Summary:

- Tilray reported earnings which are likely to pace Canadian peers.

- The company delivered its 15th consecutive quarter of positive adjusted EBITDA and even generated positive free cash flow.

- Management continues to expect positive free cash flow for this fiscal year.

- The stock no longer trades with the hype that it did previously, making it a worthwhile bet on prospects for cannabis legalization in the United States.

Douglas Rissing

Tilray (NASDAQ:TLRY) is likely still widely known as a Canadian cannabis operator that’s hyped to be an investment on legalization of cannabis in the United States. What some investors might not know is that much of the hype has faded courtesy of a vicious crash in the stock price. While one can still make an argument that the stocks of US operators remain more compelling, I can see some investors continuing to favor TLRY as a momentum play in cannabis due to the greater liquidity. With the stock trading at reasonable valuations, investors may find the stock a legitimate buying opportunity for prospects of legalization.

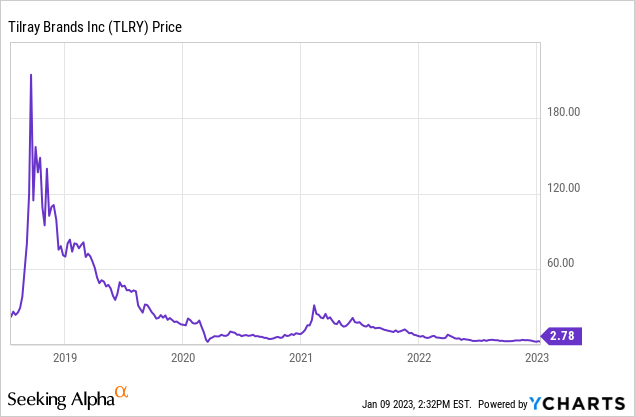

TLRY Stock Price

The cannabis sector has gone through many boom and bust cycles, mostly driven by hype. TLRY stock at one point traded deep in the triple digits after Canada legalized cannabis in 2018. TLRY is down 90% even based on the significantly lower peak in 2021.

I last covered TLRY in October where I explained why the stock was a buy on President Biden’s changing stance on cannabis reform. The stock is down double digits since then. Meanwhile, TLRY continues to improve its balance sheet and make progress on cost rationalization.

TLRY Stock Key Metrics

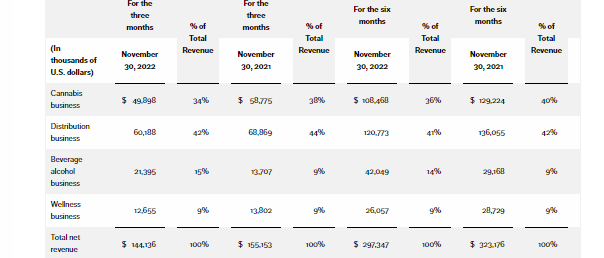

The latest quarter saw revenues decline 7% YOY to $144.1 million. That did however include a 8.5% headwind from currency fluctuations. On a constant currency basis, revenues were slightly higher YOY.

As usual, most of TLRY’s business actually comes from non-cannabis operations in spite of the company being known for cannabis. That said, TLRY maintained its top leadership position in Canada with 8.3% cannabis market share and cannabis sales made up 34% of overall revenues.

FY23 Q2 Press Release

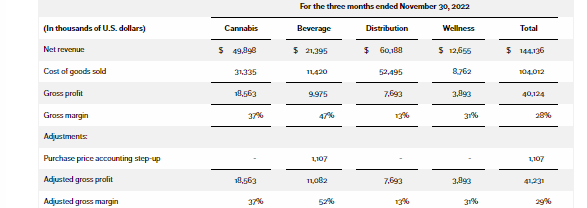

Cannabis gross margins were solid at 37% while beverage gross margins led the way at 52%.

FY23 Q2 Press Release

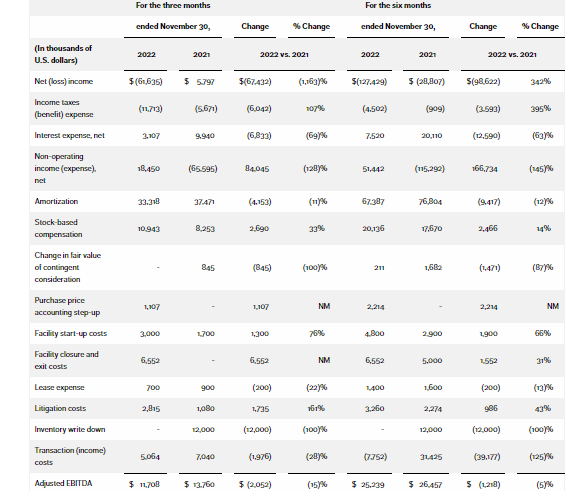

TLRY generated $11.7 billion in adjusted EBITDA, the 15th consecutive quarter of positive adjusted EBITDA. The company’s reconciliation to adjusted EBITDA includes more adjustments than I typically see.

FY23 Q2 Press Release

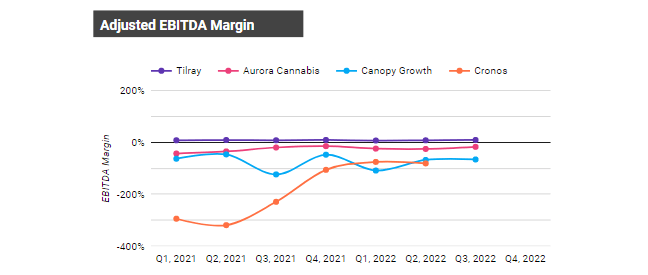

TLRY is the only one of the biggest Canadian cannabis operators to generate positive adjusted EBITDA.

Cannabis Growth Portfolio

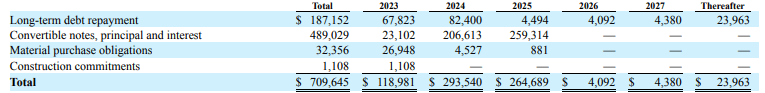

This year, TLRY has made great use of its at-the-market program to help improve its balance sheet. The company ended the quarter with $433.5 million in cash vs. $593 million in total debt, representing significant improvement from the sequential quarter which had $415.9 million in cash and $605.7 million in debt. TLRY does have a significant amount of debt maturing over the next several years – given the higher interest rate environment, I would not be surprised if TLRY continues to issue equity to pay down debt.

2022 10-K

On the conference call, management reiterated expectations for up to $80 million in adjusted EBITDA with positive free cash flow generation for the year.

Is TLRY Stock A Buy, Sell, or Hold?

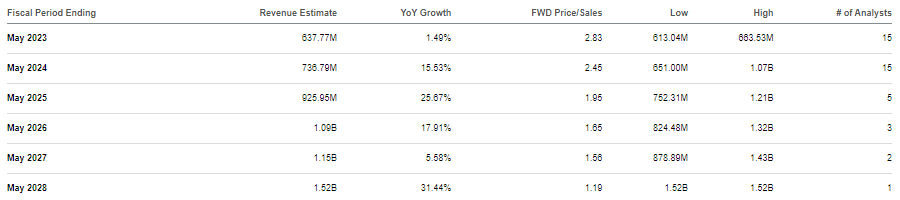

TLRY used to be a highly-priced ticket on cannabis legalization. As I stated in my prior article, President Biden has signaled intentions to move forward with cannabis reform. Yet TLRY trades at among its cheapest valuations ever, at less than 3x price to sales.

Seeking Alpha

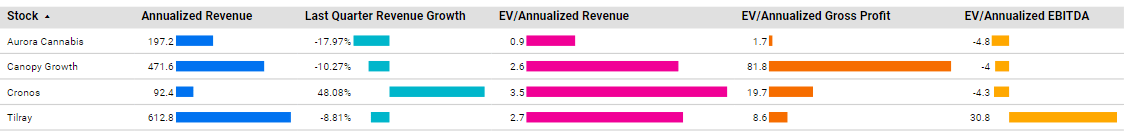

As compared to Canadian peers like Aurora Cannabis (ACB), Canopy Growth (CGC), and Cronos (CRON), TLRY also looks competitively priced especially considering that it is the only company with positive adjusted EBITDA.

Cannabis Growth Portfolio

TLRY stands to benefit strongly from US legalization for two primary reasons. First, courtesy of the great spaciousness of Canada, TLRY operates several large greenhouses. Absent legalization, these greenhouses are not able to be fully utilized as the Canadian market is too small. That has been such a problem that management has even expressed intent to utilize excess capacity to grow fruits. US legalization may enable international commerce, allowing TLRY to operate their greenhouses at full capacity with higher margins.

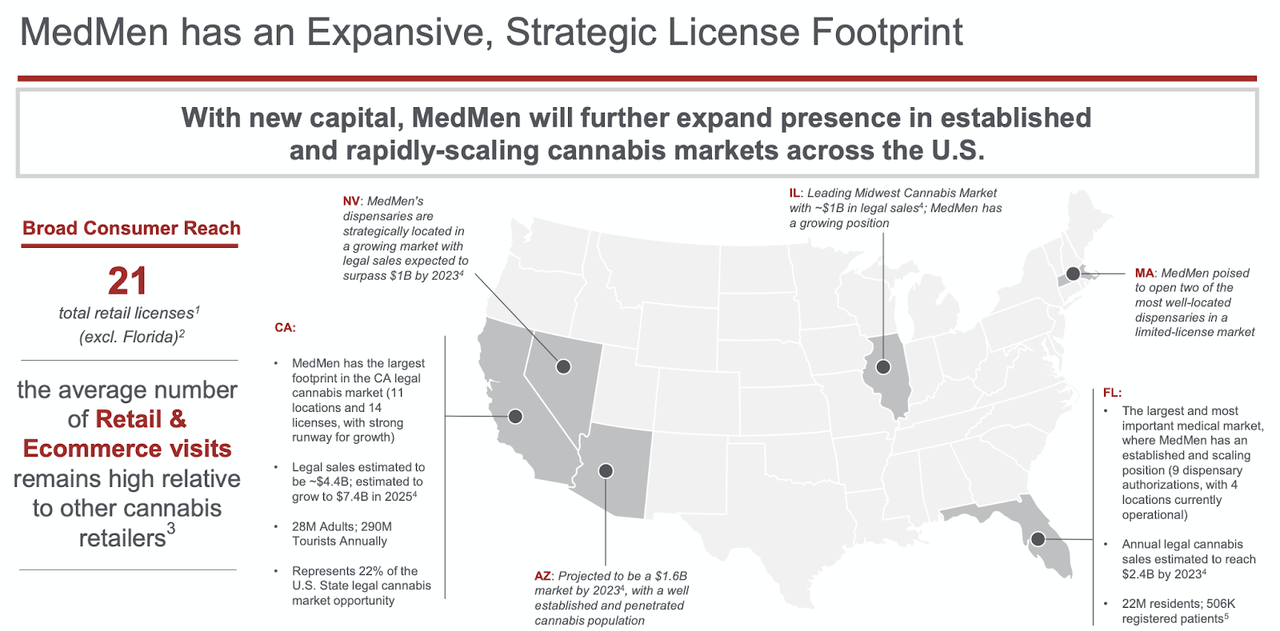

Another key point is that TLRY has previously made a $165.7 million investment in the convertible notes of US multi-state operator MedMen (OTCQB:MMNFF). MMNFF is a well known multi-state operator (‘MSO’) in the United States.

2021 Investor Presentataion

Assuming 15% long-term growth, 15% long-term net margins and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see TLRY trading at 3.4x sales, presenting 20% potential upside based on consensus estimates. Upon legalization, those margin and growth assumptions may prove too conservative, let alone the likelihood of TLRY trading at mania valuations.

What are key risks? There are numerous risks to consider. TLRY represents a preferred trading vehicle due to it being listed on major exchanges, something that the stocks of US cannabis operators do not have due to cannabis still being illegal on the federal level. The flipside is that federal legalization may cause capital to shift out of Canadian operators and toward US operators. Another risk is that of a potential lack of focus. Management noted their intent to become the “most diversified cannabis lifestyle company.” If the cannabis business was so lucrative, then one would not expect TLRY to be so aggressively pursuing businesses outside of cannabis, especially considering that cannabis already is a minority portion of the overall business today. While diversified business lines may help boost margins, it may reduce investor appetite in the company as a cannabis investment. Other key risks include ongoing operating losses. While TLRY appears set to start generating positive free cash flow, it will likely continue to lose money on a GAAP basis and will need to keep diluting shareholders to fund the business. This makes TLRY a potentially dangerous long-term holding as legalization needs to happen sooner than later for this stock to pay off. I continue to view higher quality MSOs and certain ancillary stocks to be the best way to position long term in the cannabis sector. TLRY is still buyable here, but I prefer to instead invest directly in the stocks of US-based companies.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Cannabis Growth Portfolio.

The Generational Opportunity In Cannabis Stocks

For more coverage on cannabis stocks including my top picks, consider a subscription to Cannabis Growth Portfolio. Subscribers get access to the model portfolio, cannabis sector research dashboards, real-time updates, and more.

Plus, get access to exclusive reports:

- Trulieve’s monopoly strategy

- Why Ayr Wellness has multi-bagger upside

- My top pick of the year

Join Cannabis Growth Portfolio Today!