Summary:

- Tilray’s stock price has fallen 18.3% in 2024, lagging behind the market and its peers.

- Tilray’s Q3 report showed slow growth, declining adjusted EBITDA, and a troubled balance sheet with high debt levels.

- Analysts’ expectations for Tilray’s future revenue and adjusted EBITDA have been decreasing, indicating potential downside risk for investors.

edelmar

I have written negatively about Tilray Brands (NASDAQ:TLRY) for a while, and I am expressing my views again before they report their Q4 later this month or in August. In early April, I warned that it could break down, and it is lower. It has not yet done what I think it will do: Break to a new all-time low.

Tilray Has a Falling Price

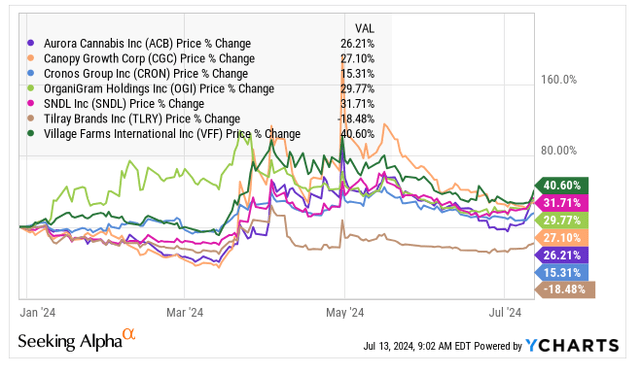

Tilray is down 18.3% in 2024, which is lagging the overall market, which has rallied. The New Cannabis Ventures Global Cannabis Stock Index is up 9.5%. The stock was up year-to-date when I wrote about it 14 weeks ago, and it has declined by 27.7% since then.

Is it a Canadian thing? I don’t think so! Here is the action among the largest Canadian LPs so far in 2024:

TLRY is the only one of these seven stocks that has declined, as the rest are each up more than 15%. Leading the way is Village Farms (VFF), which is one of my favorite cannabis stocks, as I explained a week ago. In third place is Organigram (OGI), which is my favorite LP. It has rallied since I wrote about in June, but it is still a great deal in my view.

The stock peaked in 2018 near $300, so it is down a lot now. Looking at the two year-chart of TLRY, it looks like the stock might be bottoming:

So, this is a down stock that is holding its all-time low of $1.50 a little more than a year ago and lagging its peers. Some may find the set-up appealing, but I don’t. I see falling highs. The stock faces resistance currently at $2.00, and 15% above that in my view.

Tilray Fundamentals Are Weak

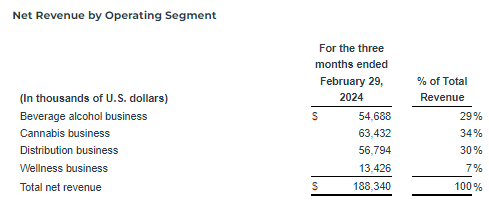

It’s been a while since Tilray provided an update. Their Q3, which ended in February, was reported on April 9th, days after my last piece. Analysts had been expecting Q3 revenue to be $200 million, with adjusted EBITDA of $14 million. Total revenue fell short of expectations at $188.3 million, up 29% from a year earlier. Adjusted EBITDA fell short as well, declining 24% to just $10.2 million.

The growth recently has been slow, except for what new acquisitions have contributed. Tilray reports four different segments, and it has done acquisitions in alcohol beverage and cannabis. Here is how the net revenue breaks down by segment:

Tilray Press Release

Alcohol revenue soared by 165% due to acquisitions primarily. The cannabis revenue grew by 33%, again boosted by M&A (Hexo). The pharmaceutical distribution revenue fell by 13%, and the wellness revenue grew by 12%.

The cannabis revenue is broken down by the company. Canadian medical cannabis revenue in Q3 was only $6.4 million, up slightly from a year earlier. Canadian adult-use increased a lot, but it was aided by the HEXO and Truss acquisitions. The $40.3 million net revenue was up from $31.7 million. Wholesale cannabis revenue during Q3 added $2.8 million, which was up from $0.1 million a year earlier. Finally, international sales increased from $9.7 million a year earlier to $14 million.

The reported gross margin improved from -8% a year ago to 26% in Q3. The company provides an adjusted gross margin that fell from 30% to 27%. Looking at the operating segments for profitability, the gross margin and adjusted gross margin for its alcohol business plunged. The overall cannabis gross margin improved, but the adjusted gross margin fell substantially. The low gross margin for its largest business by revenue, pharmaceutical distribution, was down a bit. The smallest segment, wellness, also saw a small decline.

The company reported a large operating loss in Q3 at $82.1 million. For the first three quarters of FY24, the operating loss was $158.2 million. It is better than the first three quarters of FY23, which saw an operating loss of $1.28 billion (mainly due to impairment charges of $934 million).

The company continues to burn cash in its operations, though the use of cash declined from Q2 to Q3, when it used $15.4 million. For the first three quarters, Tilray’s operations consumed $61.6 million, which was more than the $35.7 million it used in the first three quarters of FY23.

Tilray is not drowning in debt like Canopy Growth (CGC), but it does have a lot of it, so this cash use weighs on the company. Net debt at the end of Q2 was $309 million, and it fell to $242 million at the end of Q3. Cash has come way down through the fiscal year and was $226 million, including marketable securities.

Another issue is its investment in MedMen, which has declared bankruptcy. In its Q3 10-Q, Tilray carried the investment at $32 million still, which was down from nearly $75 million at its Q4 in FY23. This could hit the balance sheet.

Analysts Continue to Expect Too Much From Tilray

The company provided guidance in its Q3 press release that adjusted EBITDA would be $60-63 million for the year. The analysts, according to AlphaSense, are looking for Tilray to generate FY24 revenue of $788 million, which would be up 26% from FY23. They project adjusted EBITDA will be $56 million, which is below that guidance and would be down 8% from FY23.

For FY25, which ends next May, analysts project revenue will increase 11% to $874 million with adjusted EBITDA growing 55% to $87 million, a margin of 10%. For FY26, analysts expect revenue will increase 8% to $943 million with adjusted EBITDA soaring to $143 million, a margin of 14%.

The analyst estimates have continued to come down over time. The FY24 estimate at the end of 2022 for adjusted EBITDA, according to AlphaSense, was $95.7 million. For FY25, the current year, the estimate then was $137.1 million. For FY26, the adjusted EBITDA forecast of $143 million is down 50% from $285.2 million. Investors should be very careful about the analyst expectations for Tilray.

Investors Are Paying Too Much for Tilray

For those investors looking to capitalize on cannabis, Tilray, which is diversified well beyond the industry, is a poor way to do so. I use two forms of valuation analysis to conclude that Tilray is very expensive. Compared to its projected adjusted EBITDA over the next year, the enterprise value, which is the $1.6 billion market cap plus the net debt of $242 million, trades at 21.1X. For FY26, that drops to 12.9X. Again, though, this adjusted EBITDA outlook appears to be too high. For assessing downside risk, I use price to tangible book value, which is 4.0X for Tilray.

Alcohol is the biggest part of Tilray in my view. I follow Boston Beer (SAM) for my personal investing, and it trades just 13.4X enterprise value to projected adjusted EBITDA for FY25. Its price to tangible book value is 3.8X, but it is a debt-free company on a net basis due to its high cash level. Tilray seems expensive relative to this alcohol company.

The stock trades expensively to other Canadian LPs. Organigram and Village Farms, two that I like, are both doing a lot of revenue in Canada and have international operations as well. Organigram has an outside investor, British American Tobacco (BTI) that is buying more of the stock (directly) at a higher price. OGI trades below tangible book value (.8X) and is trading at an enterprise value to projected adjusted EBITDA of 29X for FY25 and just 8X for FY26. Village Farms, which has a small amount of net debt, trades at just 0.6X tangible book value and less than 8X projected adjusted EBITDA for 2024. I think that these Canadian LPs stand out relative to Tilray.

I don’t think the other two businesses are that valuable. The wellness business is a hemp food company and very small. The pharmaceutical distribution business has had minimal growth and very low profitability. Investors who care about investing in cannabis can do better than Tilray.

Ahead of the Q3 report, I shared a target with members of my investing group of $0.77 based on 1.5X tangible book value. After the report, that would be $0.71, which would suggest an enterprise value of $846 million. This works out to 9.7X the projected adjusted EBITDA for FY25. Even at 15X, the stock would fall from here, as the price works out to be $1.25. There is a lot of downside risk to TLRY in my view.

Conclusion

I have been cautious regarding cannabis stocks for a while now, but I am more optimistic than I have been. Falling prices and a better chance of rescheduling (the end of 280E taxation) are good things! With that said, I don’t like all cannabis stocks, and TLRY is one that I really don’t like.

I see a challenged chart, a high valuation, growth inflated by acquisitions and a troubled balance sheet. The company is confusing, as it is in four very different fields. It bet on MedMen in the U.S., which was a very bad bet. It hasn’t proven it can integrate acquisitions in the cannabis space. There are better Canadian LPs to buy that are cheaper, and there are a lot of other options for cannabis investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

420 Investor launched in 2013, just ahead of Colorado legalizing for adult-use. We have moved the service to Seeking Alpha. Historically, we have provided great coverage of the sector with model portfolios, videos and written material to help investors learn about cannabis stocks, and we are excited to be doing it here!