Summary:

- Tilray’s short interest has reached a new 52-week high, indicating growing skepticism and concerns over the company’s financial situation.

- The number of outstanding shares has significantly increased due to dilution, leading to frustration among investors.

- Tilray’s recent financial results were mixed, but the acquisition of beer brands has diversified its revenue base and led to rising revenue estimates.

shapecharge/E+ via Getty Images

Back in May, I detailed how Canadian cannabis firm Tilray (NASDAQ:TLRY) saw its shares hit a new low after a major debt offering. The company was essentially refinancing debts coming due this year and next as it looked to get its financial house in order. A number of months later, the stock has rallied a little, but the number of non-believers has also risen sharply.

Tilray has been on my radar since the stock basically went vertical back in 2018, reaching a high of $300. Over the last couple of years, as the company continued to miss revenue estimates, shares plunged. It has been nearly two years since the stock even traded in the double digits, and earlier this year, Tilray hit a low of $1.50. From my most recent coverage in May, I had a hold rating on the name, and my sentiment has not completely changed just yet. At that time, I was worried about the ongoing losses and cash burn, as well as the ongoing reduction in revenue estimates. Tilray has made some major strides then, but still has a few near-term headwinds that need to be addressed.

Tilray reported its fiscal Q1 results on October 4th, and the news was rather mixed. The company beat street estimates for total revenues, but it reported a larger than expected loss. The main problem seemed to be adjusted gross margins for the cannabis segment, which plunged 16 percentage points over the prior year period. The company did narrow its net loss attributable to shareholders by about half though, as it continues to work on reducing its expense base.

Tilray reported a 20% increase in cannabis revenue in the period, mainly driven by its acquisition of Hexo. As a result, the company has market share position to 13.4%, up from around 13% in fiscal Q4. The company has also already achieved more than half of the annualized synergies it expects from the Hexo deal, which will improve the income statement moving forward. Beverage revenues were up 17%, but this growth will accelerate in the coming quarters thanks to a recent acquisition.

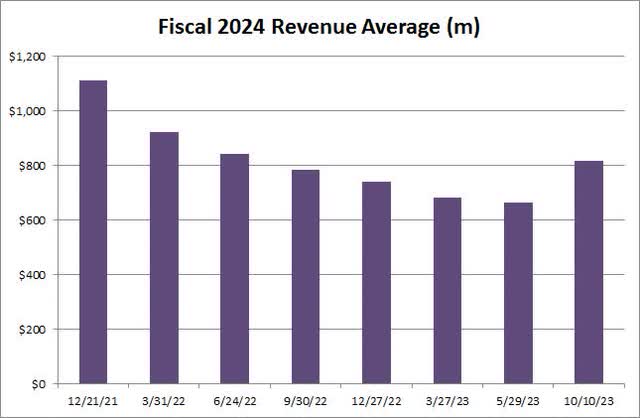

Tilray management had previously planned to get to $4 billion in revenue by 2024, but that’s not likely to happen. The company has worked to diversify its business, however, as it recently picked up several beer and beverage brands from Anheuser-Busch (BUD) as it adds to its liquor portfolio. As a result, we’ve seen something lately that we haven’t seen in a while for Tilray, and that’s rising revenue estimates. The chart below shows a history of the street’s average for the top line for the May 2024 fiscal period.

Tilray Revenue Estimates (Seeking Alpha)

One of my major concerns over time has been the company’s large losses leading to substantial cash burn. Tilray reported a $30 million improvement in operating cash burn for the quarter over the prior year period, but still burned through $16 million. Hopefully some of these reduced losses can get the company to being cash flow positive in a couple of quarters. The company finished the latest quarter with around $466 million in cash, although that number on a net basis is a lot lower thanks to debt on the balance sheet that Tilray is working to reduce over time.

Recently, I’ve been watching the number of shares short, and in the graphic below, you can see how the trend since my previous shows things being up, up, and away. The end of September data came out on Tuesday afternoon, showing a new 52-week high for the number of shares short, with short interest more than doubling since the middle of May.

At the moment, Tilray has almost 16% of its reported float short. That percentage would normally be quite high if we looked at a large cap stock, but when including names with a market cap of more than $300 million in the US market, Tilray only slots in around the top 5%. The name would move up a few slots if we cut things off around the company’s market cap of $1.5 billion, but still by no means is this in the top few dozen names in terms of float percent shorted yet.

Tilray Short Interest (NASDAQ)

One of the main reasons why short interest has increased so much is that there are more shares available to short now. This is also one of the reasons why investors have been so frustrated, with dilution piling up at a significant rate over time. As the chart below shows, Tilray’s outstanding share count has surged in the past couple of years, and these numbers are after the Aphria deal was finalized. The number of shares was well below these levels before that merger was completed.

More than 730 million shares are now outstanding here, up from roughly 460 million just two years earlier. As the company continues to use stock for acquisitions, compensation, and to repay some debts, the number of shares outstanding will continue to rise moving forward. It’s hard to get the stock going in a substantial way when you add over 110 million shares to your total in just a six-month time period. As Tilray dilutes investors a little more in the coming periods, short interest may rise a little more, providing a slight headwind to the stock.

Tilray Shares Outstanding (Company Filings)

My personal rating on Tilray remains a hold. While I am not a fan of the ongoing dilution, losses, and cash burn, the company looks a lot different now than it did in the past. Investors are no longer relying primarily on cannabis approval for significant growth, but it would be a nice upside catalyst. I’m not going to upgrade my rating to a buy yet because I want to see a quarter or two of results with these new beer brands under the belt. Additionally, I’d like to see if dilution levels off a bit, because this could also help to stop the ongoing rise in short interest.

On a valuation front, Tilray currently trades for about 1.9 times its expected sales for this fiscal year. That’s fairly comparable to the valuation that peer Canopy Growth (CGC) goes for at 1.8 times, which is why I don’t see a tremendous amount of upside for Tilray just yet. If there is more progress here on reducing losses and improving the balance sheet, then perhaps I could argue that Tilray deserves a higher multiple.

In the end, the number of shares short in Tilray has reached a new 52-week high. The growing base of naysayers primarily seems related to tremendous ongoing dilution, but also some skepticism over the company’s financial situation. Recently, the company reported some mixed results, but the addition of several beer brands to the portfolio certainly diversifies the revenue base. Should the company tighten its expense base a bit more, the name could be worth a look in 2024, but I’m not pounding the table just yet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.