Summary:

- Right now, our technical analysis is at odds with our fundamental analysis, which is often good news, as it means we will be afforded a lower entry on a stock.

- What will make or break Tesla, Inc.’s stock in 2023 is the margins.

- The stakes are high for Tesla because if the margins remain healthy, the stock will do quite well. However, if the margins contract, then the bears will be in control.

- Our in-depth analysis below discusses why the Tech Insider Network analyst team is forecasting that the margins will, indeed, overcome a lower average sales price to sustain operating leverage.

- Looking for more solid entries into tech stocks? Join my Investor Community, including an automated hedging signal and trade alerts.

jetcityimage

On 1/26/23, we sent out a trade alert notifying our readers that we purchased shares of Tesla, Inc. (NASDAQ:TSLA) after the release of its 1/25/23 Q422 earnings release. Based on the 2/17/23 closing price of $208.31, TSLA is up 31%. Since that Q4 report, we thought it be worthwhile to update our readers on our thoughts both fundamentally and technically on what we’re watching for in the upcoming weeks.

Right now, our technical analysis is at odds with our fundamental analysis, which is often good news, as it means we will be afforded a lower entry on a stock position we plan to build.

The technicals are telling us a lower entry is on the horizon. However, what will make or break Tesla stock in 2023 is the margins. As most Tesla investors are aware, the company has lowered its price on its vehicles. Coupled with the $7500 EV credit, Tesla’s vehicles are more affordable in Q1 than ever before, with some price points below $50,000 for the Model Y SUV when combining the price cut with the EV Credit.

This has led to Model Y selling out in Q1, per a Reuters report on February 15th. Considering a Model Y is now priced at $52,990, down from $65,900, this means a 30% price reduction is possible with the additional $7500 EV credit with the total cost of $45,490.

With these incentives, most investors can see a path to Tesla meeting its delivery goal this year, however, the impending issue is if Tesla can do so while maintaining healthy margins.

The stakes are high for Tesla because if the margins remain healthy, the stock will do quite well. However, if the margins contract, then the bears will be in control. This is a big moment for Tesla, as high average sales price has been a contentious issue for meeting its addressable market. Wall Street will want to see it’s possible to do both — serve a wider total addressable market (TAM) with more affordable prices while maintaining a healthy bottom line.

Our in-depth analysis below discusses why the Tech Insider Network analyst team is forecasting that the margins will, indeed, overcome a lower average sales price to sustain operating leverage. Once we discuss the margins in-depth, which to reiterate, we believe is the most important piece to Tesla’s 2023 story, we then go into how we plan to build this position while respecting the fact the broad market is in the driver’s seat for growth stocks.

Tesla stock: What to look for in 2023

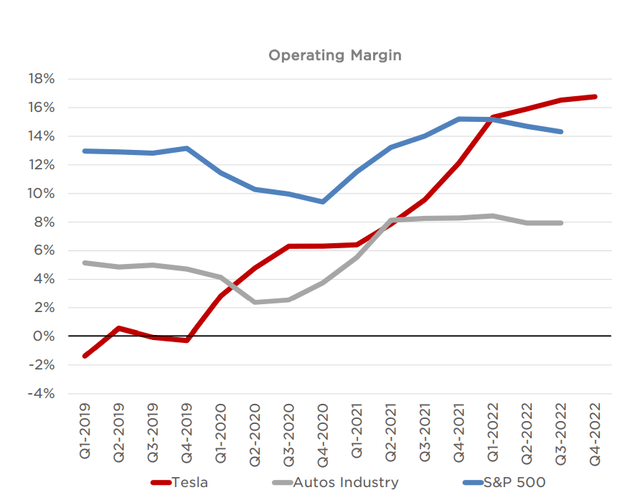

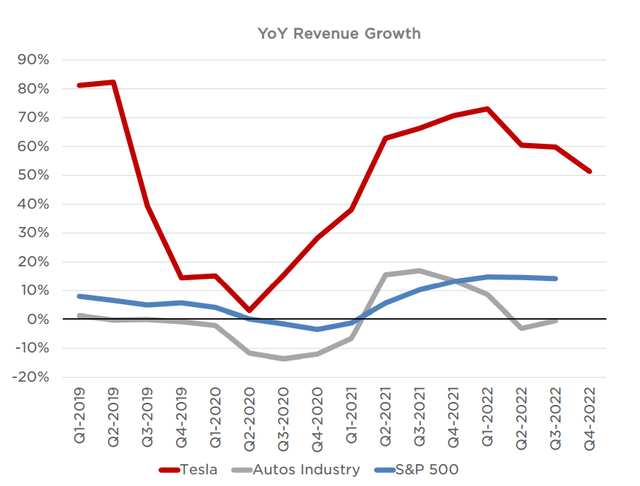

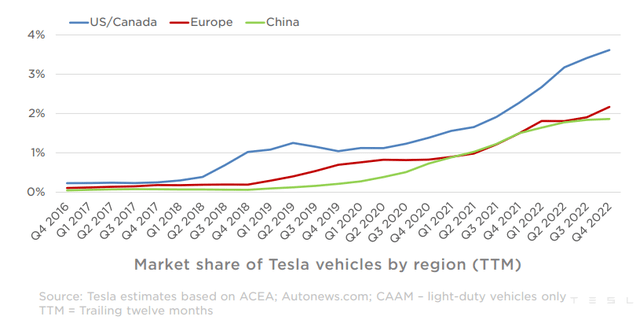

First, let’s take a quick look at Tesla through a few graphs. If you were presented with the following company, would you find this an attractive business?

-

A company with steadily increasing operating margins vastly superior to its competitors and greater that those in the S&P 500.

Source: Tesla Q422 investor presentation

-

With historical y/y revenue growth also exceeding its peers due to strong demand for its product.

Source: Tesla Q422 investor presentation

-

With a significant market share gain opportunity for its products.

Source: Tesla Q422 investor presentation

It’s these attributes that have drawn us to Tesla as an attractive business. However, as investors in the equity, there are several key factors we are monitoring that may drive the stock.

Profitability: Gross margins (GM) vs operating profit margins (OPM)

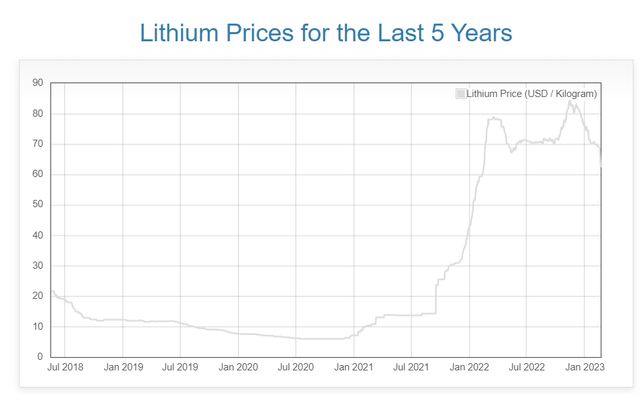

Both are impacted by different variables. For GM, the main drivers are the ASPs Tesla charges for their cars and number of cars sold less costs of goods sold such as raw materials costs, particularly lithium used in batteries. For reference, here’s the 5-yr price chart of lithium ($/kg). Tesla does not break out this cost but they did refer to lithium battery demand as “quasi-infinite” and a “significant cost.” It won’t impact their production targets but it continues to be an unpredictable cost headwind. It also explains while there has been renewed speculation that Tesla is interested in purchasing lithium mining assets.

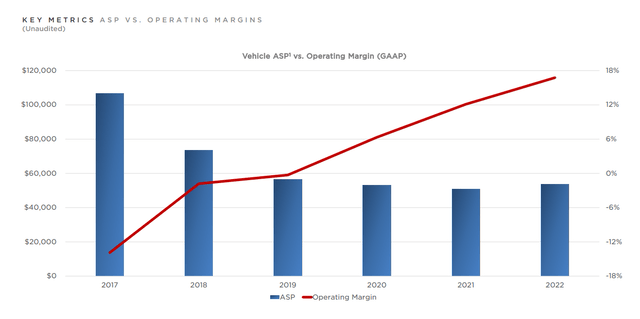

For OPM, it’s mainly related to R&D and factory ramp-up costs. Here’s a snapshot (2017 – 2022) of Tesla’s ASPs in relation to its GAAP operating margins. It’s grown from negative 14% to almost positive 17%.

Source: Tesla Q422 investor presentation

The chart above demonstrates that while ASPs have come down about 40% from a little over $100k to $47k, OPM has expanded. A reflection of the immense impact manufacturing efficiency has on operating leverage from higher utilization as the number of cars produced and sold increased.

In the most recent Q4 call, Tesla discussed how their future focus would be on increasing operating margins over time. A sign of the evolution of its mindset from that of a technology company needing to invest and sacrifice short term profitability to one with a large industrials-like manufacturing footprint and supply chain focusing on costs and efficiencies. A focus that long-term investors should find appealing.

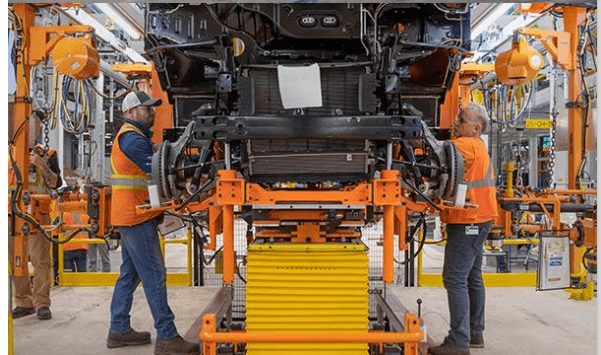

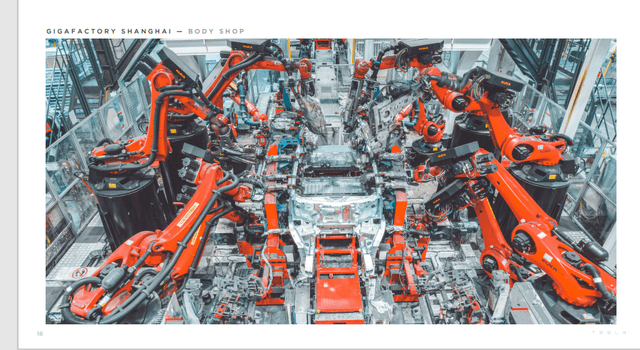

Perhaps a simple picture provides insight on how Tesla thinks about manufacturing efficiencies versus its peers. If you compare the Q422 investor presentation of Tesla to GM and Ford. There’s not one picture of a human. Rather, you see high precision Kuka German robots. There’s not a single robot in GM or Ford’s presentation. Tesla’s Q4 opm were 16% compared to GM at 8.8% (adj) and Ford at 5.8% (adj).

GM:

Source: GM Q422 Investor presentation

Tesla:

Source: TSLA Q222 Investor Presentation

Ford:

Source: Ford 4Q22 investor presentation

That said, at the moment, the investment community is understandably focusing on the automotive gross margins given the recent price reductions A positive takeaway from the call was that Tesla expects ASPs to stay above $47,000 and automotive gross margin to go above 20%. Indications that automotive gross margins have bottomed. This message contributed to the stock rally (emphasis added below).

“The next question from investors is, after recent price cuts, analyst released expectations that Tesla automotive gross margin, excluding leasing and credits, will drop below 20% and average selling price around $47,000 across all models. Where do you see average selling price and gross margins after the price cuts?

Zachary Kirkhorn, CFO:

So there is certainly a lot of uncertainty about how the year will unfold, but I’ll share what’s in our current forecast for a moment. So based upon these metrics here, we believe that we’ll be above both of the metrics that are stated in the question, so 20% automotive gross margin, excluding leases and rent credits and then $47,000 ASP across all models.

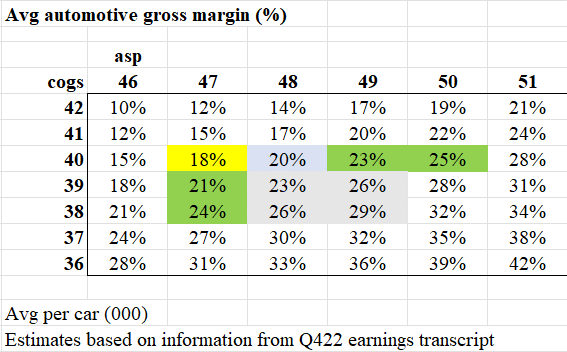

An analyst pointed out that the avg COGS per car has gone from $36,000 in mid-2021, peaking at $42,000 back to almost $40,000 currently. Estimates that management did not refute. So a very simple back of the envelope calculation comes to about 18% auto gross margins currently ($(47,000-40,000)/($40,000)). The key takeaway is that pricing and costs efficiencies will both have an impact in getting margins above 20%. For example, using the prior calculation just a $1000 increase in ASPs or $1000 decrease in COGS alone will lead to 20% auto gross margin. If both happen at the same time, that’s about a 23% auto gross margin.

There was a follow-up if COGS could go back down to $36,000. This exchange provided further insight.

Excellent. Zach, actually, I’d like to follow up on the data point you just gave on cost. If I look back at the COGS per car, you guys bottom close to $36,000 in the middle of 2021. And then the number went up as you had to face with inflation in input costs and the ramp of Berlin and Texas. And this quarter, I think we are close to $40,000 and we peaked maybe close to $42,000 at some point last year.

And so my question from here is, how much time do you think it takes you to get back to this kind of $36,000, which would mean Berlin and Texas and those input costs, all that stuff is normalizing, is that like — and that would be like a kind of like a 10% decline in the COGS per car? Is that something we can hope to see this year or is that too optimistic?

Zachary Kirkhorn, CFO

The Austin and Berlin ramp inefficiencies in 4680 will make a substantial amount of progress on that over the course of the year, and that’s within Tesla’s control. We’re doing a lot of work on cost reduction outside of that. And we talked about supply chain costs, expedite, logistics, attacking everything.

On the raw materials and inflation side, where lithium is the large driver there and this was a meaningful source of cost increase for us, we’ll have to see where lithium prices go. And we’re not fully exposed to lithium prices, but I think in general, is what we’ve seen from our forecast here, cost per car of lithium in 2023 will be higher than 2022. So that’s a headwind that would have to be overcome to return back to those levels. So, I don’t think we’ll get there this year, but I think we’ll make progress. And we’ll continue to find ways to offset these raw material costs that we don’t have control over. [Indiscernible] is there anything on that?

Furthermore, to the extent the Fed’s actions have lowered non-lithium prices, there will be a lag.

Roshan Thomas, VP of Supply Chain, added the following.

“.. on the non-cells raw material, we begin to capture benefits of indexes tapering out, but due to the length of various supply chains, it does take time before this is reflected in our financials. And while alumina is down like 20% year-over-year, steel is about 30% down year-over-year, the global non-cells raw materials market continues to be influenced by geopolitical situations in Europe, high production cost due to labor cost increases and energy spikes and disruptions due to natural disasters like typhoon in Korea four months ago, pandemic lockdowns.

So, we believe that meaningful price corrections will ultimately come, but it remains uncertain exactly when. In the meantime, we continue to redesign supply chain to make it more efficient and work with our supplier partners to find more efficiencies, streamline logistics and transportation to reduce costs.”

Below, is a simple sensitivity analysis of the impact that changes in asp and cogs per car have on automotive gross margin per car. It excludes leasing and credits. The numbers are estimates only and the primary purpose is to illustrate the magnitude these changes have on automotive gross margins. The yellow highlight is where they are estimated to be currently, blue is the minimum level Tesla has guided, green is potential upside depending on the change only in price or cogs and gray is if both change. At the moment, a change in price will likely be the main driver in automotive gross margin improvement. So, an increase in asp to 49k or 50k results in an automotive gross of 23% and 25%, respectively.

Knox Ridley

Gross margins and operating margins for 2023

We outlined the variables that impact both. We will look for continued signs of stabilization in the Q123 report and further confirmation that we have seen the bottom in both.

In Q122, Tesla reported operating margins of 19.2% and ended Q422 with 16%. For 2022 it was 16.8% vs. 12.1% in 2021. If the operating margin stabilizes at a level similar to or greater than Q4, then a recovery in 2H23 is reasonable, if not sooner in Q2.

Tesla will have an investor’s day on March 1st, this may provide further insight.

Long-term OPM potential:

Tesla has not provided any medium to long-term OPM targets, but if they did, this would lead to a re-rating of the stock. The auto industry is still cyclical so that may be wishful thinking. At the moment, Tesla’s OPM dwarfs its auto competition. Perhaps, we are getting closer to the point where the best comp will be other industrial companies with best in-class margins. A topic we will look at in the future.

This is what Musk had to say.

“As we mentioned many times before, we want to be the best manufacturer. But really, manufacturing technology will be our most important long-term strength. And we’ll talk more about our upcoming plans at the March 1st Investor Day.”

For a point of reference, Mercedes Benz and BMW have about 13% group operating margins while Ferrari has 23%. Of course, they have different product mixes, price points and client bases but they are useful comparables to parameterize the margin potential.

In Q122, Tesla reported 19.2% operating margins. So, is a medium-term 20%+ operating margin realistic?

Another potential source of upside to margins is if Tesla acquires a lithium mining asset so that they will have better control over their lithium input costs.

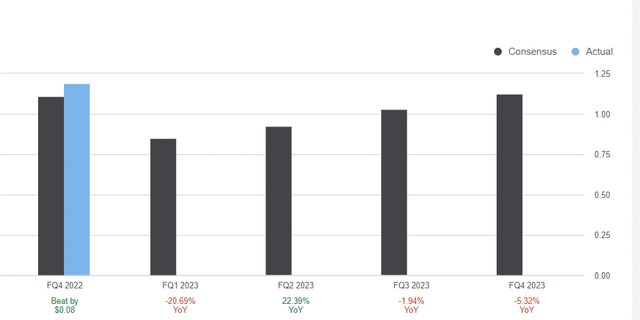

Earnings outlook

Fundamentally, analysts have reduced their adjusted 2023 EPS estimates to $3.97, compared to 2022 $4.07 EPS (actual) mainly due to a decrease in Q1 estimates. Reflecting management’s guidance of operating margins similar to q422 due to recent pricing initiatives and raw materials costs but then stabilization and improvement over the course of the year. Upside to these estimates will likely come from higher ASP assumptions.

The current demand outlook

One factor that contributed to the stock rally was management’s comments that January orders were 2x that of production (emphasis added).

The most common question we’ve been getting from investors is about demand. Thus far — so I want to put that concern to rest. Thus far in January, we’ve seen the strongest orders year-to-date than ever in our history. We currently are seeing orders at almost twice the rate of production. So it’s hard to say that will continue twice the rate of production, but the orders are high. And we’ve actually raised the Model Y price a little bit in response to that.”

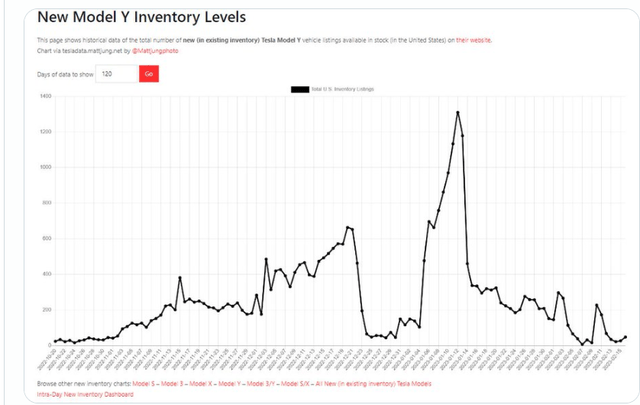

There are signs that demand has remained strong and that the combination of Tesla price cuts and changes to incentives from the U.S. government have been positive for demand. According to Electrek, the Model Y is sold out for Q1. There are no more production slots for a Y order in Q1. Estimated delivery now is April to June. Model Y levels are estimated to be low.

Demand indicators that are supportive of higher pricing and moving automotive gross margin above 20%. Recall, that a $1000 asp increase alone will get to 20%.

Cash flow

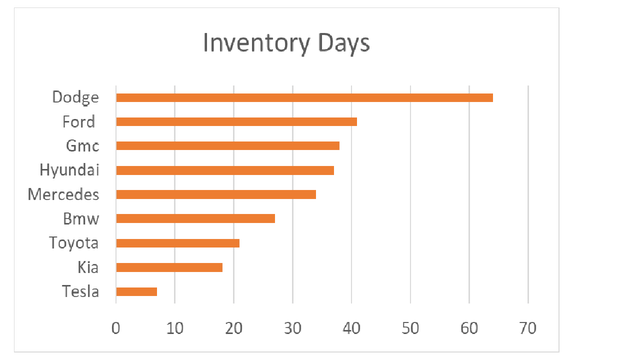

We had recently written that the decline in FCF, mainly due to an inventory build in Q4, was worth monitoring. From Q2 of last year to Q3 to Q4, it increased from 4 to 8 to 13 days of inventory. Although higher, these levels are much lower than peers. According to Statista, as of 2022 one of the highest was Dodge at 64 days. Ford had 41, GMC at 38, Hyundai at 37, BMW at 27, Toyota at 21 and Kia at 18.5 days. Here’s a snapshot on how Tesla compares to its peers.

A glass half-full perspective would be that Tesla’s lower inventory vs its peers is a product of their leading manufacturing capabilities. And that the recent inventory “build” (relative to its historic levels) was a reflection of their effective inventory management and anticipation of future demand in 2023.

Given the recent demand trends, we are less concerned and will check inventory levels at the end of Q1. These initial concerns were tempered by the large $20b cash balance that would allow Tesla to execute necessary investments if cash flow was tied up in inventory.

One factor that impacted Q4 cash flow that we are still looking into is the $4.4b spent on investments. Given the recent lithium asset acquisition speculation, could they be related?

More on FSD:

From a gross margin perspective, this is how Elon described (emphasis added) the impact of a customer paying for the FSD software.

Elon Musk

Yes. Something that I think some of these smart retail investors understand, but I think a lot of others maybe don’t is that the — every time we sell a car, it has the ability, just from uploading software to have full self-driving enabled and full self-driving is obviously getting better very rapidly.

So that’s actually a tremendous upside potential because all of those cars, with a few exceptions — I mean, only a small percentage of cars don’t have Hardware 3. So that means that there’s millions of cars were full self-driving can be sold at essentially 100% gross margin. And the value of it grows as the autonomous capability grows. And then when it becomes fully autonomous, that is a value increase in the fleet. That might be the biggest asset value increase of anything in history. Yeah

But it’s still a work in progress

There was recent headlines on 2/17/23 regarding concerns over the software. Tesla recalled about 300k cars and will update the software. The stock finished up over 3% for the day so the market does not seem to be concerned. But we will monitor it.

Conclusion

The recent data points have given us reasons to give more credence to Tesla’s Q4 constructive commentary around auto gross margins and company operating margins for 2023.

The next catalyst will be the March Investor Day.

Things we will be updating our premium members at Tech Insider Network on:

-

Further evidence of a stabilization in automotive gross margins and group operating margins

-

Demand vs. production trends through January and February

-

Pricing trends

-

Manufacturing initiatives to increase cost inefficiencies

-

Efforts to secure lithium assets

-

Recent FSD concerns

How to position now and going into Tesla’s Investor’s Day on March 1st

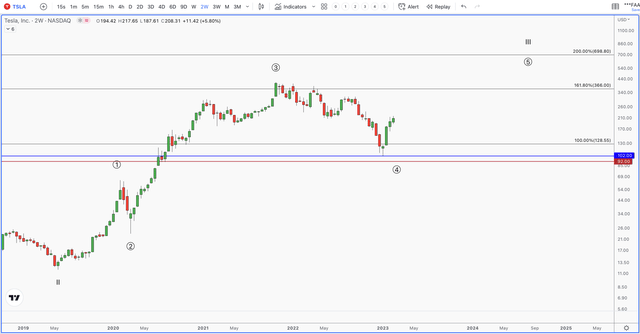

The 2022 bear market appears to be a large degree correction within an even larger uptrend. Like some FAANGs, this implies that when the current macro cycle ends, and a new growth cycles begins, it has a probable chance of making new all-time highs. This cannot be said about all tech.

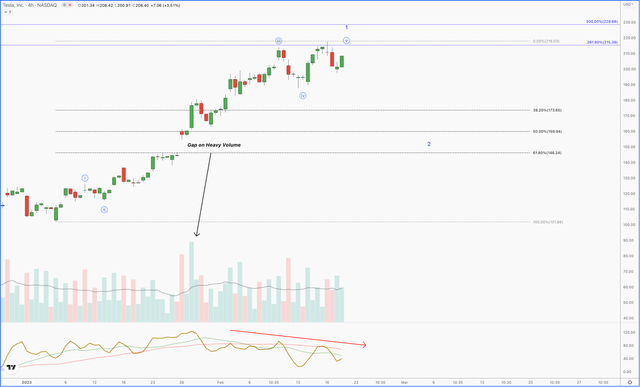

The question the next few weeks will answer is: Has TSLA bottomed at $102, or Does TSLA have one more low around $92 before bottoming?

If we look at the structure of the 2022 decline, it appears to be incomplete. In other words, the final drop only has 4 waves in place, and implies a 5th wave drop is soon to follow. Considering that strength of Tesla’s recent earnings report, this decline, if it were to unfold, would be the result of a continuation of macro forces. This cannot be ruled out.

The below chart has two scenarios to address, one of which outlines this possibility. The blue count implies that TSLA bottomed at $102 and will need to make a higher low in the coming weeks/months that holds $138 and turns back up. The red scenario breaks below $138, and continues to make a slight new low into the $92 region, which would complete the large degree drawdown off the 2022 high.

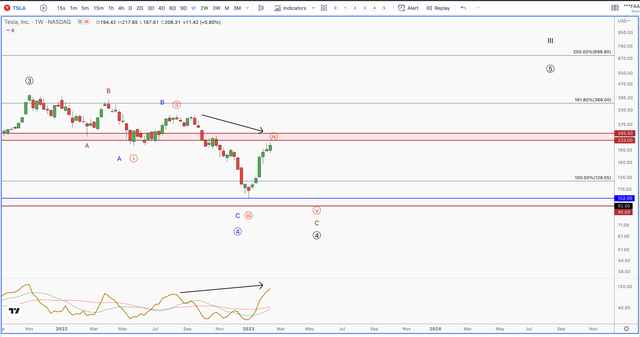

In the above chart, you can see how the weekly momentum indicator is making a higher high while price makes a lower high. This is typically bearish, and a warning to anyone looking to buy TSLA at these levels.

If we zoom-in on the bounce, we have a what appears to be a bullish structure. Note the gap in the middle of the uptrend on heavy volume. This gap stayed open, and price continued higher. These gaps tend to occur in the middle of the move, which has proven to play out. We are now in the final moves of this bounce as momentum and volume continues to fade at these price levels.

If our blue scenario is in play, the coming pullback needs to hold $138. If we break below $138, the odds start to shift that the scenario in red is in play. Regardless of what plays out, we believe Tesla, Inc. is about to set up a great buying opportunity for years to come.

We issue real-time trade alerts to our research members when we enter, exit, add or trim to a stock. Our portfolio is actively managed with allocations that correlate to a stock’s current technical strength or weakness, as well as the underlying fundamentals.

What’s next

This Thursday at 4:30 pm Eastern, I will be holding a webinar for premium Tech Insider Network members to discuss how I plan to navigate the broad market, as well as various tech entries including Tesla. We offer trade alerts plus an automated hedging signal. In addition, we are holding an annual webinar on March 14th that discusses “How to Build a Defensible Tech Portfolio” Follow me on Seeking Alpha for more details.

The Tech Insider Network Analyst Team contributed to this article.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Check out my premium service "Tech Insider Research"

We were the first service to offer specialized tech sector coverage that combines fundamentals and technicals. After recommending a stock, we continually provide new entries and exits.

We are the only retail team that offers an audited portfolio and is featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our team offers two plans that work out to pennies an hour for a full-time analyst team.