Summary:

- Tilray Brands consistently misses quarterly targets and lacks organic growth.

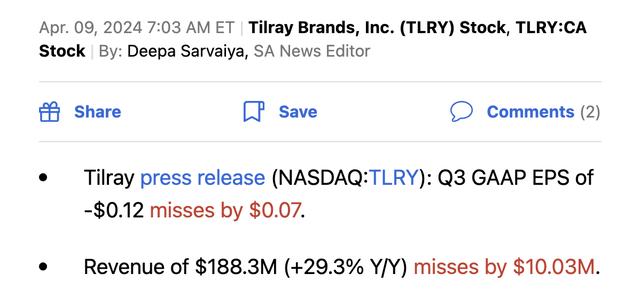

- Tilray’s revenue for FQ3 ’24 was $188 million, missing analyst targets by $10 million.

- TLRY stock trades at 25x adjusted EBITDA targets for a company that just cut FY24 targets flat with last year.

SolStock/E+ via Getty Images

While Tilray Brands, Inc. (NASDAQ:TLRY) always tells a great story, the Canadian cannabis company doesn’t actually report good numbers. The company constantly acquires businesses to generate reported growth, but Tilray isn’t generating organic growth, leading to the constant view that the business is too complex to manage. My investment thesis remains Bearish on the stock after the company missed quarterly targets again.

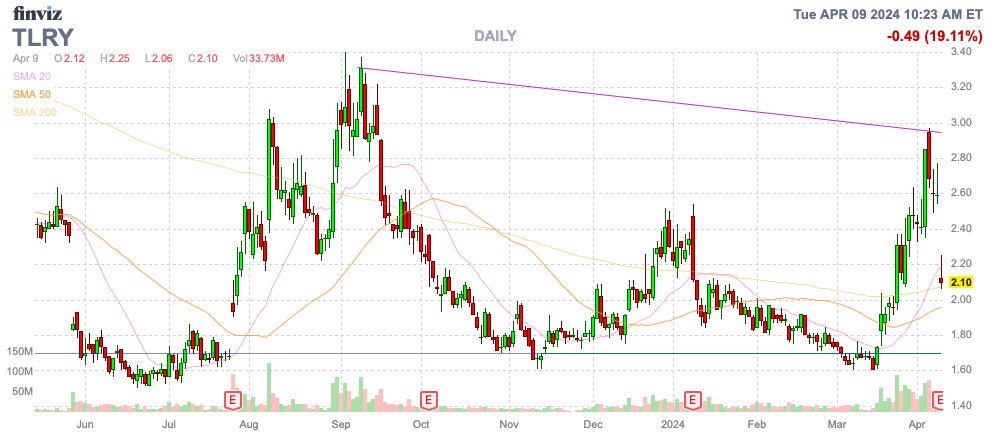

Source: Finviz

Another Miss By Tilray

Tilray reported FQ3 ’24 results before the open with the following numbers:

The cannabis company, turned craft beer company, reported FQ3 revenue of $188 million, missing analyst targets by a very wide $10 million. Investors need to understand the FQ2 revenues were $194 million, missing consensus targets by over $1 million.

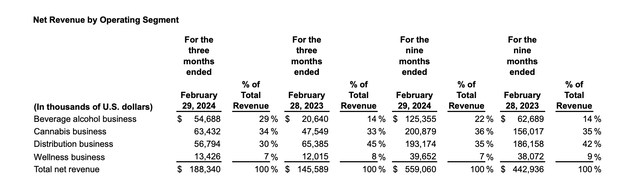

While Tilray technically reported 29% growth, revenues were down over $5 million sequentially from the peak level for the November quarter. Beverage alcohol net revenue grew 165% YoY to $55 million, but the business was only up from the $47 million reported in the February quarter.

Source: Tilray Brands FQ3’24 earnings release

The sequential revenue decline was due to the Cannabis business slumping ~$4 million and the Distribution business dipping over $10 million. Again, one business rises while the other segments dip, and the recent focus on the craft beer acquisition last year fits with that narrative.

Tilray reported FQ4’23 revenues of $184 million after acquiring HEXO to boost the Canadian cannabis business. The company just reported a quarter where sales were only $4 million above the FQ3 levels, despite buying craft beer brands that more than doubled the Beverage alcohol business.

Investors originally bought into the Tilray investment story for the cannabis business, but now the company has moved far beyond cannabis. The Wellness business was a $20 million quarterly business when acquired a few years back and the business is now down to $13 million, while the Distribution business has slumped to only $57 million.

Even the cannabis business is complicated with a Canadian medical cannabis segment and an International cannabis segment with a promising jump in revenues to $14 million, up from below $10 million last FQ3. The Germany approval of recreational cannabis could drive International cannabis growth, but this segment of the business is now less than 10% of sales, with the focus on beverages far exceeding International cannabis.

Profit Issues

Even beyond revenue growth, the Canadian cannabis companies have limited profits. The Distribution business has always had limited gross margins, reducing the revenues with the actual possibility of producing strong profits.

Tilray guided to adjusted EBITDA targets of $68 to $78 million for FY24, with goals of the acquired craft beer business from Anheuser-Busch (BUD) contributing higher margins when consolidated with the existing Beverage alcohol business. The company saw gross margins dip to only 26% in FQ3, with the Beverage alcohol business dipping to only 34% margins now, despite having several quarters to improve the underutilization issues inherited from the craft beer brands acquired.

The company just ended up cutting the adjusted EBITDA target for FY24 with just 1 quarter left in the year. Tilray now has a goal of only achieving $60 to $63 million in adjusted EBITDA for the year ending May 31 (less than 2 months away). The Canadian cannabis company will no longer hit free cash flow positive targets for the fiscal year, though this target included collecting cash from asset sales, not based on operating cash flows.

Tilray only reported FQ3 adjusted EBITDA of $10 million, with the business stuck at the $10 million quarterly range, though the target requires a jump to adjusted EBITDA of $30+ million in FQ4 after hitting $22 million last year. The market clearly doesn’t believe the target is achievable and sustainable.

The Canadian cannabis business was $63 million in the February quarter, with reported excise taxes of $22 million. The company didn’t break out details on the excise tax, but presumably Tilray would benefit to a great extent on the Canadian government lowering the tax rate to possibly a maximum of 10% based on recommendations of Canada’s House of Commons Standing Committee on Finance versus the current floor of C$1 per gram, leading to taxes in the 30% range.

Tilray could save up to $15 million in excise taxes per quarter. Though, the devil will be in the details of the Canadian budget announcement in the next week, and many questions exist on whether the Canadian cannabis companies don’t just end up lowering prices to offset the lower tax benefit.

The stock has a market cap of $1.5 billion for a business producing an adjusted EBITDA of only $60 million. Tilray trades at 25x EBITDA, and the company doesn’t generate organic growth.

Takeaway

The key investor takeaway is that Tilray Brands, Inc. keeps missing financial targets, yet the stock trades at an elevated valuation multiple. The company makes the financials difficult to analyze due to all the acquisitions, but the key adjusted EBITDA target could actually slump YoY.

Investors are better off finding another cannabis stock actually focused on the cannabis market now to invest in the sector.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Q2, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.

Well written. Thank you for sharing.