Summary:

- Tilray Brands, Inc. reports another weak quarter, with revenues missing estimates in FQ3’23.

- The Canadian cannabis company agreed to buy out the remaining part of HEXO to again consolidate the cannabis sector.

- TLRY stock remains expensive, trading at over 5x sales while generating no growth.

OlegMalyshev

After another weak quarter, Tilray Brands, Inc. (NASDAQ:TLRY) again shifted the discussion to an acquisition of another business. The stock will likely trade weak due to the constant integration issues with Canadian cannabis mergers and the failure to grow after prior acquisitions. My investment thesis remains Bearish on Tilray, as the company fails to achieve revenue growth and reasonable margins while chasing another deal.

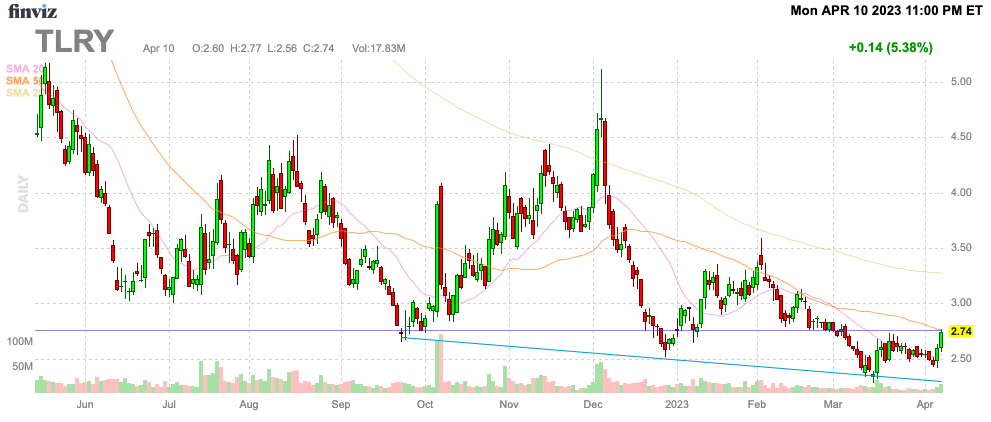

Source: Finviz

Another Distraction

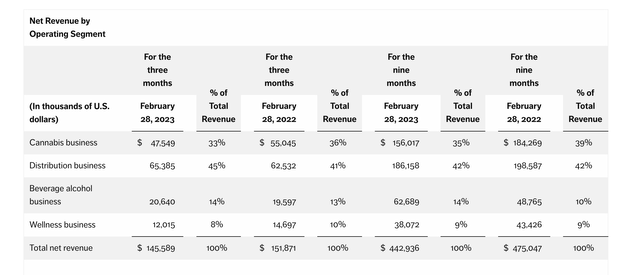

Tilray Brands, Inc. already has a massive business, with quarterly revenue of $146 million for the just-reported FQ3’23 period. The problem is that the cannabis company has always had a problem managing this large business, highlighted by the $5 million revenue miss.

The Canadian cannabis company already operates in segments from cannabis in both Canada and International markets to a distribution business in Germany to beverage alcohol and wellness units. The distribution business has $63 million in quarterly revenues, with the primary cannabis business only producing $48 million in revenues.

Source: Tilray FQ3’23 earnings report

Tilray just announced plans to purchase HEXO Corp. (HEXO) in a take-under deal that doesn’t really surprise the market. The biggest question is how Tilray can manage the addition of another cannabis business after failing to make much progress with the prior deal with Aphria in 2020.

HEXO recently reported FQ2’23 results, with revenues slumping 54% to C$24 million and an adjusted EBITDA loss of $C2 million. The business would probably collapse on its own, yet Tilray now has to spend time integrating the business while showing no previous ability to combine a business and grow.

In the last year, Tilray acquired Montauk Brewing Company in New York, yet the beverage alcohol business only reported minimal sales growth for the just-reported February quarter. Revenues barely grew $1 million to reach $21 million, though Montauk Brewing was listed as the 10th largest craft brewer at the time of the deal last November.

Again, the numbers continue to reinforce a theory that Tilray seeks far-flung businesses without any base business to fundamentally support these growth projects. The company did report an adjusted cannabis gross margin of 47%, but the company still reported an adjusted loss of $23 million for the quarter with a limited adjusted EBITDA profit of only $14.0 million, or below 10% of revenues.

Tilray’s Acquisition Of HEXO – Another Cannabis Deal

The HEXO deal adds to the 12.9% market share of Tilray and includes $215 million in pro-forma annual cannabis sales. At the time of the Aphria deal, the combined company had promised a retail market share of 17.3%, with annual gross cannabis sales in the $232 million range back in 2020.

What the Canadian cannabis company really needs to achieve is internal growth from the existing business units. The beverage alcohol and wellness segment now includes the business units of SweetWater Brewing Company, Breckenridge Distillery, Montauk Brewing Company and Manitoba Harvest, but the combined revenue of these 2 segments fell YoY by several million dollars despite all of these small brands having large growth opportunities. Each individual brand should match the current sales of the combined segments with the distribution capabilities and scale of Tilray.

Not to mention, the company again wrote down inventories and the inclusion of the HEXO cannabis business combined with Tilray Brands only appears to increase the complexity of the operations. Tilray alone has written down $55 million in inventory this fiscal year, to nearly wipe out half of the cannabis gross profits for the year.

As highlighted in the past, Tilray still has a nearly $1.7 billion market cap despite all of these issues. The company has no growth and limited adjusted EBITDA targets of $60 million for the year.

In total, revenue excluding the distribution business were only $80 million in the quarter. Tilray only has an annualized revenue run rate in the $320 million range now for the $1.7 billion market cap.

The company promises an accretive deal for the HEXO business, but the pro-forma numbers from the past don’t project the company being able to maintain the combined cannabis market share in Canada. The results of past acquisitions over the last few years suggest the integration will lead to shrinkage of the combined business with lower revenues in the years ahead.

Takeaway

The key investor takeaway is that Tilray Brands, Inc. isn’t a buy after reporting quarterly results and announcing the purchase of HEXO. The stock trades for over 5x non-distribution sales and 28x adjusted EBITDA targets for the year.

The cannabis stock is far too expensive in a generally crushed cannabis sector, while Tilray Brands, Inc. shareholders have seen the stock hold up far better than the sector in the last year.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.