Summary:

- Tilray’s stock has bounced back by 55% since mid-November but is down 11% since September.

- The company’s recent acquisitions have impacted its balance sheet, with net debt increasing and operating losses expanding.

- Analyst projections for Tilray’s future revenue and adjusted EBITDA have weakened, and the stock’s chart remains challenging.

AnthonyRosenberg

I last warned about Tilray Brands (NASDAQ:TLRY) here in mid-November, suggesting it could make new lows. It did not, as it has bounced twice at the $1.65 area and is now at $2.595, up 55% since then. It’s down 11% since I wrote about it in September, calling it very overpriced. The overall cannabis sector, as measured by the New Cannabis Ventures Global Cannabis Stock Index, has declined by less than 5% since then.

Tilray reports its fiscal Q3 on Tuesday morning, and the stock could come under a lot of pressure. In this follow-up, I review the results of the recent quarter, take a look at the future expectations, assess the chart and analyze the valuation.

Tilray in Fiscal 2024

The diversified Tilray has become more of an alcohol company this year, closing the acquisition of several craft beer brands from Anheuser-Busch (BUD). This deal closed in late September, and the company’s press release suggested that it would triple sales of craft beer by units.

The company has closed not only the beer acquisition but also some cannabis M&A. The balance sheet has taken a hit. Net debt moved from $88 million at the end of Q1 to $309 million at the end of Q2. Cash flow from operations in the first half of FY24 was -$46.3 million compared to -$17.1 million in the first half of FY23.

Revenue in H1 was $370.7 million, up 25% from a year earlier. The gross margin fell from 30.7% to 24.7%. The operating loss expanded to $76.1 million. Adjusted EBITDA has declined 13% to $20.8 million.

The Outlook for Tilray Has Weakened

When I wrote in November, Tilray Brands had reported their Q4 for FY23. At that time, the analysts were expecting revenue to be $816 million in FY24 and for adjusted EBITDA to be $69 million. Now, according to Sentieo, they project revenue will increase 27% in FY24 to $796 million. They anticipate that adjusted EBITDA will grow just 9% to $67 million. The projections are now weaker. In January, the company guided FY24 adjusted EBITDA to be $68-78 million, so the analysts are now below the expectations of the company.

In mid-November, analysts were expecting FY25 revenue to be $924 million with adjusted EBITDA of $105 million. These estimates are lower too, with revenue now anticipated to increase 11% to $896 million and adjusted EBITDA projected to grow 49% to $100 million.

For the report this week, analysts are projecting that revenue will increase 37% to $200 million. They expect adjusted EBITDA will rise just 1% to $14 million. These estimates have declined over the past three months.

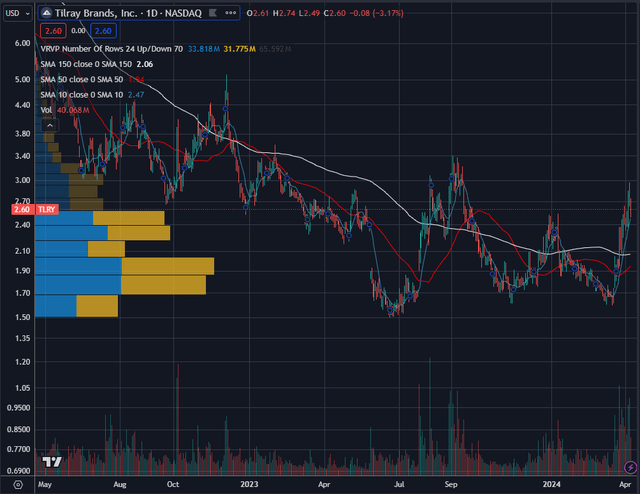

The Tilray Chart Remains Challenging

The all-time low was set in June near $1.50. The stock traded above $5 as recently as November 2022:

The stock has lifted off of the recent double-bottom near $1.65 during a very bullish time for cannabis stocks. Since the end of 2022, it is down, though, by 3.7%. The NCV Global Cannabis Stock Index has gained 9.0% during that period of time.

Tilray, which has dropped 78.5% over the past 5 years, has gained 12.8% so far in 2024. While it has rallied, it has lagged the Global Cannabis Stock Index gain of 30.5%.

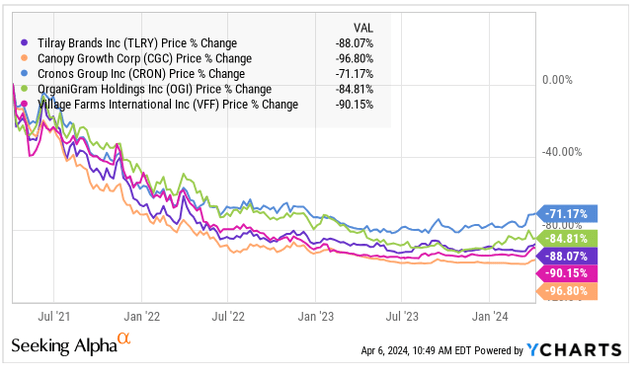

Compared to the LPs that I follow closely, its 88.1% decline has trailed only Cronos Group and Organigram over the past three years:

Tilray Seems Very Overvalued

Since the Q2 report, Tilray has disclosed two increases in the share-count, and I get a total of 762 million shares outstanding. On January 10th, it shared an SEC filing regarding the issuance of 12.4 million shares to Double Diamond Holdings to pay debt. On February 10th, an SEC filing revealed the issuance of 6.9 million shares to pay off some of the convertible notes.

The current fully-diluted in-the-money share-count of 789 million is boosted by 27.2 million RSUs that were outstanding. Investors should also take into account the potential issuance of 64.8 million shares if the convertible note issued in May of 2023 becomes in-the-money. The conversion price, $2.66, is not that much higher than the current price.

At $2.60, the market cap is $2.05 billion. Adding the net debt of $309 million, the enterprise value is $2.36 billion. Comparing that to the projected adjusted EBITDA for FY25 (May 31), the stock trades at a very high 23.6X. The current price to tangible book value is also very high at 5.1X.

Comparing it to other cannabis companies that I include on my Focus List, Tilray Brands trades at a much higher P/TB. In that September piece, I suggested that Cronos Group (CRON), Organigram (OGI) and Village Farms (VFF) made a lot more sense for investors. Each of those stocks has rallied since then, while Tilray has declined. Organigram, which is up a lot in 2024, trades now at just 1.0X tangible book. I own a lot of OGI again in my model portfolio after being out right ahead of the secondary offering in late March. I own VFF too, and it trades at just 0.7X tangible book value. I have no position currently in Cronos Group, which also trades at 1.0X tangible book value.

Comparing the enterprise value to projected adjusted EBITDA, Tilray, at 23.6X (FY25), trades at a big premium to the two Canadian LPs that I include in my model portfolios. Village Farms trades at 14.75X projected adjusted EBITDA for 2024, and Organigram trades at 15.5X projected adjusted EBITDA for FY24 (September 30).

Evaluating the company, though, one should look outside of the cannabis industry. In a piece about a year ago, I compared it to Boston Beer Company (SAM), which I include on my own personal watch list. Then, it traded at 17.4X EV/projected adjusted EBITDA for 2023. Now, it trades at 13.3X for the projection of 2024 adjusted EBITDA. Since the article a year ago, TLRY is about unchanged, while SAM has dropped nearly 8%. Unlike TLRY, SAM has net cash. It trades at a lower P/TBV too.

I think that valuing a very diversified company like Tilray can be difficult. The cannabis business seems wildly overvalued. The pharmaceutical distribution business has high revenue and very low margins with limited growth thus far. The hemp foods business has done quite poorly. Will the alcohol business make up for all of this? I don’t think so.

I currently have a year-end target based on 1.5X tangible book value of $0.77, substantially lower than the current price. This works out to 9.1X projected adjusted EBITDA for FY25. If it were just an alcohol company, perhaps this would be too low, but a lot of its business is non-alcohol. The company has a lot of debt and is burning cash.

Conclusion

Tilray hasn’t yet done what I have been projecting: breaking $1. I continue to believe that it will. The stock has underperformed its peers, and the outlook has been dimming.

For those who want to own a Canadian LP, I suggest Organigram and Village Farms, both of which look to have better balance sheets and valuations. Within the cannabis sector, a few ancillary stocks look better. I think Planet 13 (OTCQX:PLNH), down 3% in 2024 despite the strength in MSOs, looks better too.

I think that investors have been a bit fooled by the aggressive M&A that Tilray has executed. It boosts revenue, but the company has been challenged on the profitability front.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

420 Investor launched in 2013, just ahead of Colorado legalizing for adult-use. We have moved the service to Seeking Alpha. Historically, we have provided great coverage of the sector with model portfolios, videos and written material to help investors learn about cannabis stocks, and we are excited to be doing it here!