Summary:

- Transocean is a highly leveraged bet on expansion in offshore activity, due to both the dependence of pricing on utilization and its debt-laden balance sheet.

- Offshore drilling is expected to pick up in coming years, and Transocean believes that this increase in activity will be relatively insensitive to oil prices.

- Transocean’s stock could prove inexpensive if day rates increase sufficiently, but the company’s debt and the precarious state of oil markets make this a risky investment.

Jeremy Poland/E+ via Getty Images

An investment in Transocean (NYSE:RIG) is a highly levered bet on expansion in offshore activity. Rig pricing is heavily dependent on utilization, and this, combined with Transocean’s debt-laden balance sheet, makes the business highly operationally and financially leveraged.

While oil and gas prices have softened over the past 18 months, offshore activity continues to pick up and Transocean expects the current upcycle to be extended. A tighter market should lead to higher day rates and provide Transocean with an opportunity to deploy some of its eleven stacked rigs.

If deepwater offshore activity increases sufficiently and remains elevated, Transocean’s stock could begin to look inexpensive. The company’s balance sheet and the volatile nature of the industry make this a risky proposition, though.

Market

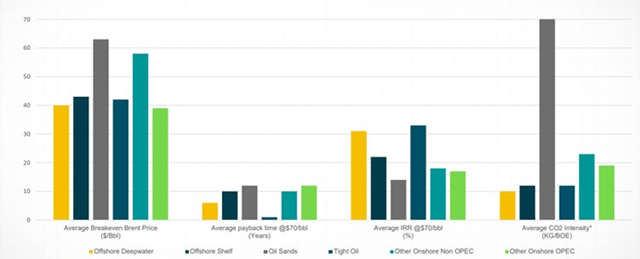

Transocean operates a fleet of high-specification floating drilling rigs, specifically exposing it to deepwater and harsh environment drilling demand. There are large reserves of hydrocarbons offshore in deep water and harsh environments, but these reserves require large investments to develop and take a long time to pay off. These reserves therefore need favorable economics and a stable outlook before they are developed. Transocean believes that offshore deepwater has low breakeven prices and offers compelling returns.

Figure 1: Benchmarking New Oil Supply (Transocean)

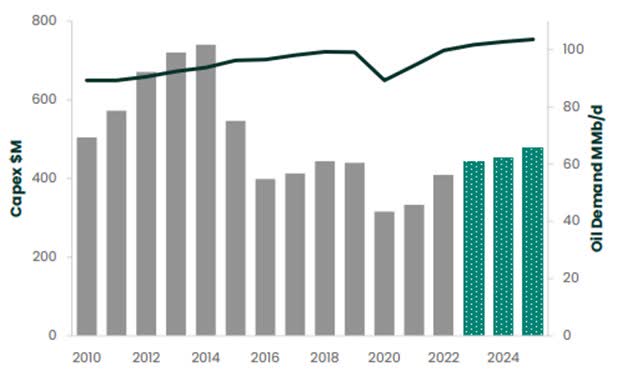

As a result of their strong return potential, Transocean believes that deepwater basins will be an important contributor to hydrocarbon development in the coming years. Offshore CapEx is expected to be in excess of USD200 billion in 2024, growing to USD234 billion by 2027. This would represent a significant deviation from recent years, where there has been a relative preference for short-cycle barrels.

Figure 2: Oil Demand and CapEx (Baker Hughes)

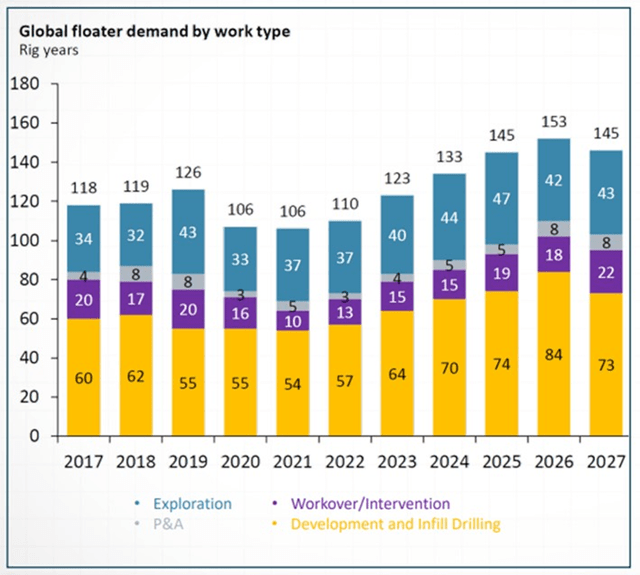

Transocean expects a considerable increase in drilling activity in the coming years, with demand increasingly directed toward exploration and development.

Figure 3: Global Floater Demand by Work Type ( Transocean)

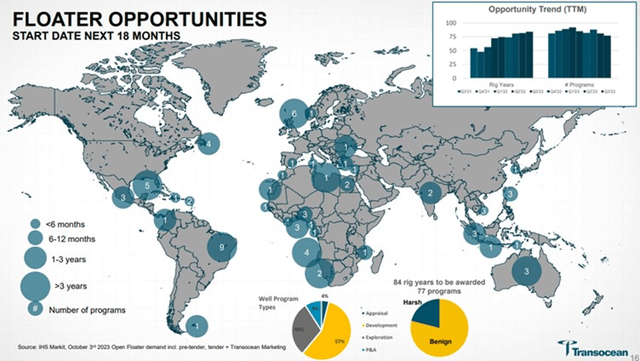

Gulf of Mexico

A significant portion of Transocean’s revenue comes from the Gulf of Mexico, and activity here has been healthy. There is steady demand for short-term programs with independent operators, and the supply of high-specification ultra-deepwater rigs is limited. Transocean is currently in discussions with customers regarding 20K programs beginning up to three years into the future, indicating both market tightness and the potential for a multi-year period of solid activity.

Brazil

Brazil also continues to be a source of strong demand, with Transocean believing that the active rig count will expand from 29 over the next year. There have been 27 awards in Brazil over the past year; 18 for rigs already in the country and nine for rigs new to the country. Additional awards are expected to bring another two rigs into the country. The active rig count is expected to reach at least 36 in 2024-2025, based on currently known tenders. Utilization of rigs in Brazil is expected to remain high, and exploration success could result in additional rigs.

Africa and the Mediterranean

Transocean believes that there are over 20 opportunities in Africa and the Mediterranean commencing in the next 18 months. Activity in Nigeria could be picking up for the first time in a decade, with Transocean expecting 2-4 long-term programs to be tendered over the next six months. This is an example of activity that could prove resilient to economic weakness. Angola, Namibia, and Mozambique also represent opportunities.

Asia

ENI, PTTEP, and Petronas present opportunities in Indonesia and Malaysia, amongst other countries.

North Sea

The market for high-specification harsh environment rigs in the North Sea is expected to remain tight, with the supply in Norway now fully utilized. Transocean believes that this tightness will persist as suitable rigs are being actively utilized outside of the Norwegian market.

Figure 4: Floater Opportunities (Transocean)

Greater activity will allow Transocean to deploy more rigs, driving revenue higher. More importantly, it will increase day rates, leading to both greater revenue and higher margins. While customers remain disciplined and are opposed to higher day rates, Transocean believes that USD500,000 plus day rates are inevitable.

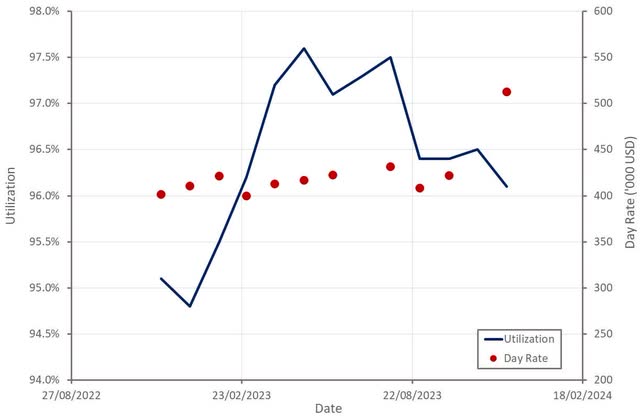

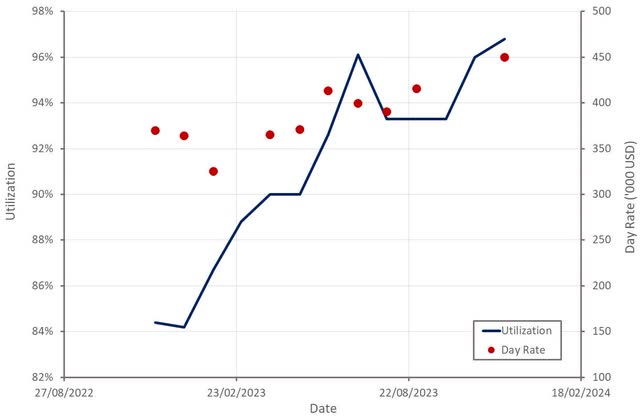

Figure 5: Drillship Utilization and Day Rates (Created by author using data from Transocean) Figure 6: Harsh Environment Utilization and Day Rates (Created by author using data from Transocean)

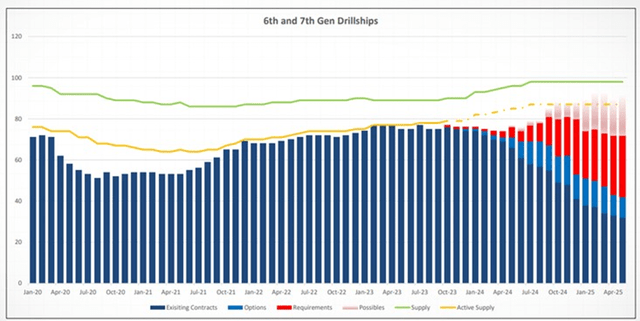

The market is likely to become increasingly tight in late 2024 and into 2025. This should see currently stacked rigs return to the market and in time, higher day rates.

Figure 7: 6th and 7th Gen Drillship Supply and Demand (Transocean)

With oil prices grinding lower, and ongoing OPEC supply cuts needed to support the market, there is good reason to expect a correction. Particularly if economic weakness in China and Europe gathers pace.

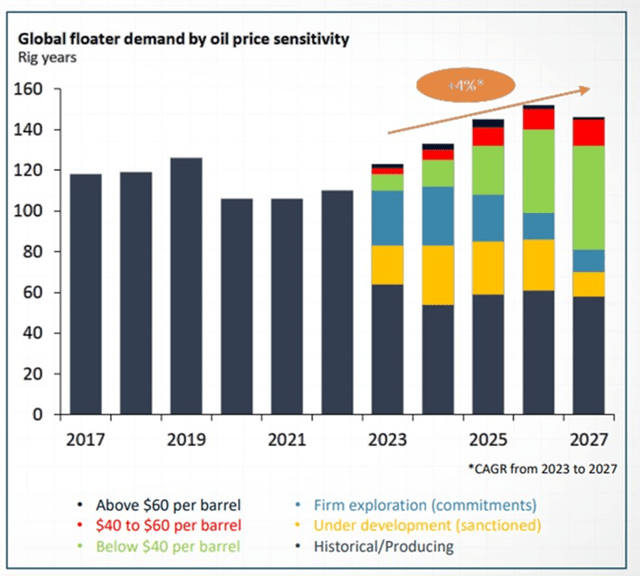

This raises the question of how much offshore activity there would be at lower oil prices. Data suggests that activity should remain fairly robust, provided oil remains above USD40 per bbl. While I am skeptical of this, there are countries that want to increase production independent of prices and energy security is a concern for many.

Figure 8: Global Floater Demand by Oil Price Sensitivity (Transocean)

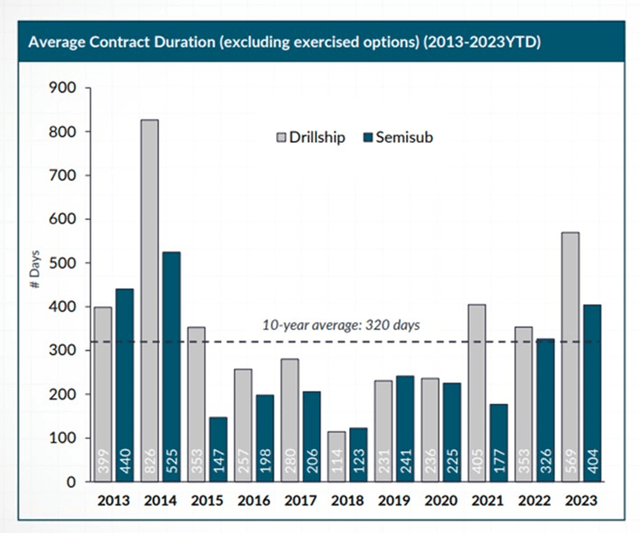

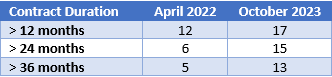

Customers are committing to longer-term contracts, which is supportive of an extended upcycle. It also indicates that the market is becoming tighter, even if this isn’t fully apparent from day rates yet.

Figure 9: Average Contract Duration (Transocean)

Transocean

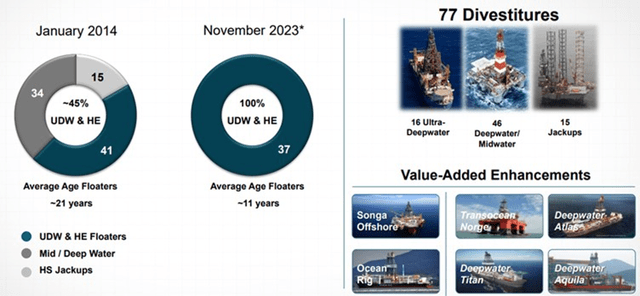

Transocean has 38 floaters, all of which are suited to ultra-deepwater and harsh environments. Transocean’s fleet has changed significantly over the past decade, shifting towards a focus on the high end of the market. The fleet’s age has also declined significantly, supporting growth with less expense.

Figure 10: Transocean’s Fleet Transformation (Transocean)

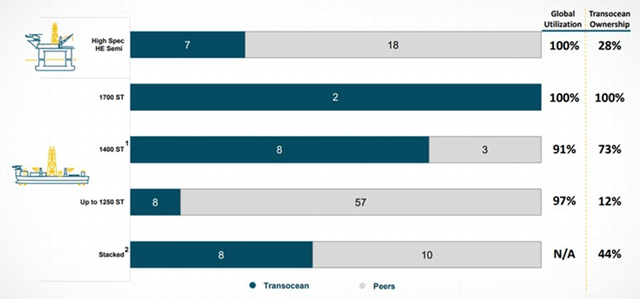

While Transocean’s fleet is significantly smaller than it has been in the past, the company retains a dominant position at the high end of the market.

Figure 11: Industry High Specification Fleet (Transocean)

Transocean is also exploring offshore drilling adjacent technologies and services for markets like:

- Carbon capture

- Deepwater minerals

- Offshore wind

While this is less relevant in the near term, given Transocean’s balance sheet problems, it demonstrates that Transocean’s business could have value long term.

Financial Analysis

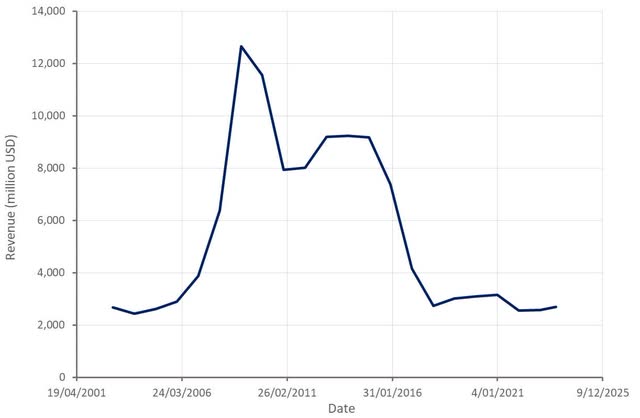

Transocean’s revenue increased 3.2% YoY in the third quarter to USD713 million. Growth is largely being driven by increased pricing. Since the fourth quarter of 2022, Transocean’s average ultra-deepwater fleet day rate has increased by approximately 33% to USD416,000 per day and is expected to increase to USD437,000 over the next 12 months.

Fourth quarter revenue is expected to be roughly USD760 million, which would represent 25% YoY growth. While this is strong, it is in large part due to a weak prior year period. Transocean is currently guiding to USD3.7-3.9 billion in revenue in 2024, which would be a 33% growth rate at the midpoint.

Figure 12: Transocean Revenue (Created by author using data from Transocean)

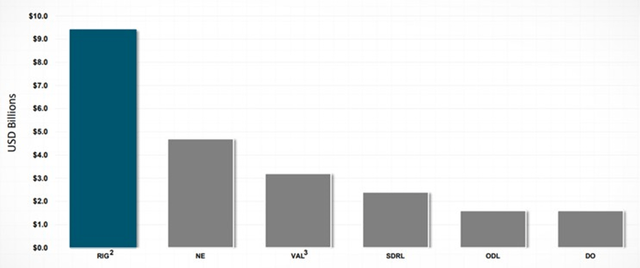

Transocean’s backlog is currently around USD9.4 billion and increasing. Longer duration contracts at higher day rates should support solid backlog growth going forward. Shell, Petrobras, and Chevron represent approximately 33%, 31%, and 14% of Transocean’s backlog.

Figure 13: Industry Backlog Comparison (Transocean)

Transocean’s average contract duration is increasing, which is indicative of an extended upcycle and market tightness.

Table 1: Transocean Contracted Rig Counts (Created by author using data from Transocean)

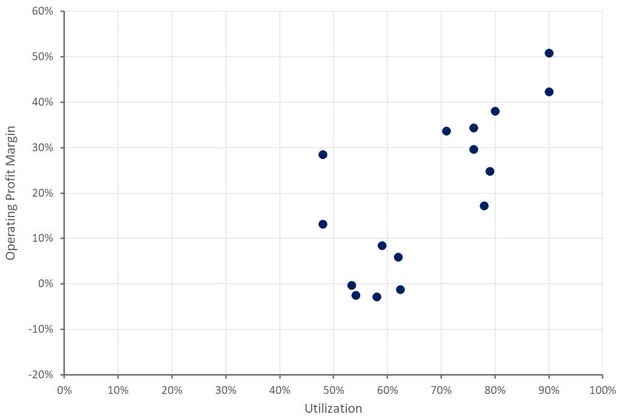

Transocean recorded adjusted EBITDA of USD162 million in the third quarter, resulting in a 22.5% adjusted EBITDA margin. While profitability is generally improving, preparation costs for new contracts weighed on margins in the third quarter. Transocean’s profitability is closely related to fleet utilization and rig pricing, and as these improve, so should the company’s margins. GAAP net income breakeven is likely to occur at around USD4 billion in revenue. Suggesting Transocean could be profitable in late 2024 or early 2025.

Figure 14: Transocean Operating Profit Margins (Created by author using data from Transocean)

Transocean’s business is supported by the fact that CapEx is well below depreciation and amortization expenses. While CapEx is picking up to support growth, Transocean has a relatively young fleet and a number of stacked rigs, which limits investment requirements.

Operating cash flows in the third quarter were negative USD44 million, primarily due to contract preparation and mobilization costs. CapEx was USD50 million, resulting in a negative free cash flow of USD94 million. With an operating fleet of 25-30 rigs, Transocean believes its cashflow breakeven day rate is USD275-300 thousand. Beyond this, cash can be used to pay down debt.

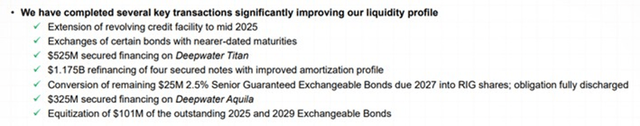

Transocean had approximately USD1.4 billion liquidity at the end of Q3 2023 and is projecting USD1.5-1.7 billion liquidity at the end of 2024. The company believes it is capable of sustainably supporting USD4-4.5 billion debt with a mid-BB credit rating, and plans on continuing to delever its business, presumably targeting a reduction to at least this level. This is an important initiative as Transocean paid around USD230 million in interest in the third quarter, consuming roughly 32% of the company’s revenue.

Figure 15: Liquidity Improving Transactions (Transocean)

Conclusion

Shareholders really need the current upcycle to persist for a number of years. Transocean has a large amount of debt, which needs to be reduced over the next few years while the market is healthy. Once this process is completed, Transocean can begin returning cash to shareholders.

Transocean’s equity could prove inexpensive if the deepwater offshore market tightens sufficiently. With a decent level of utilization and day rates around USD500,000 per day, Transocean could be trading on a mid-single-digit P/E multiple.

There is a risk that strong oil supply growth and weak demand causes the market to crash, though. While some activity is likely to prove resilient in the face of lower prices, this situation represents a serious threat to Transocean as another extended downturn would likely be difficult to navigate with such a weak balance sheet. While I can see the case for an investment in Transocean, I don’t believe it offers a compelling risk-reward tradeoff.

Figure 16: Transocean EV/S Multiple (Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.