Summary:

- Transocean, the leading offshore driller, has published a presentation for the company’s investors.

- If the day rates rise slightly from the current levels, the EBITDA will reach multiyear highs.

- Offshore oil will do well, and so will Transocean if there is no “black swan” event.

Reg Lancaster

Transocean (NYSE:RIG) recently published its investor presentation. As always, the management is highly optimistic. But there are a few things that make me optimistic too.

Transocean’s investor presentation

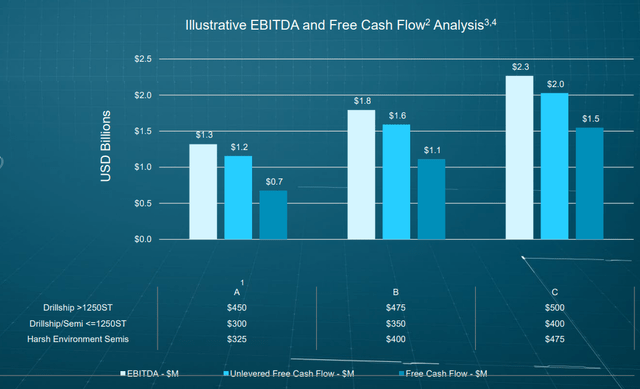

To start with, I would like to cover Transocean’s financial projections. The management made a few forecasts regarding the company’s EBITDA, free cash flow, and balance sheet.

Transocean’s management came up with several quite conservative predictions of the day rates. In fact, some of RIG’s equipment is already enjoying day rates close to $500,000. So, predicting that Transocean’s average drillship of over 1250 ST will enjoy a day rate of over $500,000 does not sound unreasonable. In that case, the company’s annual EBITDA will be $2.3 billion, the unlevered free cash flow will total $2.0 billion and the free cash flow will be $1.5 billion.

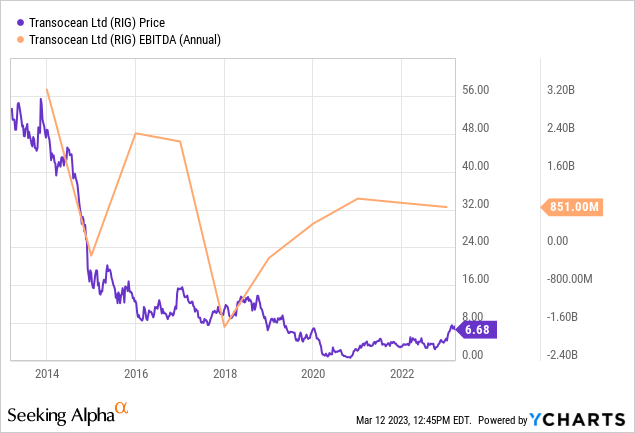

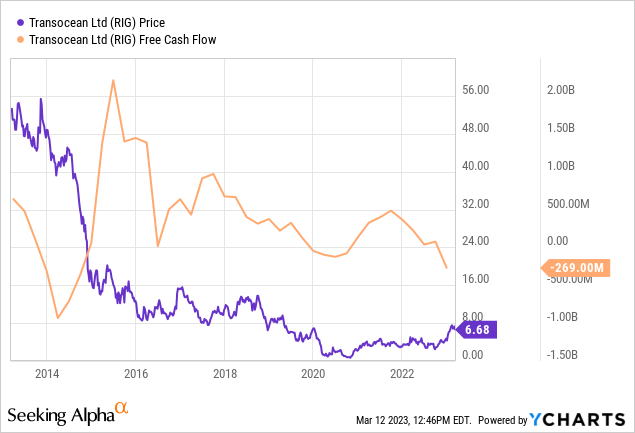

Let us have a look at RIG’s historical EBITDA, whilst also comparing it to the company’s stock price.

As you can see from the diagram above, the company’s EBITDA was pretty close to $2.3 billion in 2015, 2016, and 2017. At the time, the stock price was in the $16 – $45 range. As I am writing this, the stock price is below $7 per share.

Even more remarkable are the free cash flow data. Throughout the 10-year period, RIG’s annual free cash flow hardly exceeded $1 billion. When it did, the stock price was over $16 per share.

So, RIG’s stock price, based on these projections alone, is undervalued.

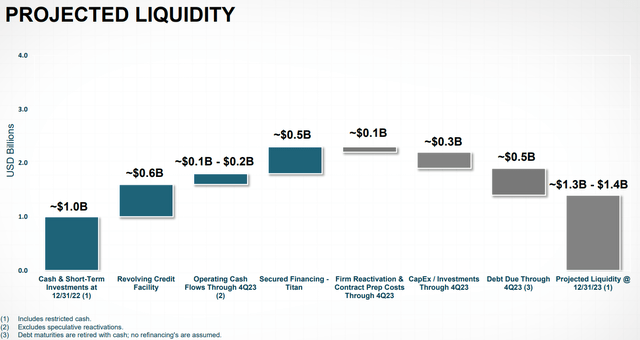

The management also expects RIG’s cash position to get better by the end of 2023. The cash held will total $1.3 – $1.4 billion, over and above what the bank requires.

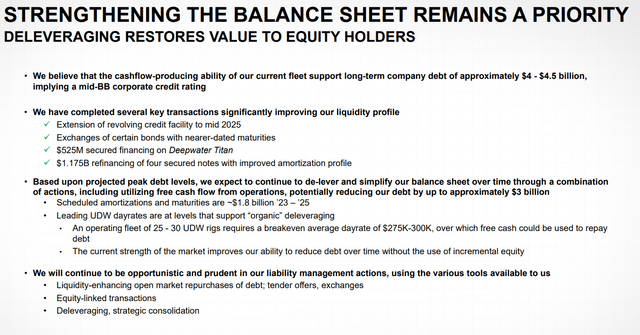

The management summarized the key developments to the company’s business that have recently happened. Most of you, Transocean experts, already know these facts. But I would like to point out that debt exchanges seem to be the most preferred management method to keep the company’s leverage and cash under control. “Liquidity-enhancing open market repurchases of debt; tender offers and exchanges” are listed as the first bullet point in the company’s top tools.

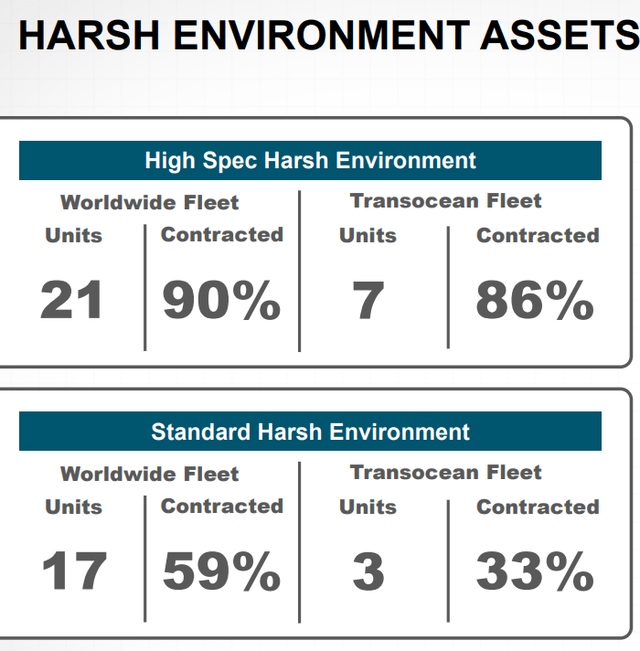

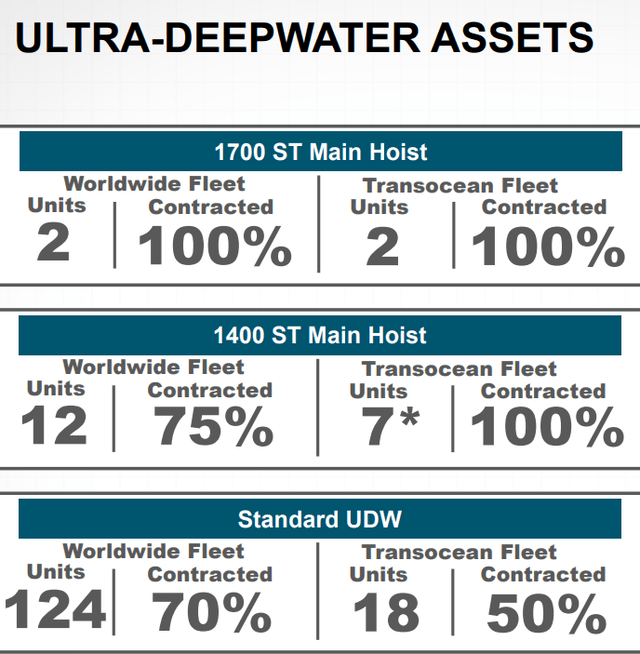

It seems as if all of Transocean’s active or warm-stacked equipment is already engaged. But it is not entirely so. For example, only 86% of Transocean’s harsh environment assets are contracted.

As concerns ultra-deepwater assets, just 50% of RIG’s UDWs are contracted.

So, at the very least the non-contracted equipment could be engaged by the company’s clients. We have some growth potential here.

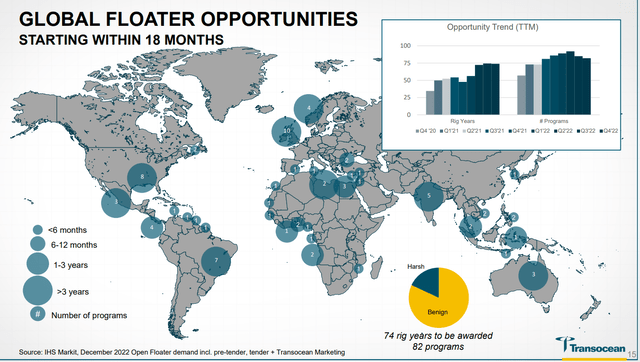

As concerns the bigger deepwater market, there are 74 rig years to be awarded for floaters alone. The whole offshore market is obviously much bigger than that with more opportunities outstanding.

Offshore recovery

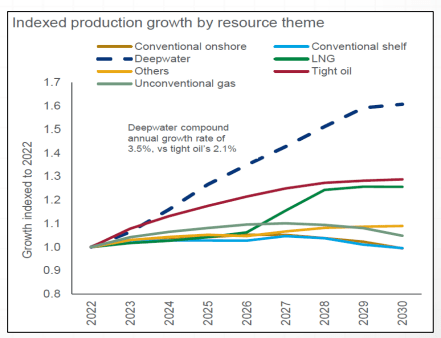

Transocean’s management is highly optimistic in regard to deepwater drilling. According to their projection, the production growth pace for offshore would far exceed these of many other fossil fuels, including conventional onshore oil and unconventional gas.

Transocean

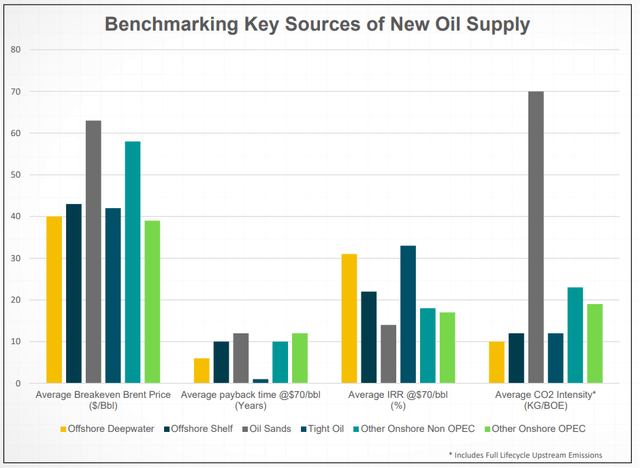

Importantly, the management also provided the company’s investors with some of the key financial statistics of the offshore oil industry as a whole. Please see the diagram below.

The statistics are reasonable. In order for offshore oil drillers to break even, Brent oil has to cost at least $40 per barrel. This is not much, provided there is no economic depression in the near term.

Offshore’s payback time is not as long as some people think. On average it takes offshore deepwater investments just about 6 years to pay off. It is not the longest time period, especially if we look at some onshore non-OPEC projects and oil sands.

The average internal rate of return (IRR) for offshore is more than 30% when the oil prices are just $70 per barrel. That is a relatively high rate of return, whilst $70 per barrel is quite a moderate oil price.

Some skeptics might be thinking that the management has a vested interest in praising their business. But other sources hint at offshore’s growth potential too. In fact, many experts, including Rystad Energy, note that offshore recovery is there.

According to Rystad Energy, the offshore oil and gas sector is projected to grow at the highest pace in a decade in the next two years. New project investments will total $214 billion. Annual greenfield capital expenditures will exceed $100 billion both in 2023 and 2024. This is remarkable because such figures were last observed in 2012 and 2013.

In my view, even more support for offshore oil will also be due to the limited oil supply. Most of the oil shortage will be due to low production in the US shale patch, I think.

US oil supply is limited

One of the largest potential sources of oil is US shale. It is widely accepted that OPEC is reluctant to raise supply when it is not 100% certain the demand is there. It is unlikely that sanctions against countries with some of the largest oil reserves will be canceled in the near future. The countries I mean are Russia, Venezuela, and Iran.

At the same time, there is quite a problem with increasing production for shale oil drillers in the US. Here is why.

First, the Congress and the White House administration have passed some environmental regulations that limit and in some cases prohibit drilling for more oil in certain areas. For example, drilling leases were prohibited in the Arctic to protect wildlife. Also, one of the main purposes of the Inflation Reduction Act was to support green energy sources and to encourage consumers to turn away from fossil fuels. The point I am making is that drilling in the US might get even more expensive for producers due to regulations.

But the problems do not end here. Due to the higher prices service providers and equipment suppliers charge, there is elevated producer price inflation in the oil industry. As I have mentioned in my previous article on the future of oil prices, in some cases these costs have risen by 30-40%. This makes increasing production economically irrational.

Moreover, the Covid-19 crisis also made oil majors get more conservative. So, instead of raising production, they get rid of the debts and pay their stockholders better dividends. That is why shale companies’ production growth potential is quite limited. This substantially affects the total oil production growth, thus putting upward pressure on commodity prices. This, in turn, is a great positive for the offshore oil sector.

Risks

- As I have mentioned many times before, Transocean has some substantial debt. This might become a problem if the interest rates rise substantially from the current levels. Yet, the Fed’s rate hiking shall pass too. Moreover, RIG’s liabilities are no longer as high as they used to be thanks to the management’s timely debt exchange transactions.

- The largest threat, in my view, is that of a recession and a sharp oil price collapse. But there is still a probability no economic downturn will happen in the near future. In addition, high energy prices might still persist if there is negative economic growth but not enough oil. It is not very likely but might still be the case.

- Note that my forecast is based on one key assumption that all other factors would stay the same.

Conclusion

There are risks to buying RIG due to its debt load and general macroeconomic uncertainty. However, the recovery is obviously there. The balance sheet has been strengthened, the day rates have been rising, and the EBITDA is projected to reach multi-year highs, whilst oil supply shortages seem to be here to stay. The main risk is that of a recession provoked by higher interest rates, I think.

Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.