Summary:

- New equity issuance is needed to finance growth and has been flooding the market with new shares.

- Tilray executed an aggressive M&A strategy that likely destroyed billions of shareholder value.

- While optically cheap, it is very likely that the share price declines further.

Michael Fischer

Summary

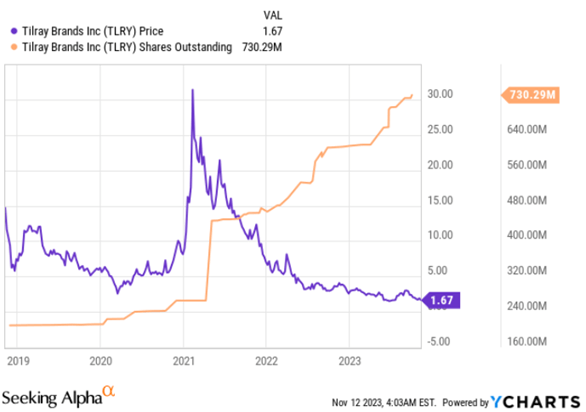

After a successful IPO in 2018, Tilray’s share price showed an explosive rise when Cannabis-related stocks were the hype of the moment. After reaching a peak of $ 30, the share price has decimated in the years following to a share price of around $ 2 today. This is a schoolbook example of a bubble that busted. While the stock price is optically cheap, I believe that the share price will likely decline even further. The company is showcasing a toxic cocktail of heavy share dilution, slow-growing revenues, negative profit margins and negative cash flows. Additionally, Tilray’s management continues with its acquisition strategy as if zero-interest rates were still reality. From my analysis I’ve concluded that the long list of M&A’s were mainly financed by newly created shares. This strategy’s resulting share dilution in my view has only destructed shareholder value. As a result the number of outstanding shares has increased substantially. I consider Tilray as a short candidate as I do not see any supporting factors other than that share price is optically cheap.

Introduction

Tilray Brands, Inc. (NASDAQ:TLRY) is a leading global cannabis-lifestyle and consumer packaged goods company with operations in Canada, the United States, Europe, Australia, and Latin America. The company is a pioneer in cannabis research, cultivation, and distribution, and its products are available in over 20 countries. Tilray’s production platform supports over 20 brands, including comprehensive cannabis offerings, hemp-based foods, and alcoholic beverages. In 2021 Tilray merged with Aphria creating the world’s largest cannabis company.

Tilray’s business segments include:

- Medical cannabis: Tilray is a leading supplier of medical cannabis to patients and physicians around the world. The company’s products are used to treat a variety of conditions, including chronic pain, anxiety, and epilepsy.

- Adult-use cannabis: Tilray is also a major player in the adult-use cannabis market. The company offers a variety of products, including flowers, concentrates, and edibles.

- Hemp-based foods: Tilray produces a line of hemp-based foods, including hemp seeds, hemp oil, and hemp protein powder.

- Alcoholic beverages: Tilray owns several alcoholic beverage brands, including SweetWater Brewing Company, Blue Point Brewing Company, and Montauk Brewing Company.

M&A and dealmaking history (2019 – Now)

The company has been aggressively pursuing external growth opportunities. Below is a list of acquisitions registered since 2019:

- January 2019: Tilray signs revenue sharing agreement with Authentic Brands Group to develop and market consumer cannabis brands. Tilray puts up $ 100 million plus up to $ 250 million in cash and stock if certain commercial milestones are reached.

- January 2019: Tilray acquires Natura Natural Holdings for up to $ 70 million subject to performance milestones.

- February 2019: Tilray acquires Manitoba Harvest, a Canadian cannabis producer, for $419 million pending on performance milestones.

- August 2019: Tilray acquires FOUR20 for $ 110 million paid in shares.

- December 2019: Tilray merged with its largest shareholder, Privateer Holdings Inc.

- May 2021: Tilray closes merger with Aphria, another Canadian cannabis producer. As part of the deal Tilray shareholders received 38% of the merger company, while Aphria shareholders received 62%.

- August 2021: Tilray acquires majority position in MedMen convertible notes valued at $ 165 million.

- December 2021: Tilray strengthens its strategic position in the U.S. with the acquisition of Breckenridge distillery.

- March 2022: Tilray enters a strategic alliance with Hexo Corp. and acquires a significant equity stake in Hexo through convertible notes.

- November 2022: Tilray acquires Montauk Brewing Company.

- June 2023: Tilray acquires Hexo Corp.

- August 2023: Tilray acquires eight beer & beverage brands from Anheuser-Bush.

- August 2023: Tilray announces acquisition of Truss Beverage Co.

The list is large with approximately three acquisitions per year. Financial details of the acquired targets (revenue, profit, …) are never disclosed in press releases. This makes it rather difficult to assess whether Tilray ‘s acquisition track record is successful or not.

Share Dilution

As Tilray is not generating and free cash flows, acquisitions are largely funded by the issuance of common shares. The biggest dilutive event was without doubt the merger with Aphria in 2021. The merger took place at the height of the Cannabis frenzy. Since 2021 the number of shares outstanding has nearly tripled.

Tilray’s share price versus shares outstanding (YCharts chart creator)

More detail on the purpose for share issuance was given in Tilray’s annual reports. Most equity issuance was related to acquisitions. On the other hand, new issuance was also needed to fund their operations.

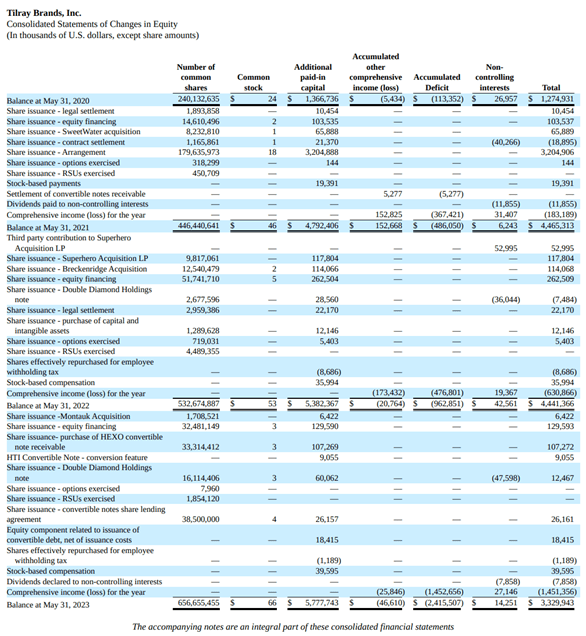

Changes in equity 2021-2023 (Tilray’s 2023 Annual report)

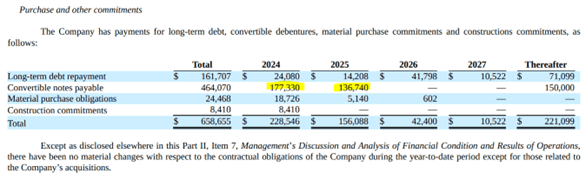

And more dilution can likely be expected as there are $300 million convertible notes that need to be redeemed over the course of the next 2 years.

Convertible notes repayment schedule (Tilray’s 2023 Annual Report (10-K))

Over the last 3 years their operations have been bleeding cash. Although in 2023 the operational cash flows were slightly positive.

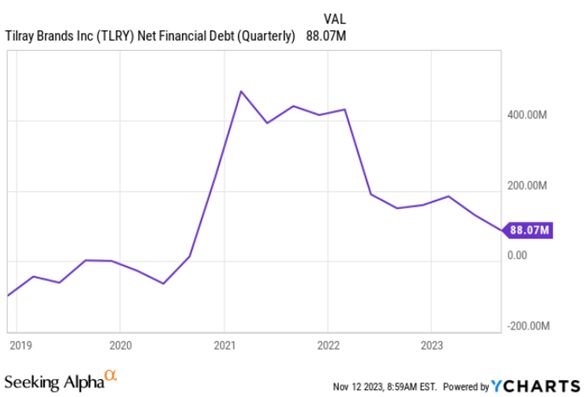

Net financial position deteriorated in 2020 and 2021 but improved since 2022. The improvement of their net financial position can be fully attributed to the issuance of equity issuance. Over the last 3 years Net cash provided by financing activities totalled $ 322 million.

Net debt position (on a quarterly basis) (YCharts fundamental chart creator)

Revenue evolution

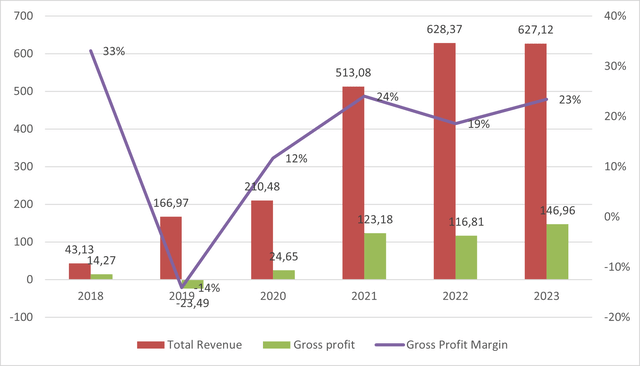

Traditional valuation methods such as discounted cash flow modelling are rather difficult to apply on Tilray. The company is not profitable and needs to scale up to reach profitability. Therefore, it is more reasonable to look at the revenue evolution and gross profit evolution to conclude if Tilray is growing fast enough and creating shareholder value. To justify a growth valuation it goes without saying that a prerequisite is that the company is growing both revenues and gross profit. In 2021 gross profit and revenues jumped related to the Aphria merger. Post-merger revenue grew by ~22% in 2022 YoY% and stagnated in 2023. This while gross profit was approximately stable. What’s remarkable is that gross profit margin is only 24%, which is quite low compared to consumer staples.

Tilray’s revenues and gross profit 2018-2023 (Tilray’s Annual Reports (10-K))

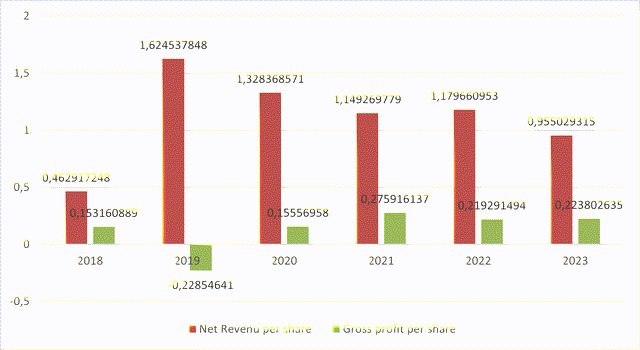

Of course, revenue growth and gross profit do not give the full story. Revenue growth can be bought by acquisitions or capex spending (or both). As stated before, acquisitions were largely financed by share issuance. Revenue and gross profit per share show the dilutive effects of share issuance.

Net revenues & gross profit per share (Tilray’s revenues and gross profit 2018-2023)

Apart from the initial growth sprint in 2019, both revenues and gross profit on a per share basis have not increased over the last 5 years.

Based on these numbers and to my opinion there was no value creation by Tilray whatsoever during this period. When reading through their last quarterly reports, it is worth noting that Tilray never reports revenue growth on a like-for-like basis or mentions the proportion of organic growth versus external growth. This adds a layer of mist on the financial number and is a red flag.

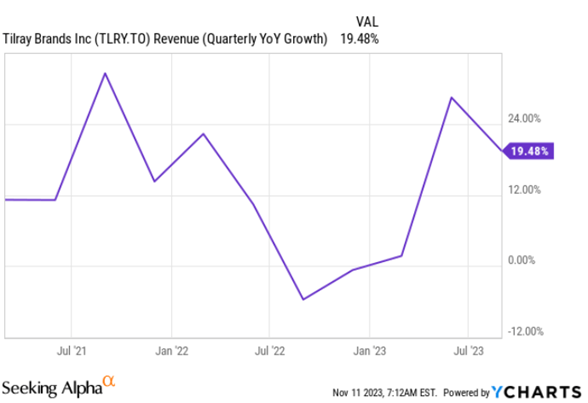

That might suggest that there is very little organic growth, and revenue growth is mainly due from acquisitions. In ‘good’ quarters Tilray reports around 20% revenue growth. This is too low to justify a growth stock valuation (based on revenues).

Quarterly revenue growth (YoY%) (YCharts fundamental chart creator)

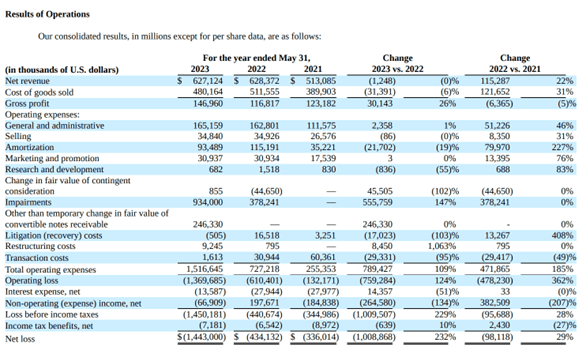

A last important point is that gross profit does not equal net profit. The company has reported losses year after year since 2019. Besides the relatively low gross profits, the income statement reveals high SG&A costs. In the last two years SG&A costs totalled around $ 200 M. or approximately 30%. Tilray’s cost structure is inherently unhealthy and does not allow the company to become profitable in the near future even when gross profits would increase considerably.

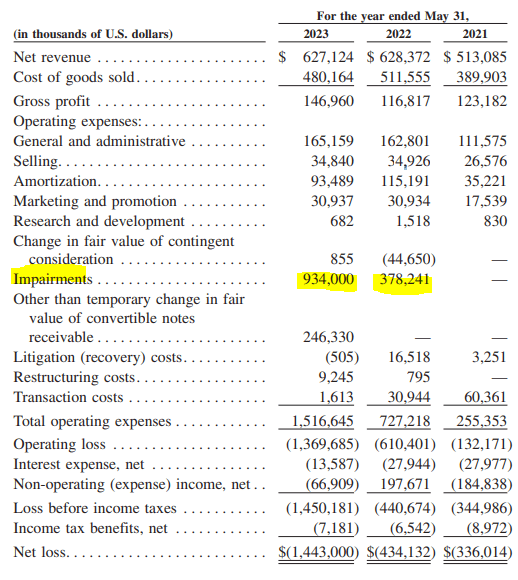

Income statement 2021-2023 (Tilray’s 2023 Annual Report (10-K))

Impairments

Another indication that Tilray’s M&A strategy is far from being successful is the impairments that Tilray did over the last two years. In 2022 and 2023 impairments totalled $ 1.3 billion. These impairments were mainly composed of a write-down on goodwill and impairment of intangible assets (customer relations and distribution channels).

Net expenses including Impairments (Tilray’s 2023 Annual Report (10-K))

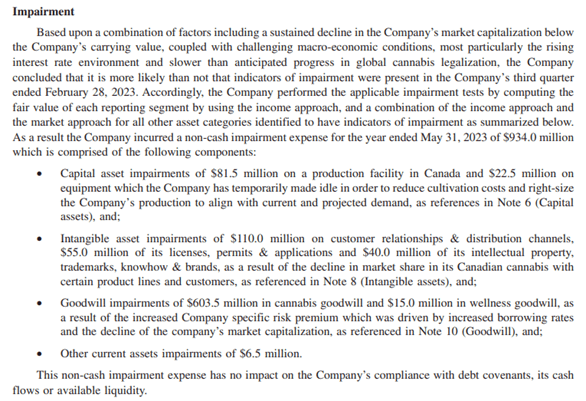

For the $ 900+ million impairment the company pointed at the increased interest rates, slower progress in global cannabis legalisation and the declining share price.

Impairments details 2023 (Tilray’s 2023 Annual Report (10-K))

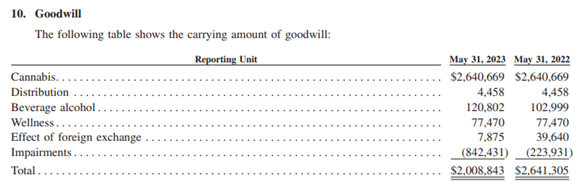

It is a fair assumption that more impairments will follow in 2024. There is still around $ 2 billion of goodwill in the books.

Goodwill & Impairments (Tilray’s 2023 Annual Report (10-K))

Management compensation

Executive compensation is markedly high. In 2023 the CEO, Irwin Simon, earned a staggering $15 million. This is approximately 10% of gross profits and is disproportional to the company’s earnings. The CEO’s salary package was even more exuberant in 2021. According to mjbizdaily.com, Irwin Simon received around $ 30 million in the calendar year that Aphria merged with Tilray. Exuberant salary packages do not help establish investors’ trust and are inappropriate considering the company’s financial performance.

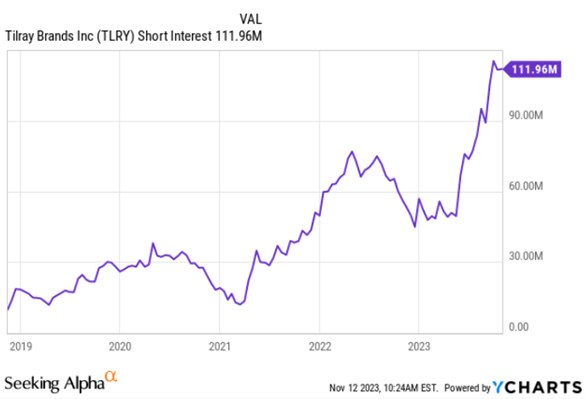

Short interest

The market is losing its patience with Tilray. The share price is at a 5-year low and short interest is increasing. Considering the weak fundamentals and the lurking dilutions this should not come as a big surprise. Short interest amounts to approximately 20% of outstanding shares.

Short interest (nasdaq.com) (YCharts fundamental chart creator)

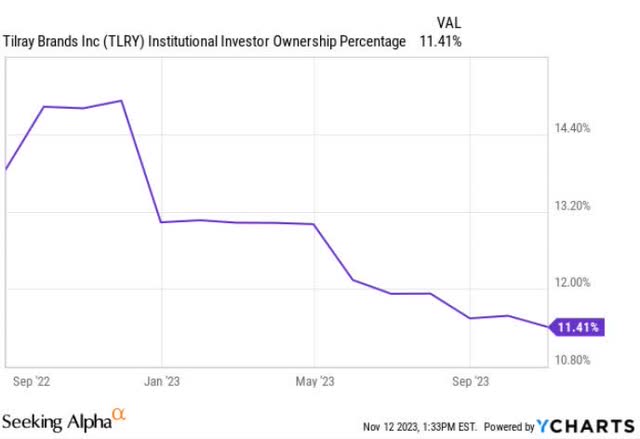

Additionally, institutional investors are decreasing their shareholdings.

Institutional ownership (%) (YCharts fundamental chart creator)

Valuation & conclusion

As the article title is hinting, I am not overly positive on Tilray. In my opinion, Tilray is a good short candidate for the underlying reasons:

- Growth of revenue and gross profit do not compensate for dilutive effects of new share issuance. Revenue per share and gross profit per share are not growing.

- Tilray is rigging up M&A deals financed with share issuance causing a flood of new shares.

- The share price is at a 5-year low, while equity issuance is needed. High interest rates and capital costs present an extra headwind for the company.

- Recent impairments indicate M&A activities have been destructive for shareholder value.

- Organic growth is not reported in financial statements and likely is not that impressive.

- CEO Irwin Simon’s salary is exuberant, especially compared to gross profit.

- The company has not reported profits yet and is not likely to do so in the near future. Their core cost structure does not allow near-term profitability. Gross profit margin is low and SG&A costs are extremely high.

- Shorters are building a position in Tilray.

- Share price is reaching penny stock territory and the market cap is nearing the $ 1 billion threshold. Institutional investors might be obligated to sell.

Although the share price is at a 5-year low, the company is still valued at approximately $ 1.1 billion. The current EV/Revenue valuation of approximately 2x might seem reasonable for growth investors. To me that valuation multiple is unjustified for a business with such low gross profit margins and poor prospects for profitability. And as explained before Tilray does not earn the label of growth stock as revenues per share have actually declined over the last 5 years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.