Summary:

- Tilray Brands announces record-breaking revenues in recent quarter, with improved financial performance, free cash flow, and positive adjusted EBITDA.

- The company’s stock price rallies and gains as much as 30% over the last two days.

- Tilray’s acquisition of HEXO solidifies its dominance in the Canadian cannabis market and expands its product offerings.

- I rate the company as a hold for now and recommend you watch for future rallies.

Riccardo_Mojana

Tilray Brands (NASDAQ:TLRY) announced record-breaking revenues in its recent Q4-2023 report. The company has completed its acquisition of HEXO and is reporting better financial performance compared to last quarter and last year. Although the company is still operating in the negative, it reported free cash flow and positive adjusted EBITDA. The news of the company’s improved performance caused its stock price to rally and gain as much as 30% over the last two days. The news is welcoming to investors, but there are still choppy waters ahead. I rate the company as a hold for now and ask investors to consider reloading investments after the current rally subsides.

Business Operations

Tilray reports its business in four operating segments: Canadian Adult Use Recreational, Canadian Medical, Beverage Alcohol, and Wellness and Medical Distribution. Besides Canada, the company has medical cannabis operations in Europe including Germany, Italy, Poland, and the Czech Republic. Revenue from international operations makes up 15% of the company’s total revenues. The company did not give any updates on its operations in New Zealand and Australia.

Tilray’s acquisition of HEXO has solidified the company’s dominance in the Canadian cannabis market. Tilray has a variety of cannabis brands and products. The company says in its Q4-2023 press release:

Tilray’s market share in Canada has reached ~13% and the Company holds the #1 market position across all major markets and a leading share across most product categories. Tilray is now #1 in Flower, Oils, and Concentrates, and #2 in Pre-Rolls, #4 in Vape, and Top 10 in all other categories.

The HEXO acquisition gave Tilray additional cannabis products, brands, and distribution networks. The company presents its larger footprint in its HEXO acquisition presentation. Tilray feels that the Canadian cannabis market will stabilize over time through consolidation of its large numbers of LPs and retail stores. According to the company’s Q4-2023 earning transcript, it may begin growing fruits and vegetables at some of its facilities in order to improve financial performance.

Tilray has positioned itself well in the US via its ownership of several breweries. Its alcohol business makes up 18% of its total revenues. The company owns the following US breweries: SweetWater Brewing Company, Montauk Brewing Company, Alpine Beer Company, Green Flash Brewing Company, and Breckenridge Distillery. Some of these companies enjoy large US distribution. Each one offers its own unique craft brews and spirits. The trend towards craft alcohol remains strong in the US.

The company’s wellness segment makes up 8% of its total revenue. Its major asset is a hemp protein company named Manitoba Harvest. Its products are sold online and at major retail stores across the US and Canada.

Q4-2023 Record Revenue and Performance

Tilray showed marked improvement across most of its operating segments. Total revenue for Q4-2023 was $184.2 million compared to $153.3 million from last year’s quarter, which represents a 20% increase YoY. The quarter marked the highest quarterly revenue numbers the company has seen to date.

The company reported a gross profit of $67.2 million versus negative $67.2 million during the prior year’s same quarter. Margins were 36.5% compared to negative 4.4% YoY. Net loss was $119.8 million compared to a loss of $457.8 million YoY. The company net loss declined by 75% YoY.

Q4-2023 revenues break down in to the following segments: Cannabis Business $64.4 million,

Distribution Business $72.6 million, Beverage Alcohol Business $32.4 million, and Wellness Business $14.8 million. Compared to the previous year’s quarter the cannabis segment was up 21%, the beverage segment up 50%, distribution up 19%, and wellness down around 5%.

Cannabis revenue breaks down into the following categories: Canadian Medical $6.1 million, Adult Canadian Recreational $58.3 million, Wholesale $0.8 million, and International $15.7 million. The company reported excise taxes of $16.4 million.

Adjusted EBITDA was $22.2 million versus $11.5 million YoY, representing an increase of 93%. Tilray ended the quarter with more than $30 million in free cash flow. The company reported cash on hand and short-term investments of $448.5 million. Its current and total assets far outweigh its total liabilities.

The next improvement which one will want to see in the company’s financial performance is the movement towards net income instead of loss.

|

In Millions of $US |

May 23 |

Feb 23 |

Nov 22 |

Aug 22 |

May 22 |

|

Revenues |

184.2 |

145.6 |

144.1 |

153.2 |

153.3 |

|

Cost of Revenues |

117.0 |

156.3 |

102.9 |

103.5 |

160.1 |

|

Gross Profit |

67.2 |

(10.7) |

41.2 |

49.7 |

(6.7) |

|

Margins |

36.5% |

(7.3%) |

27.8% |

32.5% |

(4.4%) |

|

Total Operating Expenses |

86.4 |

76.5 |

84.0 |

82.0 |

88.7 |

|

Operating Income |

(19.3) |

(87.2) |

(42.8) |

(32.2) |

(95.4) |

|

Net Income |

(119.8) |

(1,171.0) |

(69.5) |

(73.5) |

(478.1) |

|

Cash & ST Investments |

448.5 |

408.3 |

433.5 |

490.6 |

415.9 |

|

Current Assets |

773.0 |

758.5 |

814.7 |

910.9 |

803.5 |

|

Total Assets |

4,307.3 |

4,375.9 |

5,474.4 |

5,592.5 |

5,449.7 |

|

Current Liabilities |

433.0 |

469.7 |

426.5 |

273.3 |

280.3 |

|

Total Liabilities |

977.3 |

969.1 |

991.2 |

1,029.3 |

1,008.3 |

|

Free Cash Flow |

31.19 |

(19.49) |

24.67 |

(49.27) |

(26.12) |

|

Book Value Per Share |

$6.22 |

$5.51 |

$7.29 |

$7.53 |

$8.26 |

|

NTM Total EV / Revenue |

2.14x |

||||

|

Median Street Target |

$8.83 |

Financial data from Seeking Alpha and TIKR.

Tilray also reported its PY2023 results. Revenue was $627 million compared to $628 million in the prior year and gross profit was $147 million. The company reported a PY net loss of $1.443 billion versus $434 million the prior year. This amount includes the large asset reduction / impairment from Q3-2023. The adjusted net loss was $130 million compared to $183 million from the previous year. Adjusted EBITDA was $61 million compared to a $48 million during the previous year. The amount represents a 28% increase.

Cannabis revenue for the year was $220 million, down from $238 million during the prior year.

Gross cannabis revenue broke down into the following categories: $214.3 million Canadian Adult, $43.6 million International, $25 million Canadian Medical, and $1.4 million Wholesale. The company paid $63.9 million in excise tax for the year.

The company gave some guidance for PY2024. It expects an adjusted EBITDA between $68 million and $78 million, which will represent an increase from PY2023. The company will focus on generating free and positive cash flow from quarter to quarter.

Stock Price Increases 30% During Rally

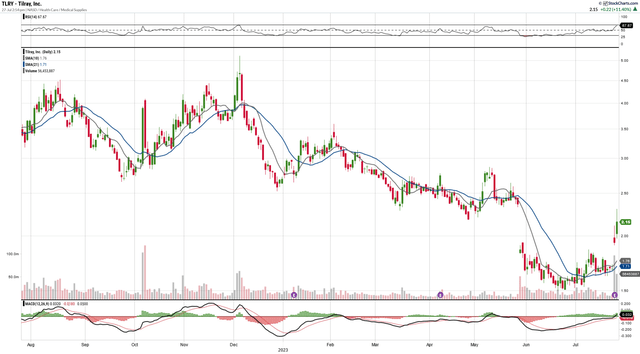

1-yr price performance graph for Tilray (www.stockcharts.com)

The company’s stock price has declined 34% over the last twelve months. The trend is consistent with the bearish conditions surrounding the cannabis market. The recent rally caused by the earnings surprise brought the price up 38% to a high of 2.25 earlier today. The price is currently trading above its 20 and 50 moving-day averages, but still trailing its 200 day-average.

The company’s stock price remains undervalued as is true for all cannabis and cannabis support stocks. Tilray’s book value per share is over $6.00 and its median target price is over $8.00. The larger stock market has entered bull territory. The rate hike decision from the Fed this week seems to have made the market even more bullish. These factors are helping Tilray’s rally and it will likely subside. When the rally loses steam, the price will fall back between $1.50 and $1.75 per share.

Risk and Investment Strategy

The rally for Tilray’s stock will not last much longer. The record performance and HEXO acquisition will soon be digested by investors and the stock price will go back to its previous average. Such a movement may allow investors to reload on the dip. Otherwise, during the rally, I rate the stock as a hold. It is likely that the company’s future earnings releases will rally the stock again, but one must be cautious of the overall bearish conditions.

Tilray admits in its Q4-2023 press release that it is not waiting for the synergies of US cannabis legalization or passage of the SAFE Banking Act. The company is rather looking at its expansion into European markets, continuing its Canadian market dominance, and growing its US alcohol and wellness distribution. The company is committed to better financial performance and it will be good news for future stock price gains. There is plenty of room for Tilray’s stock price to grow, but the larger market conditions will continue to have negative effects. As it stands, the company is becoming one of the stronger players compared to the other Canadian cannabis LPs. It is one of the few companies that has not undergone a reverse stock split.

Conclusion

Tilray’s Q4-2023 financial reports showed improved financial performance. The company has completed its acquisition of HEXO and now enjoys a 13% share of the Canadian cannabis market. Tilray reported record quarterly revenues and free cash flow for the quarter. The company remains firm in making its business strategy profitable through 2024. It will continue to expand its European operations and improve upon its Canadian performance. The news of the company’s strong quarterly report caused its stock price to rally over the last two days, gaining as much as 30% in price. The sentiment towards Tilray may be turning more positive, but the larger cannabis market maintains constant bearish conditions. We see the larger market to enter into bullish terrain and hope that all cannabis stocks receive new valuations soon which reflect the new environment. Until then, I rate the company as a hold and recommend that investors watch the end of the current rally and future earnings reports from the company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TLRY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.