Summary:

- Company releases its latest fleet status report with backlog up by an impressive 16.5% sequentially but most awards had already been announced by the company in recent months.

- To continue its winning streak, Transocean will have to increasingly rely on securing work for its cold-stacked drillships but reactivation costs might prove prohibitive for some rigs.

- Cold-stacked drillship Ocean Rig Olympia has been contributed to a new deep-sea mining endeavor in return for a non-controlling interest. The disposal might result in a material impairment charge.

- Transocean surprisingly decided to cold-stack the 5th generation semi-submersible rig Deepwater Nautilus which likely means the end for this 23-year old unit.

- While shares might be ripe for a breather following the impressive 200% run from September lows, investors should consider adding on any major weakness.

Ion-Creations

Note: I have covered Transocean (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

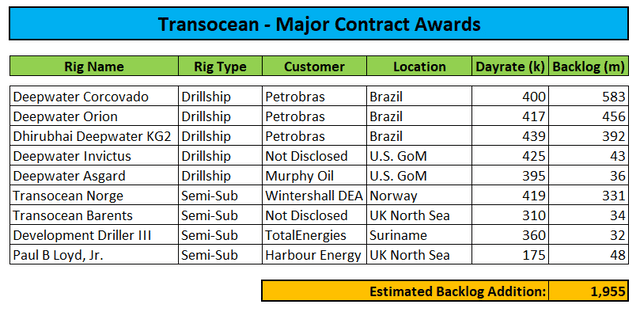

After Thursday’s market close, leading offshore driller Transocean released an impressive new fleet status report with backlog up a whopping 16.5% sequentially to approximately $8.5 billion.

That said, basically all new contract awards had already been disclosed by the company in recent months:

Fleet Status Report / Company Press Releases

With the previously warm-stacked drillships Deepwater Orion and Dhirubhai Deepwater KG2 re-entering the active fleet, Transocean has run out of more or less readily available drillships.

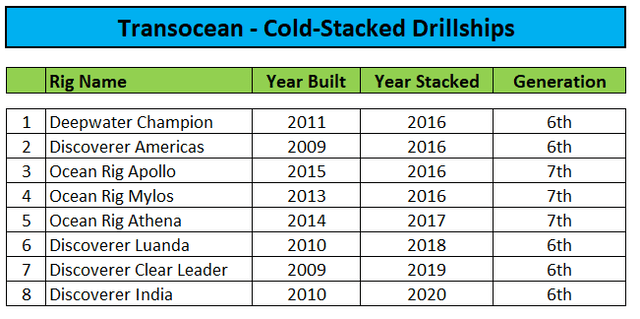

To expand backlog even further, the company will have to increasingly rely on contracting some of its cold-stacked drillships:

Unfortunately, some of the highest-specification rigs have been cold-stacked for more than half a decade already and neither Transocean nor any of its competitors have ever tried to reactivate a drillship that has been sitting idle for so many years.

That said, management recently pointed to opportunities offshore Brazil for one or two of its cold-stacked drillships but reactivation might take more than a year with costs likely to exceed $100 million.

Given these issues, it is hardly a surprise that Transocean recently joined forces with largest shareholder Perestroika A.S. and private equity firm Lime Rock Management to acquire the newbuild drillship Deepwater Aquila from Korean shipyard DSME:

Transocean Ltd. (“Transocean”) today announced that one of its subsidiaries, together with Perestroika A.S. and funds managed by Lime Rock Management L.P., have formed a joint venture, Liquila Ventures Ltd. (“Liquila Ventures”).

Liquila Ventures agreed with Daewoo Shipbuilding & Marine Engineering Co., Ltd. (“DSME”), to purchase Hull 3623, the ultra-deepwater newbuild drillship formerly known as West Aquila, for approximately $200 million.

Hull 3623 is a high specification, 1400 short-ton hookload ultra-deepwater drillship. This seventh-generation dual-activity drillship will have a large deck space, high load capacities, and will be dual-stack ready.

Transocean has made a $15 million noncontrolling investment in Liquila Ventures and maintains the exclusive right to market and manage the operations of the rig, which is expected to be delivered from DSME in the third quarter of 2023.

Please note that the Deepwater Aquila is shown under “Managed Rigs” in the fleet status report which is likely to result in revenue contributions being largely limited to management fees.

In addition, cold-stacked drillship Ocean Rig Olympia has been contributed to another deep-sea mining endeavor in exchange for a non-controlling interest in the company:

Transocean Ltd. announced today that one of its wholly owned subsidiaries has agreed to make an investment in Global Sea Mineral Resources NV (“GSR”) in exchange for a non-controlling interest in the company. GSR is the deep-sea mineral exploratory division of DEME Group NV and is engaged in the development and exploration of deep-sea polymetallic nodules that contain metals critical to the growing renewable energy market, and is a leading developer of nodule collection technology.

Transocean has agreed to contribute the stacked Ocean Rig Olympia for GSR’s ongoing exploration work, as well as make a nominal cash investment. In addition, Transocean expects to contribute engineering services on an in-kind basis. GSR intends to convert the Olympia for a system integration test scheduled for 2025 to validate the technical and environmental feasibility of recovering polymetallic nodules in ultra-deepwater on a commercial scale.

The technical challenges associated with the recovery of deep-sea polymetallic nodules offer an opportunity to combine Transocean’s unique ultra-deepwater operating experience with GSR’s proprietary technology in polymetallic nodule collection to deliver a commercially viable nodule recovery enterprise for GSR.

Depending on the value assigned to the GSR stake, the disposal of the Ocean Rig Olympia might very well result in a substantial impairment charge.

Lastly, Transocean surprisingly decided to cold-stack the 5th generation semi-submersible rig Deepwater Nautilus which likely means the end for this rather old unit.

Bottom Line

Transocean released an impressive fleet status report with backlog increasing by more than 15% sequentially.

That said, investors should not expect backlog to continue expanding at this rapid pace as the company has been running out of more or less readily available drillships. To increase backlog even further, the company will have to increasingly rely on contracting some of its cold-stacked assets in the not-too-distant future.

Since the beginning of the year, Transocean has made great progress as the company replenished liquidity and extended near-term debt maturities at reasonable terms while bagging a number of high-margin drillship contracts offshore Brazil.

Investors have honored the company’s winning streak by pushing shares to new multi-year highs with analysts raising price targets across the board.

In addition, with profitable backlog increasing and expectations for industry conditions to improve even further over the course of this year, additional upside looks likely even with the company looking expensive from a fundamental perspective relative to peers.

While shares might be ripe for a breather following the impressive 200% run from September lows, investors should consider adding on any major weakness.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.