunities in other countries, I am only slightly overweight the sub-sector. I currently am very heavily invested in my model portfolio in MSOs. The six names that I hold represent almost 70% of the model portfolio. 280E taxation continues to be likely to go away, which will be very helpful for the American cannabis companies and will not impact the Canadian LPs. Of course, if rescheduling fails, TLRY will likely outperform the MSOs.

Better Canadian LPs to own and a more attractive sub-sector in MSOs are reasons not to be long TLRY. It may continue to go down, but it has been very volatile and could go up for no good reason. I do like that the company has gotten its balance sheet in order. I also like that it seems to be moving forward on the American cannabis beverage market, using hemp-derived THC. This could become a catalyst down the road.

So, a plunging price and a valuation that seems okay have moved me to upgrade the stock to Neutral from Strong Sell. I think that cannabis investors can do better with many other stocks beyond TLRY. I appreciate how difficult it can be to be a cannabis investor now. It’s difficult to be a cannabis analyst too! I wish all of my readers a good holiday season and a better year ahead for cannabis stocks.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

420 Investor launched in 2013, just ahead of Colorado legalizing for adult-use. We have moved the service to Seeking Alpha. Historically, we have provided great coverage of the sector with model portfolios, videos and written material to help investors learn about cannabis stocks, and we are excited to be doing it here!