Summary:

- United Airlines stock has experienced a recent pullback, presenting a potential buying opportunity.

- The stock’s chart indicates the possibility of a “Golden Cross” formation if it rebounds over $45.

- Analysts expect strong earnings growth for United Airlines, and the airline industry is expected to grow in the coming years.

DaveAlan/iStock Unreleased via Getty Images

United Airlines Holdings, Inc. (NASDAQ:UAL) is a leading airline with global reach. It has a large fleet of aircraft including: Boeing (BA) 787, 777, 767, 757, and 737’s. It also has Airbus aircraft, as well as planes from other manufacturers. This stock has experienced a pullback in recent days due to some setbacks. This prompted me to do research and I have also started buying shares. Let’s take a closer look at what could be an ideal buying opportunity.

The Chart

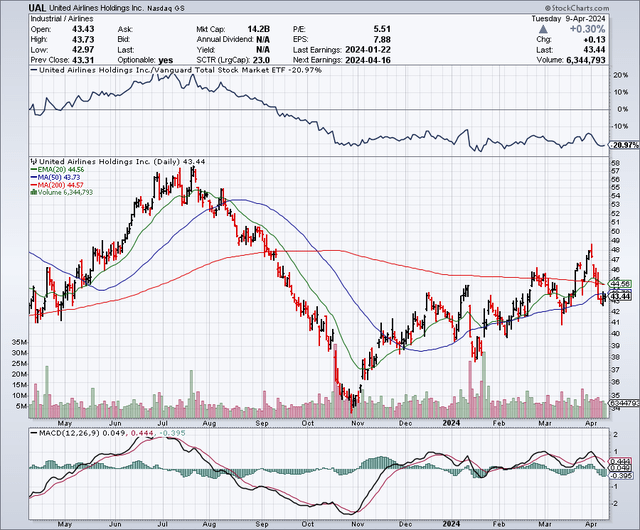

As the chart below shows, UAL shares were trading around $57 in July 2023, but then declined significantly and bottomed out at around $33, in October 2023. Since then, the stock rallied to nearly $49, but has pulled back again in the past few days. The 50-day moving average is $43.72 and the 200-day moving average is $44.62. Based on this, UAL shares could be close to forming a “Golden Cross” on the chart, but only if the stock can rebound back over the $45 level or so. Since November, it has paid off to buy the pullbacks in this stock, and I think this could continue.

Stockcharts.com

The Longer-Term Chart

I think it’s important to look at the longer-term chart, in order to get some additional perspective. As the chart below shows, UAL shares were trading for nearly $100 in 2018 and 2019. Of course, the pandemic changed all of that for a while. Now that air traffic is back to the high levels seen before the pandemic, it seems to suggest that at some point UAL shares could also rebound back to the higher levels it was trading at in the couple of years just prior to the pandemic. The earnings this company is generating, certainly could support a $100 per share stock price. So, I think investor sentiment towards UAL and the airline industry in general, needs to improve for UAL to eclipse the old highs.

Finviz.com

Earnings Estimates And The Balance Sheet

Analysts expect United Airlines to earn $9.58 per share, on revenues of $57.16 billion in revenues. For 2025, estimates are at $11.46, with revenues coming in at $60.34 billion. In 2026, earnings are expected to rise up to $13.62, on revenues of $62.65 billion. These estimates suggest that United Airlines is trading for only 4.5 times earnings for 2024, and for a ridiculously low 3.2 times 2026 earnings estimates.

United Airlines has a strong balance sheet, with around $36.74 billion in debt and $14.39 billion in cash.

The Airline Industry Is Expected To Grow In The Coming Years

Of course a recession or another major pandemic could cause a big decline in travel demand, but the long-term trend for air travel is likely to remain robust and grow in time. According to the Airports Council International, or “ACI”, global passenger traffic will continue to grow for the foreseeable future. A major portion of this increase is likely to be fueled by global population growth and also due to emerging market countries expanding their middle class, which will create demand for travel. Here are a few data points from “ACI”:

• By the end of 2024, global passenger traffic is expected to reach 9.7 billion, surpassing the 2019 level for the first time since the COVID-19 pandemic.

• Global passenger traffic is projected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2042 and 3.6% from 2042 to 2052.

• Global passenger numbers are forecasted to approximately double from 2024 to 2042 and to be 2.5 times higher in 2052.

• By 2024, international passenger traffic is forecasted to approach the 4 billion mark, with domestic passenger traffic reaching 5.7 billion.

• Looking ahead to 2042, international passenger traffic is expected to reach 8.7 billion and domestic passenger traffic to attain 10.6 billion.

Recent Setbacks

United Airlines has had a few setbacks recently, and this explains the pullback in the stock.

1) United Airlines has experienced a number of safety concerns in the past several weeks. This did not go unnoticed by the FAA, which has decided to step up oversight on this airline. On March 22, 2024, United Airlines announced that the FAA would be reviewing the airline’s processes, manuals and facilities. The FAA might also delay new flight routes for this airline. In the short term, I see this as negative news, but in the long term, I think this is a positive development because there seemed to be a series of preventable safety mishaps in the past few months. I believe this oversight was needed, and it could lead to a renewed focus on safety and proper maintenance within United.

2) UAL has been and remains dependent on Boeing for new aircraft deliveries. The issues Boeing has been having with production and safety have spilled over and impacted operations at airlines like United. The shortage of new aircraft from Boeing appears to have caused UAL to ask pilots to take unpaid time off in May.

Potential Downside Risks

The airline industry faces a number of potential downside risks, including rising oil prices, geopolitical issues, pandemics, safety issues, rising competition, and others. A major recession with job losses would decrease consumers’ appetite for travel as well. Additional delays with aircraft ordered from Boeing could also impact United Airlines negatively.

My UAL Buying Strategy

With this recent pullback, I have started by buying a small position in UAL shares. I plan to add more shares on any weakness that comes from additional negative headlines or analyst downgrades. This stock could also drop (or rise) when Q1 2024 earnings are released on April 16, 2024, and that could be another chance to accumulate. I am also selling put options as the premiums are attractive, and this strategy allows me to potentially either buy at a lower price (especially after factoring in the option premium) or it allows me to collect the option premium.

In Summary

UAL has had some setbacks and these issues will take time to resolve. However, in the long run, the FAA review and Boeing delay issues could be greatly improved, if not largely resolved, in a couple of quarters. Safety is paramount to the long-term success of United, and the heightened safety could be a long-term positive. I think the recent pullback in the stock is a buying opportunity, especially as we are seeing passenger traffic volumes back above pre-pandemic levels. It could just be a matter of time before UAL shares get back to the nearly $100 level that it hit prior to the pandemic.

I would never have a major position in the airline industry, but the valuation is so compelling that I had to buy some shares. I can’t imagine that UAL shares will be trading in the low $40 range in 2026, if the earnings estimates of more than $13 per share are accurate. If UAL does earn over $13 per share in 2026, it would be reasonable for the stock to trade back to around $100, which might let shareholders or at least their portfolios take a first class flight.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.