Summary:

- Tilray stock surged almost 40% after following the announcement that the Biden administration took a major step towards the legalization of marijuana.

- On October 6th, Biden announced that he will pardon all federal marijuana possession convictions, as well as all respective convictions in Washington D.C.

- Tilray stock quickly became the most discussed stock on social media, and sentiment could be a catalyst for an aggressive price appreciation.

- In my opinion, Tilray’s 40% price jump could have further room to go.

- I advise to buy the 125/200 percent moneyness call spreads (short $8 strike, long $5 strike) with about 10 weeks to expiration.

Olga Tsareva

Thesis

Tilray (NASDAQ:TLRY) stock surged more than 30%, and an additional 7% after hours, following the announcement that the Biden administration took a major step towards the legalization of marijuana – Biden announced that he will pardon all federal marijuana possession convictions.

TLRY is down about 98% from all-time highs, and the stock has a strong history of aggressive rallies when speculations on marijuana legalization heat up. I think this will be another opportune time to trade a short- to medium-term price appreciation.

Biden’s Announcement

On October 6th, Biden announced that he will pardon all federal marijuana possession convictions, as well as all respective convictions in Washington D.C. This is a major step in the legalization of weed and it is estimated to impact perhaps more than 10,000 individuals.

Furthermore, Biden also pleaded that all governors would follow his move and he has committed to ask the Department of Health and Human Services to review marijuana’s classification under federal law as a schedule one drug – given that marijuana is currently labeled under the same classification as heroin and LSD.

The announcement will heat up speculations that the full legalization of marijuana is imminent. In any case, Biden’s rhetoric supports such speculation: (emphasis added)

It’s already legal in many states, and criminal records for marijuana possession have led to needless barriers to employment, housing, and educational opportunities.

Biden further said, that: (emphasis added)

As I said when I ran for President, no one should be in jail just for using or possessing marijuana.

Why Tilray Jumped

As one of the world’s leading marijuana manufacturer and distributers, Tilray would be poised to enjoy an enormous business expansion – on the backdrop of a full marijuana legalization in the U.S.

For reference, Tilray is a vertically integrated cannabis company, engaging in the research, cultivation, production, marketing, and distribution of marijuana products. Currently, Tilray operates in Canada, Australia, New Zealand, as well as selected regions in the United States, Europe and Latin America.

Admittedly, Tilray’s financials are somewhat scary. For the trailing twelve months, the company recorded revenues of $628 million, but only managed to generate a gross profit of $116.8 million. Given high selling and marketing expenses, operating profit was negative $228.6 million.

Tilray is a net debtor, but the degree of leverage is acceptable in my opinion: As of June 30, the company had $623 million of total debt, against cash and cash equivalents, including short term investments, of $415.9.

However, the argument for Tilray is not what the company’s financials are today, but what the financials could be in the future, especially under consideration of a marijuana legalization in the US, which could also be followed by a similar legalization in some European countries, notably Germany.

Trading Higher On Sentiment

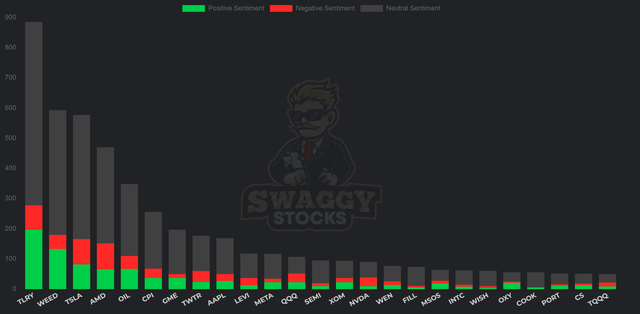

Investors, or traders, should consider that TLRY is a stock loved by retail investors. And accordingly, sentiment is a major driver of the price action. Following the Biden’s announcement, Tilray stock quickly became the most discussed stock on social media. On Wall Street Bets, for example, TLRY overtook popular names such as Tesla (TSLA) and Twitter (TWTR).

It would be easy to argue that investors should disregard WSB trends. But I strongly disagree. GameStop (GME) and Bed Bath & Beyond (BBBY) should have proven sufficiently that social media is a major catalyst for an aggressive price appreciation.

I would also like to point out that Tilray’s short interest is close to 12% of float (Source: Bloomberg Terminal, SI). Thus, aggressive buying from retail investors could fuel some ‘panic buying’ from short covering.

In my opinion, Tilray’s 40% price jump could have further room to go. In any case, reflecting on a valuation of about x2.3 Price to Sales, I argue the risk/reward is fair.

Conclusion

Investor Takeaway

Betting on a sentiment-fueled price appreciation is risky. There is no guarantee that a legalization of marijuana in the U.S will materialize. If a legalization is achieved, there is no guarantee that Tilray will greatly benefit from the market expansion. And if Tilray benefits, there is still no guarantee that the stock price reacts in accordance with fundamentals.

However, the risk/reward is clearly skewed to the upside for TLRY. In my opinion, down 97% from all-time highs and down 47% year to date, lots of negativity is already priced in. So, under the consideration of strong risk-management, the downside is relatively limited. On the upside, however, Tilray could move sharply and quickly – given the reasons outlined in this article.

Trade Recommendation

Given the speculative nature of the thesis, I believe buying call spreads provides the best risk/reward for investors interested to trade TLRY – given that the loss for call spread is limited to the options premium outlay. Personally, I advise to buy the 125/200 percent moneyness call spreads (short $8 strike, long $5 strike) with about 10 weeks to expiration (December 16, expiration). The trade would offer a pay-off of approximately 8:1, if Tilray closes above the long strike on expiration ($8/share).

Disclosure: I/we have a beneficial long position in the shares of TLRY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice.