Summary:

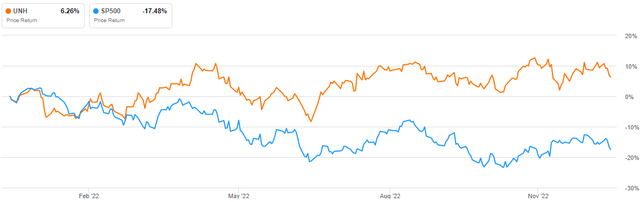

- The S&P 500’s -17.48% fall shows that the US health sector performed poorly last year. Covid issues and high inflation rates contributed to this terrible result.

- Staff shortages, supply chain disruptions, and growing operational expenses are signs of the industry’s crisis.

- UnitedHealth Group has persevered through industry challenges. Over the past year, the stock price has gained 6%, outperforming the market by 24%.

- The outlook for the US health sector is bleak, but UNH’s customer-centric strategies will carry the company over the stormy seas.

Cn0ra/iStock via Getty Images

Investment Thesis

The US health sector has performed poorly over the past year, as evidenced by the S&P 500’s -17.48% decline. This abysmal outcome can be linked to Covid-related difficulties and a challenging economic climate marked by historically high inflation rates. Staff shortages, supply chain interruptions, and rising operational costs are only indicators of the severity of the industry’s current problem.

The October operating margin for hospitals was negative, while the yearly margin was -0.5%. As of October 2022, year-to-date costs are up 8% from the same point in the previous year. Healthcare inflation will continue to be a significant problem as long as the rate of increase in costs exceeds the rate of reimbursement. Due to the continued challenges in the US healthcare industry, I anticipate this upheaval to linger well beyond the first quarter of 2023.

UnitedHealth Group Incorporated (NYSE:UNH) has shown resilience in the face of adversity and has not succumbed to the industry’s difficulties. The stock price is up around 6% over the past year, outperforming the market by about 24%.

In my opinion, the company’s fortitude has come from its innovative initiatives and emphasis on diversity in the face of economic hardship. This resilience explains the company’s continued growth in EPS and dividends.

Company Overview: An Epitome Of Diversity

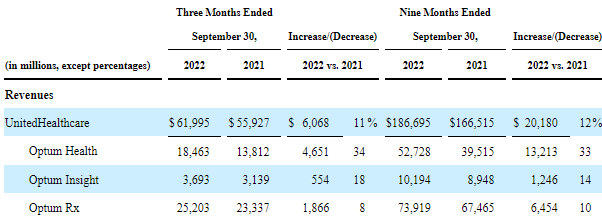

UnitedHealth Group, Incorporated is an American healthcare conglomerate. Four divisions comprise the company’s operations: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx.

The UnitedHealthcare segment: Provides consumer-oriented health benefit plans and services for national employers, public sector employers, mid-sized employers, small businesses, and individuals; health care coverage and well-being services to individuals age 50 and older addressing their needs for preventive and acute health care services, as well as chronic disease and other specialized issues for older individuals.

The OptumHealth segment: It’s a gateway to health care provider networks, administrative support for care delivery and coordination, patient education and advocacy, and monetary aid for those in need. This segment helps people directly by working with care delivery systems, employers, payers, and government agencies.

The OptumInsight segment: It provides software, data, advisory consultancy agreements, and managed service outsourcing contracts to healthcare providers, insurance companies, government agencies, and life science companies.

The OptumRx segment: This division creates and implements initiatives in the areas of step therapy, formulary management, drug adherence, and disease/drug therapy management, in addition to providing pharmacy care services and programs such as retail network contracting, home delivery, specialty, and compounding pharmacy, and purchasing and clinical capabilities.

The table below details the company’s segment-by-segment revenue performance.

UNH Form 10Q

Is The US Healthcare Crisis Brewing?

The healthcare business’s economic outlook is in peril as forces work to undermine both affordability and access. The gaps can only be filled with widespread innovation. A century-rare pandemic has put the healthcare system in the eye of the hurricane. The combination of rising costs, access problems compounded by clinical staff shortages and COVID-19, and stagnant population-level improvement in outcomes is cause for alarm. This impending storm threatens to completely upend the healthcare system and wipe out nearly half of the industry’s profit pools.

What’s next: Some Rough Seas?

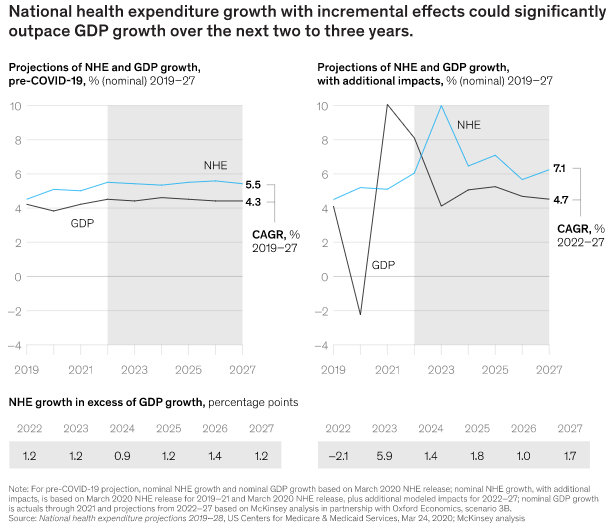

COVID-19 ended a decade of tranquility in US healthcare. Healthcare spending grew 0.3 percentage points above real GDP from 2010 to 2019. This is in contrast to the preceding decade, where the gap was 3.0 percentage points before the passage of the Affordable Care Act. In the past, government budgetary interventions have been necessary during healthcare expenditure increases that significantly outpaced economic development.

These economic recessions also spurred healthcare improvements. Two consecutive quarters of negative GDP growth have raised the possibility of a recession as inflation remains at its highest level since the 1970s. Thus, healthcare instability is more likely. A study by McKinsey & Co. found that between 2022 and 2027, national health spending might increase by 7.1%, which is significantly higher than the average GDP growth forecast of 4.7%.

Collectively, this scenario would amount to healthcare spending growth of 2.4 percentage points over GDP growth. There will be significant affordability pressure in 2023 if health expenditure growth is as much as 5.9 percentage points higher than economic growth. Short-term high inflation, a continuing clinical staff shortage, and slower economic growth in 2023 all contribute to the possibility that healthcare expenditure growth could significantly outpace economic growth in the coming years.

McKinsey & Co Analysis

The combination of much greater healthcare costs than predicted and the difficulty end payers [employers, consumers, and government] face in paying for this increase will cause a reckoning in the industry. This rise may be too much for end payers, forcing industry participants to spend more or jeopardize EBITDA. The aforesaid causes might put $450 billion of EBITDA [more than half of the expected 2027 profit pool] at risk.

Opinion: Can UNH Ride Out These Stormy Times?

Consumers desire value, especially in the current economic environment. I concur with the company’s CEO that this includes making high-quality healthcare accessible, inexpensive, and receptive to patients’ requirements.

In light of this context, this section will outline my reasons for thinking the company is giving value at a very inexpensive charge and accessible, something I feel will slingshot the company towards successfully sailing the rough sea. UNH has ramped up its efforts to deliver on this crucial customer value, initiating several initiatives to expand its reach into new communities and strengthen its connections with the individuals it serves.

First off, In September, Optum announced a multiyear partnership with Walmart to bring its technology and expertise to the retailer’s clinics, making it possible to provide value-based treatment to customers. Beginning in 2023, they will work together to open 15 Walmart health clinics in Florida and Georgia, with plans to expand to additional states and countries. As their partnership grows, they’ll have more opportunities to address social determinants of health by increasing people’s access to resources like fresh produce, prescription drugs, preventative care, and more.

They also partnered with Red Ventures, a digital media company that connects tens of millions of people each month to its customers’ products and services through a wide range of exclusive digital content platforms, a partnership named RVO. RVO Health combines Red Ventures’ health line and ratings with Optum’s consumer marketplace, the Optum Store, and the Optum Perks prescription discount card. RVO Health will allow them to engage with more than 100 million active monthly visitors seeking health advice and insights by exposing them to relevant products and services through a tailored end-to-end digital platform. Value in healthcare depends on affordability, especially regarding life-saving medication. UNH is achieving this through the discount card under the RVO scheme.

In July 2022, UNH said that starting in January 2023, people they serve with commercially insured benefits would not have to pay anything for drugs used to treat diabetes, severe allergic reactions, and other emergencies. Now, they are working with employers who pay for their health insurance to find out how they can give these essential medications for free. To date, they have engaged with many other employers, bringing the total number of people who will have access to this perk to well over 1 million. Also, even for individuals who don’t have health insurance, they’re making it easier to get the medications they need. Case in point: Optum Store and Sanofi have just announced a new partnership that would allow uninsured customers to buy insulin online for $35 per month and deliver it right to their door.

In conclusion, I think they are innovative steps that will help the company gain market share while also satisfying the demands of its clients during this challenging period. I am confident that combining these initiatives and the company’s diversification will protect it from adverse events. I believe these deliberate plans will significantly contribute to the company’s ever-increasing earnings per share and dividends.

Conclusion

The S&P 500’s -17.48% fall shows that the US health sector performed poorly last year. Covid issues and high inflation rates contributed to this poor result. The industry’s future seems bleak, and only the most creative firms will be able to weather the oncoming storm. Considering the UNH team’s strategic creativity and diversity, I am convinced they will triumph over the stormy waters. This is why I am giving the firm a buy recommendation.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was researched and written by January Mbuvi.