Summary:

- Tilray has been unable to find operational profits.

- Revenue has been declining for the last 6 quarters.

- Costs have been climbing as margins have failed to improve.

Ethan Miller

Thesis

The ongoing price war in the Canadian cannabis sector has seen overproduction lead to an extremely competitive ecosystem where growers are regularly destroying expired flower. Tilray Brands, Inc. (NASDAQ:TLRY) has been unable to improve its negative operating margins and has slowly declining quarterly revenues. Though it has maintained a healthy war chest of available cash, it has done so through dilution.

I am recommending a Sell for Tilray because it has not found a competitive enough business model and is slowly drowning in its own operational costs. Unless it finds a way to further develop or adapt, it will eventually become another victim of the price war.

Company Background

Tilray was founded in 2013, and is headquartered is located in Nanaimo, British Columbia, Canada. Besides Canada, the company has operations in several countries around the world, including the United States, Europe, Australia, and Latin America. Tilray was one of the first companies to receive a license from Health Canada to produce and sell medical cannabis, and has since expanded into the recreational market.

In addition to its cannabis operations, Tilray has also established a research and development division focused on the development of new pharmaceutical products. The company has partnerships with several leading universities and research institutions around the world and is actively working to discover new uses for cannabis and cannabinoids in the treatment of various medical conditions.

Financials

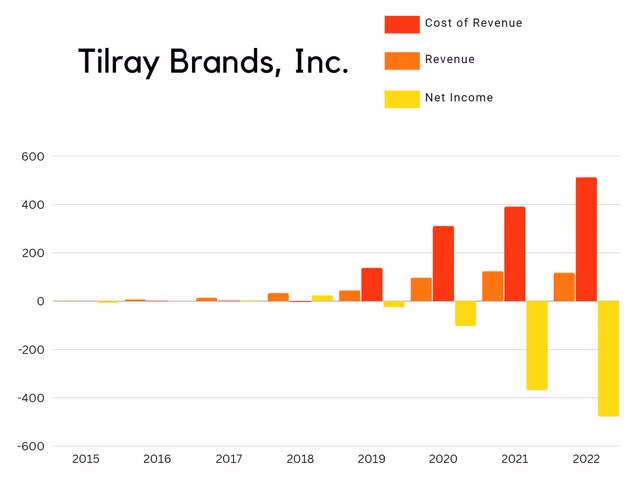

As of the most recent quarterly report, Tilray had $433.5M in Cash and Equivalents, an operating income of -$42.8M, and a Net Income of -$69.5M. When looking at their annual statements. This company has increasing costs and net losses.

Tilray Annual Revenue (Blake Downer)

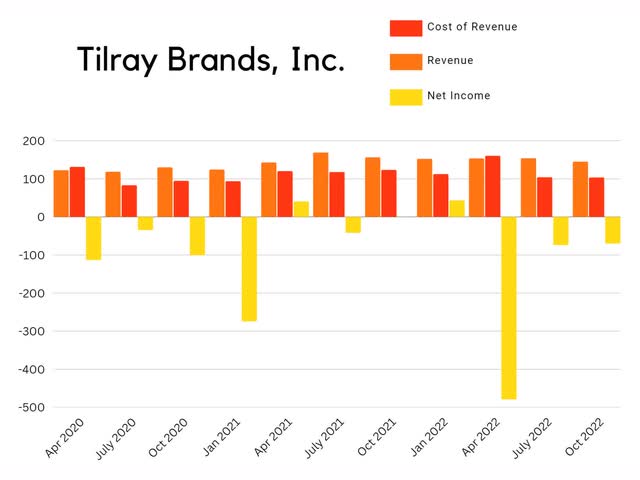

When looking at the quarterly statements, it becomes easier to see that Revenue has actually been slowly declining since its peak in Q2 2021.

Tilray Quarterly Revenue (Blake Downer)

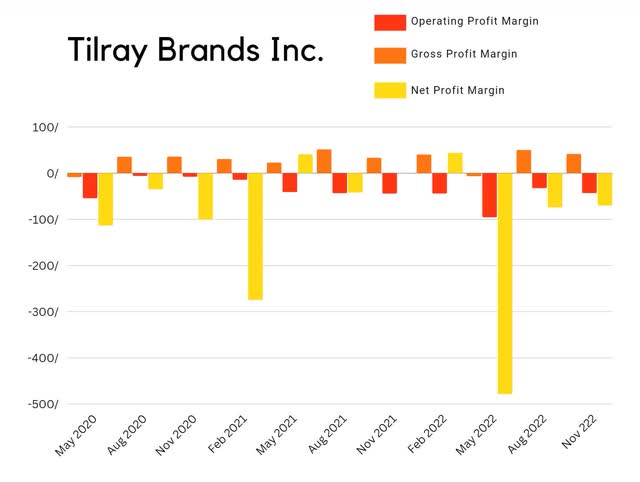

Not only is this company in a situation where costs are climbing and revenue is dropping, EBITA is consistently negative, and EBITDA is inconsistently negative.

Tilray EBITA and EBITDA (Seeking Alpha)

This can be more easily seen graphically when looking over their margins. Gross profit has been consistently positive, but not sufficient to overcome their operating costs.

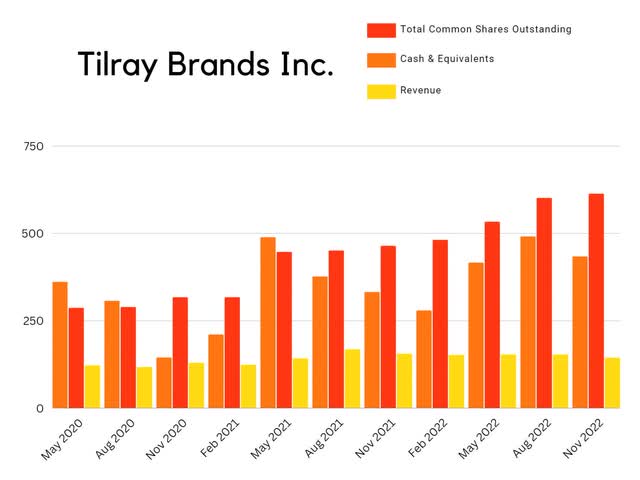

The net result has been a situation where cash falls over time, except when the company refills their coffers by diluting shareholders. The fact that these float increases aren’t being translated into revenue increases, is what makes this dilution toxic.

Tilray Share Count vs Revenue (Blake Downer)

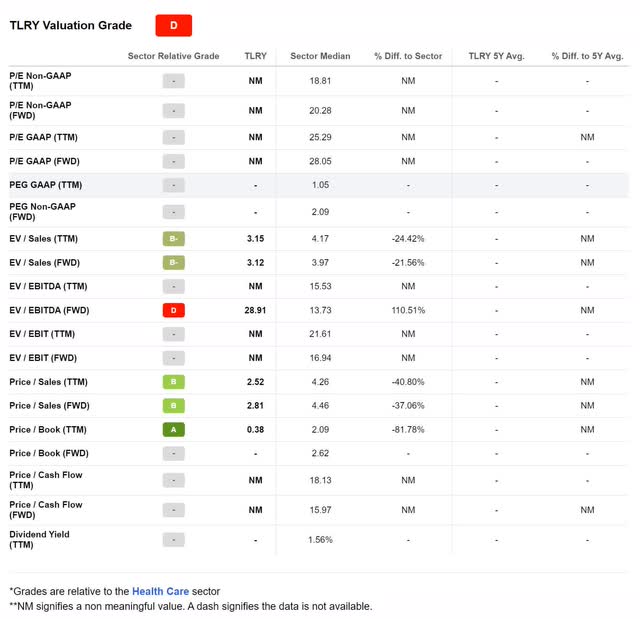

Valuation

As of March 6th 2023 Tilray had a market cap of $1.71B and was trading for $2.77 per share. Since the company has a trailing PS of 2.52, and a forward PS of 2.81. I believe this is mostly due to its considerable assets as it’s also trading at only 38% of its book value.

TLRY Valuation (Seeking Alpha)

Risks

Since the Oct 6th 2022 Biden announcement, the entire cannabis sector has been waiting for the sector wide rally it will almost certainly cause. Entering a short position on any company in the sector is inadvisable.

Catalysts

This company keeps a large war chest of cash and cash equivalents. They have a history of diluting at times when they already had a significant amount of cash on hand and are likely to continue this behavior. This means instead of waiting for them to run low, they could decide to have another round of dilution at any time.

If their revenue continues to drop, their negative operating income will only grow larger and the rate they burn money will increase. They aren’t exactly in a death spiral yet, but if the situation gets any worse, the slope of their decline will become steeper.

Conclusion

Tilray is forced to operate in one of the most competitive ecosystems on the planet. Overproduction has gotten so bad that they had to announce the conversion of some of their growing facilities to fruits and vegetables. They have made several smart moves including trying to gain a toehold in as many markets as possible.

I believe that conditions in the Canadian cannabis sector will slowly improve as more of their competition goes out of business and that this company will be doing much better in the future than they are now. But, if they don’t make a major course correction, their shareholders will likely continue to suffer from non-revenue increasing dilutions until then.

What Is My Plan With TLRY?

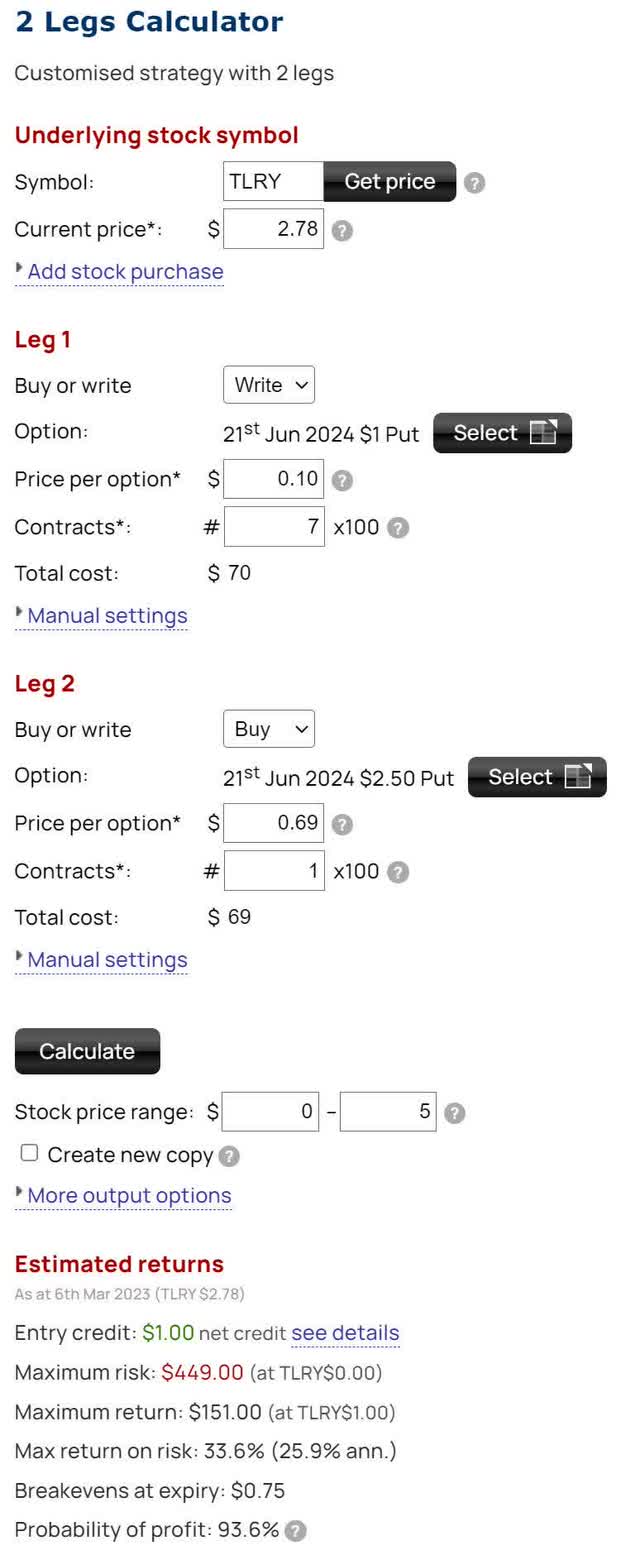

Just because I think this company is a Sell, does not mean it’s safe to short it. Opening oneself up to an unlimited risk strategy in the face of a potential sector wide rally does not sound like a wise decision. If I were planning on entering a TLRY position in the near future, it would be some form of front put ratio spread.

TLRY Front Put Ratio Spread (Optionsprofitcalculator.com)

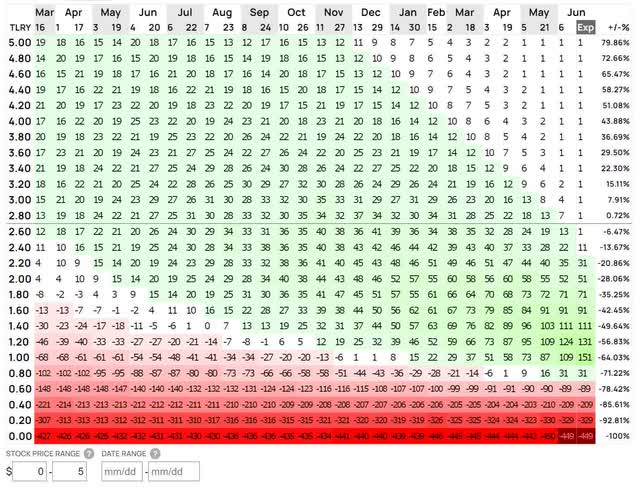

Typically, this is employed with one long position and two short positions but because I was unwilling to accept any risk in the event of a huge rally, with this hypothetical trade I chose to push all the risk to the other side of the max profit zone by selling additional puts. This trade as it sits right now, has a 93.6% probability of profit and a break-even of $0.75 per share. Since it only locks up $700 to sell the 7 cash secured puts and a maximum return of $151, this comes with a 15-month max return on risk of 21.6%. Not exactly stellar returns, but it comes with a 93.6% chance of not losing money. Even if price falls below the break even of $0.75, that represents another 72.9% move down from today’s share price. This company is already trading at only 38% of book value, another 72.9% drop would mean a Price to Book ratio of 0.10. It is unlikely to stay there for very long as value investors will step in and start buying based on things like the value of the company if it were forced to declare bankruptcy.

TLRY Front Put Ratio Spread (Optionsprofitcalculator.com)

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.