Summary:

- Canadian cannabis and beverage firm Tilray has struggled with missed revenue estimates, large losses, and cash burn.

- The company has taken steps to improve its financials, including exchanging debt for shares and looking to raising $250 million in equity.

- The valuation is looking better compared to a key industry peer, but analysts have been cutting their price targets.

Tara Moore/DigitalVision via Getty Images

Back in January, I discussed how Canadian cannabis and beverage firm Tilray (NASDAQ:TLRY) was basically stuck in the mud. The company had just missed street revenue estimates for its latest quarter, with large losses and cash burn putting a strain on the firm’s balance sheet. As we now approach the end of the company’s fiscal year, management has announced a few steps to improve the financials here, but more work still needs to be done.

Looking back at previous struggles:

Tilray shares soared as high as $300 back in 2018 when there was a major boom for cannabis stocks, but the bubble burst quickly as growth stories failed to materialize. Between a significant amount of competition as well as the failure of the US government to fully legalize cannabis, Tilray has not delivered the major revenue growth figures that were once talked about.

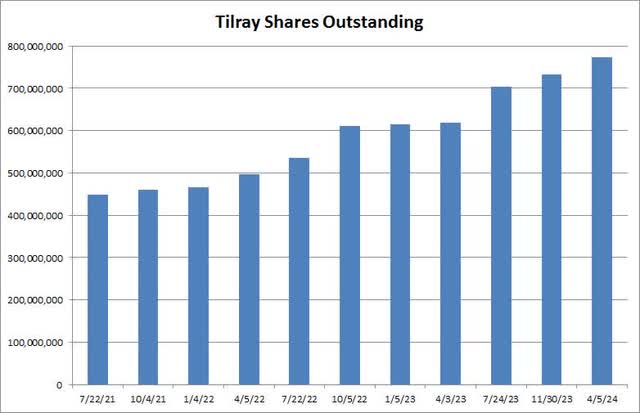

One of the items that has worried me the most over the years is dilution. Tilray management has handed out shares of stock like prizes on a game show, sending the share count soaring, as the chart below shows. Even with all of this dilution in recent years, I mentioned in my previous article that the company remained in a sizable net debt position. I stated that I couldn’t be truly bullish on Tilray shares until this financial situation was improved in a meaningful way.

Tilray Shares Outstanding (Company Filings)

Improving balance sheet, but at a major cost:

Since the date on the chart above from the company’s 10-Q filing, the company has announced multiple moves to address its large debt pile. These include the following three items:

- From the 10-Q filing on April 9th: entered into an agreement to exchange $41.9 million principal amount of its APHA 24 Notes for cancellation by issuing up to 25 million shares.

- Between April 24, 2024, and May 6, 2024, Tilray entered into certain private debt-for-equity exchange transactions with unrelated parties. The Company expects to issue an aggregate of up to 15.2 million shares of common stock in exchange for $24 million aggregate principal amount of the 5.25% Convertible Senior Notes due June 1, 2024.

- On May 13, 2024, the Company entered into an exchange transaction. The Company expects to issue an aggregate of up to 13.1 million shares of common stock, in exchange for $19.8 million aggregate principal amount of the 2024 Convertible Notes.

At the end of the February fiscal period, Tilray had over $83 million of those, 2024 convertible notes outstanding. After last week’s transaction, it had just a few hundred thousand dollars left. This should put total debt at just over $300 million, excluding any other moves, during the May ending fiscal quarter. The company started this quarter with about $226 million in cash and short-term investments on the balance sheet.

Perhaps the biggest news on this front came late last week, however. I’ve been arguing for a while now that Tilray likely needed to raise capital via equity to shore up its balance sheet. That is exactly what happened, with a $250 million equity distribution agreement being announced. This move will certainly help to improve the overall financial situation, but with the stock trading below $2 a share currently, would mean well over 100 million more shares being added to the count if the program is fully executed.

This means that in the next couple of quarters, we could see more than a billion shares outstanding. All of this dilution could weigh on the stock in the near term, which is why I can’t fully buy in just yet. However, the main issue here is that the company needs to keep driving costs down and find a way to deliver positive cash flow at some point. Otherwise, we’ll be looking at another equity offering in the future to keep things going, as well as repay all of those other outstanding debts.

Valuation argument improves a lot:

On a valuation front, Tilray currently trades for about 1.9 times its expected sales for the May 2025 fiscal year. That’s now a sizable discount to the valuation that peer Canopy Growth (CGC) goes for at nearly 4.0 times, which is due to Canopy’s surge in the last few months on the hopes of US cannabis legalization. When I previously covered Tilray, it traded at a premium of a few tenths on a price to sales basis over Canopy.

Street analysts are still fairly positive on Tilray. The average price target is currently $2.37, implying more than 20% upside from the $1.90 price shares are at in late morning Monday trading. I should note, however, that the street average was $2.65 when I last covered the name, and over $3.50 a year ago, so analysts are cutting their targets a bit, likely on this massive ongoing dilution.

Final thoughts/recommendation:

When it comes to Tilray, the name has taken a step forward in recent months by working to improve its balance sheet. The company has reduced its debt pile quite nicely and is now looking to increase its cash pile quite a bit by selling equity. Unfortunately, these efforts are resulting in significant dilution that continues to pile up over time, which is seemingly providing a headwind to shares in the near term.

For now, I am continuing to rate Tilray shares as a hold. The potential for US cannabis legalization is certainly a positive, but it is hard to recommend a name like this when the outstanding share count is surging this much over time. Management still has a lot of work left to do here as it looks to cut costs and reduce cash burn, so hopefully some of these debt reduction efforts will help there. Should the equity sales program be completed in the next few months, and we get some decent guidance on the May 2025 fiscal year that’s about to start, we can look at the rating again in a few months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.