Summary:

- Tilray Brands has expanded into craft beer, further diversifying its business model.

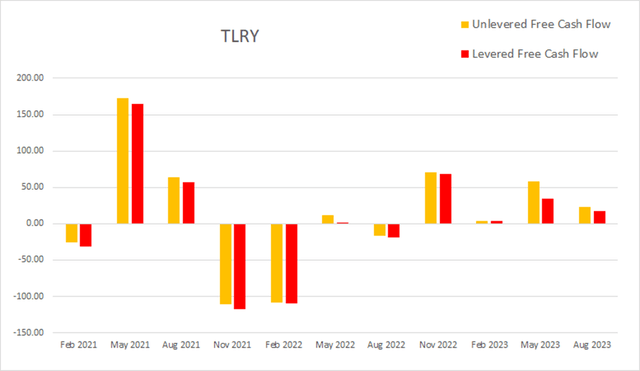

- Although still low, they have maintained positive levered free cash flow for the last four quarters.

- The cannabis industry has a history of euphoria-driven industry-wide rallies and is facing potential catalysts from both rescheduling and the passage of the SAFE Banking Act.

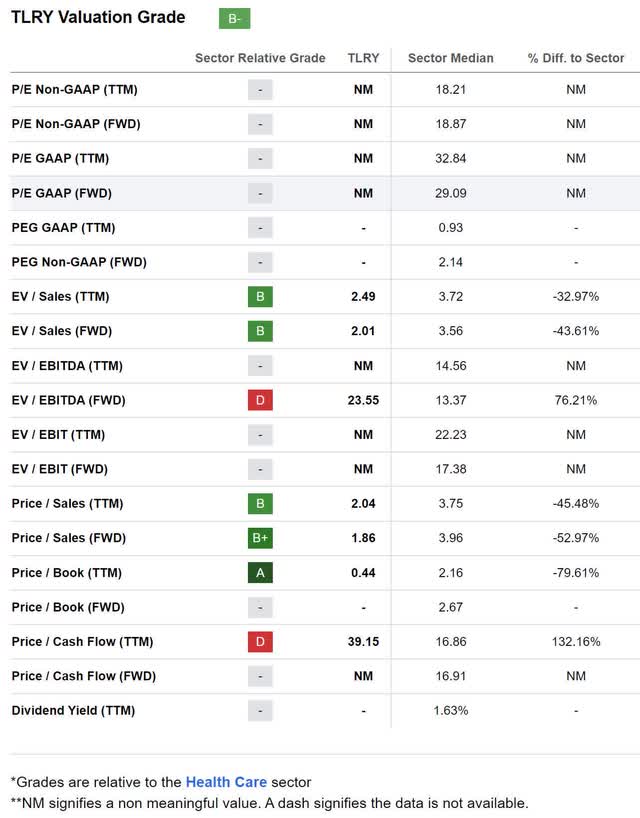

- With an EV/EBITDA of 23.55x and an expected EBITDA growth of 28.24%, I view them as trading slightly under their intrinsic value.

- I currently rate TLRY as a Hold.

Ethan Miller

Thesis

Tilray Brands, Inc. (NASDAQ:TLRY) has been on my watch list for many months. They are building a diversified business model which I expect to do well long-term. However, I am still waiting for their financials to improve before I will allow myself to invest. This is a follow-up to the article I wrote on Tilray last March. Because their quarterly levered cash flow has stayed positive since then, and the industry is facing potential catalysts from both rescheduling and the passage of a version of the SAFE Banking Act, I no longer feel comfortable handing out a Sell rating.

After reviewing the industry catalysts, and the company’s financials and valuation, I presently rate Tilray as a Hold.

Company Background

Tilray offers both medical and adult-use cannabis. They are headquartered in Leamington, Canada, but also have exposure to the United States, Europe, Australia, New Zealand, Latin America, and internationally. They operate under four segments: Cannabis Business, Distribution Business, Beverage Alcohol Business, and Wellness Business.

They offer products under many brands, including: Tilray, Aphria, Broken Coast, Symbios, B!NGO, The Batch, Dubon, Good Supply, Solei, Chowie Wowie, Canaca, RIFF, SweetWater, Breckenridge Distillery, Alpine Beer Company, and Green Flash. They have a wide variety of customer types including retailers, wholesalers, patients, physicians, hospitals, pharmacies, researchers, governments, and end-use consumers.

Long-Term Trends

The Canadian cannabis industry is projected to have a CAGR of 13.26% until 2027. The United States is projected to have its cannabis market experience a CAGR of 14.2% until 2030. The European market is expected to have a CAGR of 15.47% through 2028. The Australian market is expected to have a CAGR of 15.77% until 2028. New Zealand is projected to experience a CAGR of 15.87% through 2028. The medical market in Latin America is projected to have a CAGR of 23.94% until 2028. The global market for cannabis beverages is projected to have a CAGR of 17.7% until 2030. Globally, CBD has an expected CAGR of 31.5% until 2031. The craft beer industry in the United States is projected to have a CAGR of 10.6% through 2032.

Guidance

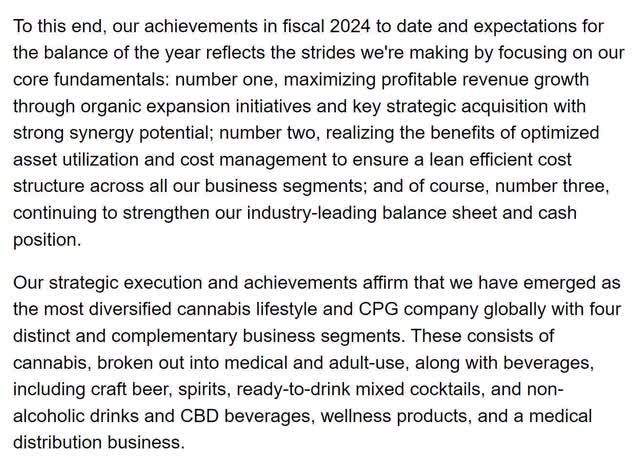

Their most recent earnings call transcript can be found here. Tilray continues to make efforts toward increasing the efficiency of its business model while diversifying its exposure.

Guidance 1 (Q1 2024 Earnings Call Transcript)

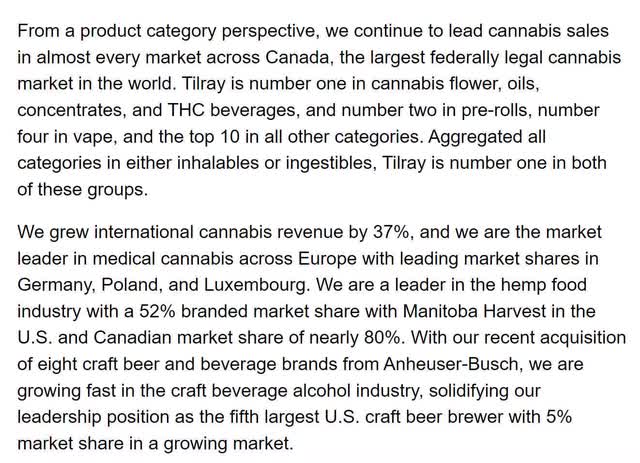

They continue to hold significant market share in Canada. They also grew international cannabis revenue and have a dominant market share in Germany, Poland, and Luxembourg. They also recently acquired 8 craft beer and beverage brands from Anheuser-Busch and are now the 5th largest craft brewer in the United States.

Guidance 2 (Q1 2024 Earnings Call Transcript)

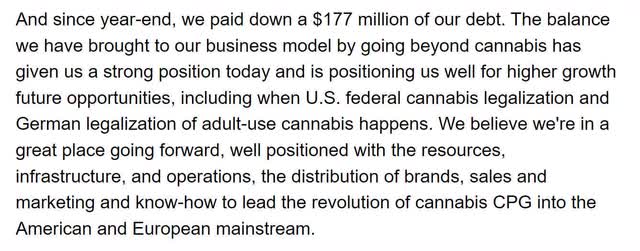

Tilray has paid off $177M of their debt. They believe this will grant them additional flexibility when the time comes for them to expand their cannabis operations in the U.S. and Germany.

Guidance 3 (Q1 2024 Earnings Call Transcript)

The price war in Canada continues to drive cannabis prices lower. Despite this, they managed to grow cannabis revenue. Including HEXO and Truss, they now control 13.4% of the market.

Guidance 4 (Q1 2024 Earnings Call Transcript)

They acquired HEXO earlier this year and are still expecting additional operational efficiency from the consolidation of packaging and logistics.

Guidance 5 (Q1 2024 Earnings Call Transcript)

They also completed the acquisition of Truss Beverage Company, increasing their market share for cannabis beverages to roughly 40%. They also expect additional cost savings once they move THC beverage production to their London facility.

Guidance 6 (Q1 2024 Earnings Call Transcript)

Their international cannabis exposure has them operating in 21 countries. They are gaining momentum in Poland, Italy, the UK, and the Czech Republic. In addition to having production facilities in Portugal, Tilray is one of only three companies allowed to grow cannabis in Germany.

Guidance 7 (Q1 2024 Earnings Call Transcript)

They are expecting to be able to continue lowering their costs in Europe. They plan on continuing to build out their medical cannabis operations in both the U.S. and Germany while they wait for the potential to expand their customer base once laws change.

Guidance 8 (Q1 2024 Earning Call Transcript)

Their alcoholic beverage portfolio continues to expand. This has allowed them to gain some exposure to U.S. consumers.

Guidance 9 (Q1 2024 Earnings Call Transcript)

They expect for their exposure to craft beer to become a more important component of their business model.

Guidance 10 (Q1 2024 Earnings Call Transcript)

Tilray expects its wellness segment to continue to benefit from its ability to meet the rising demand for hemp-based products.

Guidance 11 (Q1 2024 Earnings Call Transcript)

They expect their diversified business model to continue shifting. The trends that are currently playing out have their business model on a path that will lead to revenue comprising 30% cannabis, 30% distribution, 30% beverage alcohol, and 10% wellness.

Guidance 12 (Q1 2024 Earnings Call Transcript)

Because of the ongoing price war in Canada, their gross margins for cannabis fell from 43% to 39%.

Guidance 13 (Q1 2024 Earnings Call Transcript)

Their gross margins for the distribution segment have grown from 9% to 11% over the last year. They attribute this to a combination of focusing on higher margin sales and their decision to no longer participate in medical device reprocessing.

Guidance 14 (Q1 2024 Earnings Call Transcript)

Their beverage segment has experienced a margin expansion from 47% to 53% over the last year.

Guidance 15 (Q1 2024 Earnings Call Transcript)

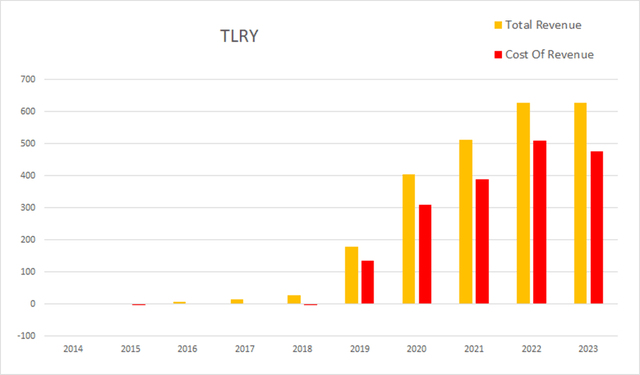

Their wellness segment has experienced a gross margin expansion from 26% to 29% over the last year.

Guidance 16 (Q1 2024 Earnings Call Transcript)

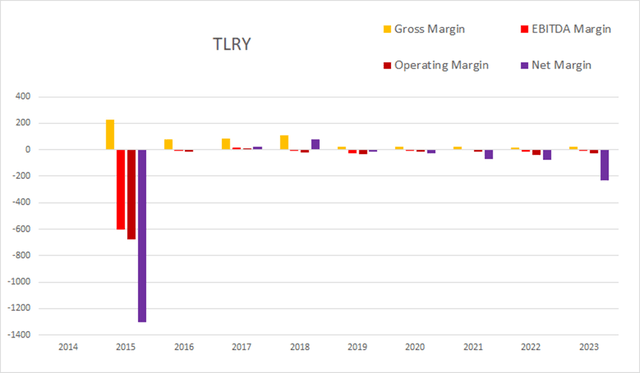

Their forward guidance for fiscal 2024 is that Adjusted EBITDA is expected to end up between $68M and $78M. They do not expect their recent beverage acquisitions to have a significant impact during their first year of ownership. They plan on minimizing capital expenditure while improving their balance sheet.

Guidance 17 (Q1 2024 Earnings Call Transcript)

Annual Financials

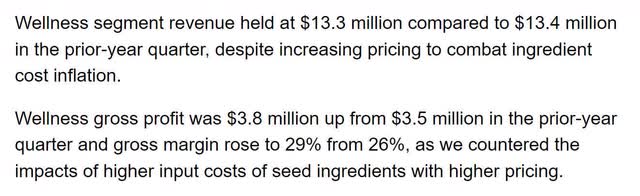

The company grew annual revenue significantly from 2019 through 2022, but it has remained fairly stable since then. As of the end of fiscal 2023, it has reached $627.1M.

TLRY Annual Revenue (By Author)

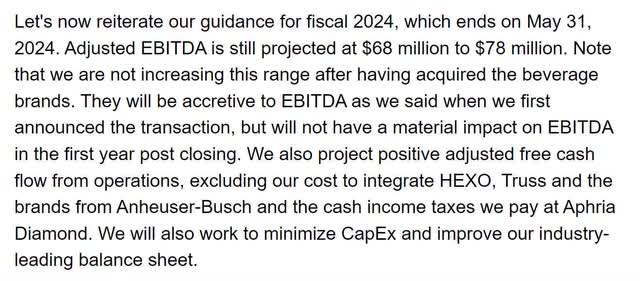

Their annual gross margins are still not high enough for them to achieve positive EBITDA or operating margins. As of the most recent annual report, gross margins were 24.14%, EBITDA margins were -7.97%, operating margins were -28.74% and net margins were -231.65%.

TLRY Annual Margins (By Author)

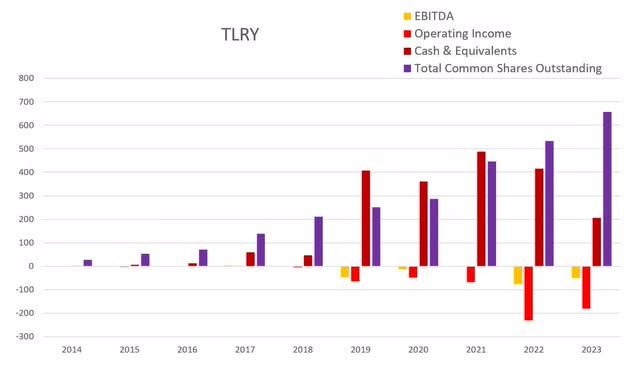

Their annual share count has grown significantly over the last several years while their operating income remains negative. Total common shares outstanding was at 26.7M in 2014; by the end of 2023 that rose to 656.7M. Over that same time period, operating income fell from -$1.3M to -$180.2M.

TLRY Annual Share Count vs. Cash vs. Income (By Author)

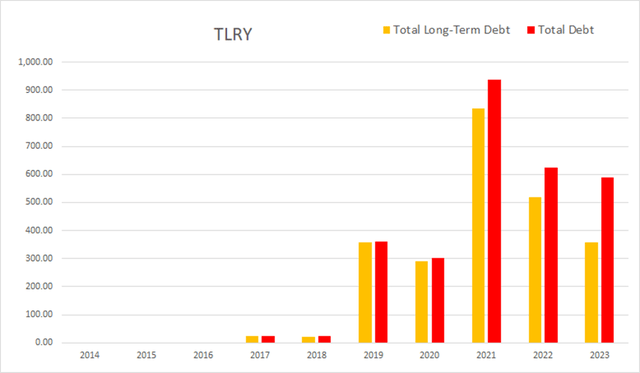

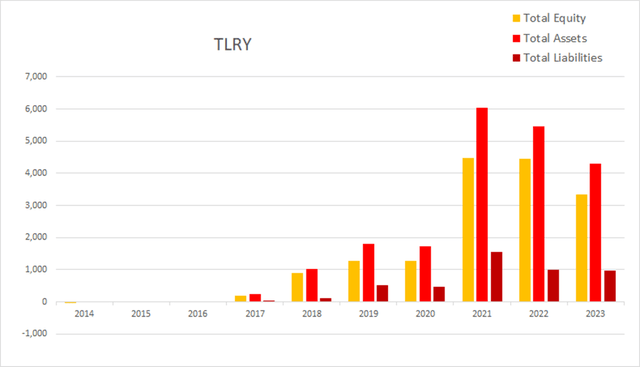

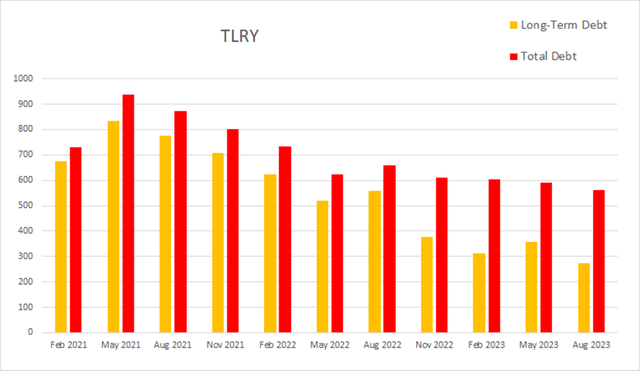

Their debt reached a peak in 2021 but has been dropping since then. As of the 2023 annual report, they had -$13.6M in net interest expense, total debt was $590.1M, and long-term debt was $357.9M.

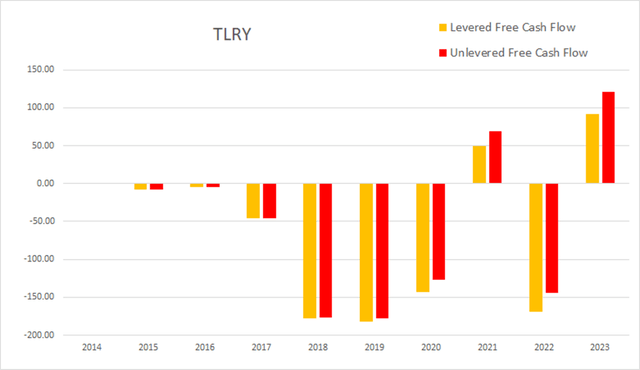

As of this most recent annual report, cash and equivalents were $206.6M, operating income was -$180.2M, EBITDA was -$50M, net income was -$1,452.7M, unlevered free cash flow was $120.5M, and levered free cash flow was $91.3M.

TLRY Annual Cash Flow (By Author)

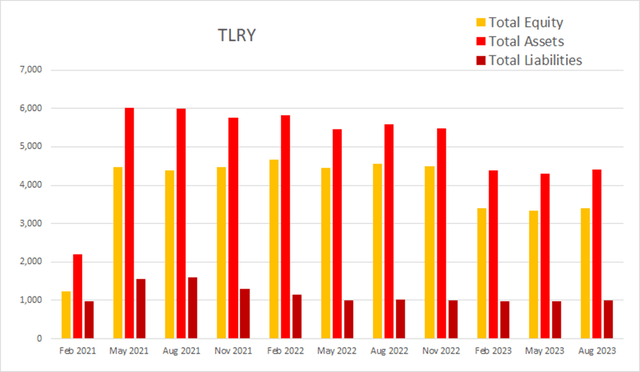

Their total equity rose significantly in 2021 but has been declining since then.

TLRY Annual Total Equity (By Author)

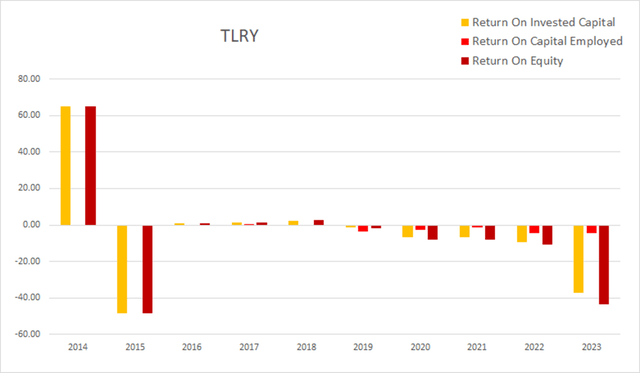

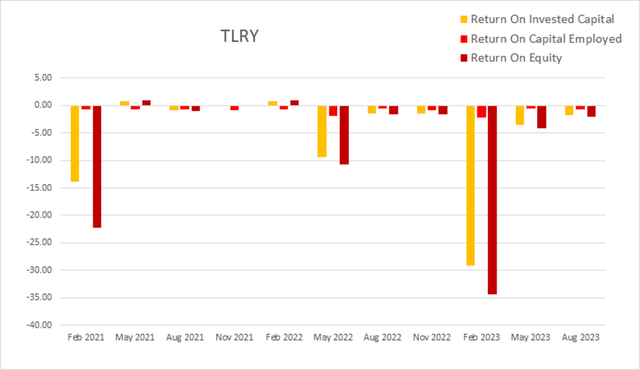

Their annual returns for fiscal 2023 were larger in magnitude than normal. I believe this was due to the significant number of acquisitions the company made. As of the most recent annual report ROIC was -37.06%, ROCE was -4.42%, and ROE was at -43.63%.

TLRY Annual Returns (By Author)

Quarterly Financials

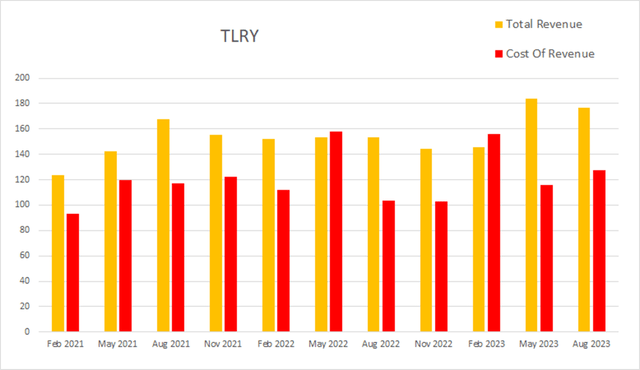

Their quarterly financials show that revenue was slowly dropping from August 2021 until early 2023. It rose significantly in May and fell slightly this most recent quarter. Eight quarters ago Tilray had a quarterly revenue of $168M. Four quarters ago that had declined to $153.2M. By this most recent quarter it had grown to $176.9M. This represents a total two-year rise of 5.30% at an average quarterly rate of 0.66%.

TLRY Quarterly Revenue (By Author)

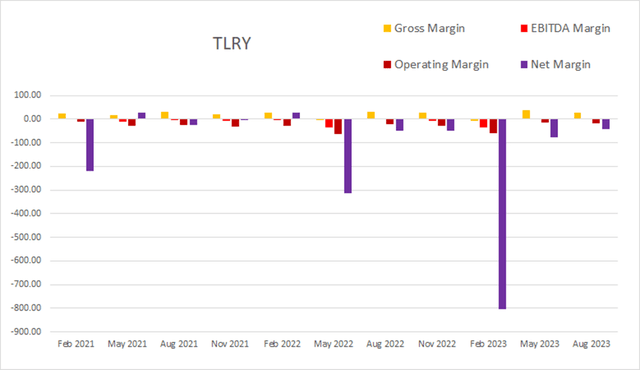

As of the most recent quarter gross margins were 27.87%, EBITDA margins were 1.07%, operating margins were -16.34%, and net margins were at -40.42%.

TLRY Quarterly Margins (By Author)

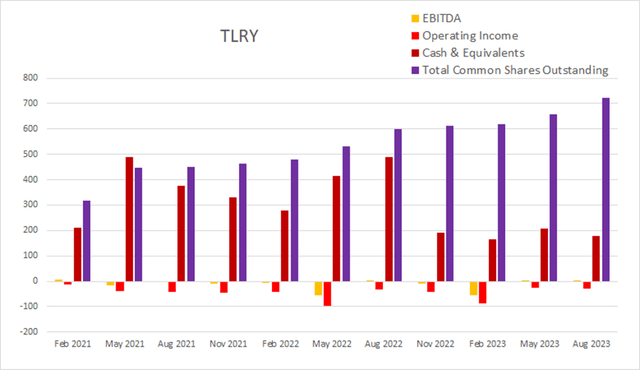

Their quarterly share count continues to grow. The sum of their last eight quarters of dilution comes to 49.45%. Over the last four quarters the pace of dilution has slowed and comes to 19.22%.

TLRY Quarterly Share Count vs. Cash vs. Income (By Author)

They continue to lower their long-term debt. In the most recent quarter, Tilray had -$9.8M in net interest expense, total debt was at $562.7M, and long-term debt was at $273.3M.

TLRY Quarterly Debt (By Author)

This is probably the most attractive part of their financials; this is the fourth quarter in a row of positive levered free cash flow. By diversifying they do not feel as much pain as their competitors from the dropping price of Canadian cannabis. As of the most recent earnings report, cash and equivalents were $178M, quarterly operating income was -$29M, EBITDA was $1.9M, net income was -$71.5M, unlevered free cash flow was $23.5M, and levered free cash flow was $17.3M.

TLRY Quarterly Cash Flow (By Author)

Total equity was basically flat from May of 2021 until November of 2022. It dropped the following quarter and has remained fairly stable since then.

TLRY Quarterly Total Equity (By Author)

As of the most recent earnings report ROIC was -1.80%, ROCE was -0.70%, and ROE was -2.10%.

TLRY Quarterly Returns (By Author)

Valuation

As of December 18th, 2023, Tilray had a market capitalization of $1.5B and traded for $1.98 per share. As they have yet to post positive net income, I cannot use the PEGY formula to produce an estimate for intrinsic value. However, I can compare EV/EBITDA to projected EBITDA growth.

With an EV/EBITDA of 23.55x and an expected EBITDA growth of 28.24%, I view them as trading slightly under their intrinsic value.

TLRY Valuation (Seeking Alpha)

Risks

Tilray has diversified itself and so now faces lower risks than many other cannabis producers. As the wholesale price of cannabis has fallen in Canada, the risk to producers remains an ever-present problem. The same problem of overproduction leading to a price war, may also occur in foreign markets. Much depends on how many competitors enter those markets, but it is possible that the company finds itself dealing with dropping cannabis prices outside of Canada.

If they do not continue to improve margins, they are unlikely to find long-term success. While diversifying their income streams lowers their risk if any one segment were to begin to struggle, if the sum of the parts is still unprofitable, their diversified business model will not have long-term compounding potential.

Catalysts

The company has maintained positive cash flow for the last four quarters while improving the margins of its segments. If they continue making progress, then they should eventually produce attractive cash flows.

By expanding into both craft beer and cannabis beverages they also gain exposure to any potential rises in demand those products experience in the future.

As more countries change their laws pertaining to both medical and recreational cannabis, Tilray is well-positioned to expand into them. While I don’t want to speculate as to when most of Western culture is slowly changing its attitude.

As cited in the thesis, the North American cannabis industry faces potential catalysts from both rescheduling and the Safe Banking Act. While this is a Canadian company, the cannabis industry in both sectors has rallied together in the past, so I expect the next major rally to affect companies in both Canada and the United States. This should give Tilray an opportunity to raise money through at-the-market offerings when it will cause the least dilution while valuations are elevated. Growing their war chest of cash through offerings has the potential to help them fund additional expansions.

Conclusions

I believe that Tilray is building itself into something that will one day become an attractive investment. Presently, I would need to see additional margin expansion within their separate segments and for their total cash flow to improve more before I would consider investing. However, I also believe present shareholders are likely going to be able to exit for a significant gain during the next industry-wide rally. So even if they continue to produce low positive cash flow and negative returns, I believe the risk of loss is relatively low.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.